If we look at the installed power battery data, the total installed capacity of passenger cars from January to November is: 102GWh for BEV and 8.61GWh for PHEV, adding up to 110.5GWh.

Several second-tier battery companies, including CATL, SVOLT, EVE Energy, and Tafel, have focused on developing around key customers.

In China’s market, finding customers is the biggest selling point for car manufacturers.

As shown in Table 1, this is the demand on the sales side of the Chinese auto market, with BYD and Tesla (domestic) both exceeding 10GWh, Jianghuai (including NIO) demanding 9.3GWh, while 11-20th place having 1.9GWh-3.6GWh.

Second-tier battery companies that did not participate in the demand brought by these sales are: BYD (for its own use), Tesla, SAIC, FAW-Volkswagen, SAIC-Volkswagen, Ideal, and BMW Brilliance.

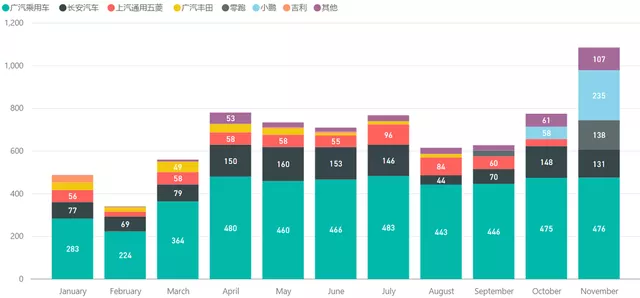

Second-tier battery companies with high participation are: GAC Motor, SAIC-GM Wuling, Geely, Changan, Chery, FAW, XPeng, and WM Motor.

The distribution of suppliers for vehicles manufacturing newcomers XPeng and GAC Motor is compared in Table 2.

These two Guangdong-based companies are particularly interesting: XPeng relies mainly on EVE Energy, with CATL as a backup when in short supply. Whereas GAC Motor now focuses on CATL, instead of using Ningde Times as its main supplier, but imports from it when supply is tight.

I personally believe that the current dependence of multiple companies on CATL’s exclusive position is likely to change by the end of 2023, when more companies will start to detach. These companies’ proportion of battery suppliers will be distributed similarly to GAC and XPeng’s current proportions. However, most car companies cannot ignore CATL as a basic supplier due to its stable supply capacity.

Development of Flat Cell Battery Industry

Four major flat cell enterprises include: CATL, SVOLT, EVE Energy and Farasis —— the latter will not be discussed in detail today, mainly involving WM Motor and FAW.

(1) CATL

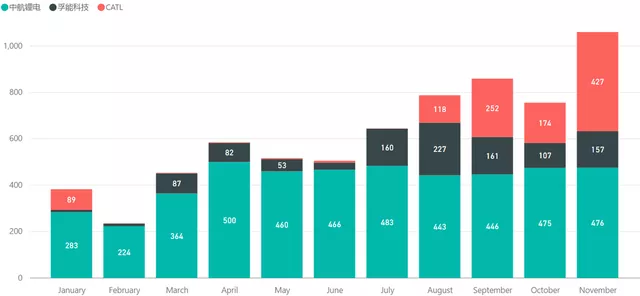

CATL’s vehicle shipments were 7.5 GWh from January to November 2021. I have had a detailed conversation with Xiaoyu before about this company, and this expansion speed requires a lot of funds. At present, it mainly relies on GAC passenger cars, and has a certain share in Changan Automobile, SAIC-GM-Wuling, and a larger imagination after developing XPeng and Leapmotor as customers.

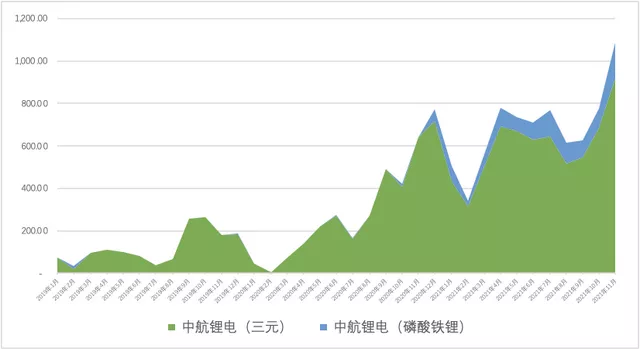

CATL’s main problem is still based on the original VDA battery cell or the clip-on battery, which does not work well with iron phosphate batteries. Continuing to follow CATL’s battery shape, there is no advantage in scale, and it is necessary to quickly switch to the short blade (stacked sheet) process to continue development in 2022.

I think that CATL will face great cost pressure in 2022, and its technology route is too similar to that of CATL, which is also a key target of attack.

(2) SVOLT Energy Technology

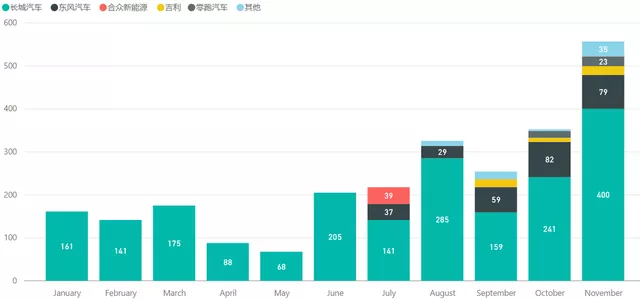

SVOLT Energy Technology’s vehicle shipments from January to November 2021 were 2.6 GWh, mainly relying on Great Wall Motor in the first half of the year, and gradually expanding to other customers in the second half of the year, including Geely, Dongfeng, Leapmotor and Hozon (a flash in the pan with CATL’s investment), overall, the success of the strategy that no longer depends on Great Wall is relatively good.

At present, most car companies have not effectively separated SVOLT and Great Wall, which is still quite different from BYD’s situation, which is conducive to expanding customers in China.

Note: BYD’s current main expansion direction is foreign brands.

(3) XWD

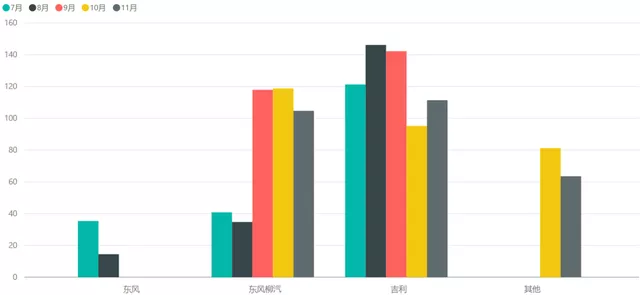

XWD’s vehicle delivery in January to November 2021 reached 1.6 GWh, mainly concentrated in the recent months (82% of the total year’s volume in the past five months), and a part of which went to Europe with Renault and was not counted. XWD’s major customers include Geely, Dongfeng Liuzhou, Dongfeng Motor, and SAIC-GM-Wuling.

In summary, I believe that second-tier shell battery companies, relying on similar technologies and cost considerations with Ningde Times, are at a disadvantage in the current cost situation. In the era of lithium iron phosphate, we need to change the way we approach cost in order to survive.

Currently, many companies are beginning to use energy storage and engineering machinery, among other non-road vehicles, to increase their shipment volumes. More and more volumes (relative to small-scale power) are not included in the statistics, but costs can be spread out to some extent. Tomorrow we will discuss Guoxuan, Funeng, and YWE, almost all major second-tier companies have now been mentioned.

As for those third-tier companies that cannot enter the top ten, we will find an opportunity to discuss them later.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.