The impact of the current chip supply crisis on the automotive industry is profound.

From the perspective of smart vehicles, there are three basic footholds: battery cells, high-performance chips, and third-generation power chips.

Recently, research company Gartner predicts that by 2025, as automotive companies increasingly popularize electrification and the demand for autonomous driving grows, in the face of semiconductor shortages and supply chain bottlenecks, to solve their own development issues, 50% of the top 10 automakers will design their own chips.

Note: Tesla has already begun, while Hyundai-Kia is also in preparation. Some Japanese automakers do not seem to be in a hurry. The pace of entering the chip design field is accelerating.

External and internal factors have brought about fundamental changes in the automotive business.

Not long ago, when chatting with Xia Pei, a level two analyst in the automotive component team, it became clear that the job is becoming too difficult. Major information in the traditional vehicle industry has already moved toward components. In the future, with the entry of smart connected vehicles into the secondary market, the industry will integrate with electronics and computers, like how electric vehicles have driven the prosperity of battery cells.

The semiconductor shortage, which has been ongoing since the end of 2020, has led to reduced automobile production by global automakers (all car companies in Europe, America, Japan, and South Korea have been affected). Tesla, which can switch main chips in three months, is arguably the least affected.

The core reason lies in the dual push of value and availability.

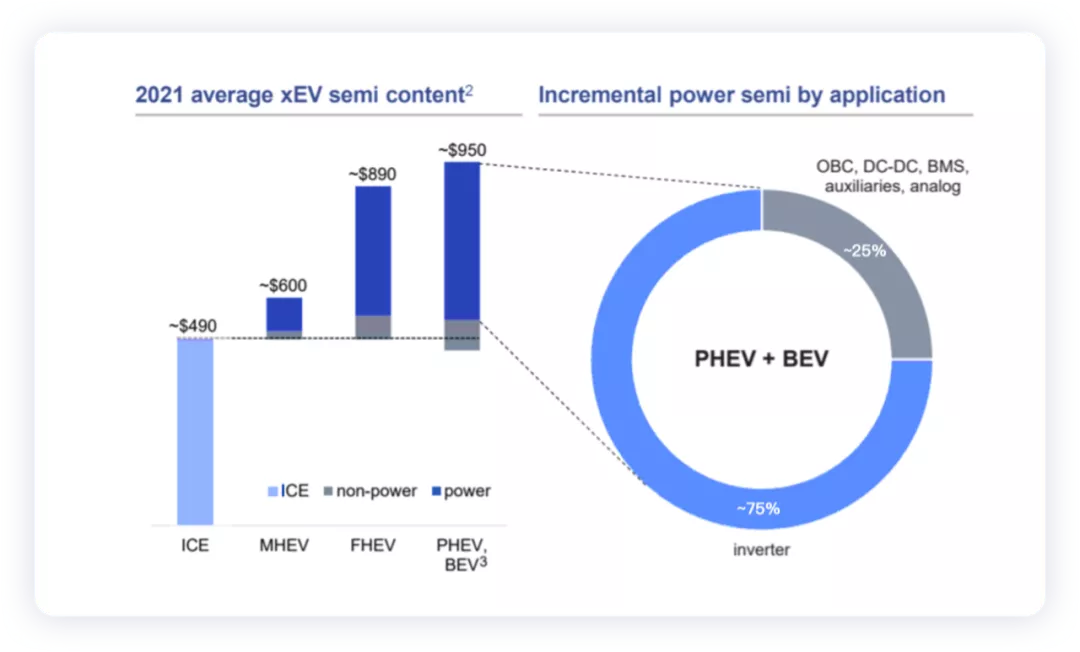

According to Infineon’s statement, at the level of value, the cost of power semiconductor components has increased the most during the transition from internal combustion engines to pure electric vehicles, with an increase of nearly $430. The vast majority is the demand for power semiconductors in the inverter, followed by OBC, DCDC, battery management systems, and electric compressors. Some chip requirements are also occupied by high-voltage analog components.

In the era of gasoline cars, chip manufacturers and automakers were isolated, managed according to Tier 3 and Tier 4, with only a list of some core quality-affecting devices.

In fact, the issue has now become: when planned production capacity lacks key power semiconductor supply support, no matter how much investment is made in platforms and whole vehicles, the core supply cannot be obtained, and it becomes similar to production planning being determined by chips, which is the current issue caused by chip shortages.

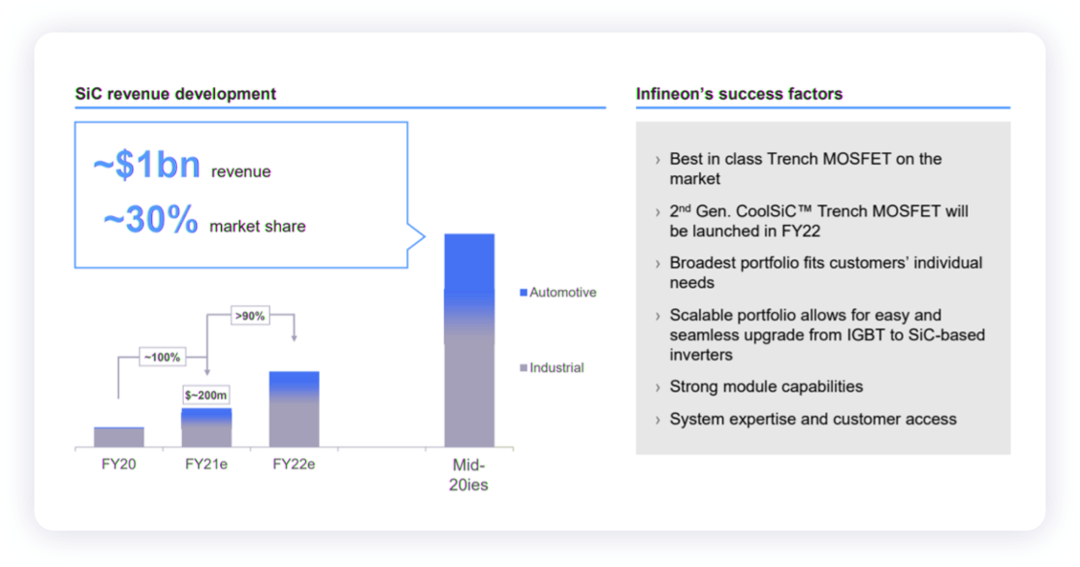

Currently, effective production capacity in SiC needs to be seized. If you cannot obtain it, you will not be able to produce 800V platforms.

The current situation in the automobile industry is due to the distance between car companies and semiconductor chips. This makes the factor that determines whether you can turn production capacity into effective output not in the hands of the vehicle factory itself, resulting in great uncertainty in the entire business system.

The purpose of the US Department of Commerce’s list-making in Asia this time is also to increase visibility. Therefore, all automotive companies are beginning to increase the visibility in their core supply chains.

According to Gartner’s research, the shortage of chips in the automotive industry that continues at present is mainly on smaller 8-inch wafers. The capacity expansion of the semiconductor technology equipment that produces these wafers is still difficult. Based on the situation of automotive chips, the global shortage may continue into next year.

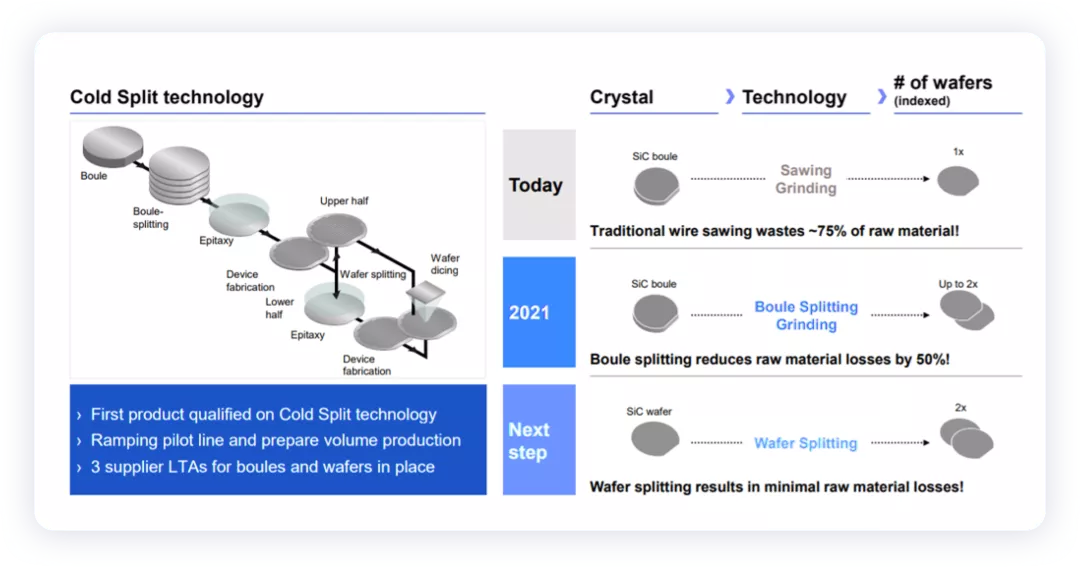

Therefore, from this logic, the first thing that power semiconductor for automobiles needs to consider is to ensure supply, and then it needs to directly connect with chip companies. The front-end process cannot be achieved, and currently it seems that the car companies involved may be the SIC module packaging.

In the logic chip field, Gartner believes that foundries such as TSMC and Samsung (which will build a new chip manufacturing plant jointly in Japan in 2022) have already provided the right to use manufacturing processes, and the entire chip ecosystem provides advanced intellectual property rights, thus making it possible for future automotive companies to customize chip designs. Last month, Ford signed an agreement with US semiconductor manufacturer GlobalFoundries to increase chip supply for Ford.

The Abilities of SIC

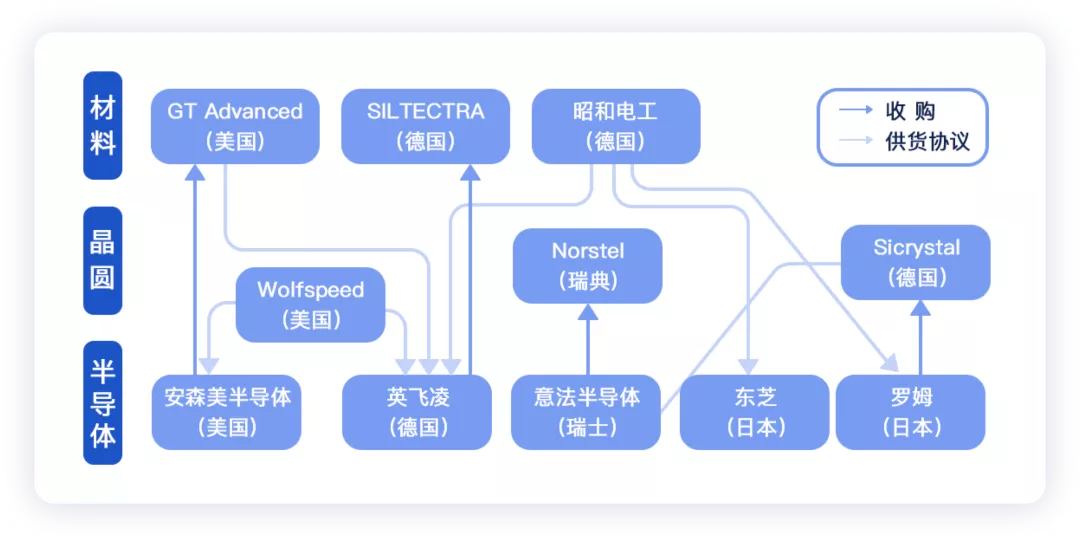

It should be noted that Japanese companies have begun to invest heavily in the third-generation power semiconductor chips.

According to a report by Nikkei, Toshiba will expand its production scale to 10 times that of 2020 by 2025, and Rohm will invest 50 billion yen to strengthen production. In order to stabilize and ensure raw materials, Japanese companies are building a “camp” that includes material manufacturers through mergers and acquisitions, etc..

Rohm’s short-term goal is to quickly increase its global market share from nearly 20% to 30%, and then expand the production capacity of silicon carbide power semiconductors to more than 5 times by 2025. A new factory building for manufacturing related products will be built by 2022 in Chikushino City, Fukuoka Prefecture, with plans to start production. Geely’s electric vehicle has decided to adopt Rohm’s products.# Toshiba Devices & Storage Plans to Increase SiC Power Semiconductor Production at Himeji Plant to Over Three Times its 2020 Level by 2023 and Quickly Expand to 10 Times, Achieving Over 10% of the Global Share by 2030

Fuji Electric in Japan is also considering advancing the start of production of SiC products by half a year to one year earlier than originally planned (2025). Stable procurement of SiC material is important in the expansion process. Because SiC products require high processing technology, cooperation with material manufacturers is essential.

Showa Denko, a Japanese major raw material company, has signed a long-term supply contract for SiC wafers with Toshiba Devices & Storage for two and a half years. In May of this year, it signed a priority supply contract with Infineon and orders continue to increase.

Summary: The automotive and semiconductor industry is becoming more and more interesting.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.