Overview of the Auto Market

The insurance data for November is out, with two data sources totaling 1.758 million and 1.7655 million respectively. This is only an increase of less than 80,000 compared to the previous month.

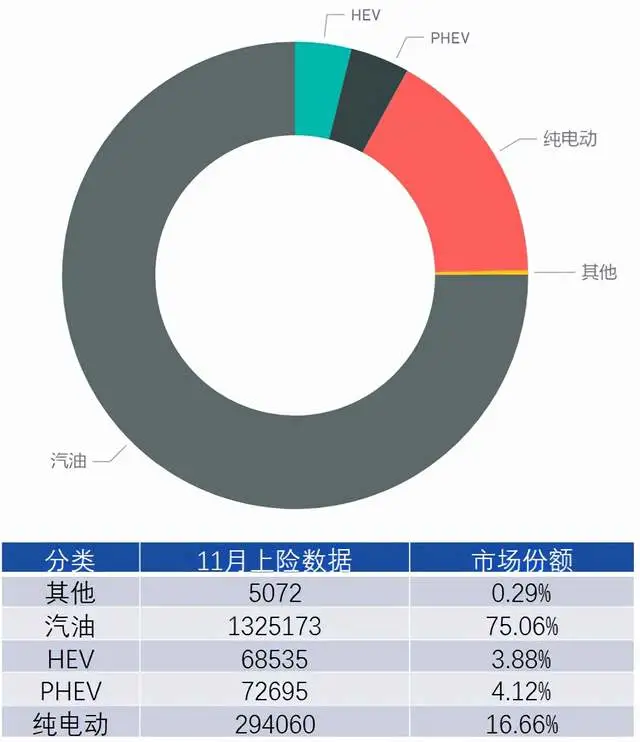

Compared to the overwhelmingly positive trend of new energy vehicle data, the entire auto industry is still gradually recovering. Pure electric new energy vehicles insured numbered 294,000, while plug-in hybrids numbered 72,700, for a total of 366,700 vehicles and a penetration rate of 20.7%. This data is quite surprising.

Note: Let me digress for a moment. I have been adapting to a new job recently, and the operation of the entire public account has been handed over to Yanyan to take care of. As things have gotten busier, I am unable to publish on a fixed schedule as I used to. I will try to write more valuable articles on the weekends.

Overview of the New Energy Vehicle Market

The auto market this year has been difficult, with high growth rates only corresponding to the low base year of 2020. The number of passenger car insurance policies has been declining since August, and currently stands at around 1.758 million per month. From January to November 2021, there were a total of 18.813 million vehicles insured.

It is predicted that there will be a push to reach 1.9 million vehicles in the final month of this year, with a total of around 20.7 million vehicles insured for the whole year.

Market Situation of New Energy Vehicles

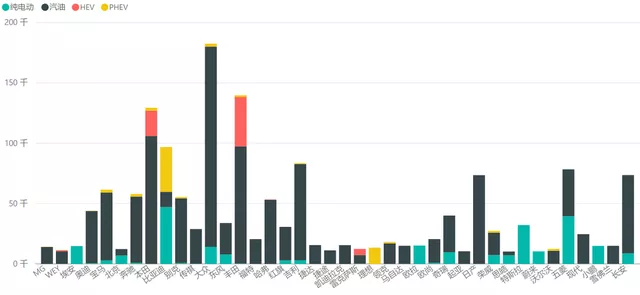

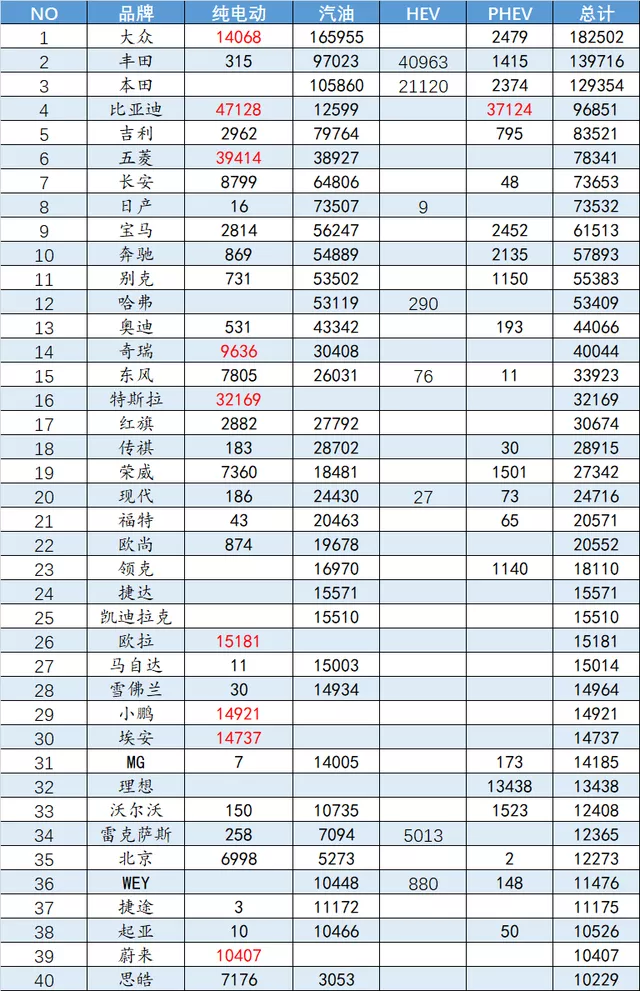

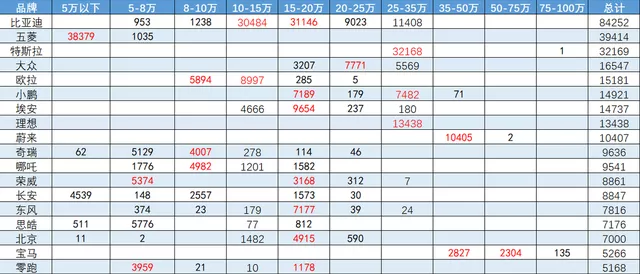

In November, the number of vehicle insurance policies exceeded 10,000 for the brands shown in Figure 3, corresponding to the data in Table 2.

Overall, the recovery of foreign brands has not been particularly good, with only Volkswagen, Honda, and Toyota exceeding 100,000, and Nissan, BMW, Mercedes-Benz, and Buick exceeding 50,000 but not reaching 100,000.

There is a lot of information in Table 2:

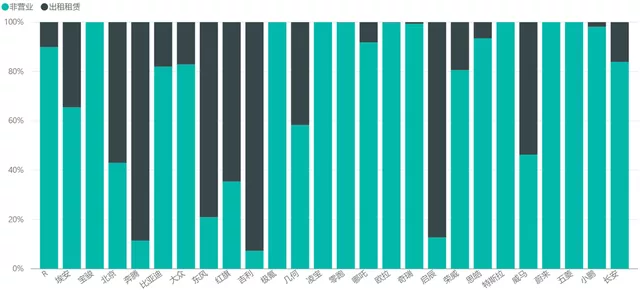

● Due to the demand for driving the economy, enterprises with more 2B vehicles have also begun this round of driving, and the typical brands are well known.

● BYD has become the best-selling brand among domestic brands, surpassing Geely, which is a particularly interesting phenomenon.

Translated English Markdown Text with HTML Tags:

Translated English Markdown Text with HTML Tags:

According to Figure 4, we can see where the value of some companies lies in the field of pure electric vehicles.

Looking at the price range, a lot can be inferred:

BYD: Concentrated around the 100,000-150,000 and 150,000-200,000 price ranges, with considerable breakthroughs even above 200,000. Currently, BYD’s strategy of trading volume for price is still very effective.

NIO, Ideanomics and XPeng: As expected, XPeng is still divided into two price ranges, 150,000-200,000 and above 250,000, with a balanced state. We will do a separate analysis on the high-end version of P5 later.

150,000-200,000: This segment actually has a large number of 2B vehicles, such as BAIC, Dongfeng, and EAET. This is a one-time impulse demand.

Below 100,000: Below 50,000 is the competition between Wuling and Changan, 50,000-80,000 are Chery, Sihao, Leapmotor and Clever, 80,000-100,000 are Euler, NETA, and Chery, the three of which are in a fierce price war in this segment.

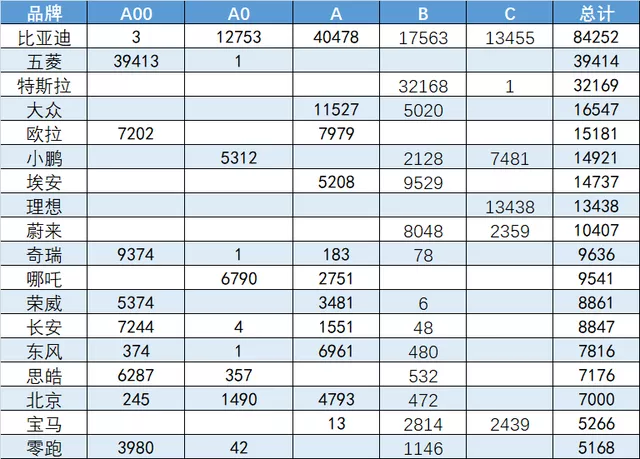

With Table 3, we can have a clearer understanding of the performance of different brands of new energy vehicles in various models.

However, there is some confusion in the vehicle level, which can be corrected according to specific models.

Objectively speaking, I think that the impact on A-class cars will still be significant after 2022. Although the demand for 2B still exists, these types of vehicles are cost-sensitive. Under the dual effects of rising battery costs and subsidies, being able to maintain the market for 2B is already good. It has a great impact on the overall personal market.

Summary: The first overview mainly gives everyone an intuitive impression. The data in November can reflect at which stage the market is in.

I think the next article will do some comments on specific models and different enterprises.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.