At the end of the year, I want to spend some time looking ahead.

Last year’s predictions had huge errors because they were based on past data. Reflecting on this, all predictions should be based on orders and market demand rather than historical data. Therefore, this article will focus more on historical and estimated perspectives to consider what the bottom line will be for next year.

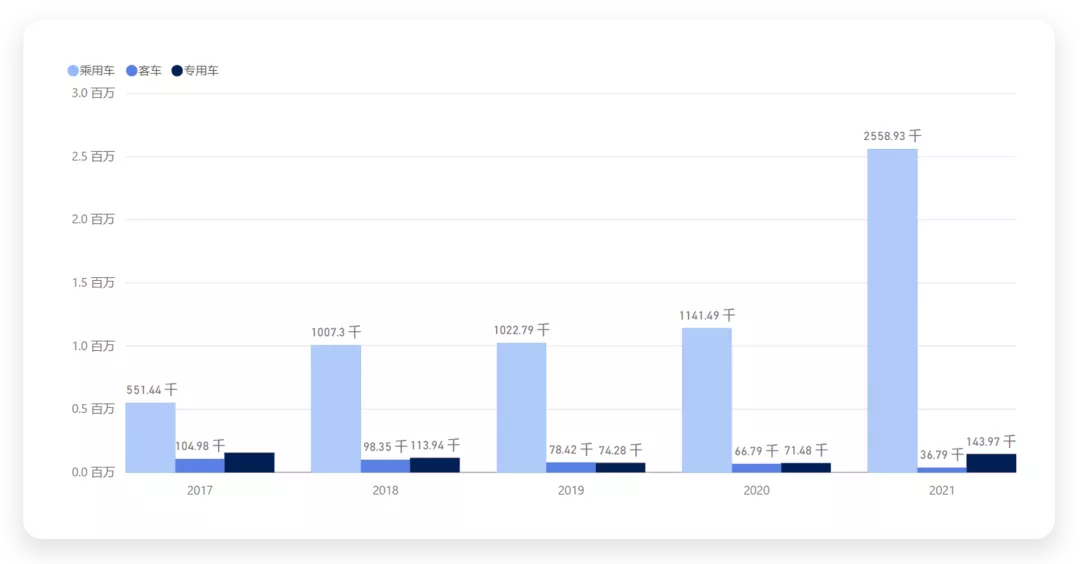

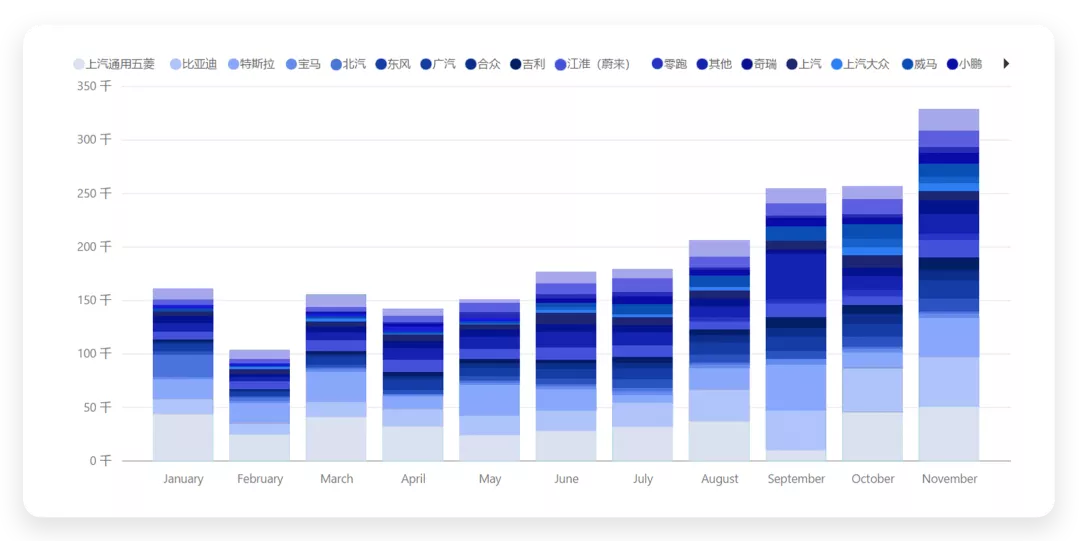

From January to November 2021, the production of new energy passenger vehicles was 2.559 million units, with a single month breaking through 408,000 units, a historical record. However, only 36,800 new energy buses were produced this year. The output of special purpose vehicles has doubled and reached 143,900 units in the first 11 months.

Looking ahead to 2022, can we reach our goal and advance the total to 5 million units?

How to Think and Forecast Based on Historical Data?

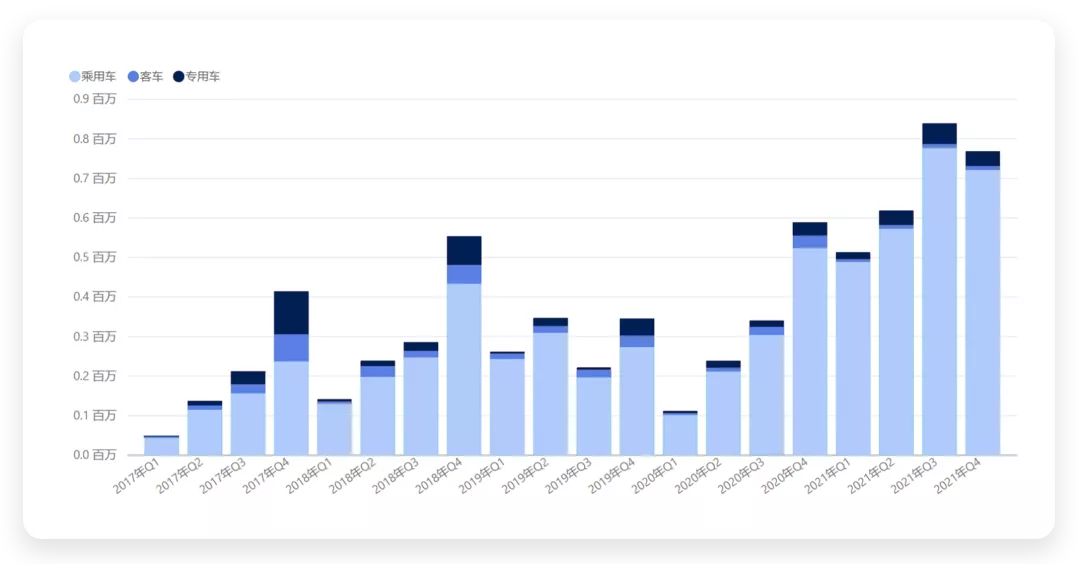

Since there have been many past errors, more imagination needs to be added according to empirical experience to make more accurate predictions, as shown in Figure 2 below.

We can see the monthly data:

- In 2017, when the shock absorber was applied, the peak production of passenger cars was 100,000, and the production of buses and special purpose vehicles was around 50,000.

- In 2018, due to subsidy reduction, the peak production of commercial vehicles was unable to reach 50,000 anymore. In November-December, the production of passenger cars exceeded 150,000.

- In 2019, the subsidy reduction had a huge impact on the entire industry, and the monthly production of passenger cars never returned to the peak of 150,000.

- In 2020, affected by the pandemic in the first half of the year, efforts were made to vigorously promote new energy vehicles in the second half of the year, and the monthly production of passenger cars rose to 200,000 in November and December.

- In 2021, there were fluctuations in the month of the Spring Festival, and then the overall output was gradually increased from July onwards, breaking through 400,000 in November, reaching a new high.

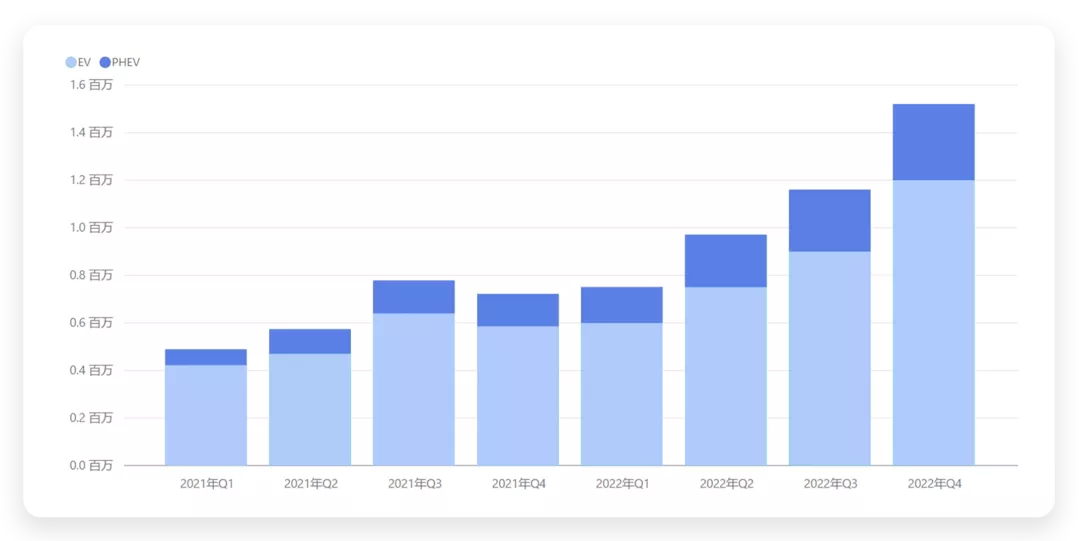

If we break down these data by quarter, the output of new energy passenger vehicles exceeded 770,000 in Q3 2021, and is expected to exceed 1 million in Q4, approximately 1.1 million units.If we look at 2020 and 2021 separately, 2020 climbed from the low point in Q1, and reached a high point by the end of the year. In 2021, it maintained a high base, and was expected to experience effective growth in Q3 and Q4.

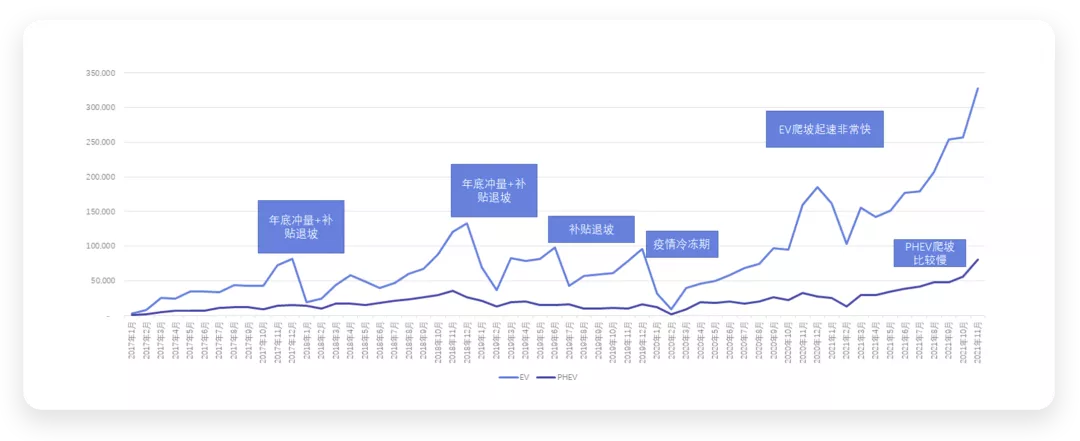

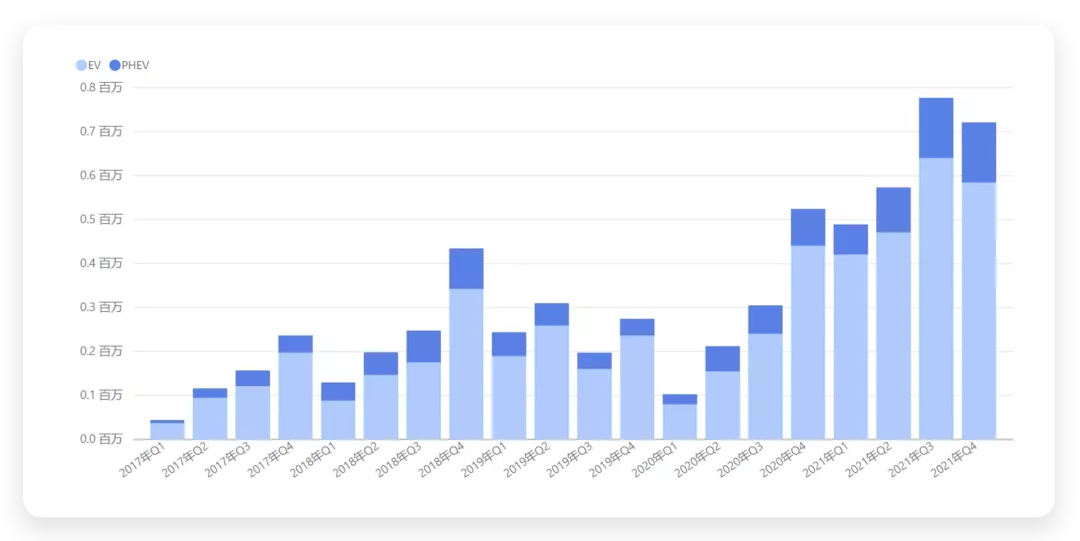

Next, let’s look at passenger cars separately, divided into two categories: all-electric BEV and plug-in hybrid PHEV. It may be clearer as shown in Figure 4:

From a quarterly perspective, the main surge in passenger car EVs occurred between Q4 2020 and Q2 2021, stabilizing at more than 400,000 units per quarter, breaking 600,000 in the last quarter, and estimated to reach 850,000-900,000 in Q4.

PHEV climbed slowly from its previous highest of 90,000 units to 130,000, and is expected to exceed 200,000 in Q4.

Based on the above, it can be estimated that the stable production capacity of passenger car EVs is currently at 700,000 units per quarter, while PHEV is at 150,000 units per quarter.

Assuming for 2022:

• Q1: due to the Spring Festival factor and the decline in momentum, it is expected to return to the amount of Q3 2021, and quarterly production will remain at 750,000 units.

• Q2: will begin to recover, with total production exceeding 1 million.

• Q3: following the trend of Q3 2021, it will reach 1.16 million units.

• Q4: next round of subsidies and momentum, with quarterly production rising to 1.52 million units.

Therefore, it is estimated that all-electric will be 3.45 million and plug-in hybrid will be 950,000.

Verification of All-Electric

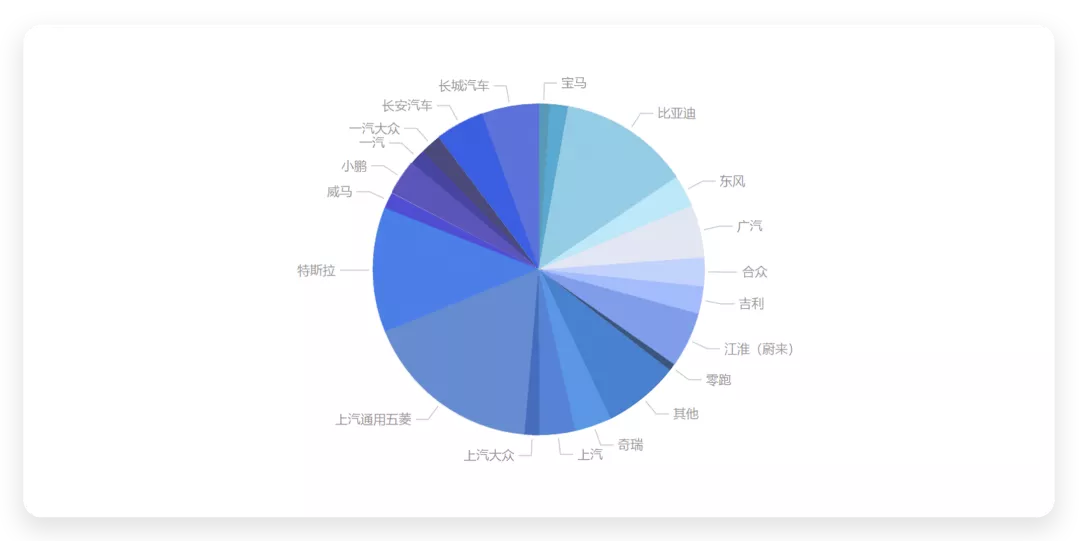

Now let’s take a look at whether 3.45 million all-electric units is realistic.From the current camp, there are mainly three types of enterprises: new car manufacturers, A00 level car companies and state-owned A-level car companies.

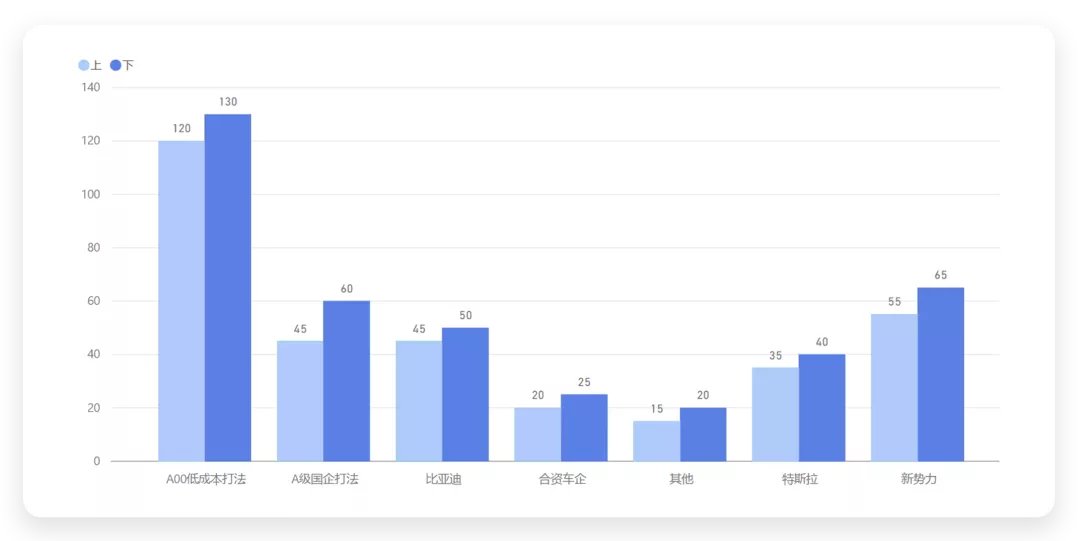

● SAIC-GM-Wuling produces 369,000 units, Chery produces 75,000 units, Changan Automobile produces 99,000 units, Great Wall Automobile produces 118,000 units, and SAIC (Clever) produces 74,400 units, totaling approximately 730,000 units, accounting for 34.8%. This part can achieve nearly 900,000 to 950,000 in 2021, coupled with 50,000 to 100,000 in other areas, so it will provide support for a production volume of 1 million starting from 2021. In my personal judgment, this part could have a 20% growth, achieving a volume of 1.2-1.3 million in 2022, mainly driven by cost (supplier’s non-profit pursuit) and credit limit (too much supply leads to low prices).

● Then Guangzhou Automobile Group, FAW Group, Dongfeng Motor Corporation, BAIC Motor Corporation and Geely produce 300,000 units at present, increasing by 50,000 units in the last month, and estimated to produce 350,000 units. It will be challenging to increase the production of these A-level cars next year. Currently, maybe some parts could stabilize through the battery-swapping model, estimated to be capable of producing 450,000 units, mainly due to Guangzhou Automobile Group and Geely’s possible active role.

● BYD: 268,000 units from January to November 2021 (market share of 12.71%), estimated to hit 300,000 BEV in the next month, and capable of increasing to 450,000 to 550,000 by the estimated stable production capacity in 2022.

● Tesla: 257,000 units have been issued a certificate of conformity in China, with a market share similar to that of BYD. It is estimated that sales will reach 400,000 units in China in 2022.

● New energy vehicle start-ups: currently producing around 300,000 units from January to November, estimated to reach 350,000 units in 2021, and capable of hitting 650,000 units in the next few years before 2022.

● Joint ventures and other enterprises: Approximately 120,000 units, estimated to increase by another 200,000 units per year in 2022. Other ordinary companies, approximately 160,000 units, will increase to 200,000 next year.

### Translation

### Translation

Summary: This estimation is relatively optimistic. My main consideration is still the cost in 2022 and whether automakers can accept this cost structure or not. It is important to maintain a high base and achieve structural growth to offset the economies of scale for gasoline vehicles and further impact their profitability balance point.

In addition, I expect that many A00 models will use domestically produced chips next year, which will further limit production. Overall, I remain optimistic about this.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.