5 Million Units: Predicted Sales Volume of China’s NEVs in 2022

Author: Li Yuanyuan

5 million units is a prediction made by many authoritative institutions and individuals, including China Association of Automobile Manufacturers, Ouyang Minggao (an academician of the Chinese Academy of Sciences), and many securities analysts, regarding the sales volume of China’s NEVs (new energy vehicles) in 2022.

At the 2022 Electricity and Power Generation Conference, Li Jinyong, the Chairman of Zhonghai Electric and the President of the New Energy Automobile Branch of the China Federation of Industry and Commerce Chamber of Commerce, agreed with this prediction. According to his analysis, high-end intelligent electric vehicles and A00-level intelligent electric vehicles will take the largest share, and their annual sales are expected to reach 1.5-2 million units.

Some guests believe that the sales volume of 5 million units next year may be difficult to achieve, but over 4 million units is feasible. At the same time, the guests all agree that Chinese car consumers have a higher acceptance and expectation value for intelligent vehicles than other countries. The improvement of intelligence and the reduction of costs are key to the continued growth of China’s NEV sales.

In addition, Zhou Lijun, the director of the Yiche Research Institute, pointed out from the perspective of China’s population evolution that opportunities should be seized in the middle-aged, feminization, singleness, and aging of the population.

5 Million Units: High-end and A00 vehicles account for 80%

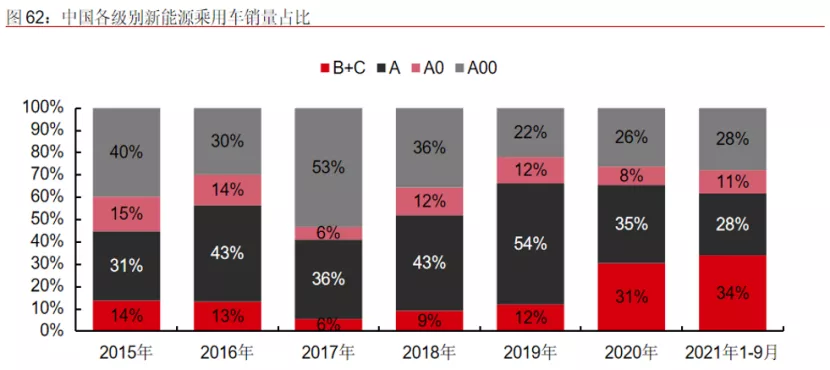

Since the early stage of the promotion of NEVs, the market share of vehicles at different levels has changed drastically, especially for A00-level electric vehicles and high-end electric vehicles dominated by B-level and C-level.

Among them, the market share of A00-level electric vehicles reached its peak in 2017, accounting for 53%, and then fell sharply to below 30%. Since 2020, with the hot sales of micro pure electric vehicles like the Hong Guang MINI EV, the A00 market has started to climb. From January to September this year, the market share of A00-level electric vehicles has risen to 28%.

Regarding high-end electric vehicles, before 2018, Chinese consumers had a relatively small selection. However, with the emergence of new car companies such as NIO, Tesla’s entry into China, and the launch of high-end models by joint venture and domestic brands, the market for mid-to-large electric vehicles has quickly opened up. From January to September this year, the market share of B-level and C-level NEVs has reached the highest level in history at 34%.

Li Jinyong analyzed that with the realization of intelligent cockpits and automatic driving, as well as the continuous decline in related hardware costs, the market share of these two types of NEVs will continue to rise in 2022.

Firstly, high-end intelligent electric vehicles represented by Tesla, NIO, Ideal, and some models of BYD are expected to produce 1.5-2 million units next year, continuing to squeeze the market share of traditional fuel high-end vehicles such as BBA. Among them, Tesla’s output may be as high as 650,000 units, and Volkswagen, with strong promotion and publicity of the ID series, may achieve a production volume of 140,000 units.

Meanwhile, Li Jinyong predicts that the production and sales of A00-class electric vehicles in 2022 will be equivalent to that of high-end electric vehicles, with an expected volume of 1.5-2 million units.

He emphasized that A00-class electric vehicles, with the blessing of intelligent cabins, are fundamentally different from traditional micro-fuel passenger cars. In the eyes of consumers, they represent a new category and a new fashion, rather than the concept of low-end cars. In addition, with low operating costs, A00 cars equipped with intelligent cabins will be the first to replace same-class fuel vehicles.

Zhou Jiang, president of NETA Automobile Trading Company and guest of the Electric Observer Conference, also agrees that the mass market is not a “low-price low-intelligence” market. What the market really lacks is “affordable and highly intelligent” intelligent electric products. The flagship model under NETA Automobile, NETA V, is a pure electric A00-class car.

Li Jinyong added that in 2022, the shortage of chip supply may also lead to the production capacity of automakers tilting towards high-end models, affecting the production of A00-class vehicles. If chip supply is sufficient, the sales of A00-class intelligent electric vehicles will be unstoppable.

In addition to high-end and A00-class vehicles, plug-in hybrid vehicles have the advantages of low fuel consumption and no range anxiety. Coupled with the empowerment of intelligent cars, the production and sales of plug-in hybrid vehicles are expected to increase significantly in 2022. Li Jinyong predicts that the production and sales volume of plug-in hybrid vehicles next year is expected to reach 1.2 million units, far higher than the level of 500,000 units in 2021, driving more domestic brands to continue to move up.

Furthermore, according to Li Jinyong’s analysis, the public consumption sales volume of new energy vehicles in 2022 will be approximately 300,000-400,000 units, and the commercial vehicle market will also have approximately 300,000-400,000 units.

Intelligent Empowerment, New Energy Vehicles Enter Millions of Households

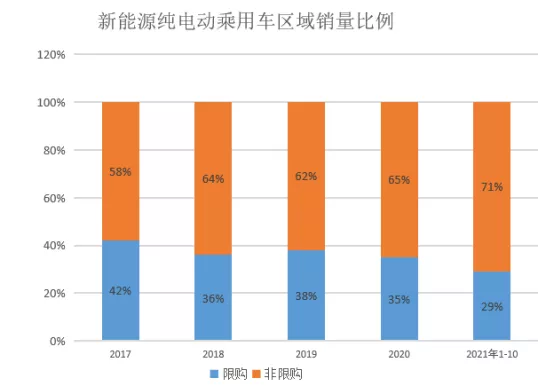

From operating vehicles to private car outbreaks, from “rich people’s toys” to civilian vehicles, from the helpless choice of restricted-purchase cities to the independent use of vehicles in unrestricted-purchase cities…new energy vehicles in China have entered ordinary households and become a popular product.

The popularization of new energy vehicles in China is closely related to the rapid development of automobile intelligence.

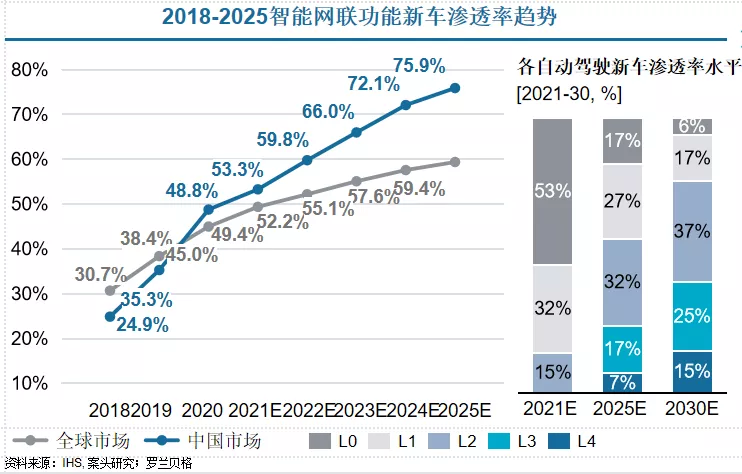

According to research data from Yuan Wenbo, a partner at Roland Berger, a guest speaker at the Electric Observer Conference, since 2020, the penetration rate of intelligent connected new cars in China has exceeded the global market average. By 2025, the penetration rate of intelligent connected cars in China is expected to be close to 76%, far higher than the global level of nearly 60%.

During the speech at the Electric Observation Conference, Zhou Lijun, Dean of the Yiche Research Institute, introduced that according to research conducted by the Yiche Research Institute, among the 3,000 surveyed users, nearly 50% of them are willing to purchase new energy vehicles, and the proportion of those who choose hybrid vehicles is close to 30%, while the proportion of those who choose to purchase gasoline-powered vehicles has decreased from 80% in previous years to just over 20%.

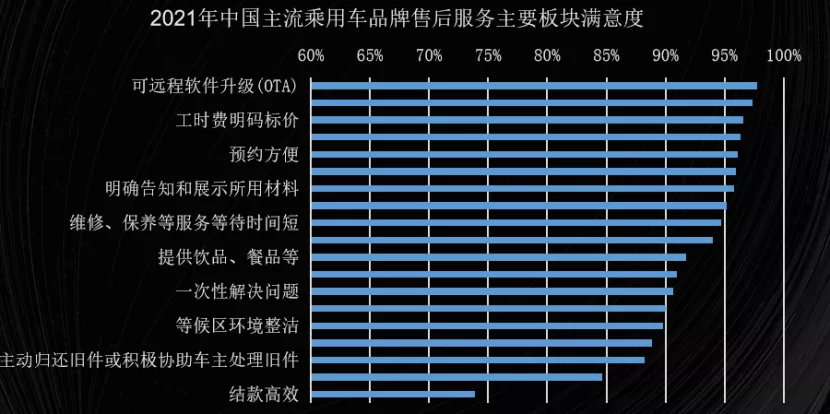

In addition, the satisfaction rate of electric vehicle users is very high, exceeding 85%. Specifically, the OTA function of electric vehicles has a satisfaction rate of over 95%. This clearly illustrates that intelligent electric vehicles have begun to occupy the minds of consumers.

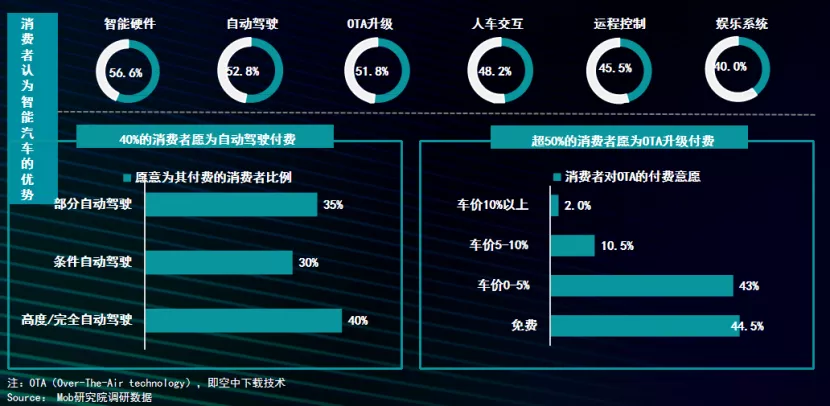

Even more important, Chinese consumers have a high willingness to pay for automotive intelligence. Survey data shows that 40% of consumers are willing to pay for fully automated driving functions, and over half of consumers are willing to pay for OTA upgrades.

Li Jinyong believes that China currently has a user base of more than 8 million new energy vehicle users, and in the past year or two, the product power of electric vehicles has been rapidly improving, and consumers’ favorability towards electric vehicles has also been increasing. In the Z era, users’ brand recognition of traditional gasoline-powered vehicles has significantly decreased, and those influenced by these factors will also experience a split in the future, thereby bringing an increase in new energy and intelligent vehicle users.

As Zhou Lijun stated, from 2021 to 2025, the Chinese auto market will enter a fully electrified and intelligent era. In other words, the period of the 14th Five-Year Plan may be the golden development period for electrification and intelligence in China.

The Four New Characteristics of Users: Middle-aged, Feminization, Singleness, and Aging

Why is the new energy and intelligent vehicle market in China booming? Zhou Lijun analyzed the reasons behind it from the perspective of population structure, namely, the “Four New Characteristics of Users”: middle-aged, feminization, singleness, and aging.

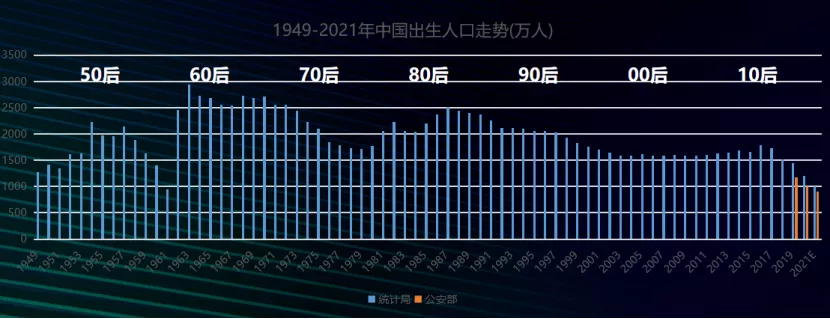

Zhou Lijun pointed out that China’s annual automobile sales have increased from less than 10 million vehicles to breaking through 10 million vehicles and then exceeding 20 million vehicles. The core purchasing power comes from those born in the 80s. Therefore, in previous years, many young men bought cars after getting married or having children, which made compact sedans or compact SUVs particularly popular.However, in recent years, the traditional fuel vehicle market has experienced severe polarization: high-end cars still have unlimited glory while entry-level models have poor sales, while electric vehicles have risen suddenly and their sales have exploded. The fundamental reason is the huge changes in consumer groups and consumer attitudes.

Firstly, it is aging. Many of the 80s generation with car purchasing needs are buying a car for the second or even third time or are replacing their cars with higher demands for the uniqueness, especially the intelligence of the cars. This group of users tends to upgrade from stand-alone car models to connected or intelligent cars.

Secondly, it is feminization. Zhou Lijun believes that during the 14th or even 15th Five-Year Plan period, the female user group among electric vehicle consumers will continue to increase, many of whom are female 80s generation- over the past decade, many car buyers were male heads of households. Nowadays, female heads of households are also buying and using cars, especially electric cars, mainly for commuting.

Consumer surveys show that micro electric vehicles, such as the Wuling Hongguang MINI EV, have sold about half of their total sales to provinces like Hebei, Shandong, and Henan, and their main purchasers are the women in those provinces. In big cities, more and more women have the financial ability to buy more expensive models such as Tesla and Ora Cat, becoming important customers of intelligent electric vehicles.

Thirdly, it is singleness. Currently, 90s generation have already joined the consumer army of the automotive market. Unlike their elders, many of these users have had cars from their homes since they were young, married late, and had the economic ability to buy cars while single. Therefore, they are more likely to choose different car models from their elders, and electric car models with strong sportiness and high intelligence provide them with the opportunity for differentiated consumption.

Lastly, it is aging. The 60s generation consumer group has a large population, strong financial power, and ample time, especially many retired elderly people, who have a strong demand for car purchasing and replacement, and are also high-quality users of intelligent electric vehicles.

Based on the automotive “new four modernizations” derived from China’s population evolution, Zhou Lijun believes that new energy vehicles will appear in product diversity, and different car models developed for different user needs will emerge.

At the same time, Zhou Lijun pointed out that the potential customers are no longer “rookies” who know little about cars, and many of them are experienced drivers. Therefore, the single sales channel dominated by 4S stores in the past is no longer suitable for today’s intelligent electric vehicle market. A multi-dimensional sales channel of 4S stores, business district stores, experience stores, community stores, and car delivery stores is needed to bring cars closer to customers and succeed in selling them.

With the changes in the sales channels, marketing methods must also naturally change, which is what Zhou Lijun calls precision marketing. In the past, automotive marketing was mainly done through broad advertising, whereas now marketing methods must transform towards digitalization and intelligence, providing customers with precise services and experiences based on the characteristics of different customers and circles.The user new fourization, product diversification, channel stereotyping, and fine marketing proposed by Zhou Lijun for marketing new energy vehicles are not only the strengths of new car manufacturers, but also practices adopted by traditional car companies.

On the eve of Christmas 2021, Yu Jingming, the general manager of SAIC Volkswagen Automobile Co., Ltd., wearing a reindeer headband and holding a fairy wand, promoted the ID. 4X on his Weibo account “Chequan Panto”. While Diess, the CEO of Volkswagen Group, answered questions from netizens about Volkswagen’s electrification on his Weibo account, showing a marketing approach filled with new energy force, devoid of traditional car company executives’ old gestures.

Obviously, facing the surge of electrification and intelligence wave, both new and old forces are trying their best to market.

If in previous years, in China’s new energy vehicle market, new car manufacturers were always taking the initiative to seize the market, while traditional giants usually shouted slogans while only trying to pass off the users with electric vehicle fitted with gasoline engines. Then, starting from 2021, joint ventures represented by Volkswagen must make cars and market them seriously.

After all, if you do not revolutionize yourself, you can only wait for your opponents to do so. It is foreseeable that soon, a large number of more grounded products and a wave of more user-friendly marketing will emerge, and the golden age of China’s intelligent electric vehicles has arrived.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.