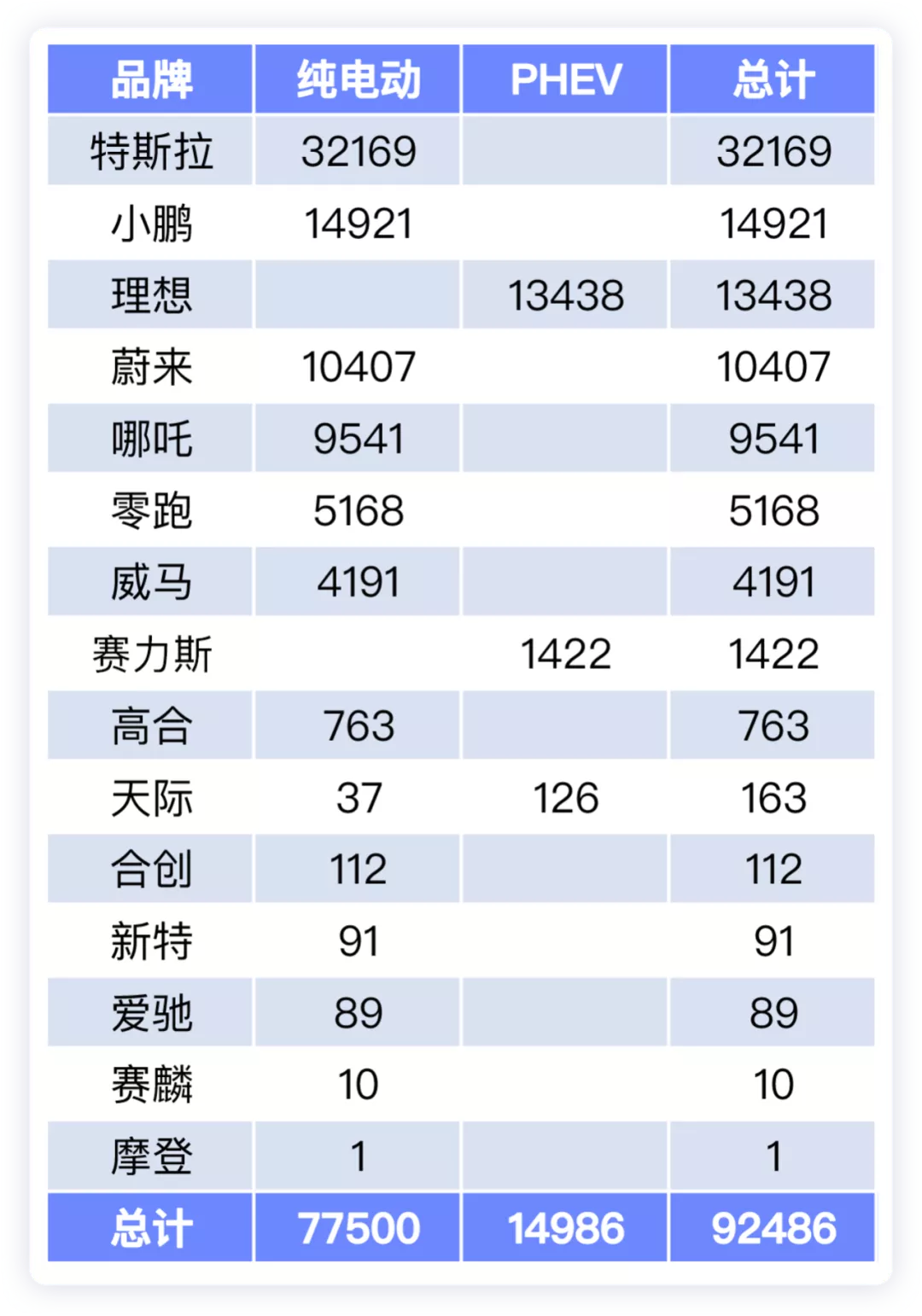

The total number of insured new energy vehicles in the new forces of electric vehicles, including Tesla, was 92,486 in November, of which 77,500 were pure electric vehicles and 14,986 were plug-in hybrid and extended-range electric vehicles, accounting for approximately 25.2% of the entire new energy vehicle market.

XPeng, Idean, NIO and NETA each exceeded or approached 10,000 units, while the second echelon is also intensifying with their own strategies.

Overall performance

- November and full-year performance

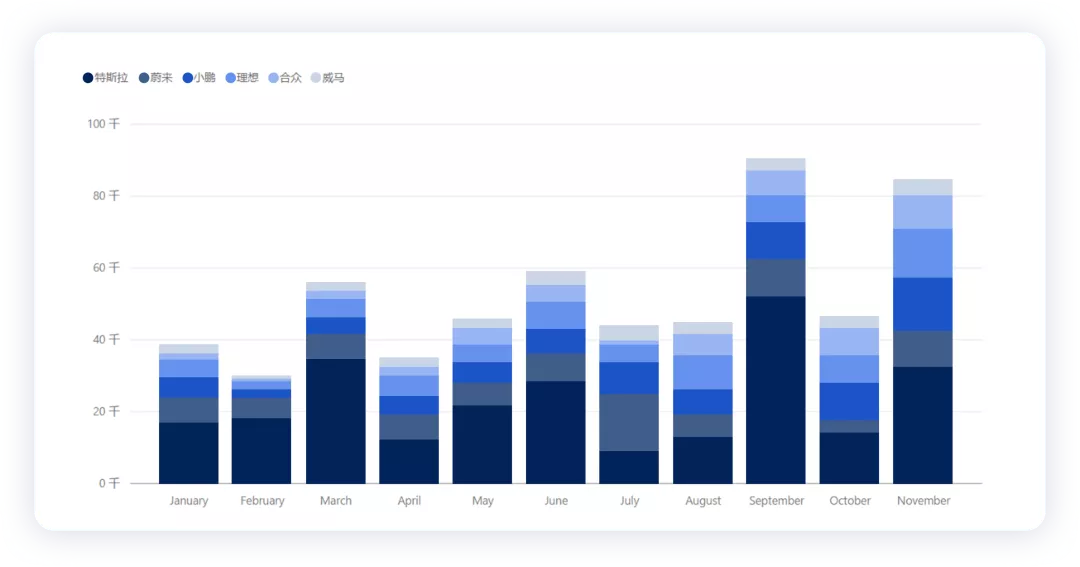

The insured data performance of major new energy vehicle companies from January to November 2021 is as follows:

Tesla:

32,196 units in November, 252,149 units accumulated from January to November, estimated at 300,000 units for the whole year 2021.

NIO:

10,407 units in November, 80,384 units accumulated from January to November, estimated around 95,000 units for the whole year 2021.

XPeng:

14,921 units in November, 80,374 units accumulated from January to November, predicted to hit 100,000 units next month.

Idean:

13,438 units in November, 77,198 units accumulated from January to November, predicted to pull up the annual sales to 92,000 units next month.

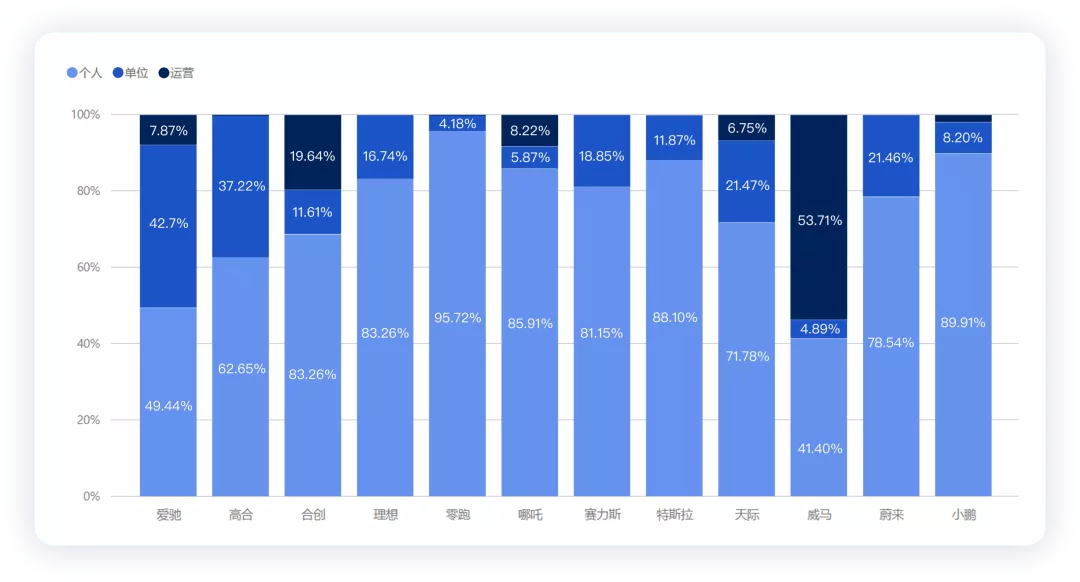

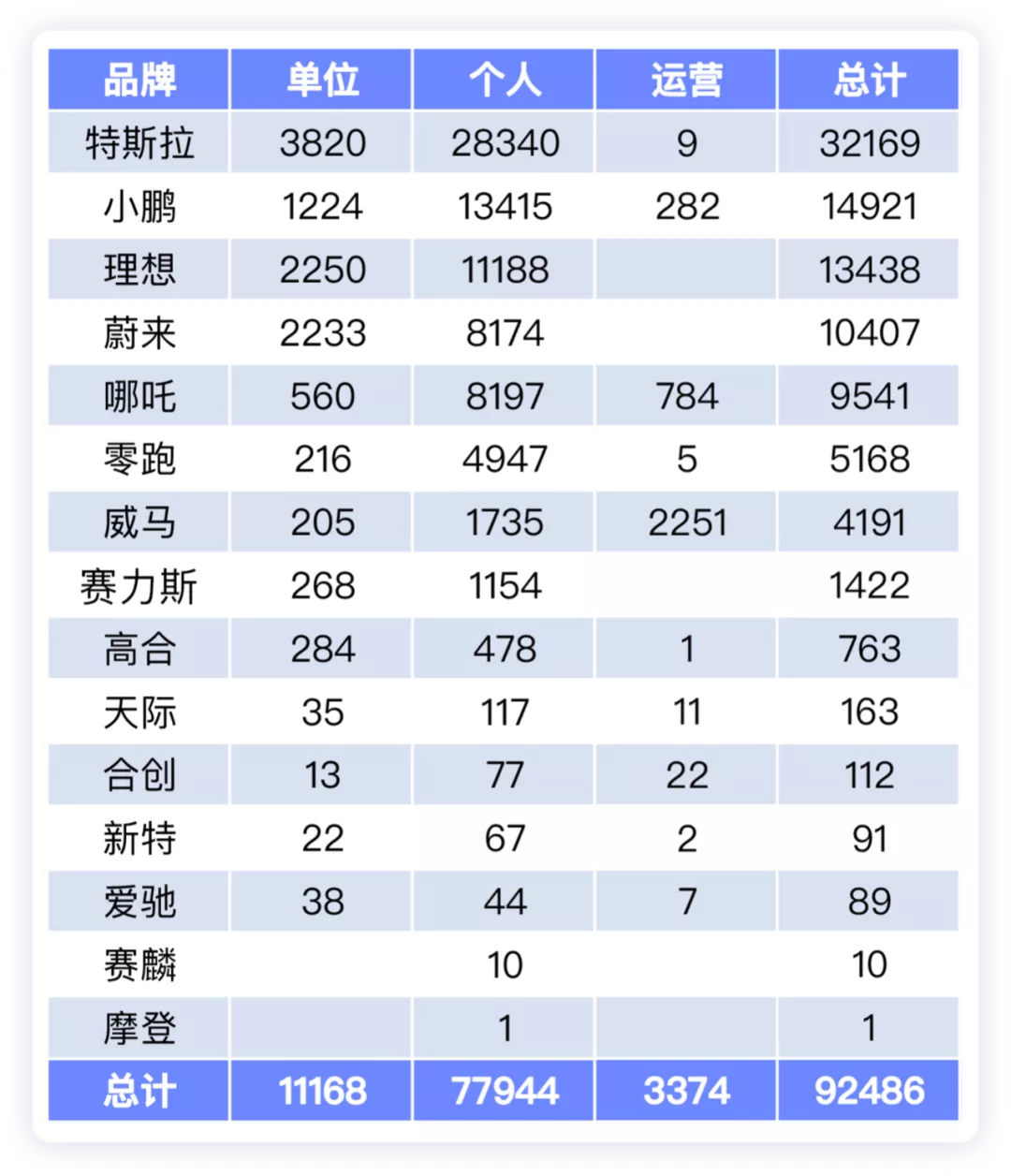

- Classified by usage property

From the perspective of absolute numbers, WM Motor has the highest proportion (53.71%) in the usage property classification of new automakers. At the same time, WM Motor has the lowest proportion of personal users. Tesla is most frequently purchased by companies (it may be used as an official vehicle by some business owners).

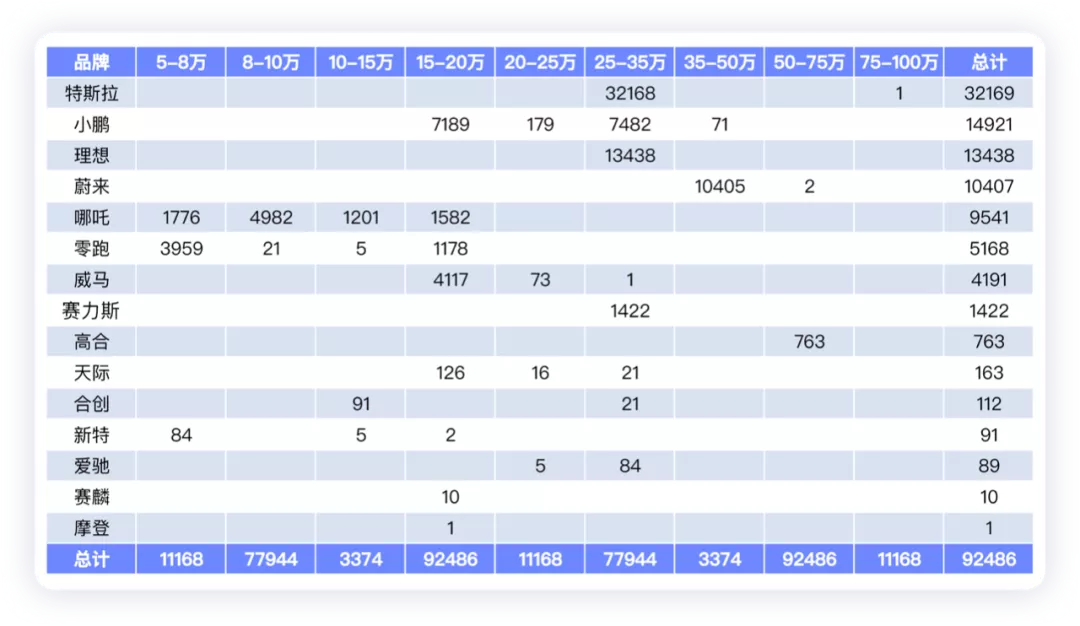

- Classified by price range

From the perspective of price, I believe that Tesla is under great pressure from the new forces of electric vehicles. Many of these companies position themselves against Tesla, learning from the fastest and finding a path to cross the river.

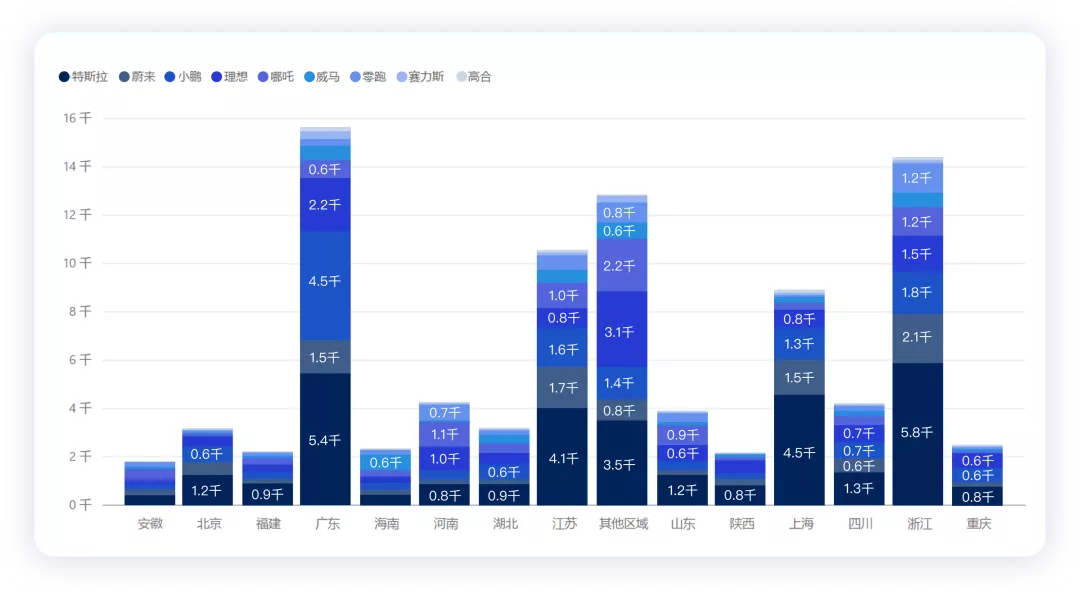

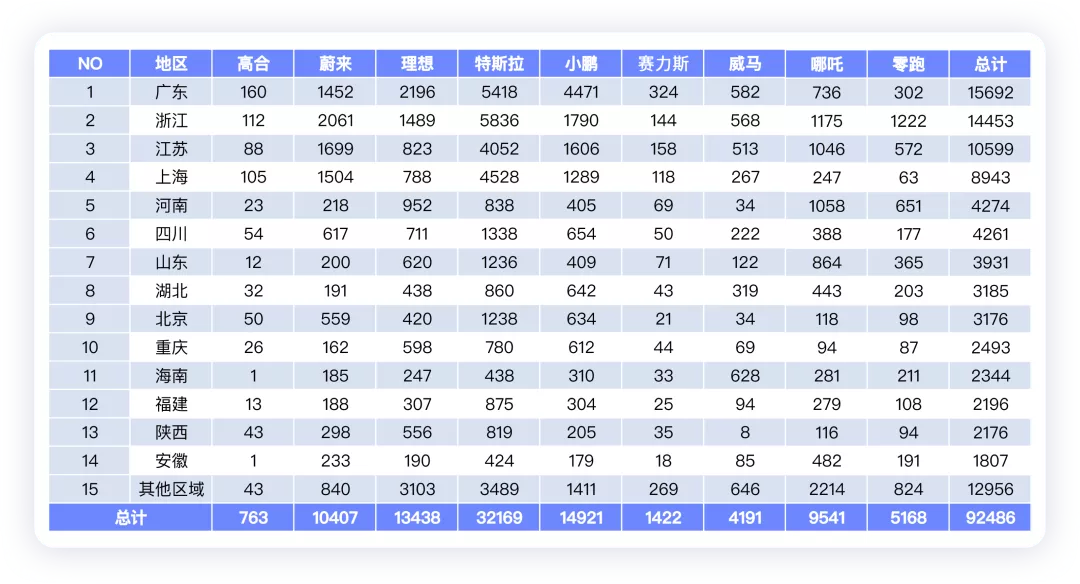

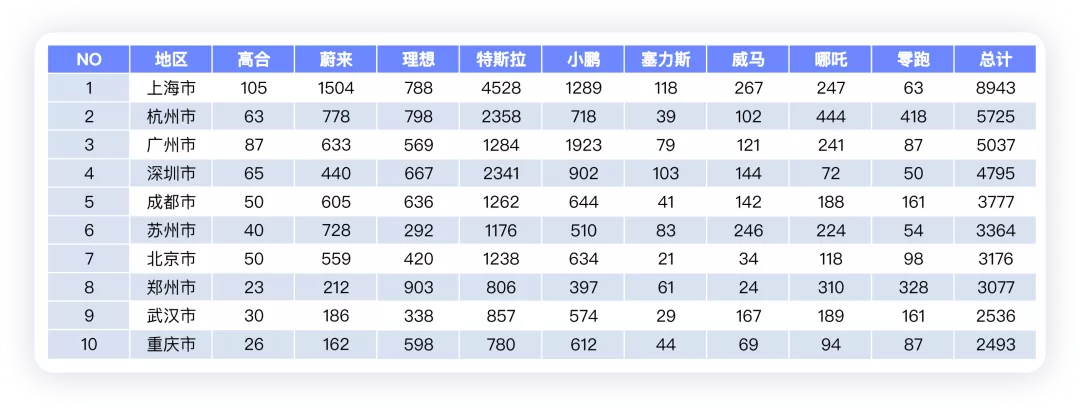

Geographical Classification

As a whole, most of the new energy vehicle startups are mainly distributed in four major areas, Guangdong, Zhejiang, Jiangsu, and Shanghai. The data of other provinces is relatively small. Of course, the region is closely related to specific vehicle models. Low-priced models have certain regional distribution characteristics in Henan and Shandong.

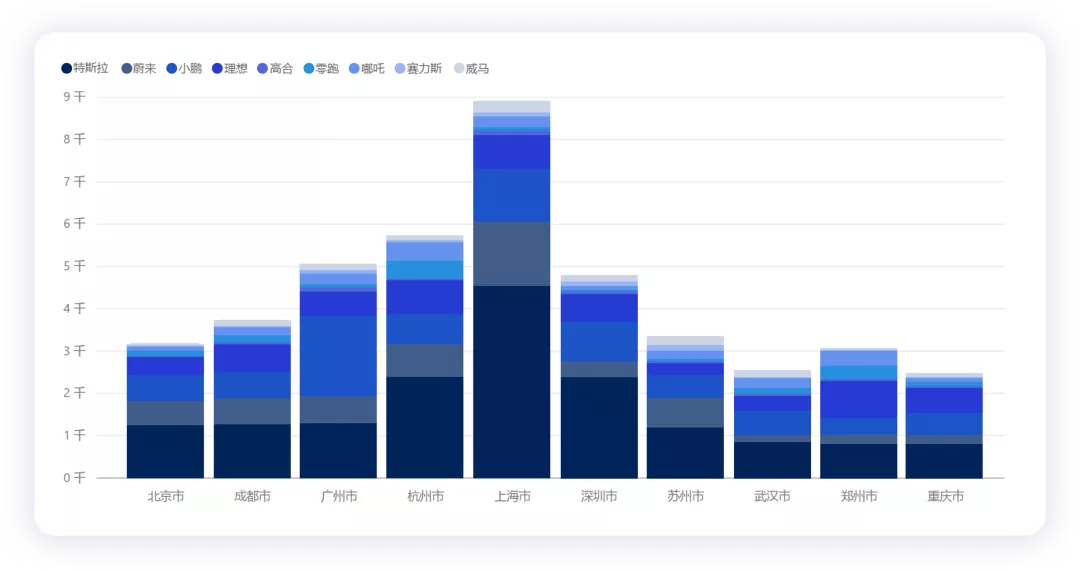

In November, the best-performing city for new energy vehicles was still Shanghai. Tesla still dominated, and Nio, XPeng, and Li Auto performed outstandingly. The second-tier cities in sales volume were Hangzhou, Guangzhou, and Shenzhen.

Among the top ten cities in sales volume, the most important brands are still the front runners in the competition with Tesla in the high-end market. It will take a long time for the following companies, such as Sitech, WM Motor, Neta, and Leapmotor, to catch up. The growth of automotive brands requires the establishment of a survival base in major cities, which is the main prerequisite for the long-term existence of new energy vehicle startups.

WM Motor, Neta, and Leapmotor, which are targeting the high-end market, still need a long time to move forward from the countryside.

In summary, I personally think that in open coastal areas, especially in the south, the change in the overall consumption concept of electric vehicles is indeed changing, and a certain degree of tolerance for new startups also provides sufficient space for the development of electric vehicles in the next few years. The penetration of electric vehicles now presents a regional distribution pattern.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.