Author: James Yang Jianwen

This year is a very important year for the automotive industry.

On a macro scale, China, the United States, and Europe have established the development direction of new energy vehicles, and major players have successively released new energy transformation strategies. The trend of electrification is irreversible.

Refining to the domestic market, the sales of new energy vehicles have exploded, and the penetration rate has also exceeded 20%. China’s new energy vehicle industrialization has officially shifted from “policy-driven” to “market-driven.”

However, for new energy vehicles, electrification is the first stage, and the key to transformation is intelligentization.

So, which new technologies are worth paying attention to this year? And which ones will become the hot topics pursued by everyone in the new year?

This is the topic that this article wants to explore (in no particular order below).

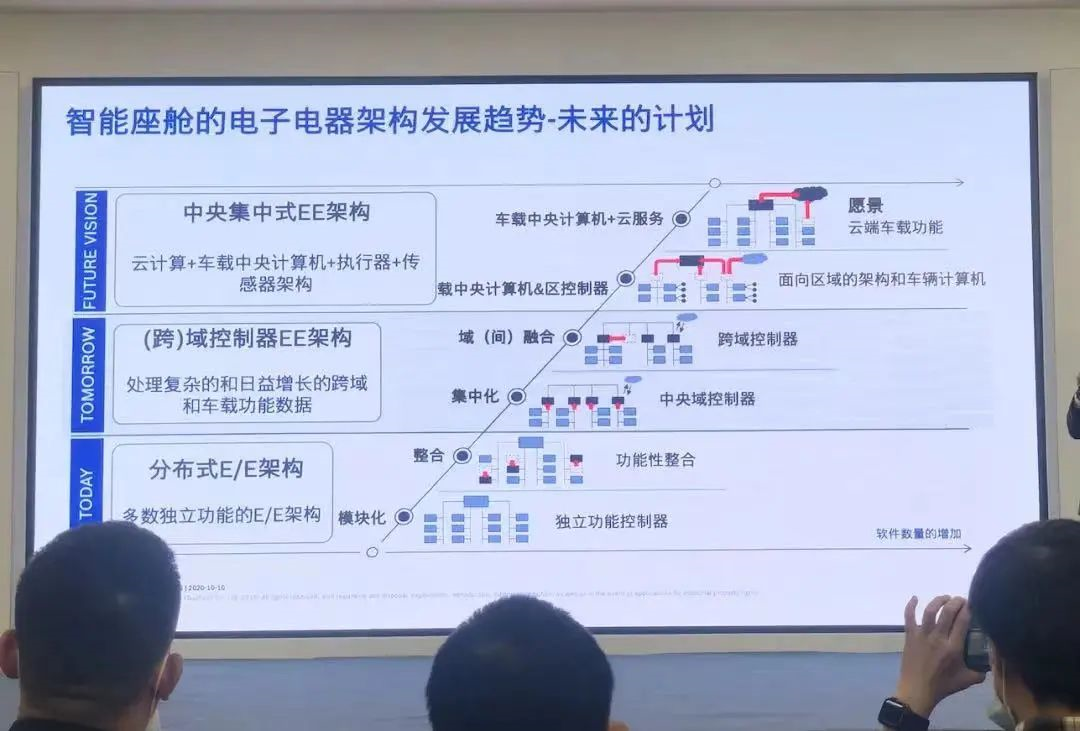

Technology 1: Domain Control Architecture

With the innovation of electrification and intelligence, the traditional distributed architecture can no longer meet the current updating needs. The electronic architecture is evolving from distributed to domain-centralized or even central computing.

This trend has already emerged at the end of last year, but it wasn’t until this year that the architecture innovation was truly perceived by everyone.

We can see a lot of models using domain control architecture: Volkswagen ID. Family, Ranz FREE, XPeng P7/P5, Hongqi H9, BYD Dolphin, among others.

In addition, major players have started to lay out further electronic and electrical evolution:

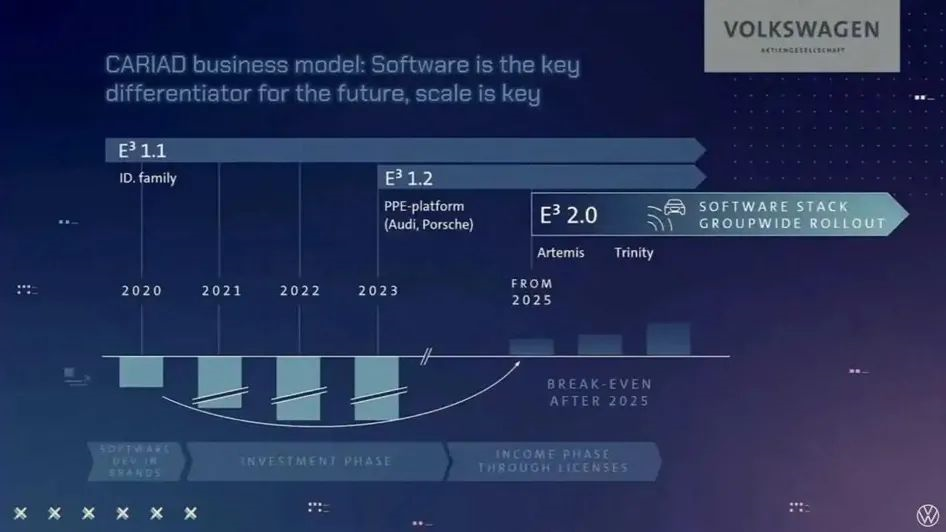

In July of this year, Volkswagen Group released its 2030 NEW AUTO strategy, which mentioned that Volkswagen will integrate its three fuel car platforms and two pure electric platforms into a new SSP scalable platform, and also develop three software platforms.

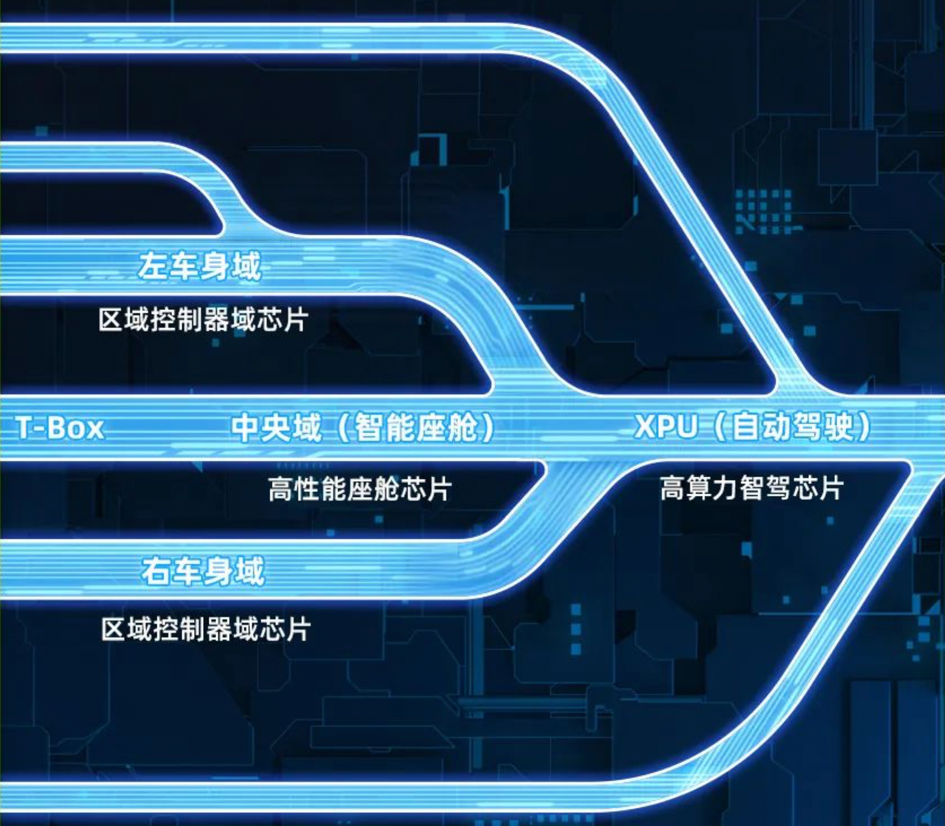

During the Guangzhou Auto Show, XPeng launched its new flagship model, the G9. This new car further evolves towards domain fusion based on domain control.

The new X-EEA 3.0 architecture adopts a “1+2” structure, which means one central computing platform (high computing power chip) + two domain controllers (left car body domain + right car body domain).

During the Guangzhou Auto Show, GAC released the X-Soul electronic and electrical architecture. This architecture consists of three core computer groups: the automotive digital mirror cloud, central computer, intelligent driving computer, information and entertainment computer, and four area controllers, integrating gigabit Ethernet, 5G, information security, functional safety, and other technologies. Compared to GAC’s previous generation of electronic and electrical architecture, the new architecture’s computing power has increased 50 times, and the data transmission rate has increased 10 times, reducing the wiring harness loop by about 40% and reducing the number of controllers by about 20.

During the Guangzhou Auto Show, GAC released the X-Soul electronic and electrical architecture. This architecture consists of three core computer groups: the automotive digital mirror cloud, central computer, intelligent driving computer, information and entertainment computer, and four area controllers, integrating gigabit Ethernet, 5G, information security, functional safety, and other technologies. Compared to GAC’s previous generation of electronic and electrical architecture, the new architecture’s computing power has increased 50 times, and the data transmission rate has increased 10 times, reducing the wiring harness loop by about 40% and reducing the number of controllers by about 20.

As early as last year, Great Wall Motors developed the GEEP 3.0 electronic and electrical architecture covering four domain controllers: body control, powertrain and chassis, intelligent cockpit, and intelligent driving. Now this architecture has been put into mass production and applied to all Great Wall Motors models.

This year, Great Wall Motors has further released the next-generation GEEP 4.0 electronic and electrical architecture. The new architecture has higher integration and consists of central computing, intelligent cockpit, and high-level autonomous driving. The central computing platform integrates body, gateway, air conditioning, powertrain/chassis control, and ADAS functions across domains.

This architecture has entered the product development stage, and will be launched in the third quarter of next year, being first mounted on new electric and hybrid platforms and gradually extended to all models.

But this is not the end. Great Wall Motors has also launched the R&D of the GEEP 5.0 electronic and electrical architecture, where whole vehicle software will be highly integrated onto a central brain and will achieve product commercialization in 2024.

It can be foreseen that more and more models will adopt domain controllers architecture in the future.

Technology 2: 800V Platform

The 800V platform is the popular trend for this year.

Slow charging is currently the pain point in the new energy industry. Installing high-power charging stations (peak charging power of 120 kW or above) is a good solution, which is an external force way.

Turning inward, high-voltage vehicle platforms have become the focus of major automakers’ layouts.

Inside the car, there are a large number of devices, which is even more so after electrification.The purpose of the voltage platform is to match the power supply requirements of different components. Some components require lower voltage, such as body electronics, entertainment devices, and controllers (usually powered by 12V voltage platforms), while others require higher voltage, such as battery systems, high-voltage electric drive systems, and charging systems (400V/800V), which gives rise to the distinction between high-voltage and low-voltage platforms.

Compared with the commonly used 400 kW high-voltage platform, the 800V platform can offer better charging performance.

Taking the Porsche Taycan, which has already achieved mass production of 800V high-voltage platform, as an example, the official claimed that the peak charging power can reach 350 kW (however, currently the peak power can only reach 270 kW, and domestically it can only provide 200 kW).

In addition, the support of the 800V high-voltage platform makes electric vehicles more “enduring”, allowing them to carry higher currents and higher voltages for faster charging, while also giving the vehicle stronger performance.

More and more automakers are also beginning to layout 800V high-voltage platforms:

BYD: the new e-platform 3.0, equipped with 800V high-voltage charging technology, can achieve 5-minute charging and 150 km of driving range;

Huawei: plans to launch the FC1 flash charging solution with 750V and 200 kW this year, which can achieve 30%-80% SOC in 15 minutes, and is expected to launch the FC2 flash charging solution with 1000V and 400 kW in 2023;

Polestar: 800V is currently under planning;

Li Auto: the layout of 800V high-voltage fast charging, supports up to 350kW ultra-fast charging, and can drive 400 kilometers in 10 minutes of charging;

Ideal: the pure electric vehicle model to be released in 2023 will use an 800V architecture, reducing charging time to 10-15 minutes.Guangqi Aion announced the release of the 880V high-voltage platform, which achieves a maximum charging power of up to 480 kW. During testing, it only took less than 5 minutes (4 minutes and 50 seconds) to charge from 30% to 80% battery capacity.

XPeng Motors expects to be the first to mass-produce the 800V high-voltage SiC platform in China, enabling 5-minute charging and a 200-kilometer range.

However, it should be noted that the supply chain for 800V high-voltage platforms is not yet mature. Most high-voltage components are still adapted to 400V platforms. However, as more and more car manufacturers turn to 800V platforms, the supporting supply chain system will also be established.

In the next one to two years, we will see more and more electric vehicles built on this platform.

Technology 3: Lidar

Although it has been discussed since 2020, it is not a very new technology.

What’s different is that at that time, automakers took a “wait-and-see” attitude towards lidar. But now, more and more automakers are actively embracing it.

Compared to cameras and millimeter-wave radars, lidar has a very obvious advantage in achieving intelligent driving: it can see distant objects more clearly, provide 3D positioning and shape information directly, and has good recognition capability in special scenes such as at night or when the lighting changes. This improves the perception capabilities of intelligent driving and makes it possible to create better intelligent driving.

Therefore, in 2021, the choice of means for achieving intelligent driving among automakers showed a very consistent tacit agreement: lidar, lidar, and lidar…

A very typical example is that Honda and Mercedes-Benz both launched L3 autonomous driving at the beginning and end of this year, and lidar played a key role in their implementation of L3.

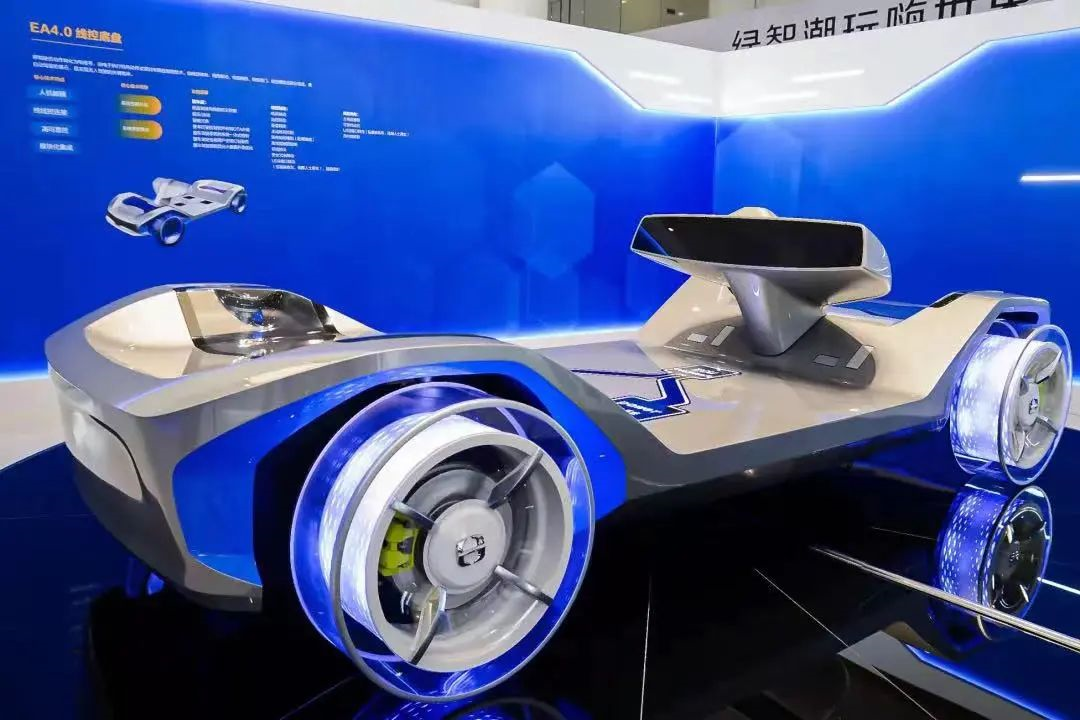

To cater to new challenges and competition brought by electrification, major automakers have begun laying out dedicated platforms, including skateboard platforms, which have emerged as a hot topic this year. A skateboard platform is a new kind of platform concept that integrates vehicle power, braking, steering, thermal management, and three power sources on the chassis to achieve decoupling of the upper and lower body of the vehicle. Manufacturers can rapidly develop models according to their own needs, shorten development cycles, and reduce manufacturing costs by using it as a standard component.

Skateboard platforms have gained popularity, thanks in large part to the propulsion from US EV start-up Rivian. This year in November, the company went public with a market valuation of up to $77 billion, and it is now just one step away from the trillion-dollar market cap mark (its current market value has already risen to $92.616 billion). Among the reasons for this achievement, is Rivian’s skateboard platform technology, which is universal and allows the company to launch two models in the shortest possible time.

In China, YouPai Technology and Hezi Motors have also begun laying out in this area, albeit the automakers still hold the dominant right over the industry. Whether this technology is truly an industry trend or merely a game for capital requires continuous observation for a period of time.

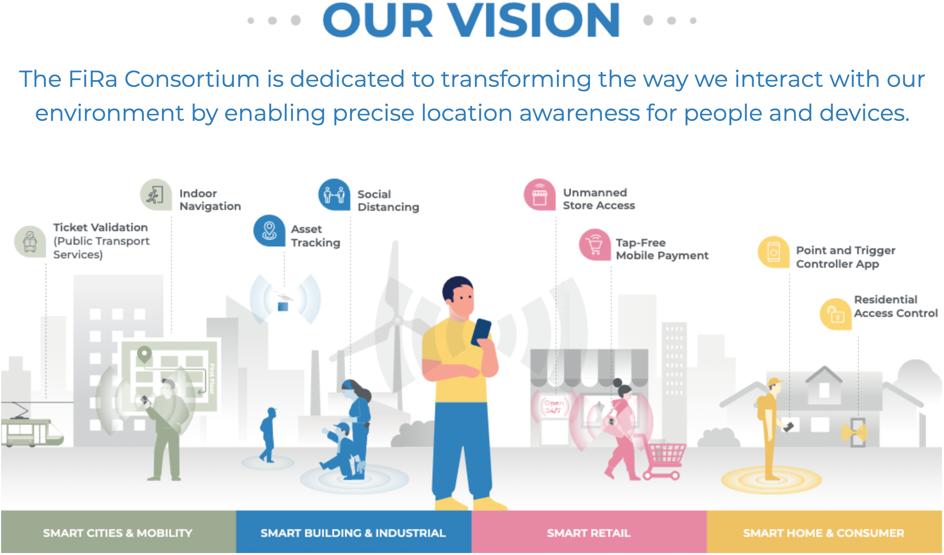

UWB Keys are the fifth technology, and this is performed as follows:

First, what is a UWB Key?The definition of UWB on Baidu Encyclopedia is as follows: UWB is a wireless carrier communication technology that utilizes nano- to micro-nanosecond narrow pulse transmission of non-sinusoidal waves to transmit data, mainly used in military radars, positioning, and communication systems with low interception/detection rates. If a radio system has a relative bandwidth of more than 20% of the center frequency or an absolute bandwidth of more than 500 MHz, it is called a UWB radio system.

UWB uses ultra-wideband baseband pulses to communicate, and can propagate through very narrow pulses. It has the advantages of being insensitive to channel fading, low transmission signal power spectral density, low interception rate, low system complexity, and can provide positioning accuracy to the centimeter level.

Do you remember Apple’s AirTag? It uses UWB to achieve high-precision positioning and tracking functions.

Digital keys based on UWB technology can achieve high-precision positioning and effectively avoid relay station attacks.

In addition, in cars, UWB technology can also achieve the following applications:

Now, more and more automakers are adopting UWB key technology solutions. The BMW iX launched at the Guangzhou Auto Show has already been adapted with UWB keys.

The NIO ET7 is the first model in China to adopt this technology, and its flagship model ET5 is also equipped with this technology.

Supplier giant Continental Group has announced orders for keyless entry systems from three major global automakers in Europe and Asia.

As the carrier of digital keys, more and more smartphone manufacturers are beginning to support UWB, such as Apple, Samsung, Xiaomi, and others.

As early as August 2019, companies such as NXP, Samsung, Bosch, and Sony formed the FiRa Alliance, which is dedicated to developing and widely promoting ultra-wideband (UWB) technology. Infineon joined the alliance in November this year.

With the improvement of the underlying ecology, in the next step, UWB-related technologies will also become a key focus for major manufacturers to make efforts.### Technology 6: AR-HUD

AR-HUD, or augmented reality head-up display. Traditional HUD can only project car-end information (such as speed, navigation, gear position, etc.) onto the windshield in front of the driver. However, AR-HUD combines augmented reality (AR) technology to display relevant information such as navigation guidance directly on the road, improving driving safety.

At the same time, AR-HUD can also have highly coordinated functions with autonomous driving technology, displaying content related to assisted driving and improving driving safety.

In summary, AR-HUD is the future development direction of HUD.

The Mercedes-Benz S was the first vehicle to mass-produce and apply the AR-HUD technology, but the price of over one million yuan makes this technology unable to be widely popularized.

However, entering this year, we can see that more and more affordable models are beginning to apply this technology.

In March, the ID.4 went on the market and became the first model priced at over 200,000 yuan to use AR-HUD technology. In October, the ID.3 went further and allowed for AR-HUD to be obtained for around 180,000 yuan.

Domestic automakers are even more powerful, with models such as the Geely Star Voyager L, Wey Mocha, Nest and other models equipped with AR-HUD, lowering the entry threshold of AR-HUD to around 160,000 yuan.

According to the internal market data analysis report of Continental Corporation (2019 version), by 2030, the entire AR-HUD market scale is basically close to more than half of the entire head-up display market scale, and the growth trend is showing a multiple increase.

In brief, the market prospects for AR-HUD are bright.

Technology 7: ADB & AHB Lighting Technology

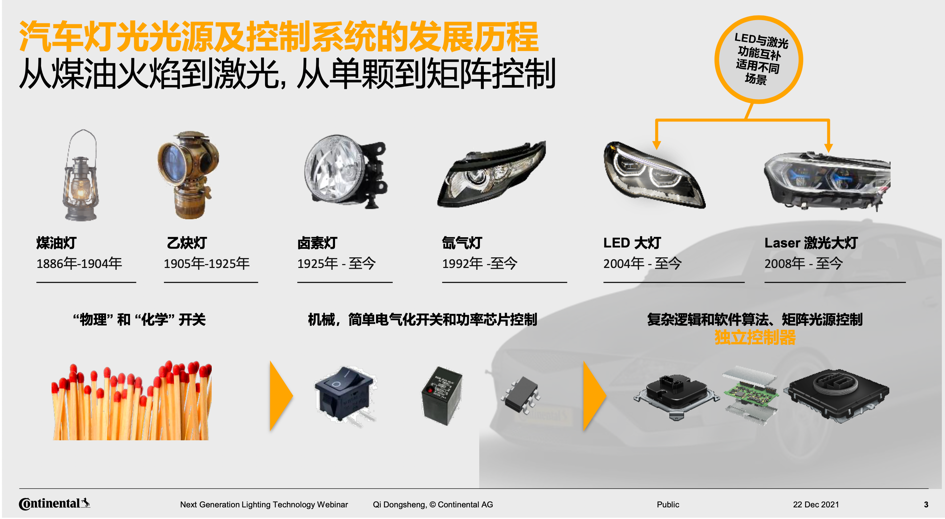

Before discussing this, let’s take a look at the development process of automotive lighting sources and control systems.The automotive headlights have gone through many iterations. Initially, there were physical kerosene lamps and acetylene lamps. With the advent of electrification, halogen lamps and xenon lamps became mainstream. Due to their good reliability and low cost, many cars still use halogen lamps. Afterwards, we became familiar with LED headlights and laser headlights, although the technology had been available for a long time, it has only been applied on a large scale in the past couple of years.

The evolution of lighting control technology is related to the improvement of light sources. Initially, there was simple on/off and high/low beam control. Later, automatic headlights (both halogen and LED) were developed. The emergence of LED headlights and laser headlights made fine control possible.

This leads to the introduction of the next two technologies: Adaptive Driving Beam (ADB) and High-Definition Lighting (AHB).

Both of these technologies require participation of the vehicle’s sensing system, such as cameras, millimeter-wave radar, maps, and chassis sensors, to fuse multiple types of information.

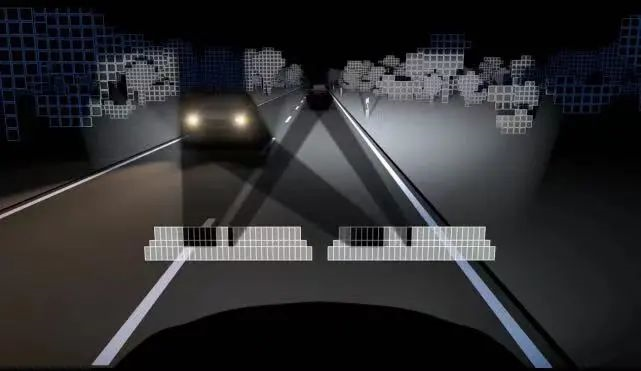

First, let’s talk about ADB. When you turn on high beam and there are oncoming vehicles, the ADAS camera in front of the car obtains target information. The data is sent to the light control unit via a high-speed bus. The algorithm calculates the anti-glare area, and then accurately controls the light beads to turn on and off. The anti-glare area will adjust by itself as the car moves to avoid causing trouble to other vehicles.

The Polestar 2 uses a similar technology, which offers an excellent experience.

Although it is not an easily-perceptible technology, it significantly improves the driving safety and vehicle lighting experience.

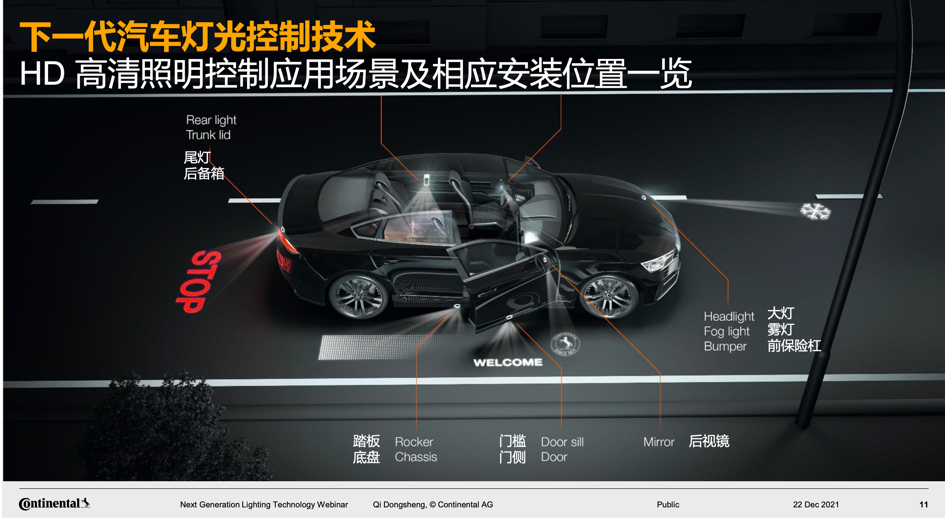

The other technology everyone is playing with these days is AHB high-definition lighting. The combination of lighting with electronics and software, and the integration into the vehicle’s network systems, makes lighting more adaptive and intelligent. You can directly project the desired patterns or shapes with your car.

Now, more and more automakers are exploring new ways to innovate in this field:

Tesla seems to have mastered the art of lighting control. One of the biggest highlights of the new V11 update is the more refined lighting control, where you can use the headlights to form the English word “TESLA”:

In addition, Tesla has also opened up the customization of light shows to users. Users can DIY the effects they want:

Moreover, more and more new cars are directly integrating LED into the vehicle design, such as the Cadillac LYRIQ.

Around the field of lighting, what other tricks can manufacturers come up with? This is also a key area to continue to pay attention to.

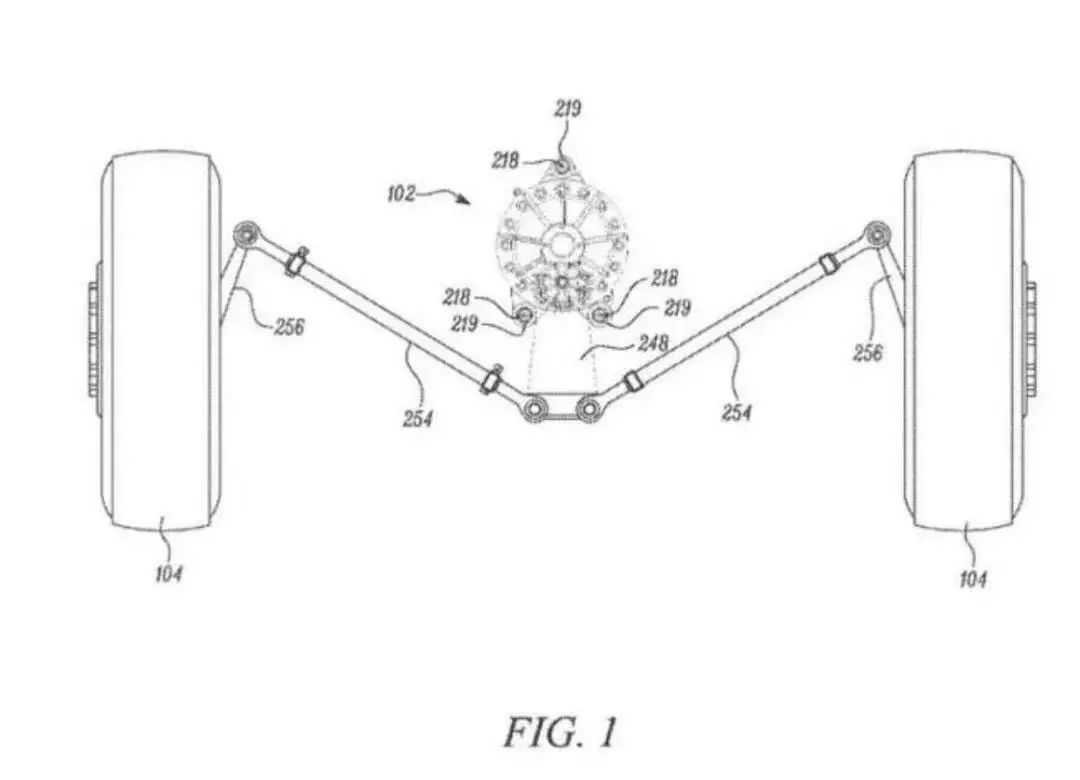

Technology 8: Drive-by-Wire Steering

This is not actually a new technology. It was first used in aerospace and later mass-produced by Infiniti.

Compared with traditional steering designs, drive-by-wire steering completely decouples the steering wheel and the wheels. Algorithms, electronic devices, and actuators replace the mechanical steering connection between the steering wheel and the wheels. Because each link transmits the signal through electrical signals, faster response speed can be achieved, enhancing vehicle maneuverability and comfort.

Since the Infiniti Q50, few cars in the industry have been mass-produced with this technology. However, as of this year, we have clearly seen a rising trend in drive-by-wire steering technology.

Toyota has released its first car, the bZ4X, based on the Toyota e-TNGA pure electric architecture. It is worth mentioning that Toyota has delegated the One Motion Grip drive-by-wire steering technology to this car.

Tesla, who is not afraid to try new things, has also stated that it is conducting related technology research and hopes to apply the technology to the electric Cybertruck pickup truck.

In November of this year, Volkswagen also announced that they are developing the next generation of chassis and steer-by-wire technology.

In China, the reason why this technology has become popular is due to two factors: regulations and the demand for autonomous driving in the future.

Talking about regulations, the national standards for steer-by-wire production in China are currently blank, so this technology cannot be mass-produced. In early December of this year, the online steering control working group meeting of China Automotive Technology and Research Center announced that NIO, Geely, and Jidu have officially become the joint leading units for the development and standardization of steer-by-wire technology, and will lead the development of national standards for steer-by-wire.

In January next year, China’s steering standard GB 17675-2021 will remove the previous constraints on the decoupling of steering wheel and wheel physics of the steering system.

After the regulations are improved, the steer-by-wire chassis will also usher in new development opportunities.

Secondly, there is a strong demand for high-end driving requirements. In the future, automotive hardware and software will definitely achieve complete decoupling so that the system can achieve more accurate control of the vehicle. At the same time, another issue is the arrival of L4 intelligent driving in the future, and we may not even need a steering wheel, which is also a problem that needs to be considered.

Jidu said that relevant self-developed software development has officially started in 2021, and Jidu has preliminarily locked in the design scheme. In early 2022, sample testing will be carried out, and Jidu can open up Jidu steer-by-wire related experience in the second half of the year.

With the conditions allowed by regulations, Geely and Jidu will strive to realize the domestic first release of steer-by-wire mass production.

Apart from Jidu, Great Wall is also carrying out related layouts.

Great Wall Motor’s intelligent steer-by-wire chassis is based on the new electronic and electrical architecture of GEEP 4.0. It completely integrates the five core chassis systems of steer-by-wire, electro-mechanical brakes, steer-by-wire shifting, throttle-by-wire, and steer-by-wire suspension, covering six degrees of freedom of motion control for the vehicle’s front and rear, left and right, up and down, encompassing all chassis driving actions, achieving 1 brain coordinate 5 systems to achieve control over six degrees of freedom, and will achieve mass production in 2023.

In addition to these companies mentioned above, Geely and NIO, who are the leaders in steer-by-wire technology standards, must also be carrying out related layouts.

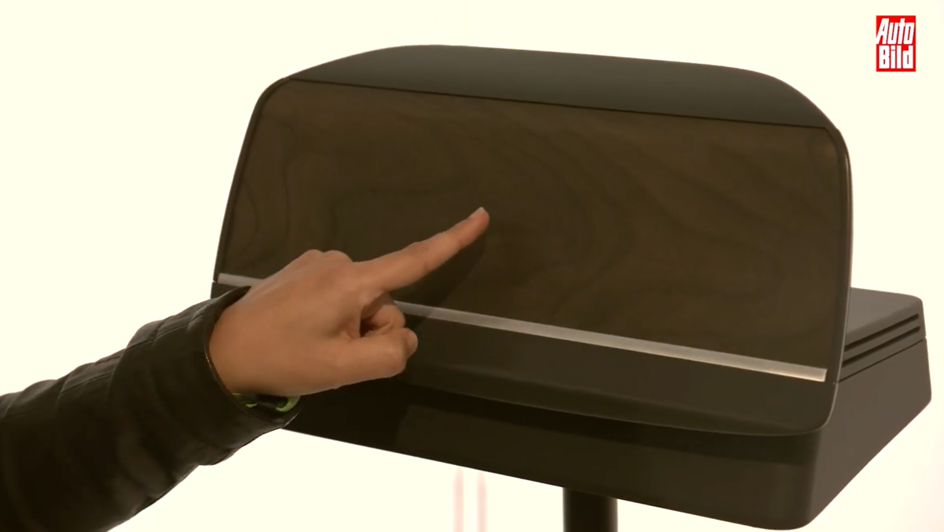

Technology Nine: New Cockpit Display Screen

What will the future cockpit display be like?

Currently, we have seen a variety of solutions: horizontal screens, dual screens, triple screens, quadruple screens:

Now, China offers a different display solution: ShyTech display screen.

Although it looks like decorative panels such as wood grain, carbon fiber, or leather style, it is an instrument display screen when lit up. The demonstration effect looks good from the following photo:

This technology can perfectly integrate information display and vehicle design.

Although this technology may take some time to land in the short term, it is indeed a very good solution for cabin display and is worth paying attention to.

China will launch this technology in 2023.

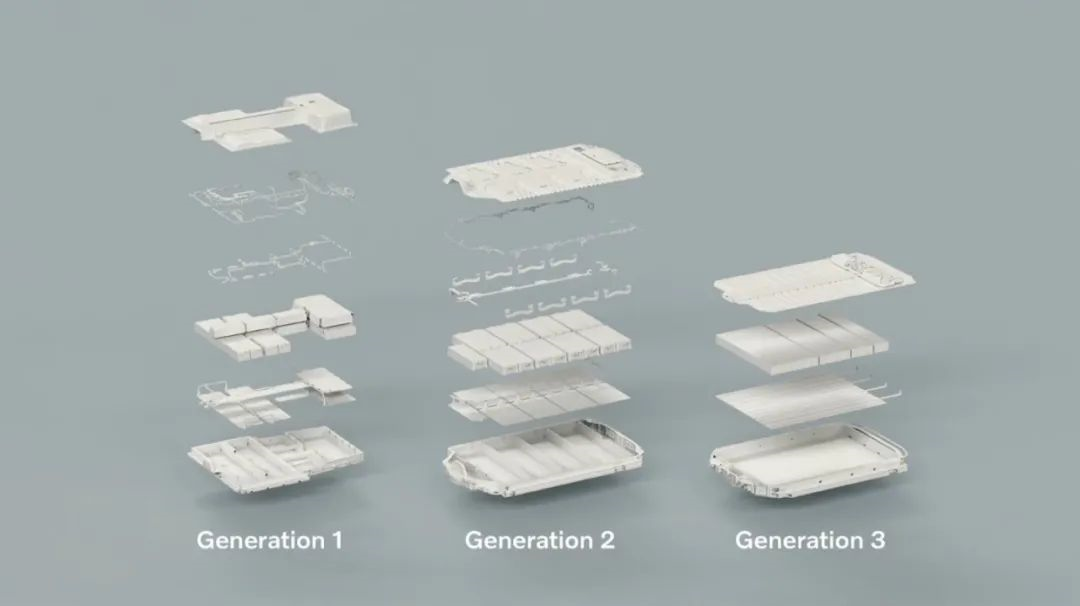

### Technology 10: CTC

CTC, Cell To Chassis, is to directly integrate the battery on the chassis.

There are two factors influencing the popularity of electric vehicles, one is the range, and the other is the cost. In terms of range, battery energy density is the most critical factor.

It is difficult to improve battery energy density through the innovation of electrochemical systems. Therefore, the industry began to focus on production, manufacturing, process, and structure.

The traditional battery integration program is generally: cell-module-Pack. Then, the industry came up with CTP (Cell to Pack) technology, skipping the module step, and directly integrating cells into a battery pack.

Tesla goes further and proposes CTC, directly attaching the battery to the chassis, calling it the "ultimate manufacturing method for all future electric vehicles."

Not only Tesla, but also Volkswagen and Volvo have mentioned CTC in their future strategies:

In addition, battery manufacturers have also joined the game. In January of this year, CATL revealed that it will launch CTC technology in 2025 and upgrade to the fifth-generation intelligent CTC electric chassis system around 2028. In December, at the second Battery Day, SVOLT Energy Technology also announced an integrated CTC battery system based on blade batteries, with a battery capacity of up to 130 kWh and a range of up to 1,000 kilometers.

From current trends, Tesla is most likely to be the first manufacturer to launch related products.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.