On December 5th, NIO held a Battery Flexibility Upgrade Communication Conference, during which Dr. Shen Fei announced the official launch of “monthly flexible upgrades.”

Despite its seemingly ordinary appearance, this communication conference, which was titled “Battery Flexibility Upgrade,” was attended by NIO’s Vice President of Energy and Co-Founder and CEO Qin Lihong.

Through the comprehensive launch of “Battery Flexible Upgrades” during this conference, Shen Fei and Qin Lihong disclosed the underlying logic of NIO Power and NIO’s system, which has guided NIO’s development over the past seven years and laid the foundation for NIO’s current achievements.

This is also the main theme of the communication conference: NIO’s system competitiveness.

In the booming market of new energy vehicles in 2021, the three leading new forces of sales with strong survival instincts have become the focus of more and more people’s research. Traditional automakers with declining sales have also become research subjects for many.

Everyone wants to know what the former did right and what the latter did wrong.

Unfortunately, each automaker has a strong personality, and while people have observed Xpeng’s strong intelligent construction, NIO’s superior service experience, and Ideal’s strong product-definition abilities, simply excelling in these areas won’t necessarily lead to a successful brand.

The answer is often negative. Investing too much effort into what was done right can often overlook the power of the system, leading to a state of learning without any guidance.

If studying them cannot provide insight into their success, then it’s best to listen to what NIO has to say about itself.

It is difficult to clearly explain this through one article, but I would still like to try to convey what I understand. Let’s start with “Battery Flexible Upgrades.”

Being able to swap batteries and NIO Power are two different things.

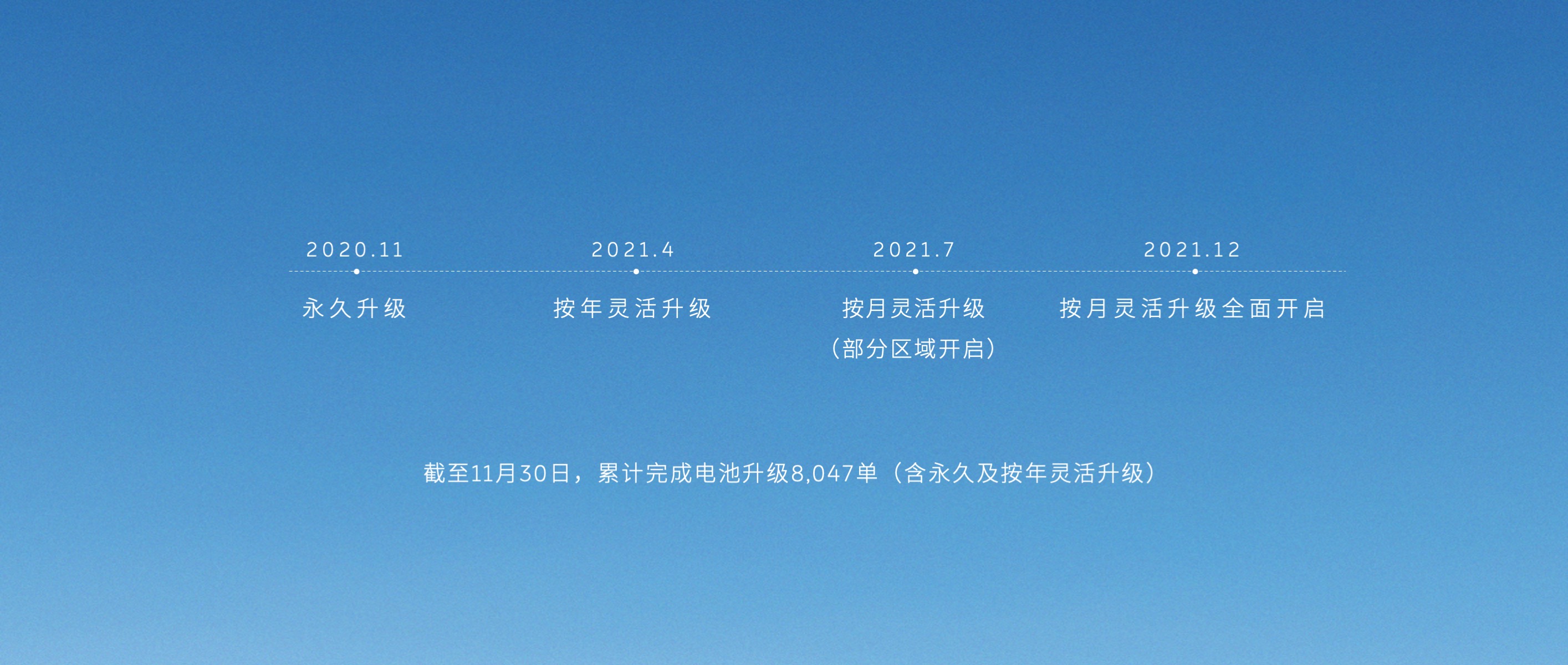

First, let’s look back at several key points regarding battery flexibility upgrades.

In November 2020, NIO officially launched its 100 kWh battery, and at the same time, it offered a permanent battery upgrade service. This meant that the previous 70 kWh battery model could have its battery upgraded to the 100 kWh battery pack for a fee.- Non-BaaS users pay a one-time fee of 58,000 yuan;

- BaaS users’ monthly fee increases by 500 yuan.

In April 2021, NIO launched its flexible annual upgrade service, with an annual fee of 7,980 yuan. This means that car owners can choose larger batteries based on their needs on an annual basis.

Obviously, the one-year rental period in this policy is still too long. Car owners with strong demand can directly choose the permanent upgrade, while those with short-term demand often end up upgrading for one year, which seems to be not worth the cost.

In July 2021, some areas began to offer flexible monthly battery upgrades, with a monthly fee of 880 yuan. This means that if a car owner travels more in a month, they can upgrade to a larger 100 kWh battery for that month, reducing range anxiety and inconvenience of frequent long journeys.

However, the shorter the time span, the greater the challenge to NIO’s battery allocation capabilities. Therefore, in July, NIO only launched this policy in remote areas and did a trial run.

In December 2021, flexible monthly upgrades were fully launched.

From April 2020 to November 2021, since the battery upgrade policy was announced, a total of 8,047 battery upgrades have been completed.

This seemingly policy that only requires the ability to “change batteries” reflects NIO’s two major capabilities.

Strong infrastructure capabilities

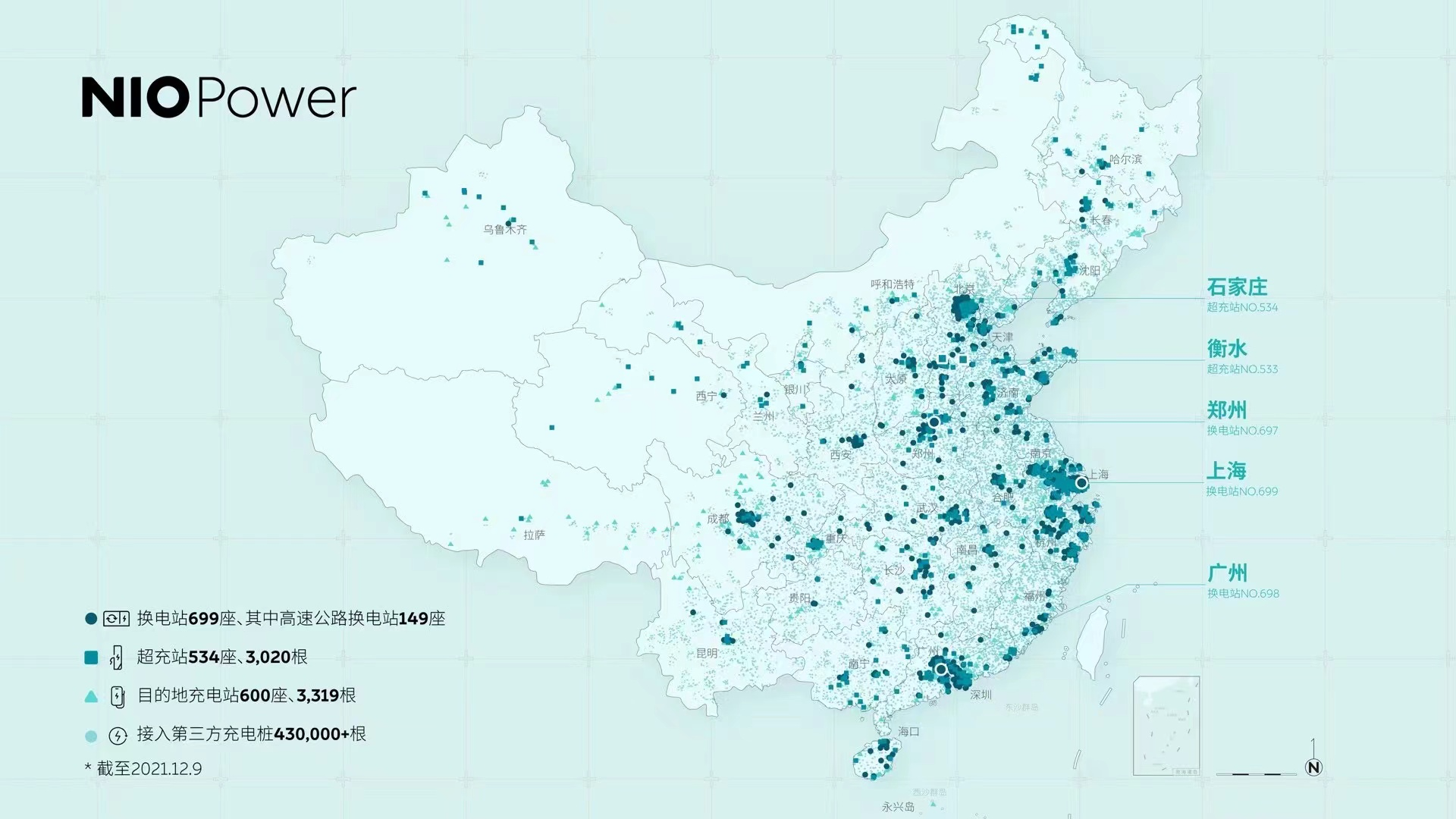

As of December 9, 2021, NIO has built 699 self-operated battery swap stations.

Back on June 30, 2021, NIO had just announced that the number of battery swap stations exceeded 300.

In just five months, the number of NIO’s battery swap stations has more than doubled, covering a high-speed battery swap network layout of five verticals, three horizontals and four metropolitan areas. At the same time, battery swap stations in urban areas have also sprung up like mushrooms, with growth rates far exceeding current sales volumes.

Such infrastructure speed has solidified the basic value of “battery swap”.

Strong battery deployment capabilitiesDuring a recent communication meeting, Shen Fei gave two examples.

The first example refers to when NIO first launched its flexible battery upgrade program. The first batch of car owners upgraded to a 100 kWh battery, but due to the limited production capacity of the 100 kWh battery and the deployment capability of the battery swapping stations, these car owners often encountered situations where they wanted to swap for a 100 kWh battery while on the freeway, but only had access to a 70 kWh battery.

The second example is related to the flexible upgrade program launched by NIO in the Northeast of China in July this year. NIO found that users in Shenyang had lower demand for flexible battery upgrades during winter, as they tended to stay at home, but during summer, users would drive out for vacations, resulting in a higher demand for battery upgrades.

It was originally thought that demand for large batteries would increase during winter when the electric vehicle range is more adversely affected, but the actual demand was weaker than that during summer.

Therefore, in order to meet user needs as efficiently and comprehensively as possible, Shen Fei said that the swapping station needs three intelligent algorithms, which is also the technical support behind NIO Power compared to other battery-swapping enabled EV models.

The first algorithm is demand prediction.

For each region, as time passes, the number of users in each region is changing. The system needs to predict the growth of users in this area, their annual upgrade demand, and monthly upgrade demand to determine whether the current reserve of 100 kWh batteries is sufficient, and whether the 70 kWh battery can meet the rotating demand.

The second algorithm is intelligent recommendation.

The intelligent recommendation is based on the current status of the different swapping stations and the current needs of the users, to make reasonable recommendations for users to choose the most appropriate swapping station for flexible upgrades.

The last algorithm is random recommendation.

The shorter the time available for flexible upgrades, the greater the randomness of user upgrades. Coupled with the impact of objective environmental factors such as holidays and weather, swapping stations also need to have strong random recommendation capabilities.

Random recommendation here means what if there is user demand for a certain region, but the swapping station cannot fulfill it?

Dr. Shen Fei’s answer is to dispatch a battery to that station. There are various ways to dispatch batteries, including using an integral subsidy to allow users to send batteries over, using work vehicles or dispatched testing vehicles to deliver batteries, etc., to meet users’ needs.Although the diversification of battery types, upgrade policies, and user demand will inevitably place higher demands on NIO’s dispatch algorithm for battery swap stations.

As a side note, let’s take a look at some detailed data that can be used as dinner conversation. Currently, the computing power of second-generation NIO battery swap stations’ terminals exceeds 20 TOPS, and each station is equipped with intelligent hardware.

In theory, the last puzzle piece of NIO BaaS should have been perfectly put together at this point, but this isn’t NIO’s idea of the “endgame” for battery swapping.

This is the second-to-last page of Dr. Shen Fei’s shared PPT. She was worried that the media might not notice this detail, so Qin Lihong re-emphasized it when he took the stage, which observant friends may have already noticed.

Although the theme of this communication meeting was “flexible battery upgrades,” the wording on the PPT has been changed to “flexible battery changing.”

At present, battery swapping can only support upgrading to a larger battery, but Qin believes that NIO Power should be able to “change batteries easily, cross-grade, go up or down.”

However, Qin Lihong also acknowledged during the communication conference, “Allowing people to downgrade their batteries would have a tremendous impact on our dispatching capabilities, resource reserves, and network layout.”

Therefore, the true final puzzle piece will be released as early as next year or at the latest, the second half of next year.

When the full implementation of this policy is rolled out, it will be a milestone for NIO’s battery swapping system as well as NIO’s ability to maximize the use of the “battery swapping capability.”

After roughly 2,500 words, we’ve finally introduced the layout of NIO Power. Now, let’s talk about NIO’s system.

Understanding the Industry and Goals

At the beginning of the article, I mentioned the view that learning single facets of each automaker’s strengths doesn’t have a decisive impact on sales. In this era, we need to cast a comprehensive net from a systemic perspective. But now a new question arises: how do we create a system that fits the times?

First things first, let’s clarify our goals.

Look

This page was first created by Li Bin, Zhou Xin, and Qin Lihong in 2015. It was one of eight pages in NIO’s A+ round financing PPT and the founding team’s basic assessment of the current situation.

What’s even more surprising is that nothing has been changed in this PPT since its A+ round financing to now.Qin Lihong said, “This chart helps us understand the driving force of industry change and why NIO, as a startup brand, chooses to do so much.”

Qin Lihong divided the development of the automotive industry into three stages based on the brand’s attributes.

In the 1.0 stage, consumers play a role as audience, and can only passively receive information. In this stage, communication between users and manufacturers is one-way, and the industry focus is on manufacturing.

This phase is more like the “popularization” stage where the industry goes from 0 to 1.

In the 2.0 stage, consumers play a role as participants, and user feedback has gradually started to influence automakers. The industry focus is on direct sales.

In Qin Lihong’s view, the most prominent company in the 2.0 stage is Tesla. What he admires most about Tesla and Musk is not going to Mars, but the courage and investment shown in direct sales. Direct sales represent the relationship between the brand and users.

Compared to traditional dealership models, automakers can directly reach users, providing both parties with a channel of communication.

This stage is the phase in which the automotive industry goes from 10 to 100, actively meeting user needs.

In the 3.0 stage, consumers play a role as owners, and they are concerned not only about the vehicle experience itself, but also about the experience of all related aspects from the vehicle. Here, the industry center is on the “user“.

In Qin Lihong’s view, NIO belongs to this stage.

This stage means that the automotive industry is no longer limited to meeting the needs of users for cars, but also to meet the needs of all related aspects from the vehicle.

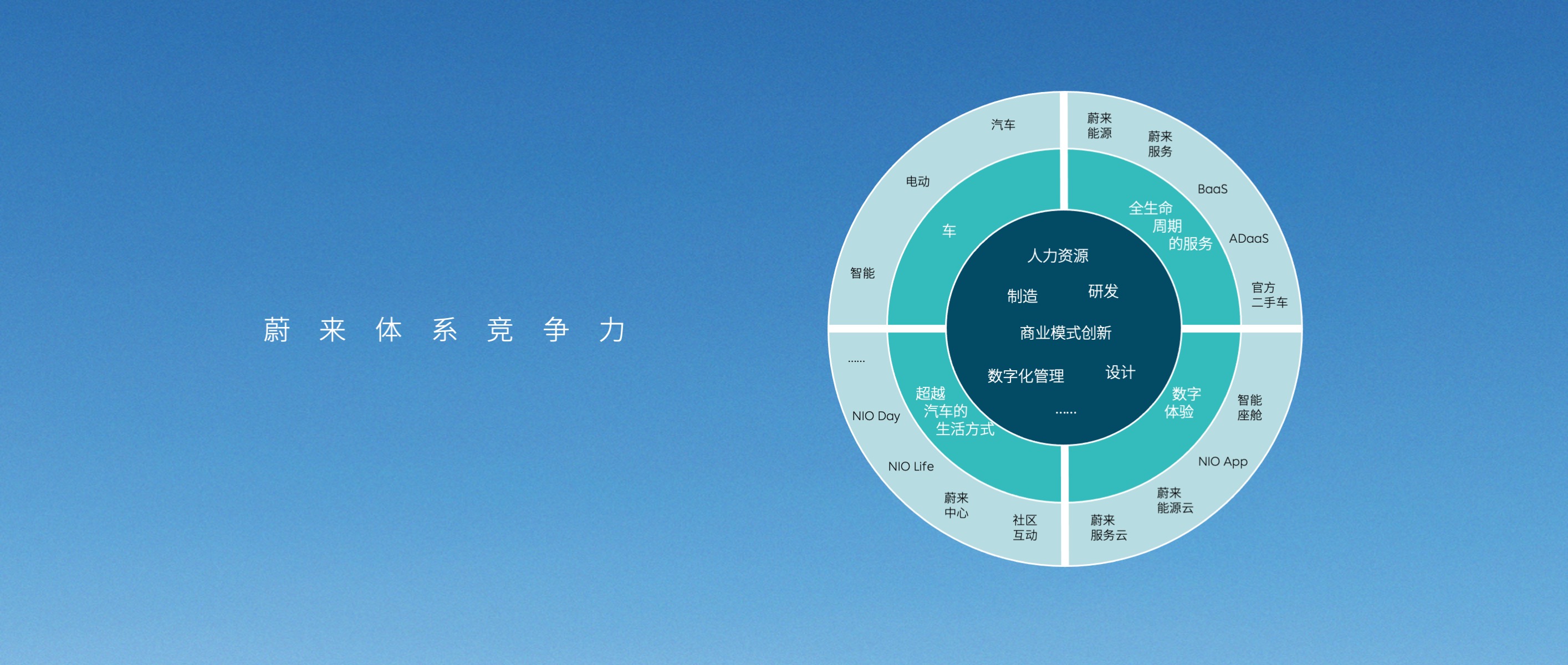

Based on the market demand in the 3.0 stage, NIO has its own compass.

Setting Goals

The compass is divided into three layers and four quadrants.

The four quadrants are the four major goals set by NIO, which can be continuously broken down and refined from the inside out.

Gradually moving toward the center, human resources, manufacturing, research and development, business model innovation, digital management, and design are the soil that supports NIO in achieving the four major goals and is the bottom-level support.

At this stage of breaking down, I also began to understand two things.

The first thing is why so many automakers want to imitate NIO, but always imitate the form without substance. When I saw NIO giving flowers to users when delivering cars, I also started to give flowers; when I saw NIO organizing user activities, I also organized user activities; when I saw NIO organizing volunteer car deliveries, I also organized volunteer car deliveries.

However, these imitations did not achieve the same effect as NIO because NIO is not just doing several individual things, but starting from a fundamental concept, covering and meeting user needs from point to line, from line to surface.The second thing is, why is NIO not at the forefront of intelligentization and cars, but only by providing good service can it capture the hearts of so many car owners?

It is also because of NIO’s systematic approach. NIO’s products are not perfect, with a score of around 70 instead of 90; NIO’s intelligentization is also not at the 90 point level, but it is around 70 points.

A moat does not require a single point to be very deep, but it needs to surround the entire city to be effective.

Execution

Finally, let’s talk about execution, which is often overlooked by many people. During the Q&A session of the communication meeting, someone asked about NIO’s services, which are divided into hard services and soft services. Hard services, such as battery swapping, can be continuously improved and meet user needs through expansion and iteration. Soft services, such as relationships with users like Li Bin, will face a bottleneck when NIO becomes larger. How will NIO face this problem?

In Qin Lihong’s view, the ultimate competition for brands is in soft power, which can be divided into two levels.

First, from a personal perspective, the emphasis is on empathy.

Second, from an organizational perspective, it relies on values. NIO needs to establish a value-driven team, but it cannot guarantee that the value can be universally disseminated and inherited.

Here, Qin Lihong also shares a story: “Recently, we have conducted different pilot projects in two or three different regional companies. In a certain regional company, we have created a new project called 24k Fellow, which is about gold, and he is our most valuable fellow in our hearts. We gave them zero sales guidance, but there is a hard indicator, which is that we will regularly follow up with users and ask them what kind of person they think their fellow is – a friend, a salesperson, or a consultant? The percentage of users who answered “My fellow is my friend” had to reach a certain percentage. We have been working on this for almost half a year, and it’s a small-scale pilot program, but we found that the trial field is doing well. They can basically meet our goals, and they are doing it with care.”

This is the driving force of values.

Conclusion

As the title of this article says: “System – The ticket for entry to 2022.”The discussion in the Tea Time Editing Department often involves a topic: Xiaomi has entered the car industry, and their first car model will be launched in 2024. Does Xiaomi still have a chance?

There are many other brands, like Xiaomi, aiming at the car industry. All of them have the same question: do the latecomers still have a chance?

From a product perspective, the entire industry will undoubtedly advance rapidly from 2022 to 2024, and all technologies will be rapidly iterated. For latecomers, they can naturally utilize more cutting-edge technologies to achieve longer range, faster charging, and stronger autonomous driving hardware.

If we stay in this perspective, it seems that the latecomers have advantages. However, what many people overlook is the “system.”

In 2022, the automobile market is not just about cars.

Of course, if the car doesn’t work well, nothing works well.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.