James Yang Jianwen

Today, a major industry news is that Intel plans to split Mobileye and list it on the stock market in mid-2022.

The news caused a stir in the industry.

Mobileye is a top provider of advanced driver assistance systems and autonomous driving solutions in the industry, especially in computer vision development and machine learning.

Speaking of this company, here’s one point: currently, Tesla, the leader of the new energy industry, chose Mobileye as its first partner in the field of intelligent driving.

Intel spent $15.3 billion to acquire Mobileye. Now, the company is valued at $50 billion and will be independently listed on the stock market.

“This move will create an independent listed company to unlock Mobileye’s value for Intel shareholders.”

With this split and listing, Intel will undoubtedly gain a lot of profits, and for Mobileye, it’s a fresh start.

It’s also time to reorganize Mobileye’s entire business.

Mobileye’s Business Layout

For Mobileye’s business, most people are familiar with its EyeQ chip business.

Models like NIO’s ES8/ES6/EC6, Volkswagen’s ID family, and Ford Mustang Mach-E all use Mobileye’s perception solution for forward-looking vision (i.e., Mobileye provides a packaged chip + perception algorithm).

Currently, millions of vehicles worldwide are equipped with Mobileye’s camera-based ADAS technology, which is also one of Mobileye’s main sources of revenue.

However, Mobileye’s business goes beyond these.

If we break down Mobileye’s business, there are three main categories: assisted driving, autonomous driving, and unmanned vehicles.

Assisted driving, such as selling EyeQ chips with embedded software, is one of them.Translate the following Chinese text to English Markdown text, using a professional way to keep HTML tags inside Markdown, and only output the results.

Furthermore, Mobileye has started to offer a packaged advanced driver-assistance system solution, Mobileye SuperVision™, positioning its product at L2. The solution is upgraded from a single forward-facing camera system to a 360-degree surround camera system, powered by 2 EyeQ® 5H high-performance computing units and 11 cameras.

The new powerfully amazing ZEEKR001 is the first commercial vehicle model. This is also the first time Mobileye has taken on the role of an independent provider of advanced driver-assistance system solutions. Further down the line, the two sides plan to work closely together to jointly develop the next generation of systems based on 6 EyeQ5® system-on-chips (SoCs). Vehicles equipped with this system are expected to debut globally by around 2023.

On the automatic driving level, Mobileye is committed to becoming a travel service provider.

Mobileye has created the Mobileye Drive™ full-stack autonomous driving system–a full-stack solution tailored for future autonomous driving. It can be used to support a range of autonomous vehicles (AVs), including autonomous taxis (robotaxis), consumer cars, and commercial trucks.

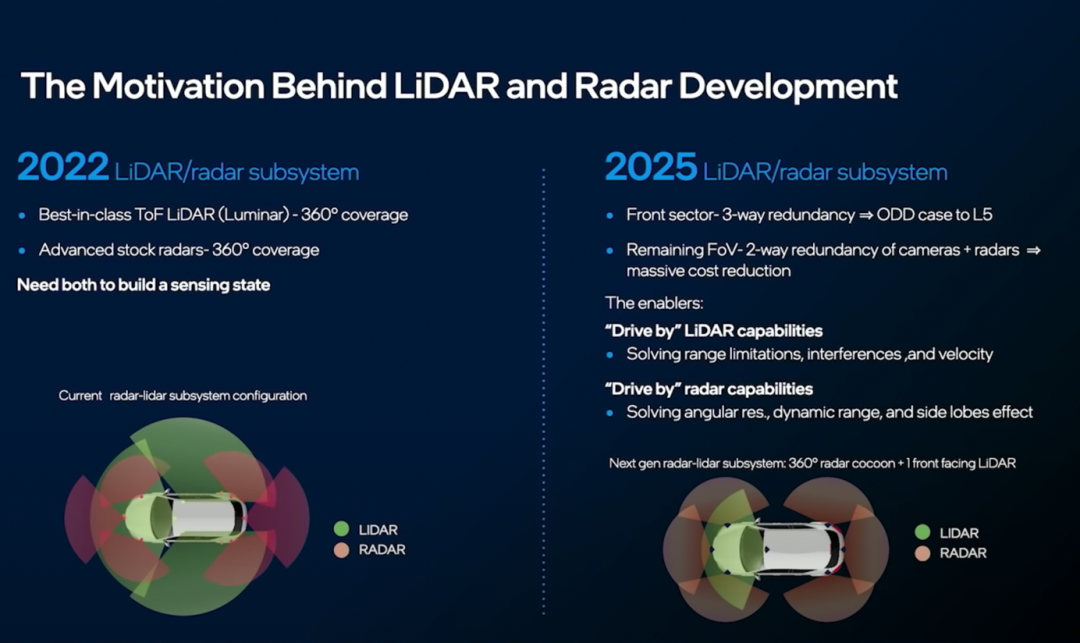

Using the same hardware and software as Mobileye SuperVision, but with the key addition of 360-degree radar and lidar coverage to enhance perception of the driving environment. Meanwhile, separate camera and radar/lidar subsystems provide true redundancy (True Redundancy™).

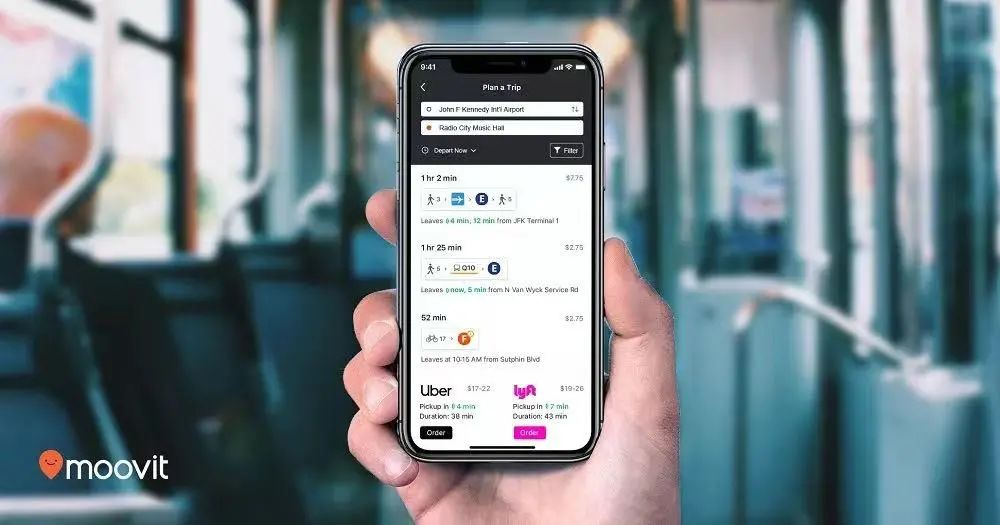

As early as May 2020, Mobileye acquired Moovit, a provider of mobility-as-a-service (MaaS) solutions, providing an ideal platform for Mobileye’s commercialized operation of autonomous driving ride-hailing services.

Based on this Mobileye Drive™ and Moovit platform, Mobileye can now operate as a travel service provider.

In addition, Mobileye is also offering autonomous driving technology authorization to its partners. Mobileye plans to work with Schaeffler to develop autonomous vehicle chassis for manufacturing autonomous shuttle buses. Prior to that, Mobileye announced its partnership with Udelv to provide its Mobileye Drive ™ system for Udelv’s autonomous driving delivery trucks designed for “last-mile” and short-haul transportation. Mobileye also formed partnerships with Transdev and Lohr to manufacture and deploy autonomous shuttle buses in France and Germany.

At the 2021 Munich Motor Show, Mobileye announced the launch of its L4 level autonomous driving taxi and partnered with well-known German international travel provider SIXT to launch the autonomous driving ride-hailing service. The ownership of these fleets of autonomous driving taxis belongs to Mobileye, while SIXT is responsible for operating and maintaining the vehicles. This service is expected to be launched first in Germany in 2022.

Mobileye has secured multiple Mobility-as-a-Service (MaaS) projects from 2023 and multiple consumer and B2B mass-produced car projects using Mobileye’s autonomous driving system from 2024.

Thus, the full scope of Mobileye’s business is officially expanding: spanning the entire autonomous driving value chain, while focusing on the huge market for advanced driver-assistance systems (ADAS) and also keeping a close eye on MaaS (Mobility-as-a-Service).

Behind the growth of business, a decline in Mobileye’s reputation

Intel officials revealed that Mobileye’s revenue in 2021 is expected to be more than 40% higher than in 2020 (Mobileye’s revenue in 2020 was $967 million).

Mobileye’s full-year revenue in 2021 is expected to increase by more than 40% compared to 2020. In addition, the company has set a record by winning new orders for 41 models from more than 30 car manufacturers this year, and the shipment volume of EyeQ® system-on-chips (SoCs) has recently passed 100 million.

However, is Mobileye really enjoying the market might as seen from the numbers?

Currently, the trend in the industry is that new autonomous driving chip suppliers are rising strongly.More and more car companies are beginning to choose newer autonomous driving chip suppliers such as Nvidia, Qualcomm, and Huawei.

NIO ET7: Nvidia Orin

Li Xiang ONE: Nvidia Orin (not yet released)

XPENG G9: Nvidia Orin

Next-generation Volvo XC90: Nvidia Orin

JiHu Alpha S new HI version: Huawei MDC810

Lynk & Co: Equipped with dual Huawei MDC intelligent driving computing platforms

NIO ES11: Equipped with Huawei MDC intelligent driving computing platform

WEY Mocha: Qualcomm Snapdragon Ride autonomous driving platform

BMW: The next-generation autonomous driving will adopt Qualcomm Snapdragon Ride autonomous driving platform

Looking at Mobileye, after announcing that Mobileye SuperVision™ went into production on JAC’s ‘EK-5’ vehicles in January, we have not seen any new models featuring this solution being mass-produced in the following 11 months.

Mobileye has always been criticized for having a too-closed perception solution, with chips and algorithms tightly bound, and partners unable to make their own modifications. This was the case with EyeQ3 and EyeQ4, and little had changed when it came to EyeQ5.

In November of this year, Mobileye even lost a major customer: BMW. In November of this year, BMW and Qualcomm reached a cooperation to jointly develop the next-generation ADAS/AD platform, while back in 2016, BMW was still in partnership with Mobileye to develop autonomous driving functions.

What many people do not know is that a year or two ago, in the AD field, Mobileye was almost completely dominant. They were the ones making the money, while other suppliers were just getting a small cut.

But obviously, times have changed.

Previously, Intel CEO Pat Gelsinger stated, "The current chip proportion in the BOM of new high-end cars is only 4%, and this number will increase by more than five times by 2030. That is to say, by 2030, chips will account for more than 20% of the BOM of high-end cars."The total addressable market (TAM) for automotive chips stands at USD 50 billion today and is predicted to reach USD 115 billion by 2030. By then, the market share for automotive chips will constitute approximately 119% of the entire chip market.

For Mobileye, the inability to seize its current opportunity could possibly lead to falling behind in future competition, so the situation is far from optimistic.

Independent Listing

Finally, back to the main topic, an independent listing.

For Mobileye, it’s a good thing.

In the automotive chip industry, business iteration and expansion speed is much faster than imagined. It’s basically like “one year in the east, one year in the west,” and Mobileye’s fortunes these past few years have been a good example.

After several years of development, Mobileye has reached a certain size. If it continues under Intel’s leadership, Mobileye’s growth will be limited.

Therefore, spinning off and listing may be the better choice. On the one hand, it can provide Mobileye with more funding and resources for connection channels, and on the other hand, the Mobileye team can have greater independence, and the company itself can have better development space.

At the same time, Mobileye needs to adjust its positioning, focus on market demand, and truly move from closed to open.

We hope that after its independent listing next year, Mobileye will become even better.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.