IPO of LG Energy Solution

LG Energy Solution is currently conducting an IPO worth 12.75 trillion won (approximately 10.8 billion dollars), which will be the largest IPO in South Korea.

As the second largest battery manufacturer in the world after Ningde times, LG Energy Solution is trying to make a leap in its independent growth process.

As someone who has been tracking this company for a while, I think we can explore this from factors such as production capacity, products, and customer structure.

Due to the limit of the article length, this article is just a beginning, as there are many things to say about LG Energy Solution.

Technology Roadmap and Capacity Expansion

Production Capacity Planning

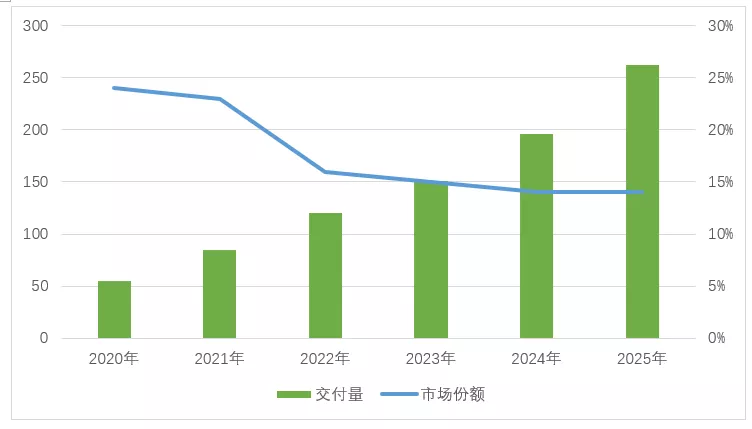

After Tesla’s Battery Day, the expansion of global battery companies has not stopped. As of the end of the third quarter of 2021, LG Energy Solution’s production capacity is 155GWh. It has established large-scale production systems in four regions, South Korea, the United States, China, and Europe, with 70GWh in Europe, 62GWh in China, 18GWh in South Korea, and 5GWh in the United States.

In terms of long-term planning, we find that LG’s biggest challenge is in various regions:

(1) Europe: The current Poland factory has a production capacity of 70GWh. The current capacity utilization rate is not high, and it is expected to increase to 85GWh by 2025. Based on customer needs, a new base with a production capacity of no less than 15GWh may be established in Europe within 4 years. This shows the trend of European automotive customers towards the huge increase in battery procurement in the future.

(2) United States: The original Michigan factory had a battery production capacity of 5GWh. It will expand to 20GWh by 2025. LG also established a joint venture with General Motors, Ultium Cells LLC, and is building the first joint venture factory with a production capacity of 40GWh. Mass production will begin in the second half of 2023, and the total capacity will reach 80Gwh by 2025. Another joint venture with Stellatis has a capacity of 40GWh and there may be a new base in North America to add some capacity.

(3) Asia: It mainly includes factories in South Korea, Indonesia, and Nanjing. The increase in local production capacity is limited, with a relatively large increase in China’s factories. LG also cooperates with Hyundai Motor Group in Indonesia. This is the largest increase for LG.

Overall, LG’s original production capacity planning is focused on soft-pack batteries. For cylindrical batteries, it will reach no less than 120GWh by 2025 (60GWh in Nanjing, 22GWh in South Korea, and 40GWh in other regions).

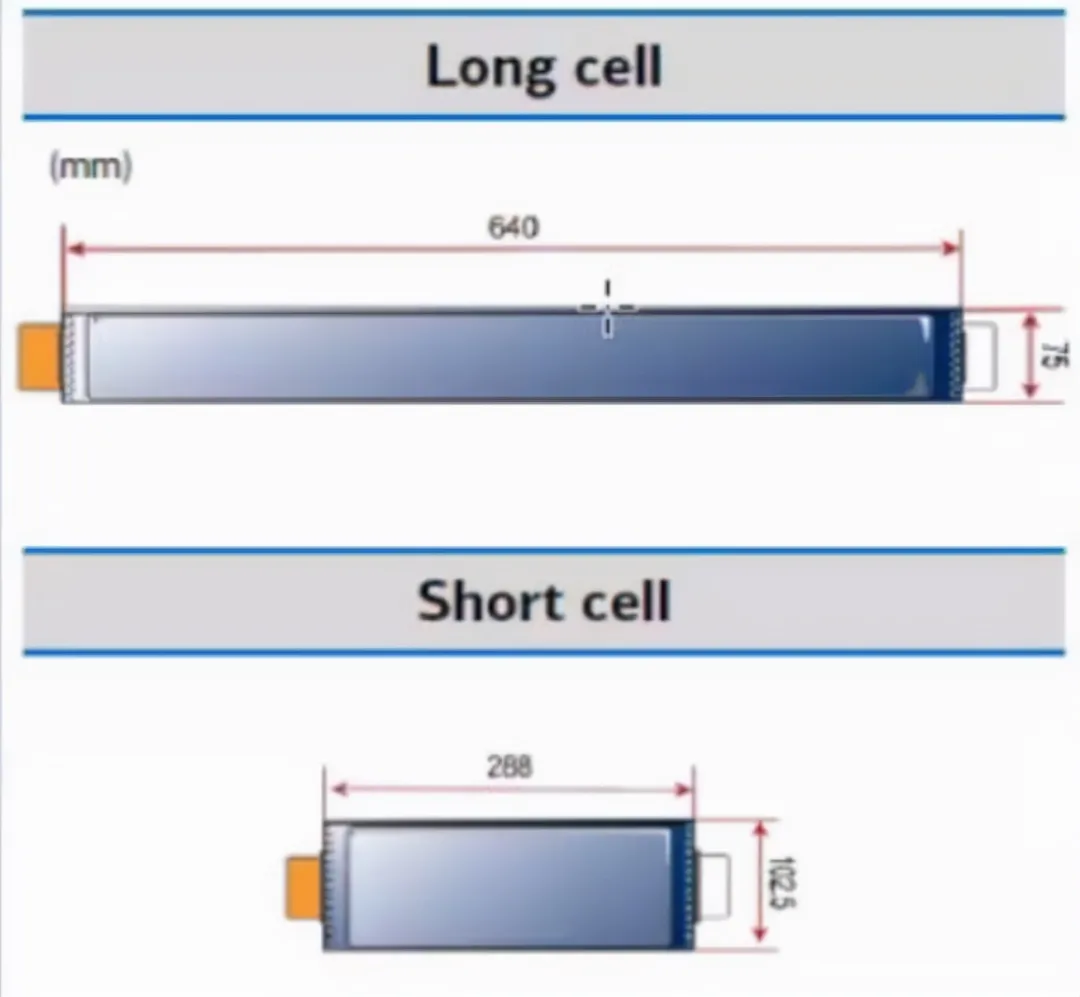

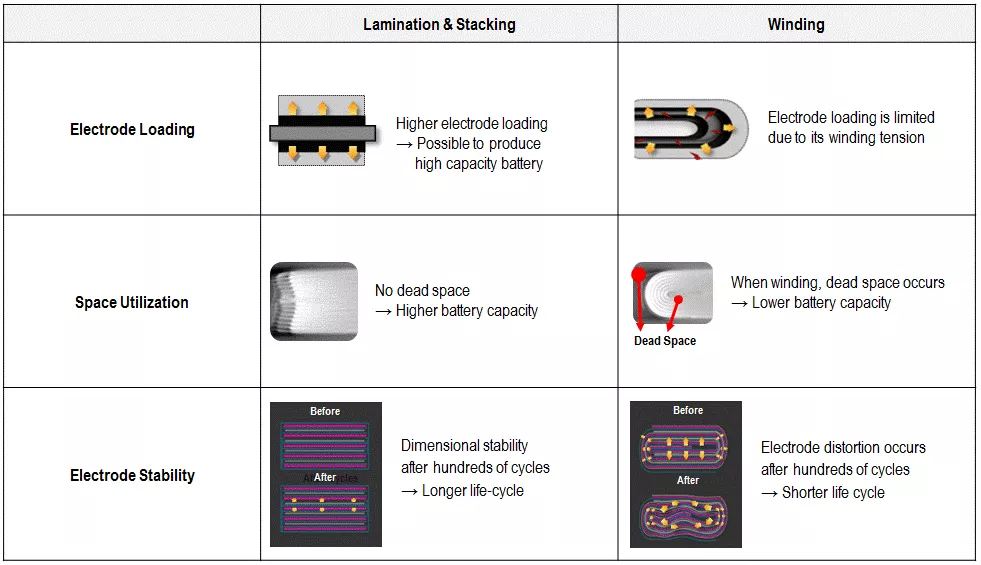

Battery Encapsulation Form and RoadmapBased on SNE’s data, the global market share of cylinder batteries is 23%, pouch batteries is 27.8%, and square batteries is 49.2% (mostly used in China). With the emergence of long and short blade-shaped cells, the stacking technology of pouch batteries has become a potentially valuable direction using a square shell enclosure.

In my opinion, LG Energy Solution’s biggest problem in recent years is the lack of customer demand input. When thermal runaway expansion experiments became the industry’s basic requirement in China, LG was absent and did not receive input conditions from Chinese car companies. Rather, they were developing according to the overseas pace, which resulted in a big gap for LG in terms of technology iteration and demand.

Currently, the LFP-based casing stacking technology has been utilized by many domestic battery companies as the main tactic to compete with iron-lithium batteries in the next stage. This may be a benefit that LG cannot enjoy.

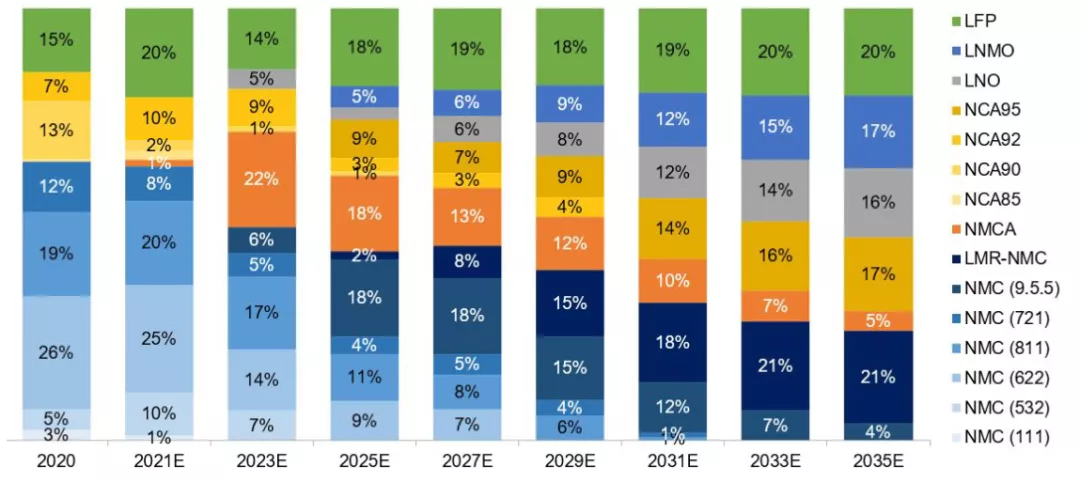

Choice between Iron-lithium and Ternary batteries

With the white-hot competition of Chinese electric cars and the intensifying competition in the battery market, LG has no participation. As the subsidy for China’s LFP technology route declines, Chinese battery companies maximize the advantages of this low-cost battery route, in combination with the promotion of structural design innovations (CTP and blades), squeezing the living space of ternary batteries.

Battery Supply System and Material Prices

From a logical perspective, why do overseas battery companies not make money?

There are still some purchasing price issues with LG’s raw materials: the average purchase price of LG’s positive electrode for the first three quarters of 2021 was 143,000 yuan/ton, the negative electrode was 37,000 yuan/ton, the electrolyte was 50,000 yuan/ton, and the average price of the separator was 4.7 yuan/m². By comparing LG’s supply chain attributes and domestic purchase prices, we can understand the fundamental reason why LG is not profitable while Ningde is making a lot of money.

According to the product roadmap, LG’s product line is mainly divided into:

According to the product roadmap, LG’s product line is mainly divided into:

● High-end: By the end of 2020, it will reach 600Wh/L (20-minute fast charging) and iterate to 700Wh/L (20-minute fast charging) by 2023. H1 can reach 750Wh/L (15-minute fast charging) in 2024. The core issue here is that the volume utilization of soft pack batteries has reached a bottleneck. High-end batteries do not have particularly good characteristics in terms of fast charging and high energy.

● Mid-range: Basically, the fast charging speed of high-end products is reduced to 600Wh/L (40-minute fast charging), and this route has been firmly occupied by iron-lithium.

● High cost-performance ratio: This area is relatively slow. The high cost-performance ratio product of 400Wh/L will not be available until 2023, but unfortunately, this data is not pretty.

In my opinion, LG needs to accelerate the transformation to 4680 to have a way out from the current situation.

In fact, according to the sales guidelines given by LG itself, the growth rate of the entire production capacity is lower than the slogan of current domestic companies. We carefully consider this issue, where did it go wrong? There are two assumptions here: the actual battery delivery in markets outside of China will be scattered to a certain extent in the future.

Summary: Next, we will sort out LG’s situation in lithium-sulfur batteries and solid-state batteries when we have time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.