Translation:

Body:

Word count: 3,238 words

Estimated reading time: 15 minutes

This article was published by an investment firm called Holon Global Investments and was originally written in English by Tim Davies, spanning 144 pages. After reading it over the course of two weekends, I personally found the logical thinking and factual content to be relatively complete and objective, which was very helpful for me. Therefore, I decided to translate it so that I can read it more carefully at a later time and share it with others.

This translation will strive to adhere as closely as possible to the original text. At the same time, since I also have relevant, but not necessarily mature, thinking and unscientific mathematical modeling, personal views will be supplemented in italics as a multi-perspective reference for comparison. This is not investment advice.

If you are interested in experiencing the original text, it is highly recommended to read it. The link is provided here: https://holon.investments/tesla-on-the-road-to-a-us-10-trillion-company-and-beyond/

It is necessary to once again emphasize that the original intention of translating this article is purely for self-iteration. In my opinion, learning how to combine rationality and sensibility, and mastering the method of systematically understanding a company and its era is more important than the conclusion. Understanding the logic and rationality behind numbers with common sense is more important than the numbers themselves. This article is a great learning material for this.

The entire article, except for the abstract and conclusion, is divided into ten chapters:

(1) The global trend of electrification in the automobile industry.

(2) How electrification solves greenhouse gas problems in cars.

(3) Tesla’s electric car opportunity (this chapter).

(4) Leading design and manufacturing of electric cars.

(5) The imminent arrival of autonomous driving in 2025.

(6) World-class energy infrastructure and storage solutions.

(7) Spike in demand for raw materials.

(8) Elements of disruptive innovation.

(9) Surpassing competitors.

(10) Tesla’s financial and value predictions.

Tesla’s Electric Car Opportunity

As the current global leader in electric vehicles, Tesla will have the opportunity to gain a 20-25% market share in the global electric vehicle market over the next thirty years with Model 2, 3 and Y.

- Tesla will dominate the electric vehicle market for the next thirty years.In 2019, Bloomberg surveyed 5,000 Tesla Model 3 owners, and the results indicated that 99% of Tesla owners would recommend the car to their friends, and 98% of those owners would buy another Model 3 as their next car. This suggests that customers who switch from gas-powered cars to electric cars are unlikely to switch back to their previous brand, at least until those brands can offer competitive products. Furthermore, Tesla owners have become a strong “sales team” for the company, actively sharing their experiences with friends who are likely to switch to an electric car in the next 5-10 years.

Electric car owners seem to be warning traditional car companies that if they cannot produce an innovative car like Tesla, they will face bankruptcy in the next decade. Throughout history, there are numerous examples of industry leaders who did not recognize the challenge from their competitors and the technological innovation they introduced. For instance, Nokia was defeated by Apple’s challenge without reacting promptly, as detailed in Element (8) of Disruptive innovation.

At the same time, some gas-powered car companies have responded quickly and invested heavily in intensive product lines. However, for most companies, it is already too late.

As the world’s most well-known and technologically advanced company, Holon believes Tesla will dominate the global electric vehicle market for the next thirty years. We believe Tesla’s first-mover advantage will enable it to capture 20-22% of the global electric vehicle market from now until 2040 or beyond, as shown in Figure 9.

Of course, this is significantly higher than the current largest automotive companies’ market share, which is Toyota and Volkswagen, each accounting for 10-12%. With the global transition to electric vehicles, the arrival of autonomous driving technology, and the goal of banning gasoline-powered cars, Tesla has a rare opportunity to dominate the electric vehicle market.

Figure 10 shows the demand curve for Tesla in the market. Our demand model predicts that Tesla will sell over 5.5 million cars annually by 2025, 14.85 million cars annually by 2030, and 34.1 million cars annually by 2040. In the next ten years, in regions such as Europe (Berlin’s super factory started production in 2022) and India (factory construction plans announced in 2022/23), where there will be significant demand, the annual compound growth rate of production capacity may reach 40%. This growth rate is more conservative than Tesla CEO Elon Musk’s long-term growth forecast for production capacity, which is estimated to be 50%. Our production capacity growth forecast for Tesla after 2040 is 1-2%.We can see in Figure 10 that the demand for both new electric vehicles and the shift from gasoline vehicles to electric vehicles will peak in 2040 (represented by the dark blue line). Calculating based on an average lifespan of 12 years, we estimate that Tesla’s total demand will reach its peak in 2049 at 45.6 million cars per year, with replacement demand accounting for 57% or 28.2 million cars per year.

If Tesla can achieve this milestone, the global fleet of Tesla electric cars will exceed 462 million by 2050, far surpassing the current gasoline car fleets of Toyota and Volkswagen.

- Tesla Model Lineup: Three Key Models

Tesla has three key electric vehicles that will enable the company to successfully reach its production capacity curve over the next 30 years. These are the Model 3, Y, and 2 (expected to begin production in 2023).

Tesla’s electric vehicle product line is in the three largest passenger car submarkets: midsize passenger cars (B-segment), midsize SUVs (Sport Utility Vehicles), and compact cars (A-segment). In 2019, these three submarkets accounted for 80% of the 75 million new cars sold globally.

Holon predicts that by 2050, the Model 3 and Y will each account for 27% of Tesla’s sales, while the cheapest Model 2 will account for 15%. These three models will together account for approximately 69% of Tesla’s annual sales. Combined with the 31% of Tesla’s other electric vehicle models (S, X, CyberTruck, and Semi), Tesla will be able to cover both entry-level and luxury passenger and commercial vehicles, establishing a strong global brand that can compete with Mercedes-Benz and BMW’s product lines at all levels.

In the next section, we will compare Tesla’s long-term production capacity curve for its three key electric vehicle models with the long-term demand curves for these three models in their respective submarkets.

Here, we assume that these three submarkets will maintain their 2020 market shares over the next 30 years, layering these market proportions directly onto our long-term electric vehicle demand curves. Since it is difficult to predict changes in customer demand for different vehicle models, we prefer to update our model when actual changes occur.

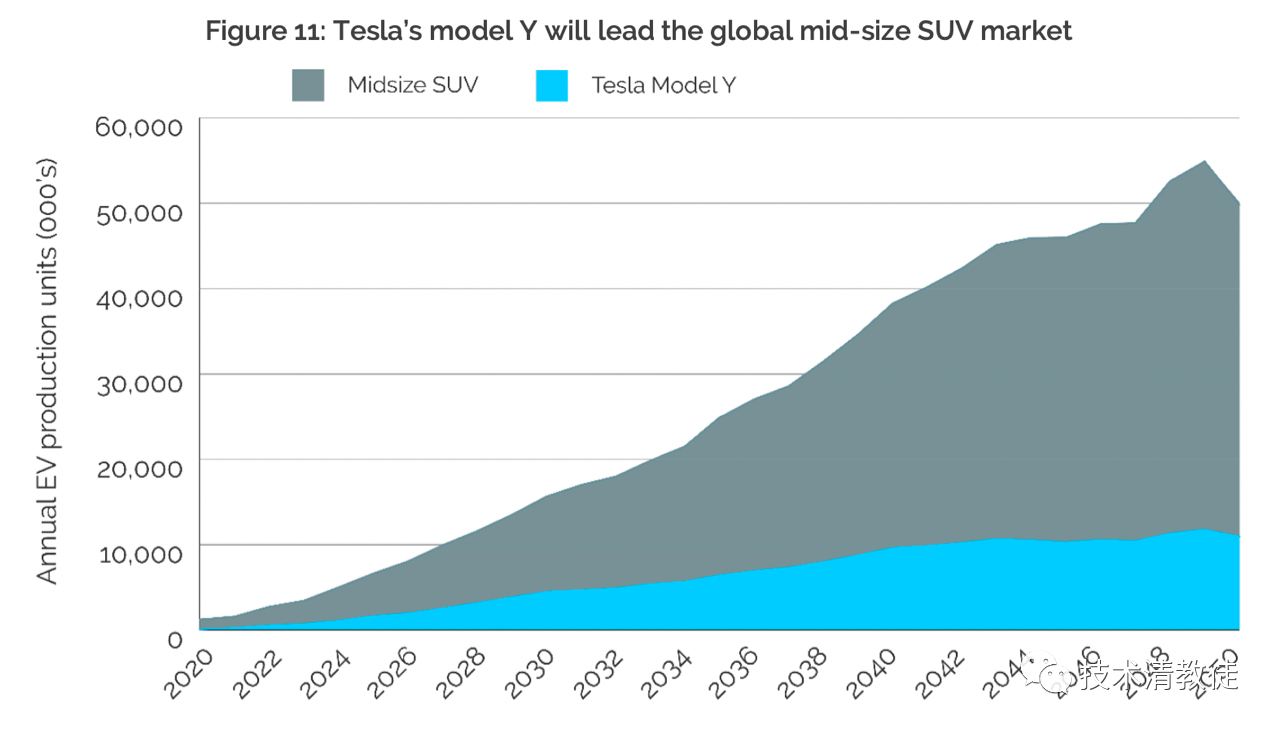

- Tesla Model Y to capture 22% of the global midsize SUV market.In 2019, the world’s largest single market for passenger cars was the mid-size SUV market, which accounted for 40% of new car sales. Tesla’s Model Y went into production for the first time in 2019, targeting this market.

Holon estimates that mid-size SUV demand will peak at around 55 million vehicles per year in 2049. Our model shows that the Model Y produced by Tesla in the Asia-Pacific region, Europe, and the United States will sell 9.6 million vehicles per year in 2040, and peak at around 11.8 million vehicles per year in 2049 (see figure 11).

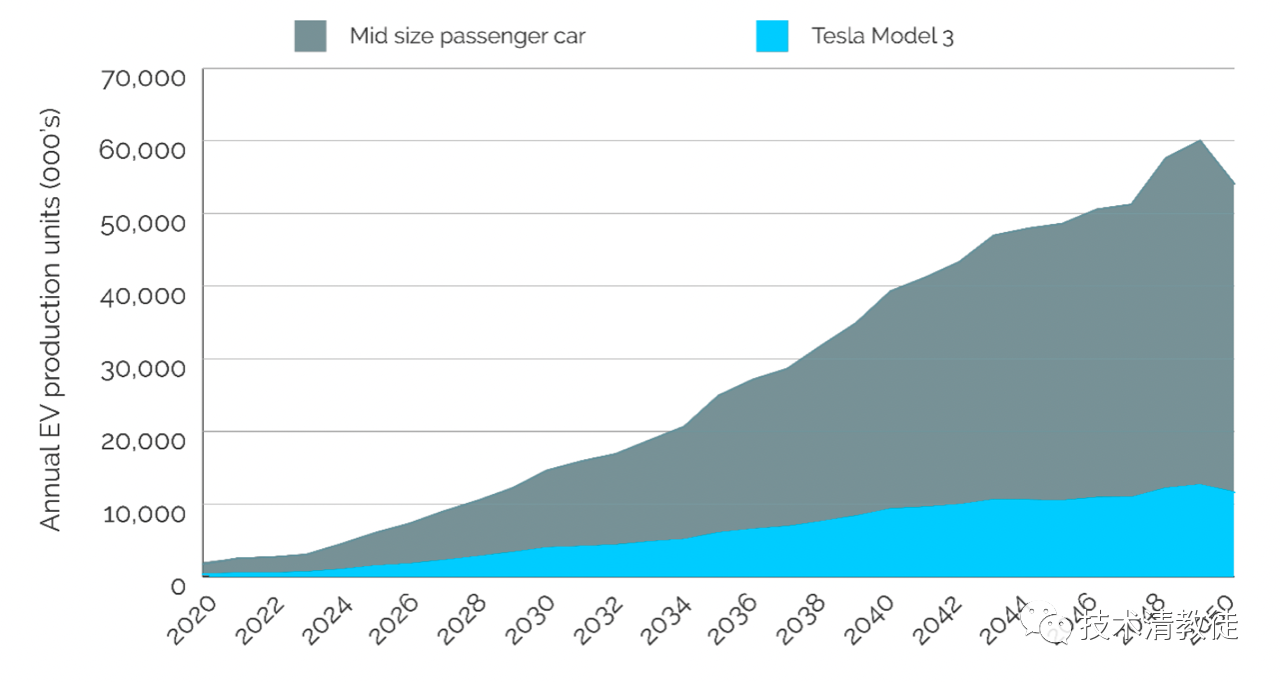

- Model 3 will occupy 21% of the mid-size passenger car market

The mid-size passenger car market accounted for 20% of new car sales in 2019 and is the second-largest source of revenue for Tesla in the next thirty years. Our model shows that mid-size passenger car demand will reach 60 million vehicles per year in 2049 (see figure 12).

The demand for Model 3 will be similar to that for Model Y. It will reach 9.3 million vehicles per year in 2040 and then accelerate to a peak of 12.6 million vehicles per year in 2049. It is almost certain that Tesla will maintain a 20%-22% global market share in mid-size passenger electric vehicles over the next 30 years.

- Model 2 will have a place in the compact passenger car market

Elon Musk announced at Tesla Battery Day in 2020 that he will launch an electric car priced at around $25,000 within the next three years. The price of this car will not exceed the TCO (Total Cost of Ownership) of the equivalent gasoline car and may even be more competitive.

We believe that the Model 2 compact passenger car will have the opportunity to become Tesla’s best-selling electric car.

If Tesla can successfully convince consumers in developing countries to accept electric cars with lower range (250-300 miles) but more affordable prices, Tesla can further squeeze the market share of fuel car companies struggling to convert in developing regions. Based on the rapid growth of disposable income in developing countries and regions such as China and India, we expect global demand for small/compact electric vehicles to reach 70 million units per year in 2049.Once the Model 2 goes into production at the end of 2022 or the beginning of 2023, Holon believes it will contribute 9.8 million vehicles to the global entry-level electric vehicle market by 2040. By 2049, demand for the Model 2 will reach 14.5 million vehicles in India, China, and Africa (see Figure 13).

By using Tesla’s integrated solar and battery storage solution instead of relying on grid power, significant savings will be made, as shown in our report “(6) World-Class Energy Infrastructure and Storage Solutions”. Therefore, we believe that the long-term demand for the Model 2 will be even more optimistic than our current forecast.

Tesla has not yet officially announced the details of the Model 2, but more details are expected to be released before it goes into production in 2022. Production facilities will include the Shanghai and Berlin super factories, and if a super factory is also established in India, Tesla will have an advantage in this huge opportunity.

Our demand model predicts that China and India will account for 40% of the global electric vehicle market in the next 30 years, and the Model 2 will be key to Tesla’s market share in this market.

- Global market share of Tesla’s segmented vehicle types

Compared to other electric vehicle companies, Tesla has a first-mover advantage. Our model shows that this will enable Tesla’s four main models to gain a global market share of 20-22%.

Figure 14 shows our estimated market share for the Model 3 (small passenger car), Model Y (midsize SUV), and Model 2 (compact car). Tesla’s factories in Shanghai, the United States, and the soon-to-be-completed Berlin factory will give it a huge production capacity advantage, and its four main models may gain 28% of the global market share by 2030.

- Tesla’s CyberTruckSome traditional pickup truck companies have started introducing hybrid pickup truck models to respond to electrification. However, the strong brand of Tesla and the unique design of CyberTruck have already brought over 1.25 million potential buyers’ pre-orders. If Tesla can convert 50% of these pre-orders into real orders, we believe Tesla will need until 2025 to fulfill them. This data is consistent with our expectation that CyberTruck will have a 40% market share of the pickup truck market in the next five years.

The powerful engine and long-range mileage will make CyberTruck a strong competitor to existing pickup trucks. The production capacity of traditional US fuel vehicle companies is at least five to seven years behind Tesla and is unlikely to catch up in the next ten years.

Rivian, the electric vehicle company invested by Amazon (planning to go public in 2021), has already launched a well-reputed SUV, but it is unlikely to pose a threat to Tesla due to serious production capacity lagging.

- Tesla’s Semi Truck

A Tesla Semi, capable of fully autonomous driving, can save the cost of long-distance transportation. As shown in Figure 15, driver costs account for 26% of transportation costs, while fuel costs account for 38%.

We believe that Tesla’s FSD and long-lasting battery advantages can give the Semi powerful competitiveness in long-distance and land transportation. However, Tesla has not publicly disclosed detailed plans. Nevertheless, Tesla is definitely one of the most competitive companies in this field.

Holon believes that the advent of electric trucks will significantly reduce transportation costs, putting existing fuel truck drivers at a cost disadvantage, which will force them to accelerate the replacement of electric trucks. This trend will be unstoppable, especially after the advent of fully autonomous driving capabilities. Therefore, we expect Semi’s production to gradually climb to a level of one million units per year by 2040.

(to be continued)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.