Translation in English

Recently, Roland Berger’s article, “Steering through the semiconductor crisis: A sustained structural disruption requires strategic responses by the automotive industry,” is quite interesting. What is described in the article is somewhat similar to what we are currently observing.

Roland Berger’s main points are:

-

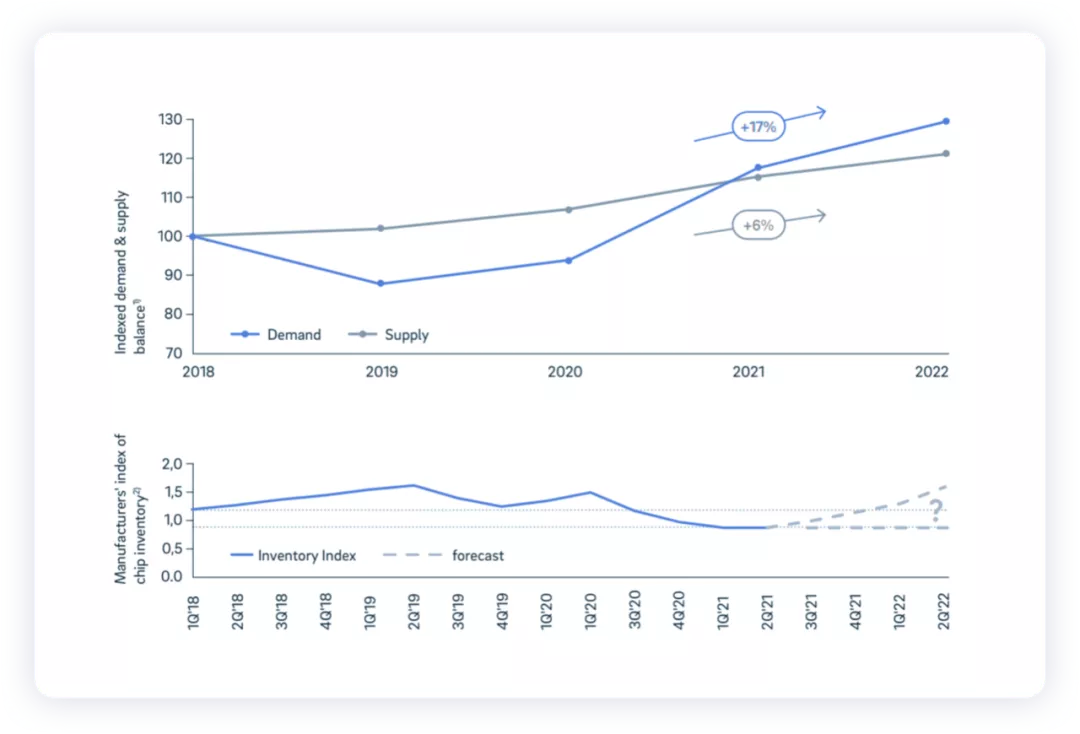

It is expected that the global semiconductor shortage will continue beyond 2022, and the chip crisis in the automotive industry and many other industries will last for several years. The decline in car sales in 2019 made chip supplies seem sufficient, but the drastic contraction and later rebound in the first half of 2020 emptied the overall chip inventory, and the predicted impact is expected to last for 1-2 years.

-

From 2020 to 2022, chip demand is expected to grow at a rate of 17% per year (mainly starting from Q4 2020), while chip supply growth is only 6% per year.

-

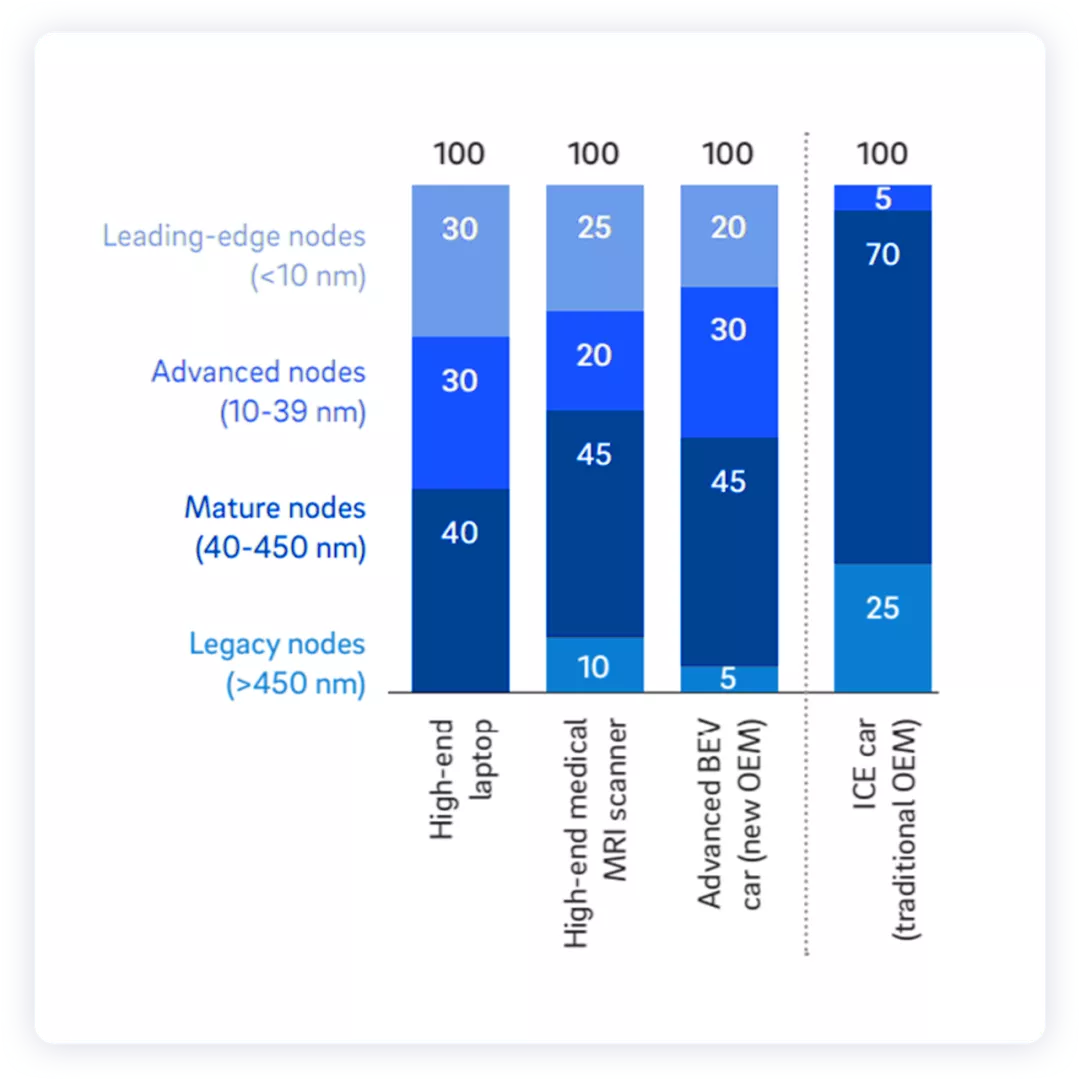

The main reason for the shortage of automotive chips is that the largest shortage occurs on older generation chips (MCUs and power chips in distributed architecture ECUs) and traditional semiconductors on which traditional internal combustion engine vehicles depend. However, the currently added production capacity is mainly aimed at the new generation centralized architecture (Domain, and even Zone architecture), and from the actual results, the added investment will not alleviate the original shortage.

Mismatch between chips supply and demand

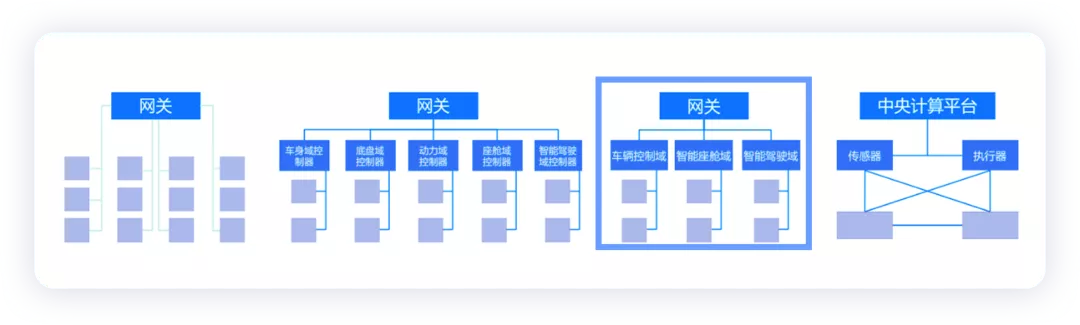

From a technical perspective, the distributed automotive architecture of most car companies currently depends on ECU technology, which is a system composed of many microcontrollers (MCUs). Each MCU has only limited computing power, and the automotive industry accounts for about 40% of MCU demand.

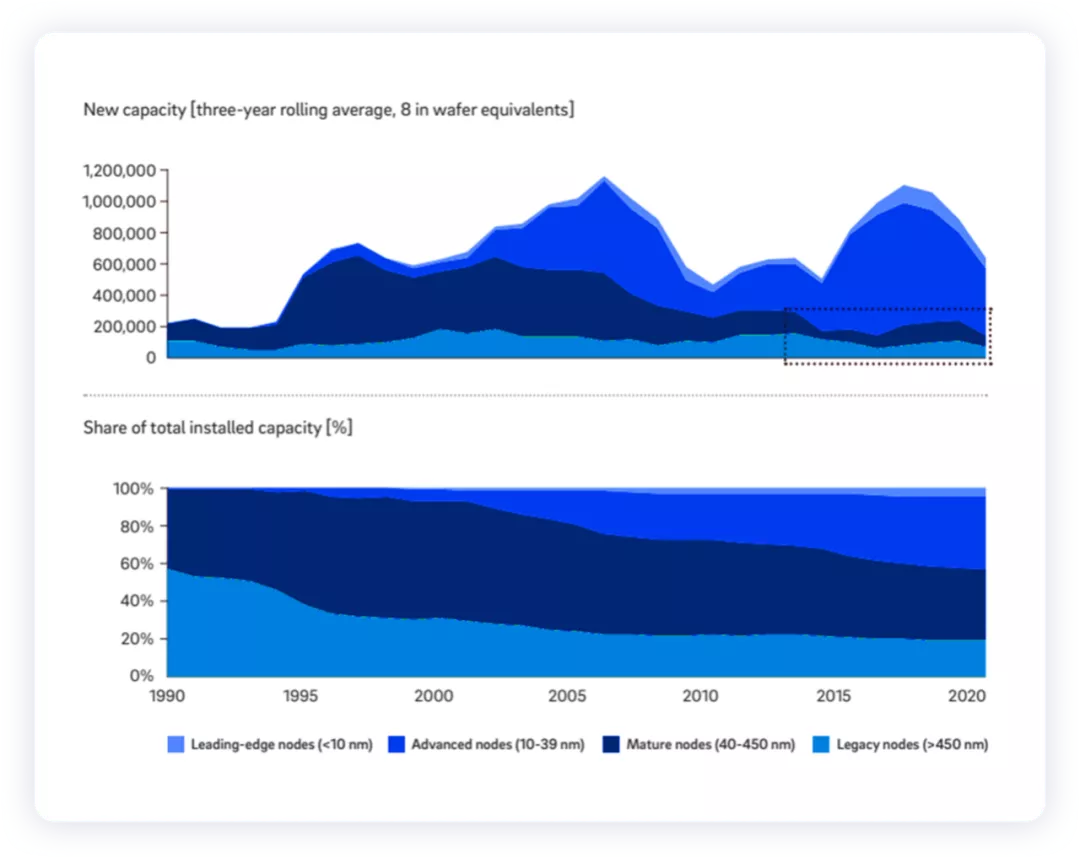

In other words, the increased demand for purchasing MCUs in the automotive industry in recent years is not synchronized with the demand in other industries. Chip manufacturers have no incentive to expand production capacity for these older process nodes.

According to Roland Berger’s research, it is currently necessary to use older technology (40-90nm process) chips in consumer electronic devices. Of course, this production capacity is not used to manufacture MCUs, but for 3D audio, fast charging, and 5G, which require power chips, RF, and audio semiconductors.# Therefore, in the process of limited production capacity, and having to rely on the process of seizing resources, consumer electronics manufacturers, due to their quick payment and low bargaining power (higher purchasing power and bargaining power), will further amplify the shortage of automotive and industrial chips.

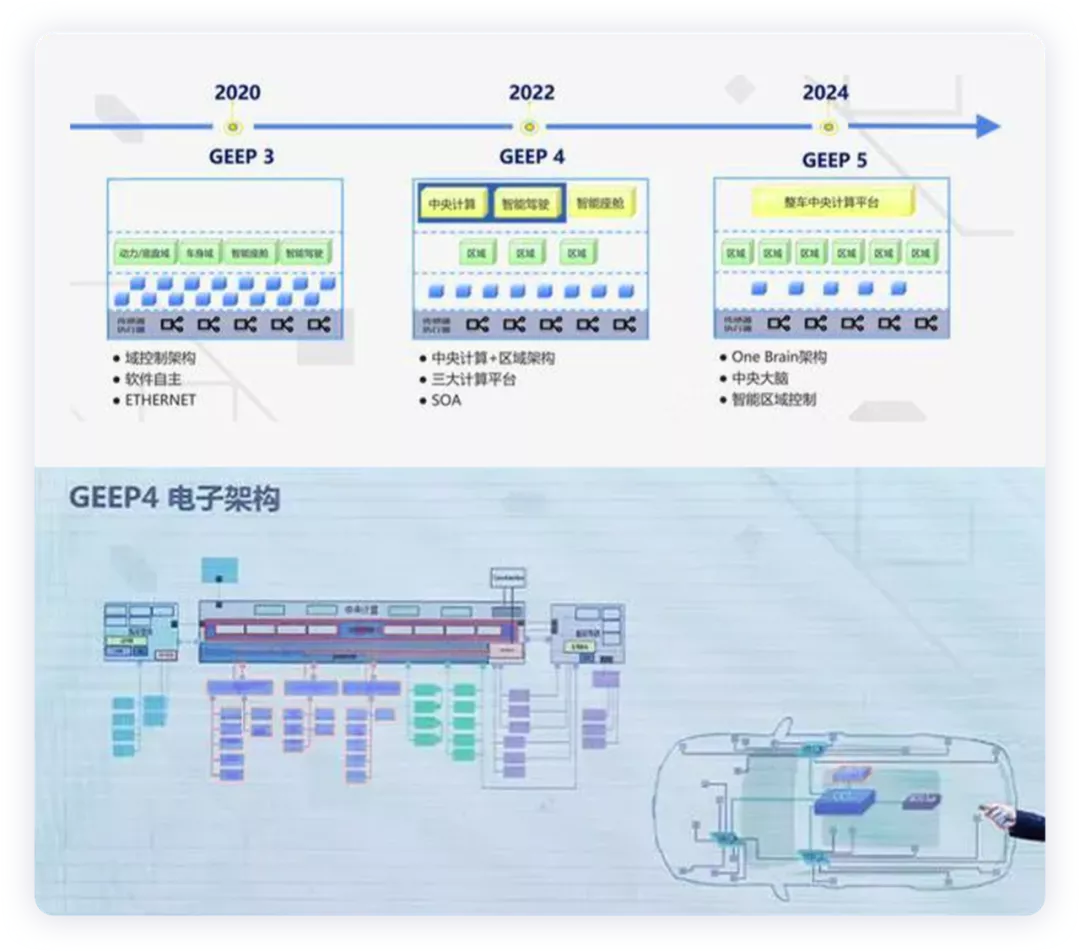

Looking to the future, automotive chip companies have also discovered a practical problem: the automotive industry is undergoing a transformation towards intelligent cars, transitioning to new electronic architectures, such as domain and zone architectures. The new demand for chips is mainly for high calculation power heterogeneous computing platforms to replace the original ECU. Automotive chip manufacturers will be very sensitive to this kind of transition and change. Around automatic assisted driving technology, information entertainment systems, and power system management, OEMs will directly look for chip suppliers to negotiate future cooperation and naturally understand which are temporary and long-term demands.

The main reason for this internal circulation is that new car companies have always maintained a certain distance from the design concept of distributed architecture from the beginning. Therefore, they can quickly migrate to centralized architecture (mainly organizational form problems). Due to the short time spent in the pit of distributed architecture, they are relatively less affected by chip supply, which also makes traditional OEMs have to take additional action towards the transition to centralized architecture.

Note: Currently, around Q3 of 2022, the three-electricity cross-domain architecture will appear, and the first-generation architecture with a central computing platform can be SOP in the end of 2023 to the beginning of 2024. It is really intense.

When everyone starts to switch from “just-in-time” to “just-in-case” purchasing of chips, objectively causing order congestion, it also renders the market-adjusting mechanism of orders ineffective, which will inevitably cause potential demand fluctuations and future demand doldrums.

I think the whole logic is like this: due to the continuous advancement of consumer electronics and IT technology, the investment in chip manufacturing capacity usually focuses on expanding frontier manufacturing capacity. Looking at giants such as TSMC and Samsung (as well as their younger siblings) from an investment perspective, investing in advanced semiconductor process capacity can maximize the lifespan of assets, protect billions of dollars of investments, and optimize and reduce long-term manufacturing costs.

From 2020 to 2022, the compound annual growth rate of advanced manufacturing processes is 26%, while the manufacturing capacity required for automotive electronics is only about 2% per year. Objectively, this is a slap in the face to the automotive industry – sticking to their slow pace, thus not being appreciated in the chip industry.

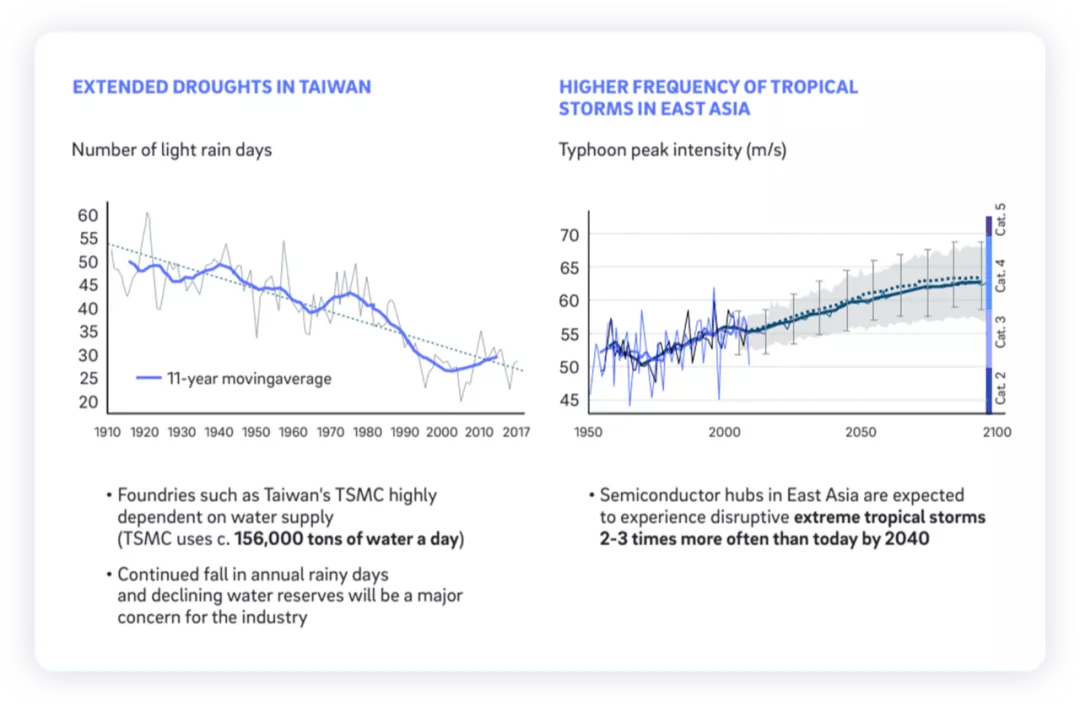

Various unexpected incidents have made interruptions in the semiconductor supply chain increasingly frequent. For example, various climatic changes (e.g., more dangerous tropical storms in semiconductor manufacturing centres in Southeast Asia, the impact of severe drought in Taiwan on water-intensive semi-finished products), factors related to the pandemic, and rising political uncertainty are all having an increasingly significant impact on semiconductor manufacturing.

Chip Replacement Solutions for Chinese Automobiles

Like the automotive industry problems worldwide, China has also witnessed the emergence of many chip-based automobiles that can be likened to a race.

Many companies start by expanding from a single product category, and in many cases, given the requirements for reliability and stability of automotive chips, they rely on 40nm or larger processes, and these chip production capacities are limited. What is even more cruel is that Chinese new car companies and joint ventures are more inward-looking, and many features are rapidly being integrated except for a few MCUs for the chassis and safety airbags and safety components.

We can calculate the following data:

●Which ECUs are not replaceable in the short term? How many are there, and how much space is there for replacement?

●How fast and deep are OEM actions towards the Zonal architecture, and as one or two quickly ramp up, how fast are the others following behind?

In conclusion, all automobile companies are holding back to make smart vehicles and new architectures to come up with new products. In any case, there is still a gap in chip supply, even with increasing production.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.