BMW Analyst and Investor Communications on Batteries and Raw Materials

BMW held a discussion with analysts and investors on batteries and raw materials on the 26th of last month. There were two main themes: the “BMW Group Battery Technology” and “Sustainable Raw Material Management.” I’d like to share some thoughts on it.

Throughout the discussion, I felt that BMW was conveying a few things to investors:

● BMW is very clear about balancing two strategies, high performance and low cost, and the future development strategy will be based on high nickel and solid-state batteries. Although the LFP strategy is widely used by Tesla, BMW’s overall strategy is still centered around high nickel technology.

● BMW’s early layout of battery raw materials and control in the supply chain is very advanced.

BMW Battery Technology

1) BMW’s overall battery technology introduction:

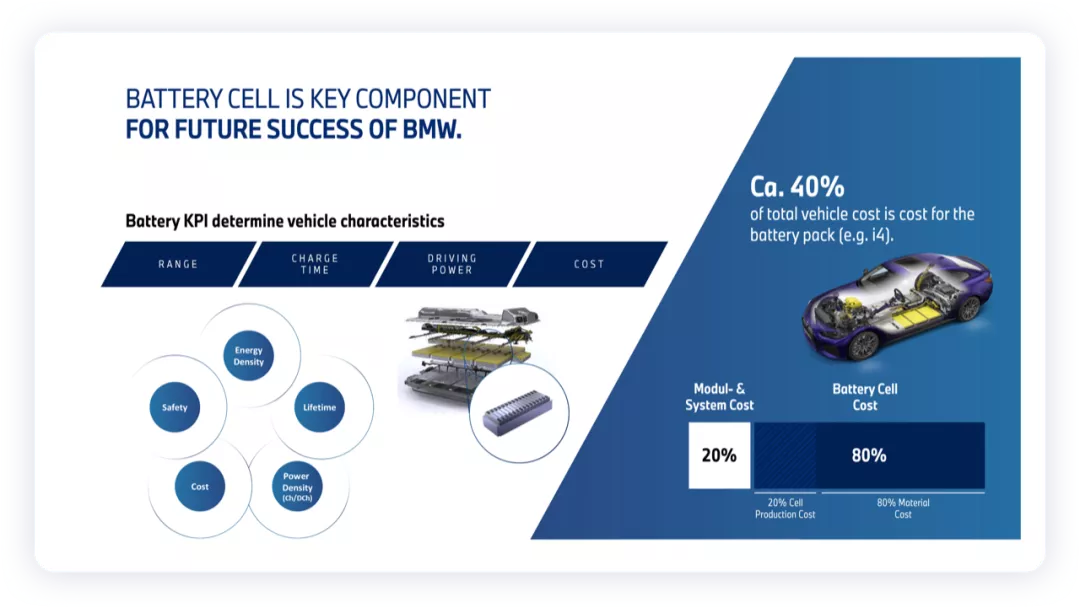

The battery system cost accounts for 40% of the total cost of the electric i4 vehicle. 20% of the cost comes from the cost of the module system, and 80% from the value chain of the battery materials.

Overall, the importance of batteries now is significant, mainly for consumers’ perception, because it affects key attributes of electric vehicles such as driving range, charging time, power, and vehicle price.

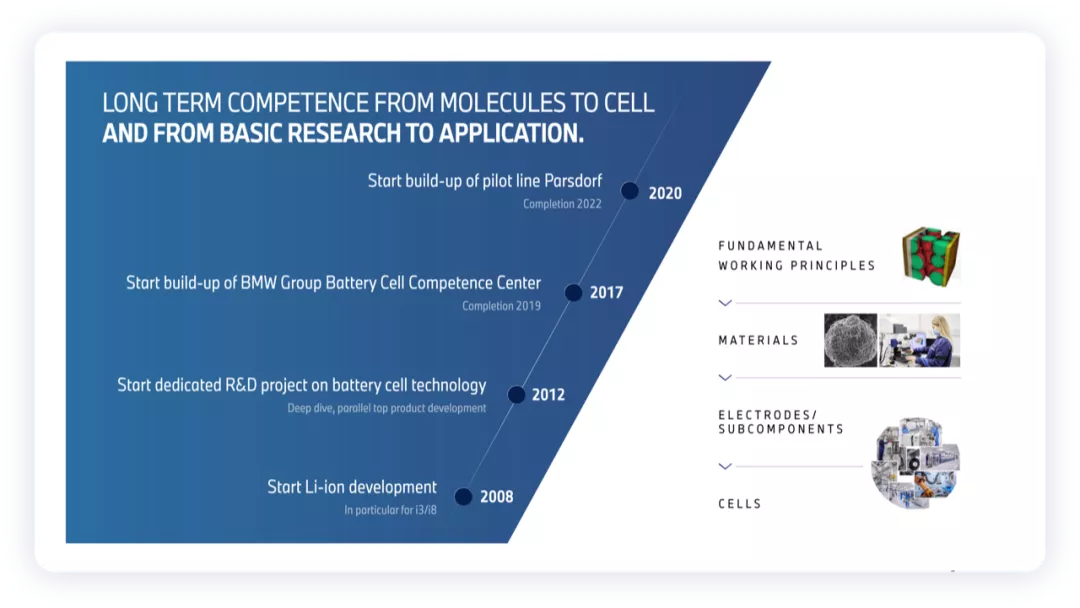

BMW – in my opinion – has been investing in electric vehicles intermittently. The battery research started in 2008 with A123, together with the Active Hybrid. The lithium-ion battery research project was established in 2012. In 2017, BMW established the BMW Battery Cell Department (with more than 300 people). Trial production of battery cells began in 2020.

Note: BMW is currently the only German company that has not deeply entered the battery cell production market, even though it supported CATL.

BMW’s battery lab covers material characteristics, development of chemical systems, formula research and development, performance and safety testing, failure analysis, etc., and has also developed samples and started preparing for pre-production in collaboration with partners. However, they have not yet announced that they’re producing their own batteries.The core logic here in the automotive industry, perhaps, has covered too many aspects of batteries, including mining and refining raw materials, material production, battery cell development, cell production, battery module development and production, battery factory construction and usage, second-use and decomposition of batteries, and material recycling.

One interesting point here is that BMW also knows that the current Chinese regulations require that the thermal runaway experiment should work within five minutes, which may need to be extended to 40 minutes in the future.

2) BMW’s Battery Cell Development Roadmap

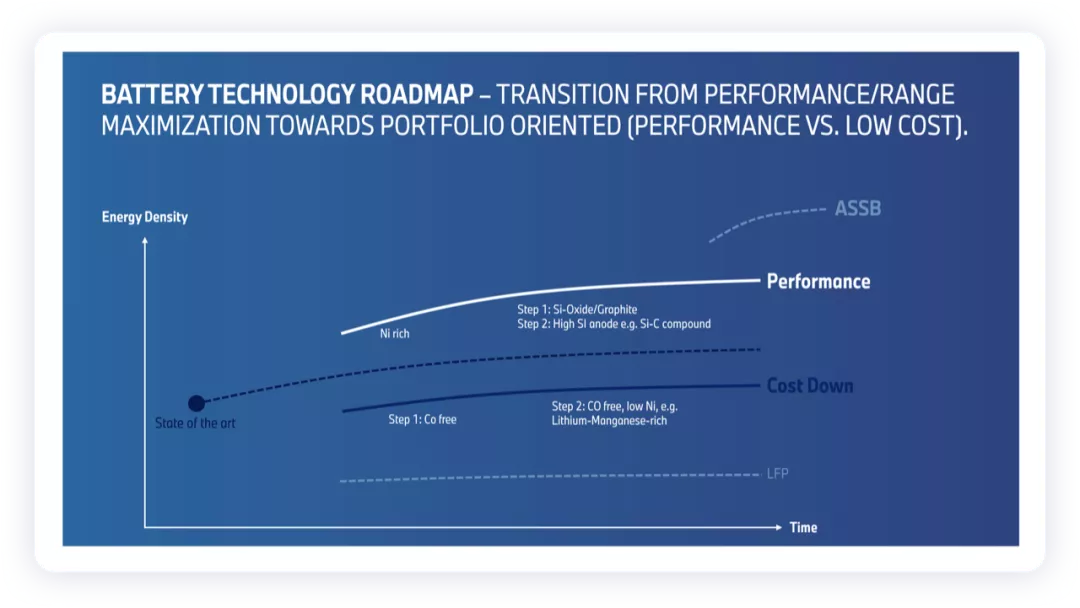

BMW’s battery cell technology roadmap mainly consists of high-performance batteries (performance improvement) and low-cost batteries (cost reduction), and the final evolution path of batteries is still towards solid-state batteries.

In the figure 5 below, BMW drew a relatively low energy density for LFP batteries. My understanding is that BMW is pushing small size cell specifications, and it is relatively difficult to make high energy density cells.

●Low-cost batteries:

On the basis of the existing NCM and NCA ternary materials, the first step is to promote cobalt-free, and the second step is to adopt a cobalt-free and low-nickel strategy, moving towards rich lithium manganese, which BMW thinks may also be expensive.

●High-performance batteries:

To improve performance, a rich nickel technical roadmap is adopted. The first step is to adopt a scheme of mixing silicon oxide and graphite, and the second step is to use highly-doped silicon negative electrodes and Si-C compounds.

●LFP:

It is configured as a low-cost entry-level vehicle.

BMW has also invested a lot of money in solid-state batteries, so the outlet for electric vehicles is placed on this technical roadmap.

Now I understand that BMW’s expansion from pouch cells to large cylindrical cells is actually completely consistent with Tesla’s idea – to move in the direction of higher energy density, and the cylindrical road is easier to walk.

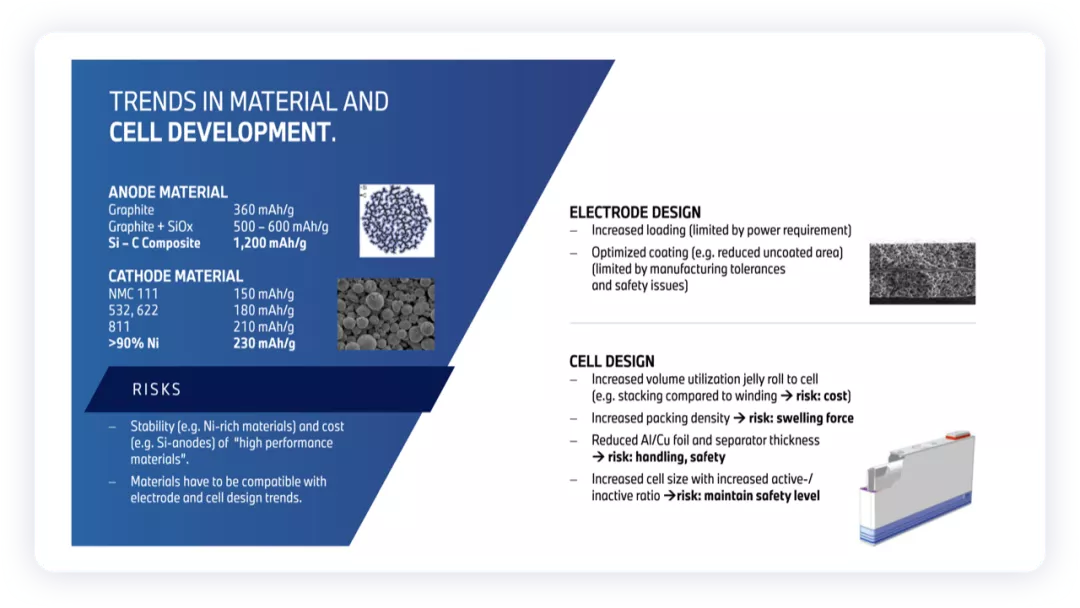

Trends in electrode design:

Mainly include increasing compaction density (limiting cell power) and optimizing coating.

Battery cell design trends:

●Increase the effective interval and fully improve the utilization of JR in the battery cell space (the main method needs to change from winding to stacking, which is mainly limited by cost).### Improving Group Efficiency (Risk: Expansion of Battery Cells) and Reducing Thickness of Aluminum/Copper Foil and Separator (Risk: Safety)

Increasing the size of battery cells also enhances the effective utilization rate of the battery cells’ space (Risk: Safety).

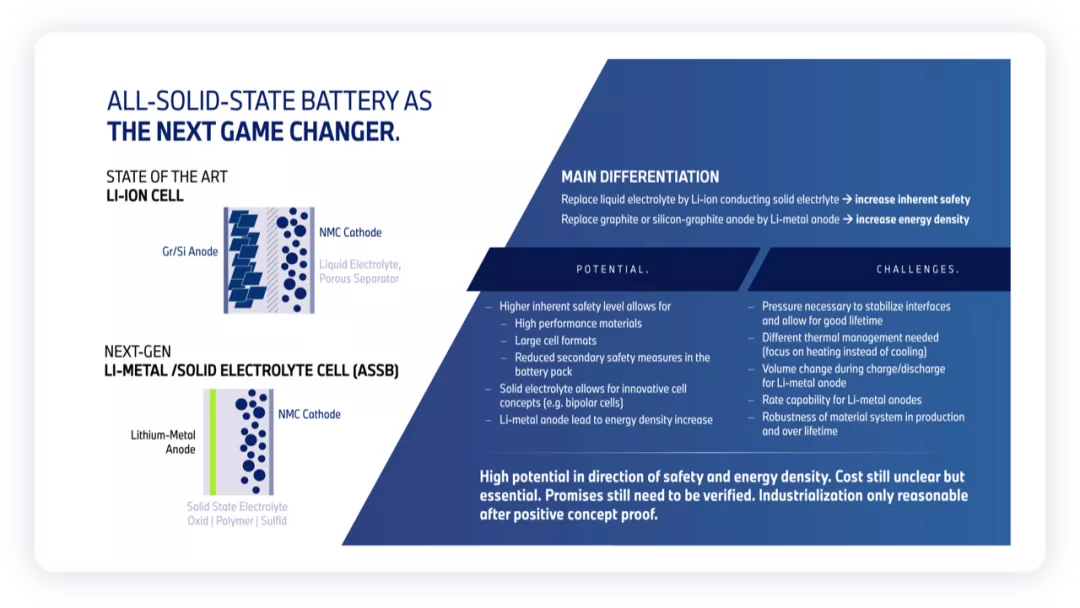

Solid-state battery has been discussed for many years, and its main benefit is the potential for better safety and higher energy density. However, all car manufacturers are unable to estimate the solid-state battery, and almost all mainstream car and battery manufacturers are trying to verify the technology, but there is currently no determinate data.

Battery Raw Material Management

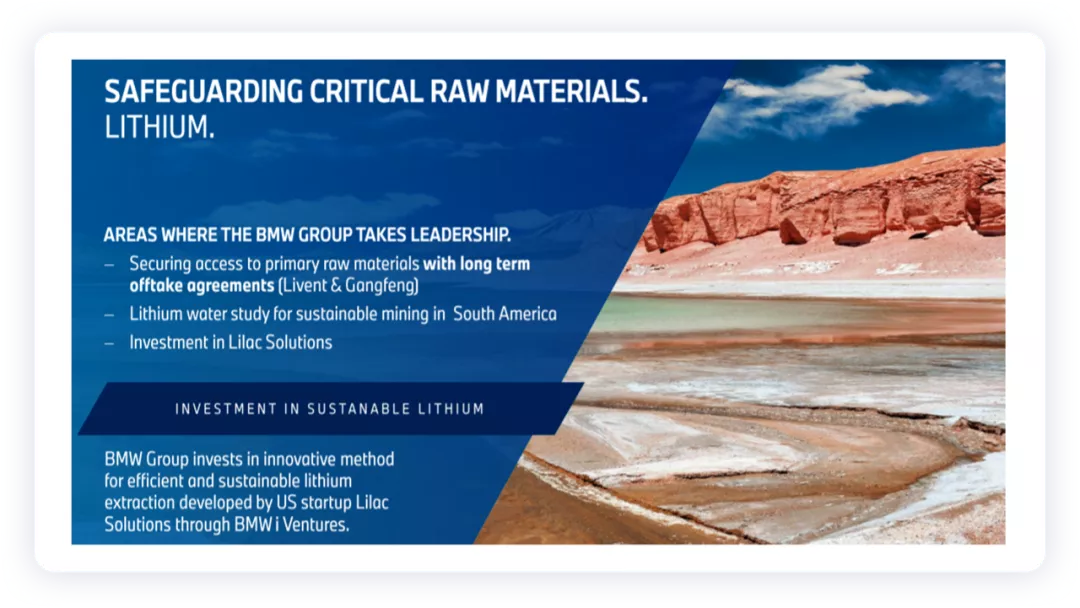

Among all car manufacturers, BMW has been working early on safeguarding lithium resources by utilizing BMW I Ventures. In terms of venture capital among all automotive companies, BMW is the blueprint for my learning.

Personally, I think that I Ventures has done a good job and needs continuous learning.

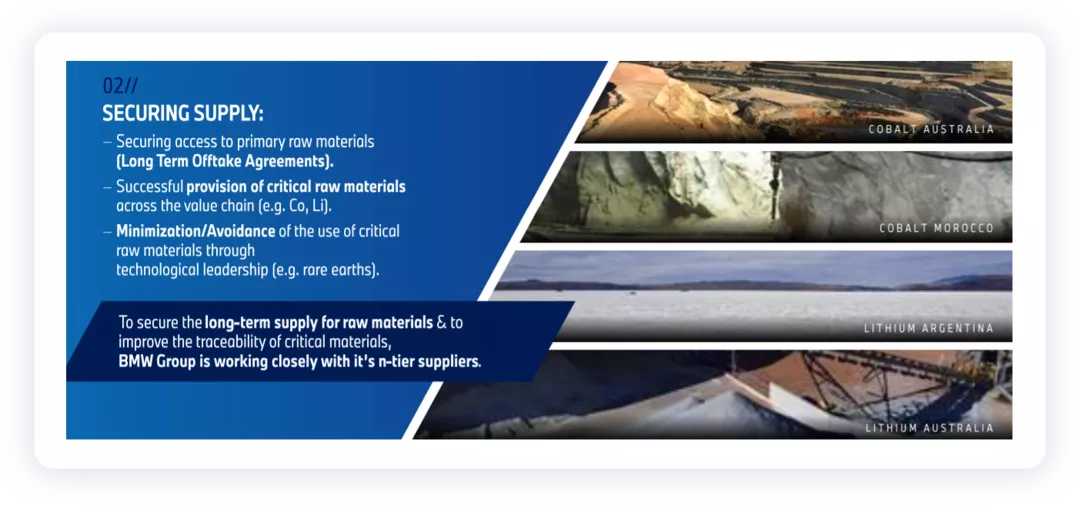

Figure 8 shows that almost all car manufacturers have their own ideas for long-term resource locking and have made preparations for motors without rare earth.

Conclusion

I believe that making batteries for cars is sometimes a necessary and unavoidable task. Overthinking instead of directly iterating will miss many opportunities.

Recently, the 4680 large cylindrical battery has been underestimated for the huge impact it will bring to the automotive industry. I still want to discuss this topic with everyone when the time is right.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.