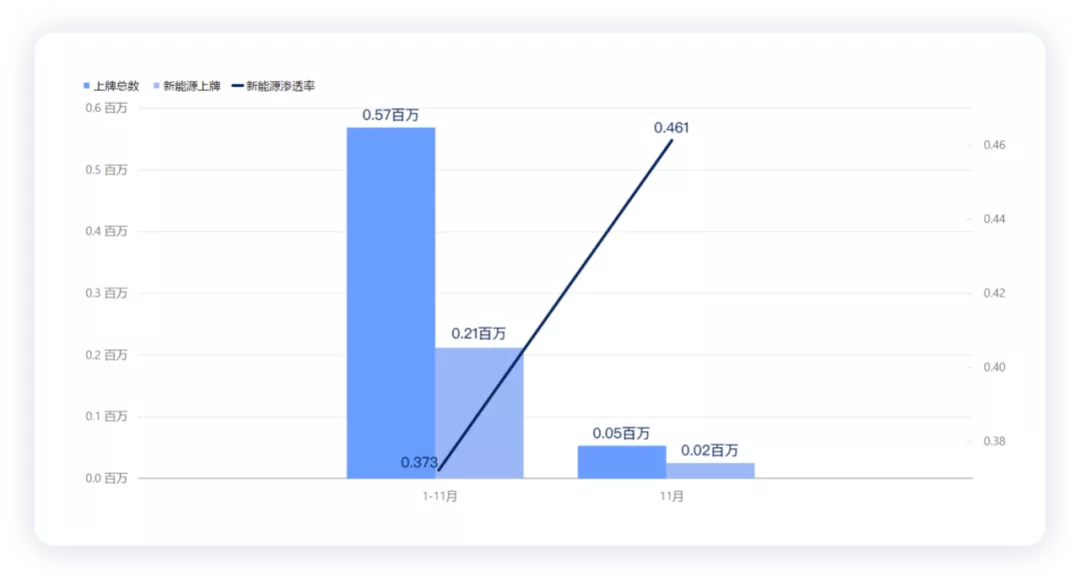

Recently, new energy vehicles are really popular in first-tier cities. According to the registration data, in November, 24,417 new energy vehicles were registered, accounting for 46.1% of the total 52,952 registrations in Shanghai.

From January to November 2021, there were 211,400 new energy vehicle registrations in Shanghai, accounting for 37.27% of the total 567,200 registrations. It is no wonder that the elevated roads in Shanghai are full of green license plates.

Analysis of Registration Data

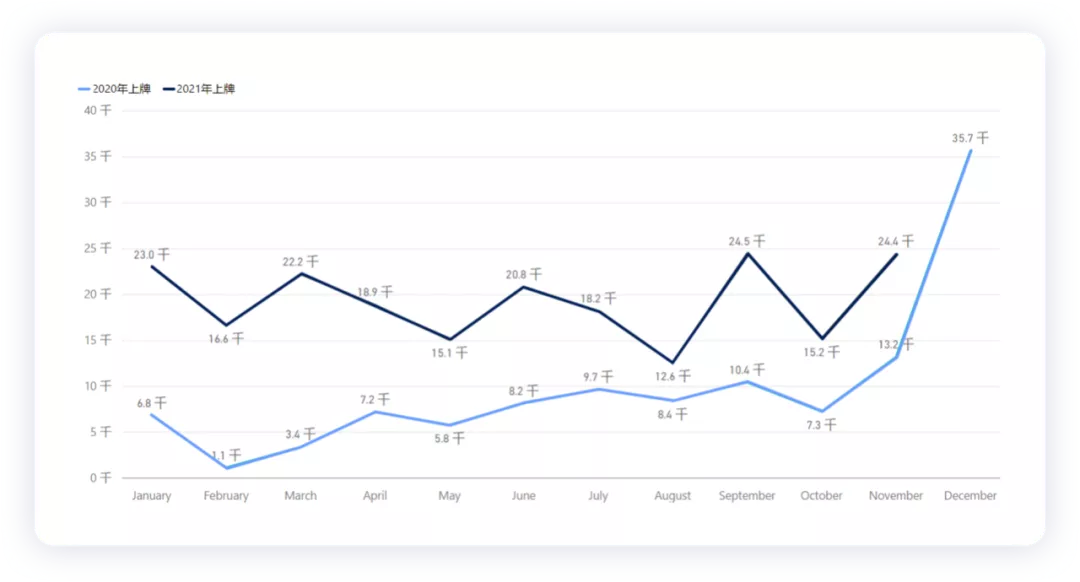

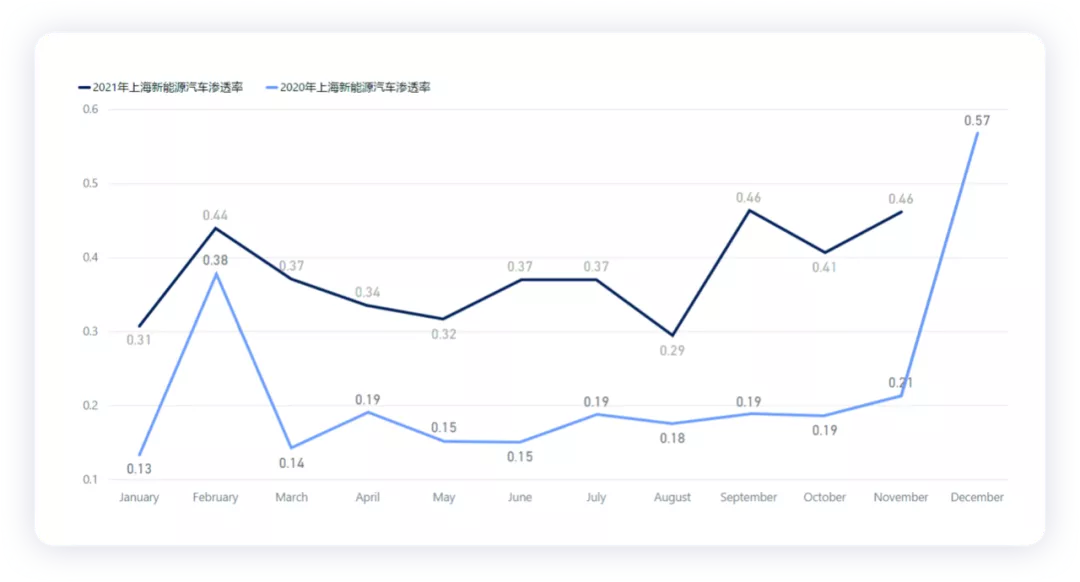

When the product strength of new energy vehicles in the price range of 200,000 yuan and above reaches a certain threshold, we can see that the number of new energy vehicle registrations in Shanghai fluctuates around 20,000 units, excluding the unstable supply from Tesla. This value is almost twice the normal monthly registration volume in 2020.

I specifically compared the total penetration rate in 2020: there were 117,200 new energy vehicle registrations, 52.68 million total registrations in Shanghai, and a penetration rate of 22.25%. By comparison, in the first 11 months of 2021, this number nearly doubled – there were 211,400 registrations of new energy vehicles, 56.73 million total registrations, and a penetration rate of 37.27%. That is to say, with a fixed total number of registrations, a large number of car owners who originally intended to buy fuel vehicles have turned to new energy vehicles.

Shanghai’s management policy regarding foreign license plates within the inner ring has had a profound impact, accelerating consumer purchase of new energy vehicles.

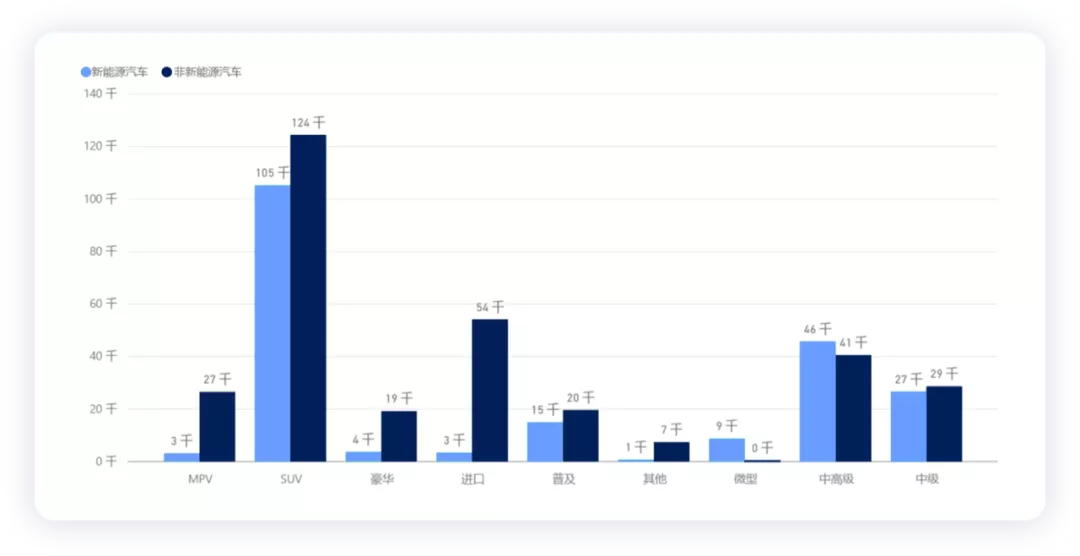

Looking at the data from 2021, 212,000 new energy vehicles were registered, compared to 320,000 fuel vehicles (including hybrids). This data has saved Shanghai people a lot of money on imported electric vehicles, and also strengthened the domestic industry’s strength.

Shanghai’s auto market is indeed becoming more luxurious, and the electrification of the MPV market is promising from a big-picture perspective. Moreover, the current wave of new domestic automakers is challenging the fuel vehicle market dominated by BBA.

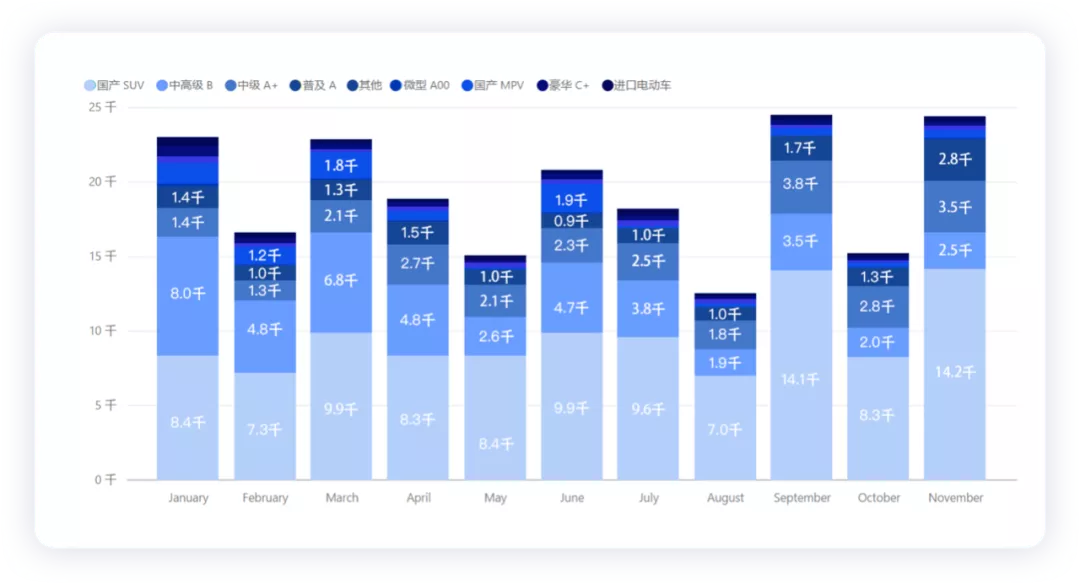

In terms of the prices of licensed vehicle models, new energy SUVs are the largest subdivision market in Shanghai, with about the same quantity as sedans. Among sedans, mid- to high-end sedans accounted for 45,700 units, followed by 26,600 units in the ultimate car market. The nearly 9,000 micro electric cars were estimated to be a peak, which was not originally an area encouraged for upgrading and transformation.

What Are New Energy Vehicles in Shanghai?

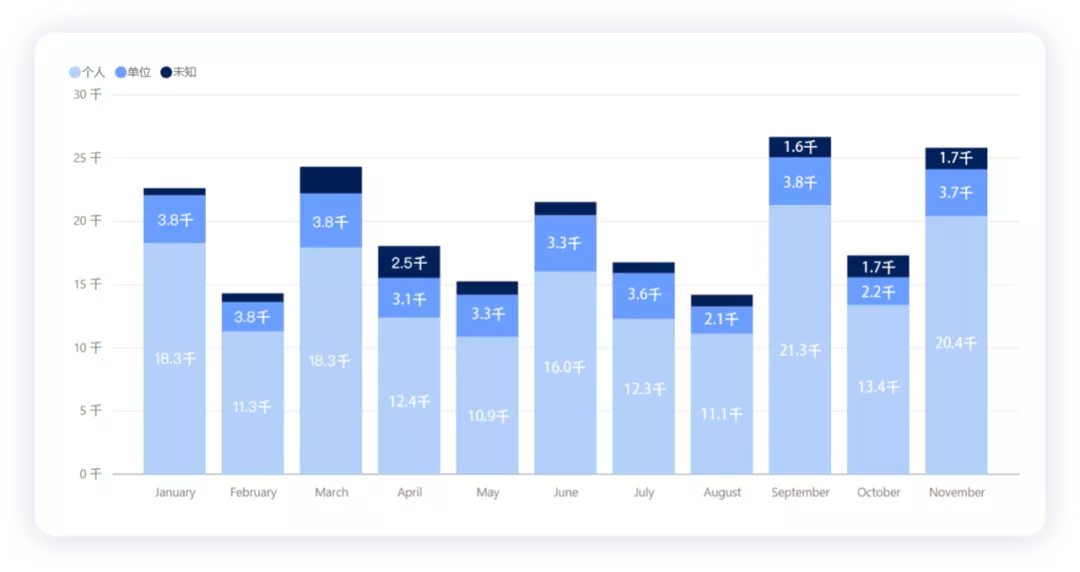

Shanghai’s insured vehicles from January to November totaled 216,700 (due to a mistake with Tesla, there may be about 3,000 more Tesla insured vehicles). I sorted them by ownership and will make a systematic review next month. This month, let’s take a look at the rough data:

● Owned by a company:

36,700 units, accounting for 16.9%, which some small companies use to hang their own cars.

● Personal use:

165,300 units, accounting for 76.28%, which truly reflects the actual demand.

● Unknown:

This corresponds to the operation below, with 14,600 units, accounting for 6.76%.

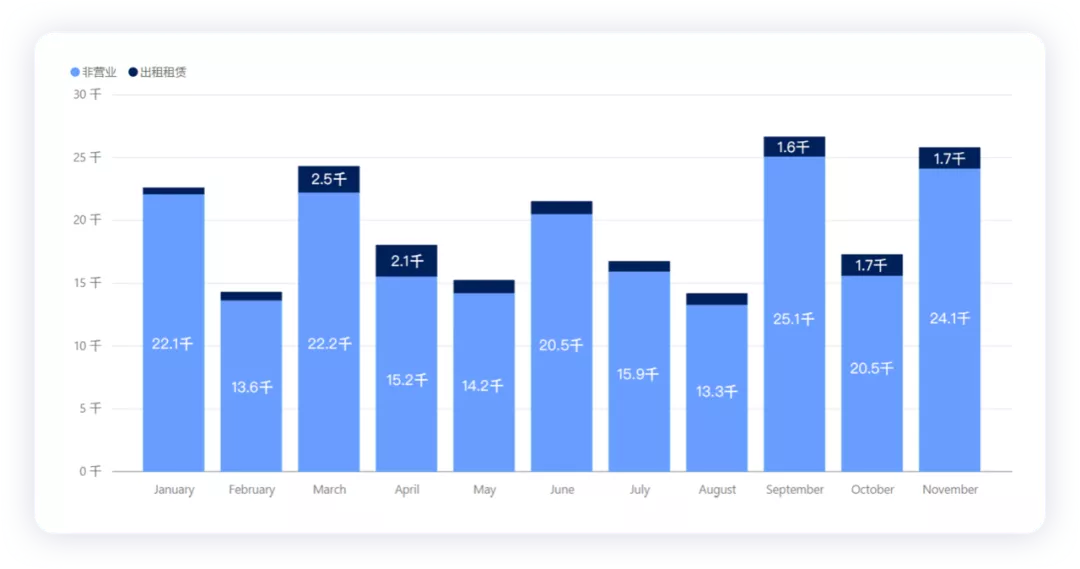

From a financial standpoint, Shanghai’s annual insured rental and online-hailing vehicles are also about 14,600 units (there are still individuals who purchase cars and then join the platform), of which 93% are non-operational.

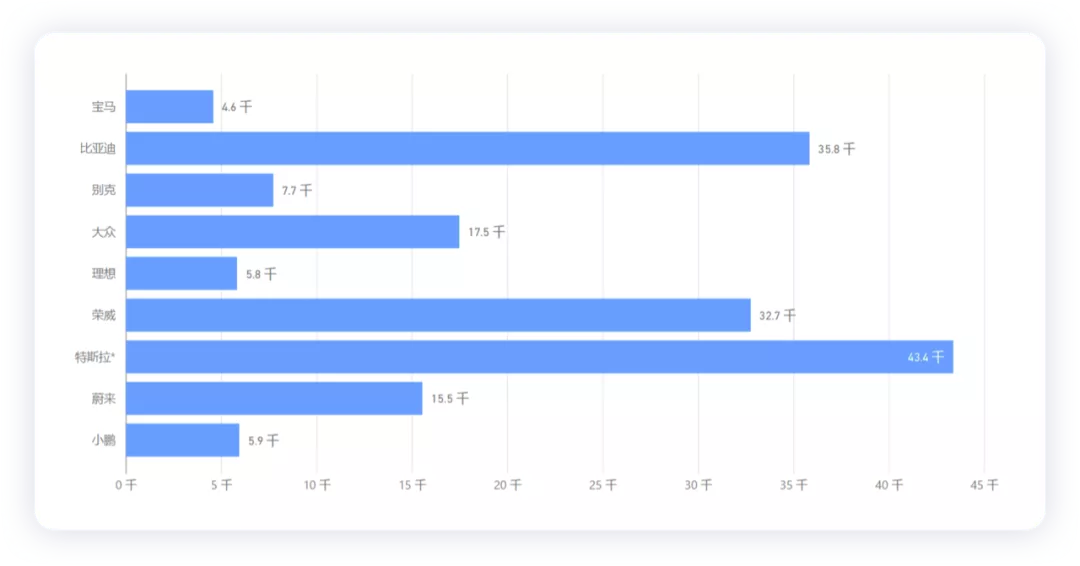

Shanghai is still very open to new forces, with WeRide ranking among the top ten, of course, Shanghai is still Tesla’s stronghold, which we can discuss in detail when analyzing the year.

Summary: Shanghai is a sample. Different from the rapid growth of A00 level, Shanghai belongs to the huge progress of luxury cars supported by license plates in new energy vehicles, followed by Shenzhen, Guangzhou, and Hangzhou. I think this part is the basis for new car-making forces and Tesla in China. The evolution of intelligent cars also needs to be popularized first in these big cities.

Summary: Shanghai is a sample. Different from the rapid growth of A00 level, Shanghai belongs to the huge progress of luxury cars supported by license plates in new energy vehicles, followed by Shenzhen, Guangzhou, and Hangzhou. I think this part is the basis for new car-making forces and Tesla in China. The evolution of intelligent cars also needs to be popularized first in these big cities.

## Summary

Shanghai is a sample. Different from the rapid growth of A00 level, Shanghai belongs to the huge progress of luxury cars supported by license plates in new energy vehicles, followed by Shenzhen, Guangzhou, and Hangzhou. I think this part is the basis for new car-making forces and Tesla in China. The evolution of intelligent cars also needs to be popularized first in these big cities.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.