Author: Wang Lingfang

In 2021, the auto industry has kicked off a wave of launches for 800V voltage platform models.

BYD, Geely, ORA, Hyundai, GAC, and Xpeng have successively released models with high-voltage 800V platforms. Among them, ORA, Xpeng, and BYD have scheduled the mass production of 800V voltage platform models in 2022.

It is widely believed within the industry that 2022 will be the year of development for China’s 800V voltage platform.

When referring to the 800V voltage platform, SiC devices are often mentioned in the same breath.

It should be acknowledged that the 800V voltage platform brings an improvement in charging speed, and the application of SiC devices helps to increase efficiency. The combination of the two results in better application effects. However, SiC devices are not mandatory.

In reality, high-voltage tolerant Si-IGBT can still be utilized as the power device on an 800V platform. However, efficiency may be reduced, although it does not affect charging speed.

There are many advantages to adopting SiC, such as smaller controller volume, improved efficiency and temperature resistance, increased driving range with the same battery capacity, and significant improvement in vehicle’s overall acceleration performance and NVH.

Of course, there may also be factors that have led the car companies to actively adopt SiC devices, such as the control device of Si-IGBT becoming larger under an 800V system, thereby increasing the difficulty of arranging vehicle components.

However, from the perspective of independent and controllable technology, there has yet to be a SiC chip mounted on a mass-produced vehicle in China, and the industry chain still needs further improvement.

Domestic and foreign car companies are constantly deploying with 800V

In April 2019, the Porsche Taycan Turbo S was globally launched with the birth of Porsche’s first pure electric vehicle and 800V voltage platform.

Subsequently, car companies initiated the era of 800V voltage platforms and have successively launched corresponding products.

On December 2, 2020, Hyundai Motor Group globally launched the new electric vehicle platform E-GMP, which also includes a multi-function 800V charging system.

Rivian and General Motors have already planned to change the voltage to 800V.

In China, Geely ORA, Xpeng, GAC Aion, BYD e-platform, Ideal Auto, BAIC ORA, and Landtourer have also deployed 800V fast charging technology.

In addition to car manufacturers, in April of this year, Huawei also launched its first AI fast charging full-stack dynamic high-voltage platform solution. According to Huawei’s plan, in 2021, the FC1 fast charging solution with 750V and 200kW will be implemented, and 30% to 80% SOC can be charged in 15 minutes; in 2023, the FC2 fast charging solution with 1000V and 400kW will be implemented, and 30% to 80% SOC can be charged in 7.5 minutes; in 2025, the FC3 fast charging solution with 1000V and 600kW will be implemented, and 30% to 80% SOC can be charged in 5 minutes.

In addition to car manufacturers, in April of this year, Huawei also launched its first AI fast charging full-stack dynamic high-voltage platform solution. According to Huawei’s plan, in 2021, the FC1 fast charging solution with 750V and 200kW will be implemented, and 30% to 80% SOC can be charged in 15 minutes; in 2023, the FC2 fast charging solution with 1000V and 400kW will be implemented, and 30% to 80% SOC can be charged in 7.5 minutes; in 2025, the FC3 fast charging solution with 1000V and 600kW will be implemented, and 30% to 80% SOC can be charged in 5 minutes.

This AI fast charging high-voltage solution will be initially installed on the BAIC BJEV Arcfox Alpha S HI version, and is planned to be delivered in small quantities in the fourth quarter of this year.

As we can see, the 800V platform has become one of the main directions for car manufacturers in the next stage.

Why Adopt an 800V Voltage Platform

Liu Minghui, vice president of XPeng Motors, told “Electric Vehicle Observer” that the purpose of increasing the voltage platform is to achieve fast charging.

Looking back at history, it can be found that the demand for voltage in vehicles has been increasing since the use of batteries on cars.

As early as 1918, when cars began to use batteries, the voltage was only 6V. Later, in order to meet the increasing electricity demand, in 1950, the voltage of the car began to increase to 12V. Now, in order to install a 20KW mild hybrid system, it is necessary to achieve a voltage of 48V to meet the power supply requirements of different cooling conditions.

After using batteries as power to drive vehicles, the demand for battery voltage is even more prominent. The voltage platform needs to be determined by considering the power required to drive the car, the maximum current under different cooling conditions, the breakdown voltage of power devices, and comprehensive cost factors.

At present, the voltage platforms of mainstream models at home and abroad are around 400V, such as Geometry and Tesla, which have a rated voltage below 400V.

The corresponding charging rate is approximately between 1-1.5C.

As the range of electric vehicles continues to grow, and without groundbreaking progress in battery energy density, this means that the amount of electricity carried by electric vehicles is increasing.

Fast charging has become the main demand of consumers. In order to improve charging speed, charging power needs to be increased.

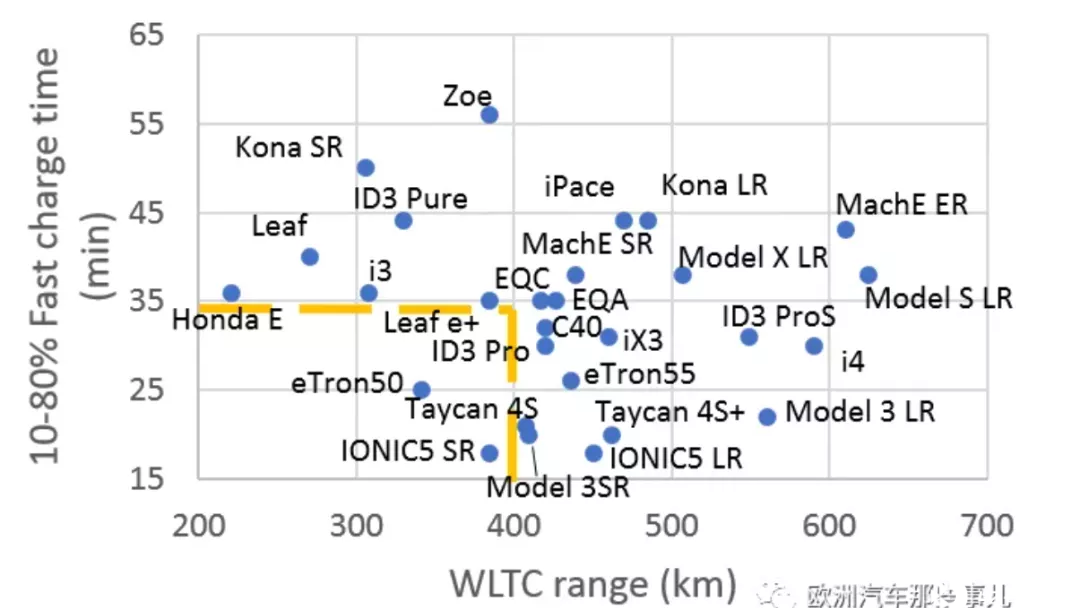

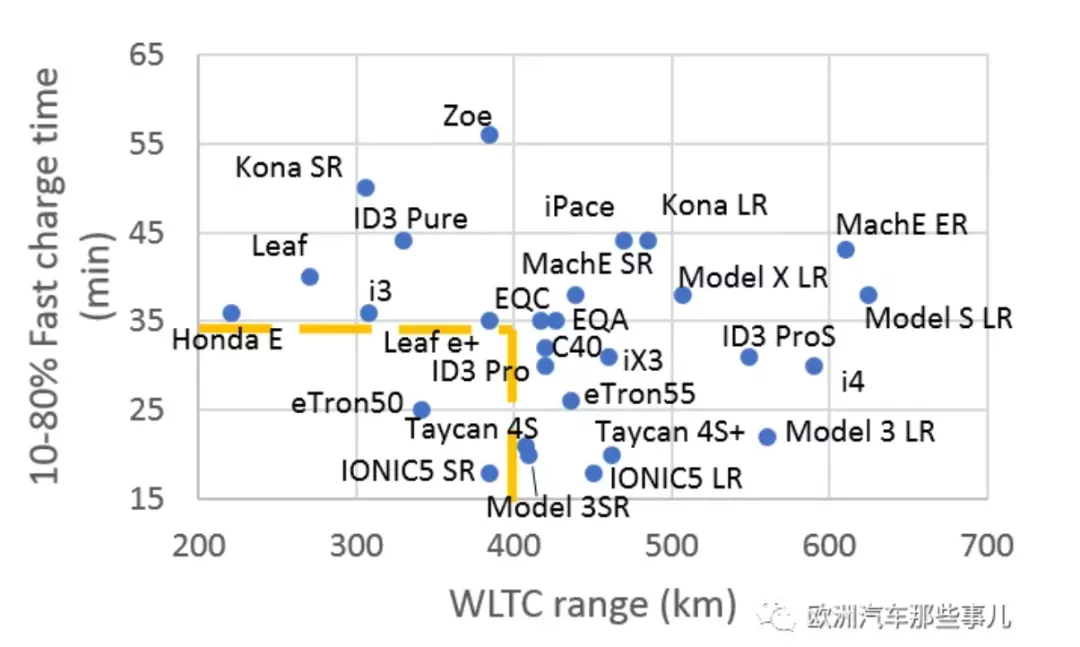

Data from “European Auto Matters” shows that 400 kilometers of driving range is the boundary for the demand for fast charging of electric vehicles. If the range is greater than 400 kilometers, car manufacturers will consider improving the charging rate.

Previously, the high-voltage system of electric cars commonly used a 400V voltage platform, which was limited by the voltage withstand capability of Si-IGBT power devices. Among charging piles based on this voltage platform, Tesla’s third-generation supercharger is the one with the highest charging power, reaching 250kW, and the peak working current is close to 600A.

Previously, the high-voltage system of electric cars commonly used a 400V voltage platform, which was limited by the voltage withstand capability of Si-IGBT power devices. Among charging piles based on this voltage platform, Tesla’s third-generation supercharger is the one with the highest charging power, reaching 250kW, and the peak working current is close to 600A.

According to the power formula, P = IU, to increase the charging power, either the voltage or the current must be increased.

When the power is the same, the higher the voltage, the smaller the current through the car line, and the power loss generated by Q = I²Rt also becomes smaller. Therefore, if you want to make the whole system more efficient, increasing the battery pack voltage can reduce the current and thus reduce the loss.

The efficiency of the motor drive will also be higher. When the current is constant, the higher the battery voltage, the greater the power of the motor, the faster the electric car speed, and the higher the efficiency of the motor drive, thereby increasing the cruising range and reducing the battery cost.

In addition, there will also be some incidental benefits, such as reducing the weight of the harness. When the power consumption is the same, the increase in voltage level will reduce the current on the high-voltage harness, that is, the harness becomes thinner, thereby reducing the weight of the harness and saving installation space.

Taking the Porsche Taycan as an example, after the voltage was increased from 400V to 800V, the current was reduced by half, and the cross-sectional area of the high-voltage harness was also half of that of the 400V architecture. The harness alone weighs 4kg less.

Among domestic car companies in China, BYD is one of the enterprises that deployed high-voltage platforms earlier. In 2019, the rated voltage of BYD Tang reached 613V. When using an 80kW fast charging pile, it can achieve 30%-80% SOC in 30 minutes. The specific voltage of BYD Tang 2021 even reached 640V, which is a 700V voltage platform product. Moreover, BYD Tang DM-i (PHEV) is also applicable to charging piles with a voltage of ≥700V.

Therefore, many car companies have set the target of reaching 800V as the next stage.

SiC-MOSFET or Si-IGBT?

In the industry, when it comes to 800V platform, SiC-MOSFET is often mentioned. Why is SiC closely related to 800V?

This requires an analysis of the characteristics of power devices currently used in cars.

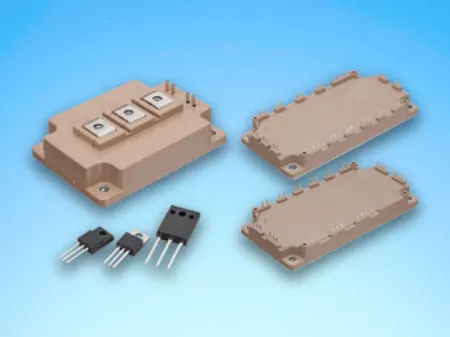

There are roughly three choices of power devices for electric cars: MOSFET, Si-IGBT, and SiC-MOSFET.

MOSFET is mainly used in A00-level models, with a low market share, and is expected to be replaced by IGBT in the future.

Si-IGBT, a power device with Si as the substrate material, is commonly used in the industry. In comparison, SiC-MOSFET is a power device with SiC as the substrate material, with many advantages but also a higher price.

Simply put, SiC-MOSFET has many advantages but it’s expensive. According to a calculation by CITIC Securities, SiC can achieve forward economy in the unit cost of the system when the battery capacity reaches 75kWh, considering the system economics of the battery cost, magnetic material cost, and other costs.

For example, in order to improve efficiency regardless of the cost, Tesla uses SiC-MOSFET for all models on the 400V voltage platform. Therefore, the use of SiC is not necessarily related to the voltage platform.

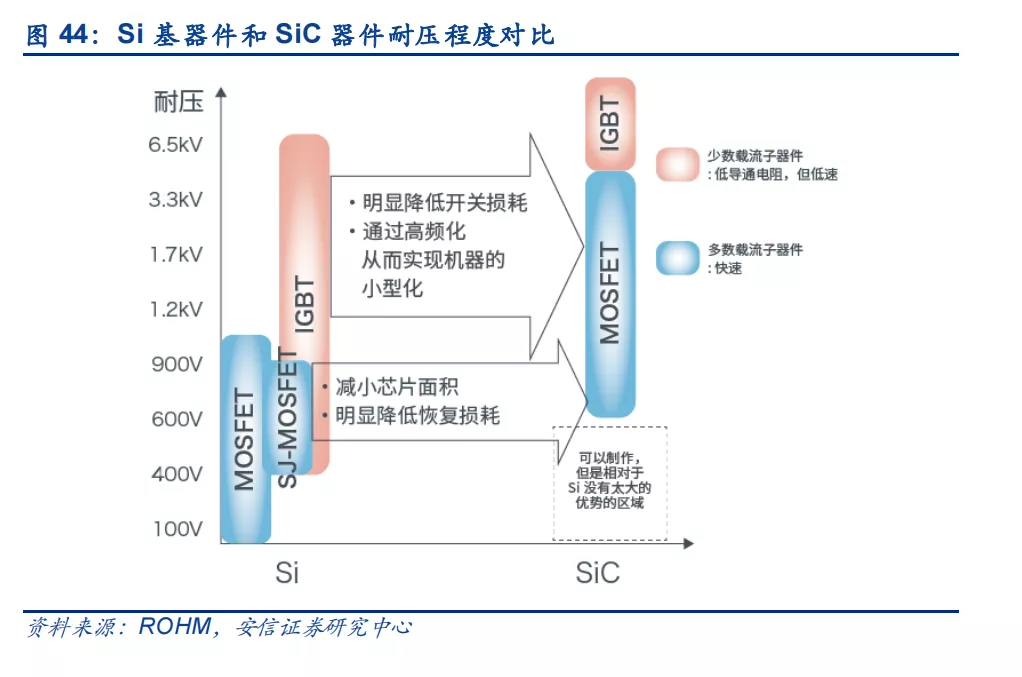

However, the advantage of SiC-MOSFET is obvious in high-voltage systems. In China, SiC MOSFET is considered for use in 800V platforms because the Si-IGBT that was previously suitable for the 400V platform no longer applies.

During operation, the motor controller will produce voltage fluctuation on the basis of the DC bus voltage. Therefore, in a 450V DC bus voltage, the maximum voltage that the IGBT module can withstand should be around 650V. If the DC bus voltage is raised to above 800V, the withstand voltage level of the corresponding power device should be increased to around 1200V. IGBT modules previously applicable to 400V will no longer be suitable.

Therefore, on the 800V platform, if Si-IGBT is still used, it needs to be replaced with high-voltage resistant ones or consider using SiC-MOSFET.

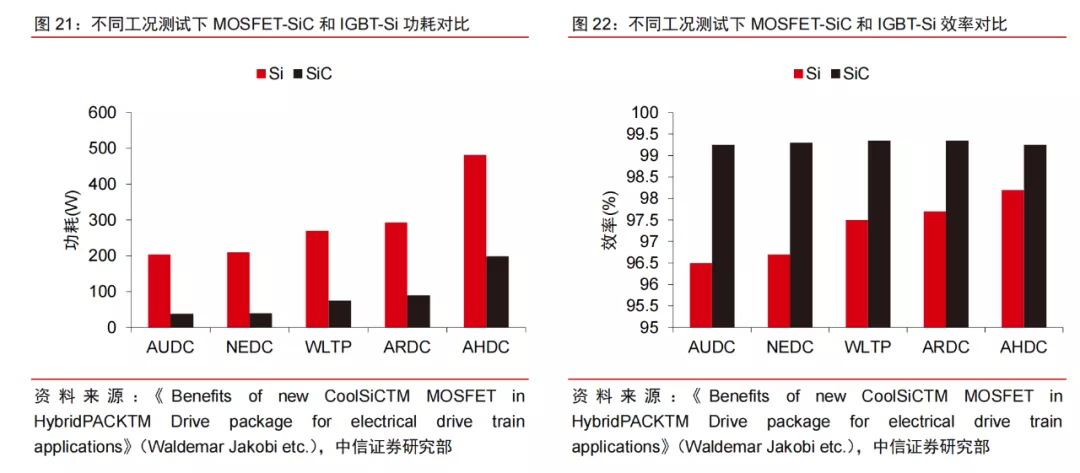

This is because even if Si-IGBT with high-voltage resistance is used, it still has the disadvantages of high loss, low efficiency, and large volume on the 800V high-voltage platform.

Some industry insiders have expressed that the Si-IGBT used on the 800V platform is significantly larger than that used on the 400V voltage platform, which brings greater difficulties in the cramped interior space layout.

Thus, SiC-MOSFET seems to have more advantages. However, the final decision to switch should also take into account an additional factor, cost.

According to Cree’s forecast, using SiC inverters in electric vehicles can save $400-$800 in battery costs (80kWh battery, $102/kWh) by increasing the range by 5%-10%, and after offsetting the additional $200 cost of SiC devices, it can achieve at least a $200 decrease in the cost per vehicle. From the perspective of the entire vehicle cost, when the cost of SiC devices drops to twice the current cost of Si-IGBT, the entire vehicle cost with SiC devices should be no higher than that of vehicles with Si-IGBTs.

According to Cree’s forecast, using SiC inverters in electric vehicles can save $400-$800 in battery costs (80kWh battery, $102/kWh) by increasing the range by 5%-10%, and after offsetting the additional $200 cost of SiC devices, it can achieve at least a $200 decrease in the cost per vehicle. From the perspective of the entire vehicle cost, when the cost of SiC devices drops to twice the current cost of Si-IGBT, the entire vehicle cost with SiC devices should be no higher than that of vehicles with Si-IGBTs.

Liu Minghui also believes that using SiC devices is cost-effective, as it can improve efficiency by about 3% compared to Si-IGBTs while increasing the range by about 5%. Simply put, considering the cost savings from space and range with the additional cost, SiC devices are still cost-effective.

In Liu Minghui’s view, the reason why SiC devices are expensive is that nobody is using them, and once the demand increases, the price will drop significantly.

Hong Siming, CEO of Sungrow Power, shares a similar view, stating that using SiC devices can achieve a cost balance when the vehicle’s battery level reaches 60%. That is to say, high-end mid-to-upper-range models with high voltage will be the first to adopt SiC devices, while mid-to-low-end models are not yet widely available. “If electric vehicles are positioned as high-end toys, although the cost of SiC devices has increased, it also improves performance in areas such as vehicle acceleration and NVH.”

Of course, it should be emphasized again that SiC devices can also be omitted without affecting fast charging rates.

Imperfect SiC Industry Chain in China

However, using SiC devices may face the dilemma of an imperfect industry chain in China. Especially in the case of relatively tight chip supply, whether China can achieve independent supply has become the primary factor to consider for supply chain security.

An industry veteran informed “Electric Vehicle Observer” that currently, no Chinese company (including BYD) has installed any SiC chip onto mass-produced vehicles. In terms of power chips, production still relies primarily on imports.

In fact, not to mention third-generation SiC devices, even for second-generation Si-IGBT chips, China still heavily relies on foreign companies for supply. At present, only a few companies such as BYD and CRRC can supply them.According to data, 95% of China’s high-end IGBT chips are mainly dependent on imports, with IGBT enterprises in Japan and Germany being the main sources of imported IGBT chips in China, including Mitsubishi and Fuji Electric of Japan, and Infineon of Germany, which almost monopolize over 90% of the domestic high-end IGBT market.

Sunpower’s R&D personnel also said in communication that SiC chips themselves are difficult, and controller development is also more difficult than silicon-based ones. “Silicon has accumulated a lot over so many years, but not yet for silicon carbide.”

The SiC device value chain can be divided into substrate – epitaxy – wafer – device. SiC substrate is the main cost and difficulty of SiC devices, accounting for up to 50% of the total cost. The main reason is that single crystal growth is slow and the quality is not stable, which also makes SiC expensive and not widely promoted.

In the SiC industry, the operating models of enterprises can mainly be divided into two types: the first type covers more complete links in the industrial chain, such as the production of SiC substrates, epitaxy, and devices, including Cree and Rohm. The second type only engages in a single or part of the links of the industrial chain, for example, Nippon Steel & Sumitomo Metal Corporation and Norstel in single crystal substrates, Dow Corning and II-VI in epitaxial wafers, and STMicroelectronics, ON Semiconductor and others in devices/modules. Overall, Cree is the world’s leading SiC technology company.

China’s SiC power semiconductor related manufacturers mainly include single crystal substrate companies such as Shandong Tiantai, Toin Crystal, Tungsten Tech, and CETC; epitaxial wafer companies such as Tianyu Semiconductor and Hantian Tiancheng; companies specializing in modules/devices such as CRRC Times Electric, Century Golden Resources, TTE and YJTC; and equipment companies such as North Huacheng and Shenke Instruments.

Although these enterprises are all laying out, SiC products in China currently cannot yet meet the demand of the vehicle-grade market.

With the growth of investment in SiC products, such as Huawei’s strategic investment in Shandong Tiantai obtaining 10% equity, and North Huacheng supplying 6-inch single crystal furnaces to Tiantai in bulk with good product defect control; BYD is also conducting SiC power semiconductor related technology development etc. Perhaps one day China can cultivate SiC chip enterprises that can meet the demand of the vehicle-grade market.

References:

- TF Securities “800V high voltage platform SiC application, new energy vehicle supply chain investment opportunity”;

- Anxin Securities “The era of super-fast charging is coming, high voltage platform speeds up penetration”;

- CITIC Securities “New energy automotive industry trend series report VIII: Power semiconductors, the song of electric masters”.欧洲汽车那些事儿《电动车续航里程与充电性能展望(上)》;

方正证券《电子行业专题报告:第三代半导体之 SiC 研究框架》

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.