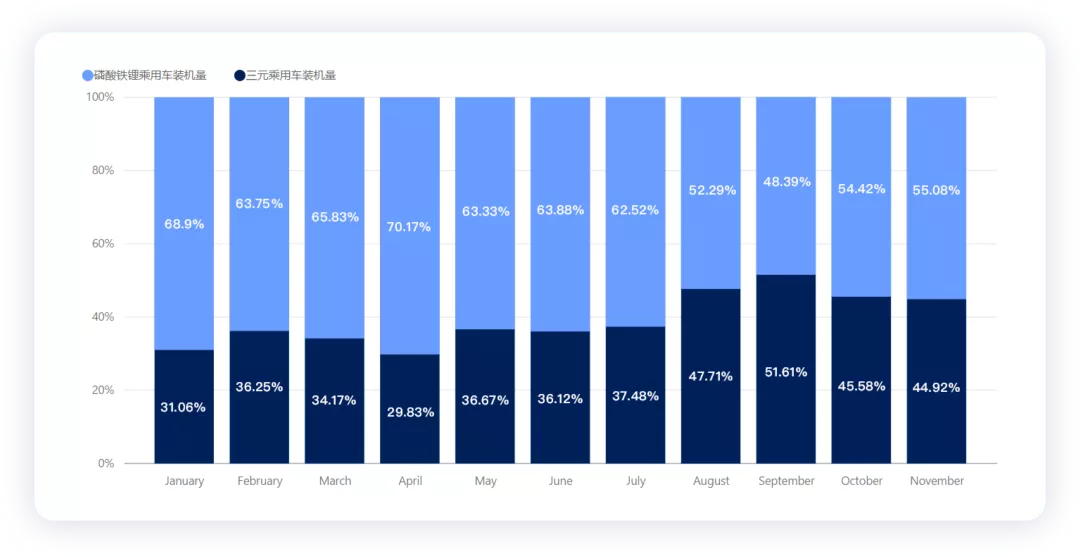

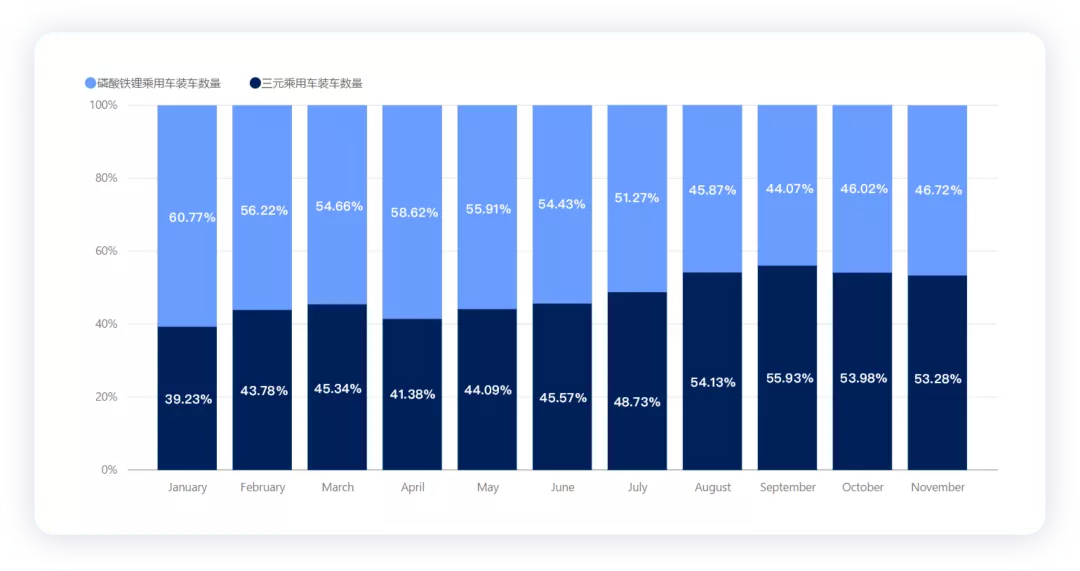

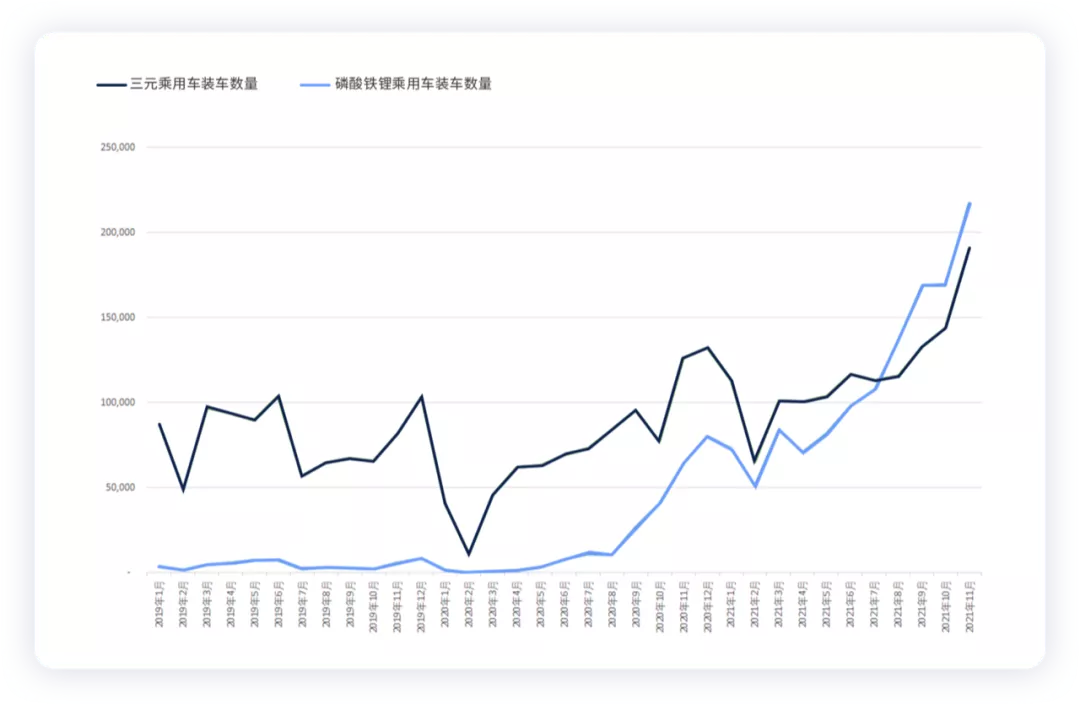

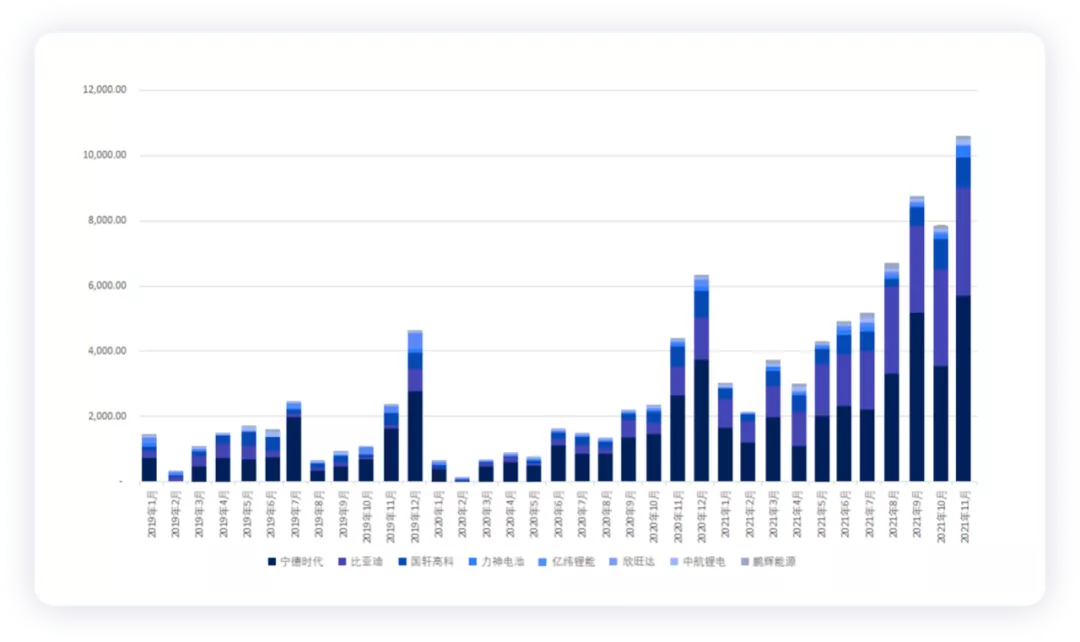

When analyzing monthly data, I sorted out the data I had mastered, and I found that in 2021, the production and installation of lithium iron phosphate in China exceeded that of ternary materials, and this trend will continue in 2022. Personally, I estimated that looking at the entire cost structure, lithium iron phosphate will continue to have overwhelming advantages in total amount domestically, and may further increase from the current 45% to 70% in passenger cars.

That is to say, lithium iron phosphate will cover vehicles below 600 kilometers, and the number of A00 level vehicles will continue to increase steadily. In terms of absolute vehicle quantity, the proportion of lithium iron phosphate batteries may rise to 75% or even 80%.

Applications of Lithium Iron Phosphate and Ternary Materials in Different Fields

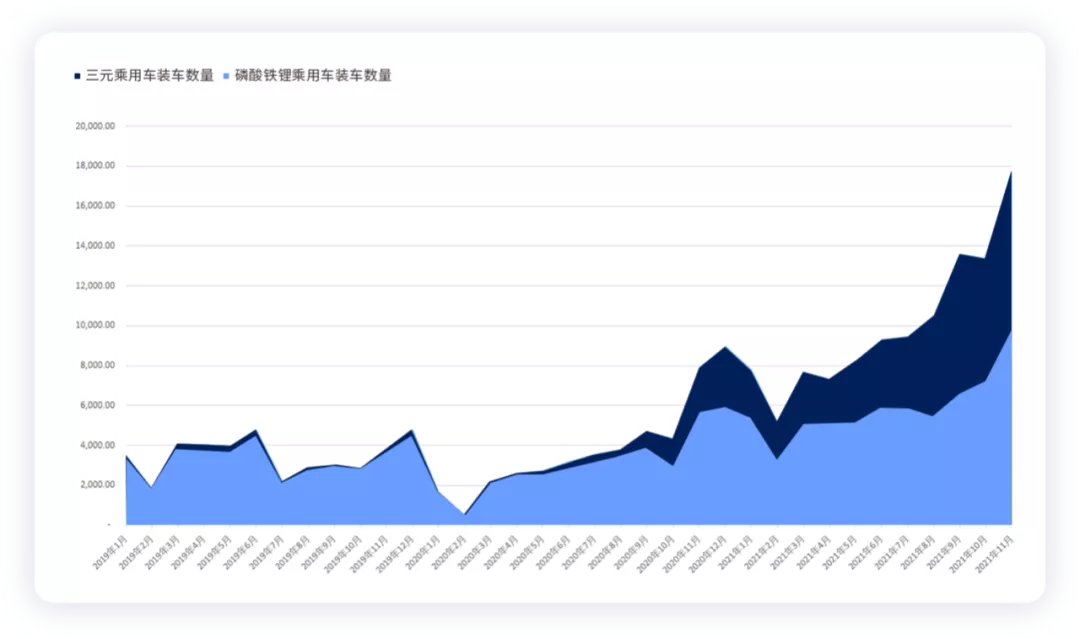

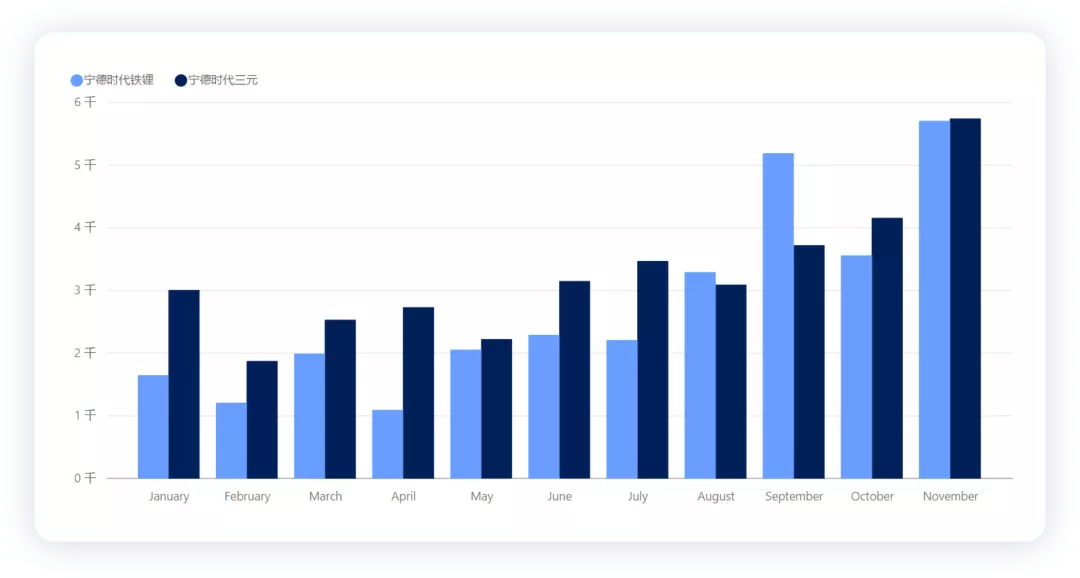

As shown in the figure below, in November, the installed capacity of lithium iron phosphate in passenger cars reached 7.99 GWh, and the number of installations reached 217,400, while the corresponding installation capacity of ternary materials was 9.8 GWh and 190,000, we can see that the number of installations surpassed in August; and then the installation capacity surpassed in September and was surpassed again (in fact, this is only due to the difference between Tesla’s domestic and export markets). In essence, China’s application of lithium iron phosphate in cars has completely surpassed ternary materials.

It is visible to the naked eye that BYD’s lithium iron phosphate is quickly approaching Contemporary Amperex Technology’s capacity. In November, the factors of lithium iron phosphate were as follows:

● Contemporary Amperex Technology:

Installation of 96,000 vehicles, capacity of 5.7 GWh (domestic market)

● BYD:

Installation of 82,600 vehicles, capacity of 3.32 GWh

● CATL:

Installation of 32,700 vehicles, capacity of 935 MWh## English Markdown Text Output with HTML Tags Preserved

Chinese battery maker CATL has been steadily increasing the number of vehicles equipped with lithium iron phosphate (LFP) batteries. In November, CATL equipped 7.6K vehicles with 169MWh of LFP battery capacity. It is clear that the entire field is entering an increasingly crowded phase.

Different battery companies may achieve a leap forward in the 4680 cylindrical battery line around the three-element route, while LFP has become an area of decisive battle on the front line and the biggest differentiator for several manufacturers.

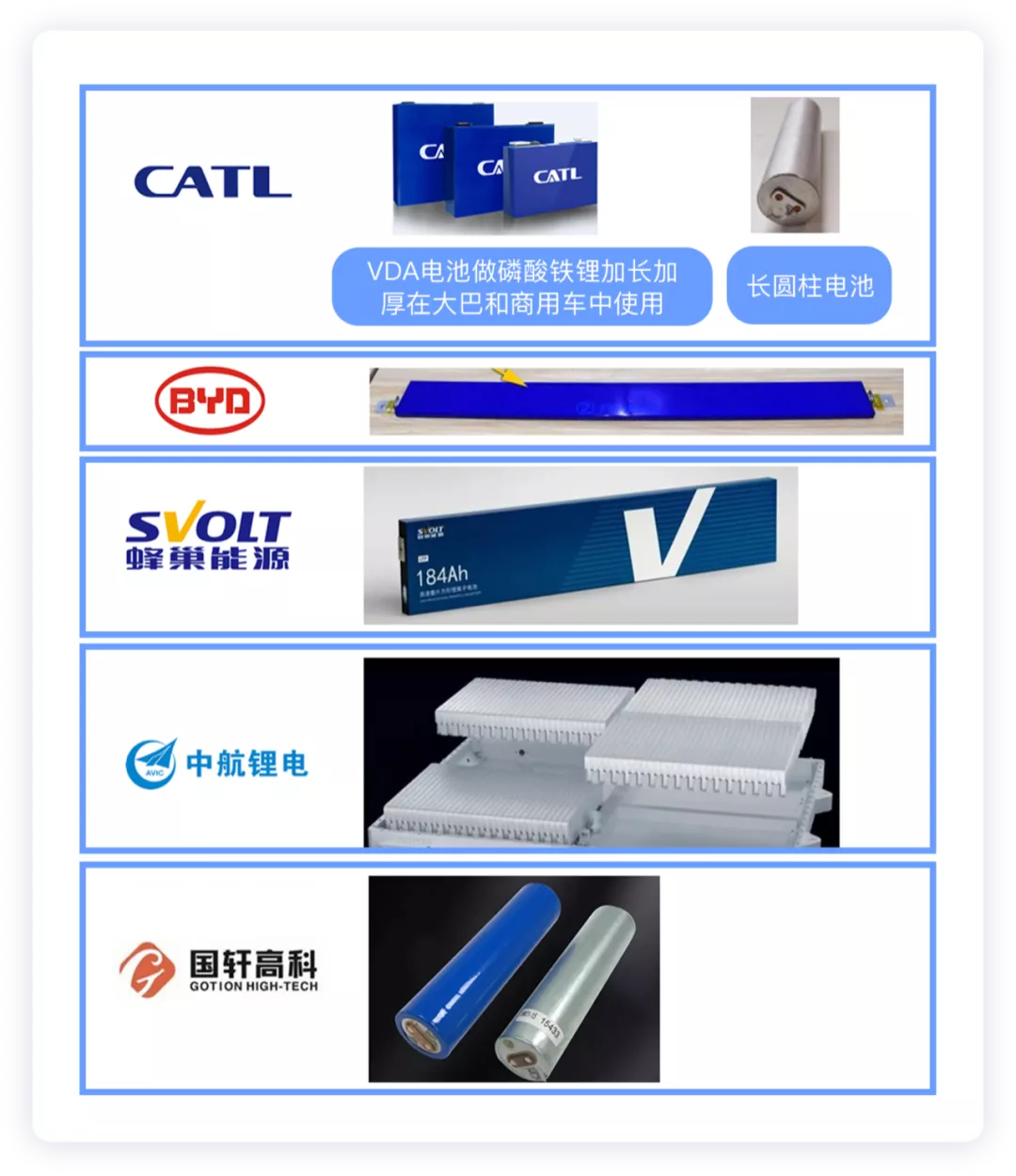

●CATL:

LFP is offered as part of the One Stop service.

●BYD:

All in LFP with the long EV blade battery and the PHEV blade module battery (1st generation and 2nd generation).

●Guoxuan:

Offering a cylindrical LFP battery as the solution.

●Honeycomb Energy:

The entire product line comprises a short blade technology route with the L600 EV application and the L400 PHEV application.

●Contemporary Amperex Technology:

LFP is extended around the original VDA size and the 590 cell specification of the iron phosphate (IFP) battery. The elongated cylindrical battery cell is suitable for low-energy applications.

●EVE Energy:

Offering large iron shell LFP and cylindrical LFP batteries.

Strategy of Contemporary Amperex Technology

CATL has a good foundation in passenger and commercial vehicles. Overall, LFP’s usage is gradually surpassing that of three-element batteries, especially in September when Tesla sold a large number of vehicles in China. CATL has already begun to shift its focus towards LFP. In 2021, CATL installed 30.2GWh of LFP battery, slightly less than 35.7GWh of three-element battery. It is expected that CATL’s LFP will significantly surpass its three-element batteries next year, and its overall development focus has changed.

In other words, if battery companies in China continue to compete for LFP with CATL, this low-threshold second-tier battery company survival battle will be particularly worthy of attention.

Conclusion: I think it’s a good thing for China to leverage the characteristics of LFP. Especially after fully utilizing the advantages of volume energy density with long and short plate technology, the LFP battle that wasn’t finished before 2017 will continue in 2022. The competition is heating up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.