Author: Wang Lingfang

2021 is about to end. In some months of this year, the penetration rate of new energy passenger vehicles and L2 intelligent passenger vehicles has exceeded 20%, indicating that new energy and intelligent vehicles have entered the stage of mass application.

Against the backdrop of the popularization of intelligent electric vehicles, the 2022 Electric Observation Conference, hosted by Electric Vehicle Observer and Cyber Car, was held online on December 18, 2021. The theme of this conference was “Trends, Scenarios, and Cases,” and 15 guests discussed the 10 major trends of intelligent electric vehicles, the development status of 8 fields, and 6 case companies shared their first-line practices.

This forum brought in-depth thinking of industry observers and the methodologies of typical enterprises, hoping to bring new perspectives and enlightenment to industry companies.

10 Major Trends of Intelligent Electric Vehicles

In the first part of the conference, founder and editor-in-chief of Electric Vehicle Observer, Qiu Kaijun, summarized the 10 major trends of intelligent electric vehicles.

(1) Intelligent electric vehicles have entered the stage of mass application. Through specific data and examples, he explained that electric vehicles have become the new favorite of trendsetters, the car of small-town youth, and the convenient and economical means of transportation for middle-aged and elderly women.

(2) Intelligent driving is being implemented. Qiu Kaijun believes that autonomous driving has ushered in the first year of commercialization, and companies are beginning to seek landing scenarios. Moreover, the higher-end the model, the more it pursues advanced autonomous driving functions.

(3) New marketing for intelligent electric vehicles. In Qiu Kaijun’s view, direct sales have become an important trend in the marketing of intelligent electric vehicles. In addition, circle marketing has also become an important way to influence consumers’ car buying decisions.

(4) Supply chain expansion and upgrading. The rapid development of intelligent electric vehicles has brought crazy demand in the field of the industrial chain. Similar to this is the demand for chips. Downstream companies investing in the supply chain have become an important way to hedge costs and seek supply security.

(5) Global cooperation. Qiu Kaijun believes that independence and globalization are not contradictory. Independence and controllability are good, but pursuing it too much may increase costs or damage competitiveness.

(6) Infrastructure enters the second half. Unlike the rapid growth of new energy vehicle sales, public charging facilities have only slightly improved, and the business model is still being explored. The problem of community capacity increase caused by private charging piles is still severe. The contradiction between charging demand and power supply is becoming more prominent.

(7) Capital chase. In Qiu Kaijun’s view, a large amount of funds have flowed into the new energy industry chain, which is also a relatively profitable industry in the secondary market. Smart car investment opportunities have just begun.

(8) Cross-industry technological integration and innovation. Qiu Kaijun believes that cross-industry integration in the automotive industry has just begun. Qiu Kaijun proposed that using innovative technologies across industries is also the core competitiveness of future intelligent electric vehicle companies.### 8 Industry Experts Share Their Thoughts

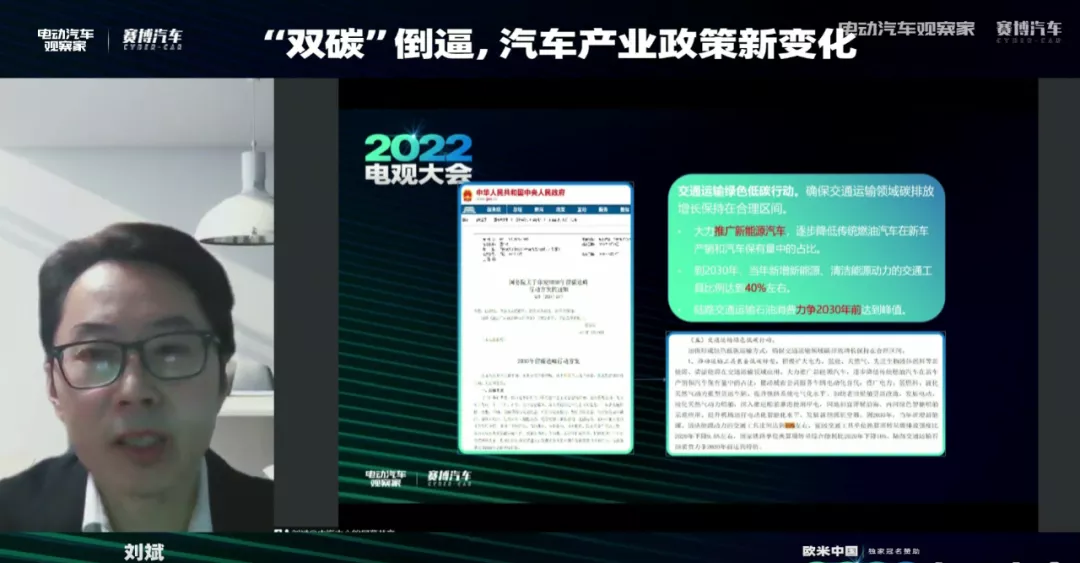

According to Qiu Kaijun, “the dual carbon” pressure means policy dividends. In the competition between traditional car companies and electric car companies, policy dividends tilt the balance towards electric cars.

Qiu Kaijun believes that car companies are transforming towards intelligent electric vehicle research and development, production, sales and services, and the talent structure and management methods are facing significant changes. Enterprises need to empower employees rather than just manage them, and enable them to unleash their full potential.

In the field of intelligent electric vehicle popularization, Li Jinyong, Chairman of CHJ Automotive and Founder of ZHIDOU, indicated that users have a high willingness to pay. 40% of consumers are willing to pay for fully autonomous driving functions, and more than half of consumers are willing to pay for OTA upgrades. Li Jinyong believes that the downward trend in the price of autonomous driving will lay the foundation for its popularization.

In the field of intelligent driving landing, Yuan Wenbo, Partner at Roland Berger, pointed out that Chinese consumers have a greater preference for Robotaxi than consumers in some traditional developed countries such as the United States or the United Kingdom. China’s development of autonomous driving has a good market environment. China’s autonomous driving penetration rate will increase rapidly in the next five years, and high-level autonomous driving will achieve mass production. There is also a trend in China’s autonomous driving industry towards local tier-one suppliers replacing overseas suppliers. Chinese companies are looking for landing scenes to promote commercialization.

Regarding new marketing for intelligent electric vehicles, Zhou Lijun, Dean and Chief Analyst of the YiChe Research Institute, believes that Chinese users are showing four major trends based on population structure and economic development characteristics: (1) Users are becoming more middle-aged, female, single and older; (2) Products are becoming more diversified (home, commuting, leisure, sports, and smart); (3) Channels are becoming more diverse (4S stores, shopping district stores, experience stores, community stores and pick-up stores); (4) Marketing is becoming more refined (digitization, intelligence, experience, and scenarios).

In the supply chain expansion and upgrading segment, Zhu Yulong, founder of Automotive Electronic Design, shared his thoughts on the industry chain. He believes that the development of intelligent electric vehicles is bringing a series of changes to the industry chain, not only pushing up the penetration rate of batteries, chips, fast charging and high-power semiconductors, but also bringing differences in the business model of power batteries, and changes in electronic and electrical architecture. In addition, computing power chips will become the next core bottleneck.

In the second half of the infrastructure sector, Huang Shan, co-founder of EV Observer, believes that public charging is still not profitable, with investments in the tens of thousands, and revenues calculated based on gross profit. The reason for the lack of profitability is due to an imbalance in supply and demand and a mismatch in time and space. Meanwhile, energy companies represented by BP and Sinopec, as well as new forces represented by major automakers and local funds, are rushing into the market, accelerating the elimination race.

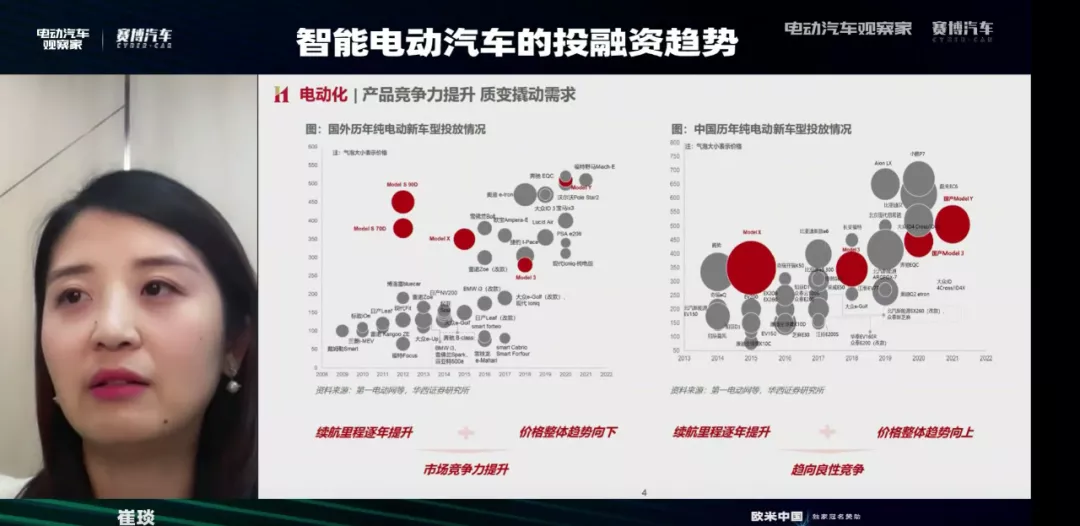

In the field of capital, Cui Yan, chief analyst of the automotive industry at Huaxi Securities, analyzed several major changes in the market value of automakers. Firstly, Toyota, whose market value was over 100 billion US dollars ten years ago, has been replaced by Tesla, whose market value has surpassed one trillion. Among Chinese enterprises, new forces and private automakers’ advancements in the fields of electrification and intelligence cannot be underestimated, continuously driving the development of independent brands. Cui Yan believes that within five years, no industry will achieve such high growth as new energy vehicles. Even in 10 years, it will still be a growing industry. “The next 10 years should be the golden 10 years of investment in the entire industrial chain of smart electric vehicles.”

In the “Dual Carbon” driving force sector, Liu Bin, chief expert of the China Automotive Technology Research Center and deputy director of the China Automotive Strategy and Policy Research Center, believes that according to the dual carbon objectives, the automotive industry should achieve carbon emissions peak around 2030. Liu Bin put forward an idea to control products and incentivize carbon reduction for buyers through taxation, forcing car companies to reduce emissions. In addition, he also mentioned that reducing carbon emissions and disposal can be accomplished by increasing the cost of using fuel vehicles and promoting recycling.

In the intelligent organization and management sector, Hu Saihong, winner of the Huawei “Blue Blood Top 10” Award, believes that without intelligent organization, intelligent vehicles are impossible. Traditional top-down corporate control makes it difficult for executives to create scarce resources, and they cannot quickly perceive the market, and gradually lag behind. Hu Saihong believes that to adapt to the development of intelligent electric vehicles, management must be open-source, distributed, and flexible at the end, reducing personal errors through learning, and ultimately adapting to handling complex business operations instead of controlling the organization itself.

## 6 Major Case Studies on Implementation Experience

## 6 Major Case Studies on Implementation Experience

NETA Automobile is one of the representative companies of civilian intelligent electric vehicles. Zhou Jiang, the president of NETA Trading Company, believes that what is truly lacking in the popular market of intelligent electric cars is whether car companies can bring affordable and intelligent high-quality products to users. NETA proposes the concept of “technological equality”, allowing bosses to afford and trust their products. In Zhou Jiang’s view, intelligent electric vehicles are an endless track, incapable of being concluded. It is impossible to predict the extent of future technological development.

Hongjing IMa is a representative enterprise of landing sectors of intelligent driving. Liu Feilong, the CEO and founder of Hongjing IMa, introduced the source of their competitiveness. Liu Feilong stated that Hongjing IMa’s rapid development is due to their creation of a system factory where software and hardware are mutually optimized. By optimizing software and reducing hardware costs, developing efficient toolchains, they have created a software and hardware collaborative advantage. By utilizing shared software architecture and leveraging technological extensibility, they create upgradable products for customers, fulfilling users’ one-stop demands.

In the field of supply chain, the representative enterprise invited by the conference is Honeycomb Energy. Yang Hongxin, Chairman and CEO of Honeycomb Energy, believes that China’s new energy vehicles have encountered a historic opportunity that comes once in a hundred years. They must seize the lead time and quickly build production capacity, iterate products, and establish supply chains before the transformation in Europe, America, Japan, and South Korea is completed. Therefore, they proposed the “Leading Bee 600” strategy to become a leading global company in the industry.

In the second half of infrastructure, the conference invited Zhida Technology. Huang Zhiming, Chairman of Zhida Technology, believes that to promote the construction of community private charging piles, we still need to find a business model where investors, operators, property, and users can win together. In addition, Zhida Technology also looks to rural areas, where solar power and charging have vast potential.

15 guests of 2022 Electrical Vehicle Conference shared their insights on the current state and trend of the development of the intelligent electric vehicle industry in China. Among the much sought-after capital fields, BAIC Capital was invited to present. Mr. Jia Guanghong, the Deputy General Manager of BAIC Capital, revealed their investment practice in the field of intelligent electric vehicles. Focusing on long-term industry development logic, BAIC Capital has invested half their funds in the “electric” related industries, such as battery, motor, and electronic control, supporting some of those companies to go public. Later on, in the field of intelligent and connected vehicles, they started investing in sensor, controller and other companies, some of which were even incubated by BAIC Capital. Currently, 14 of those invested companies have gone public.

In the “dual carbon” driven industry, Far East Holding Group was invited to share their experience. Dr. Qiu Lin, the Chief Scientist of Far East Holdings’ Zero-Carbon Division, believes that companies need to firstly understand their own carbon footprint in order to achieve carbon reduction, and then set a carbon reduction goal. The third step is to implement energy-saving and emission-reducing plans, such as improving energy efficiency throughout the entire value chain, reducing carbon emissions, purchasing green electricity, and buying green electricity certification. Finally, companies need to develop negative emission plans, such as afforestation, to ultimately achieve carbon neutrality. In the field of electric vehicle production and manufacturing, the first consideration is green manufacturing, using energy-saving and emission-reducing methods; the second is to produce more electric vehicles; and the third is to use green electricity to reduce emissions.

Overall, the 15 guests’ presentations provided valuable insights for the industry and companies to reference for development.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.