I have completed the compilation of electric vehicle market data in Europe for November (see here for the previous article). There is an interesting point: I have broken down Tesla’s sales in major European countries, which is more interesting than the overall data and better reflects the value of tracking European data.

Here are several conclusions:

● Tesla is in a high-growth stage throughout Europe: it is estimated that the total sales in 2021 in the 14 major countries will be 158,000, and Tesla can sell around 170,000-180,000 in the entire European region.

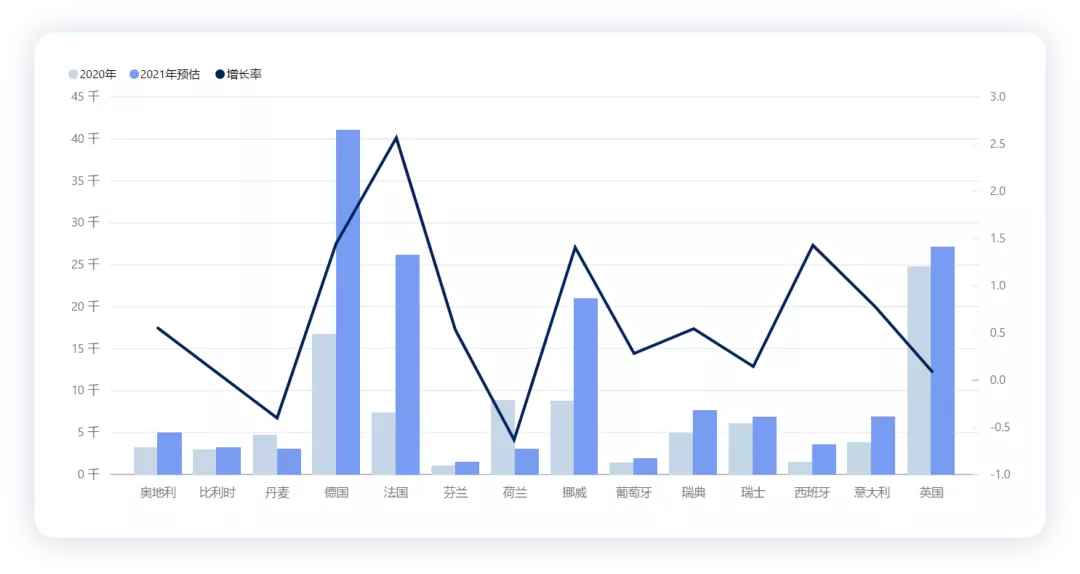

● Tesla is currently among the leading countries in the European market: it is estimated to be 41,000 in Germany, 27,000 in the UK, 26,000 in France, and 21,000 in Norway, but the market data in other countries differs greatly from this.

● Overall, the differences in the European electric vehicle market are not only in Eastern and Northern Europe + Western Europe (Southern and Franco-British) but also rapidly expanding between countries. Tesla’s strategy is still to build a supply around the Berlin factory to develop strategies for the three major markets in Germany, France, and the UK and take the opportunity to deliver to Italy. It is estimated that Tesla will achieve high growth in Europe next year.

Tesla’s sales in Europe

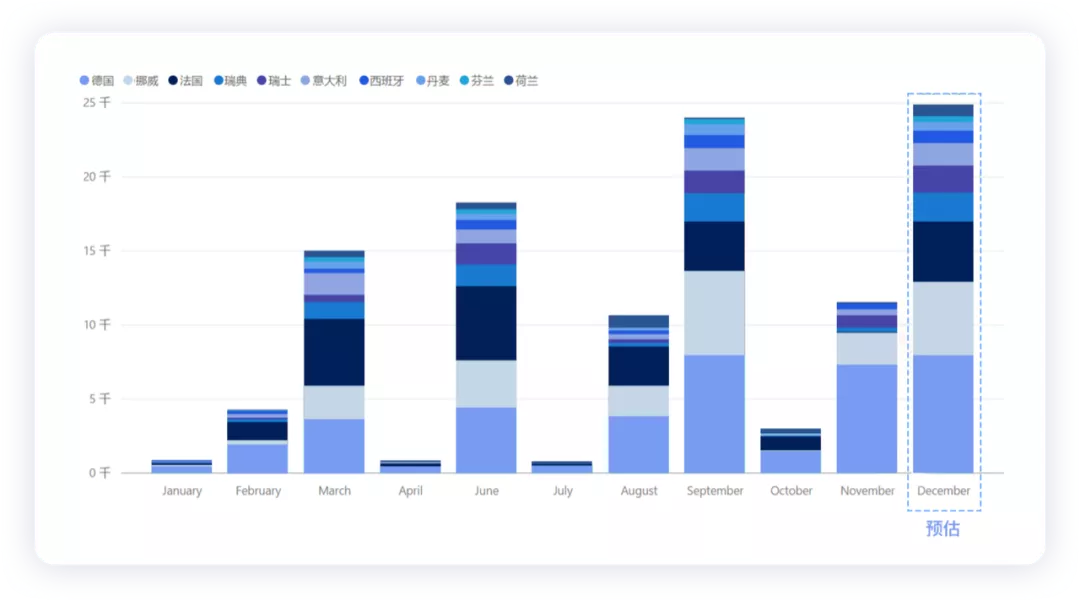

As shown in Figure 1, this is Tesla’s delivery situation in major European countries, with peaks in March, June, September, and December (expected); and the situation in January, April, and July, which has no reference value.

To illustrate the growth in 2021, I made the following chart, which should clearly show the comparison of Tesla’s performance in various countries in 2020 and 2021.

Note: The data for the UK is estimated based on the sales of Model 3 of approximately 21,000 from January to November 2021, and I added 6,000 single-month sales. Therefore, it is estimated to be 27,000 units here. This estimate may be lower, and it needs to be corrected based on facts in the future, but objectively speaking, Tesla already had a high base in the UK in 2020.

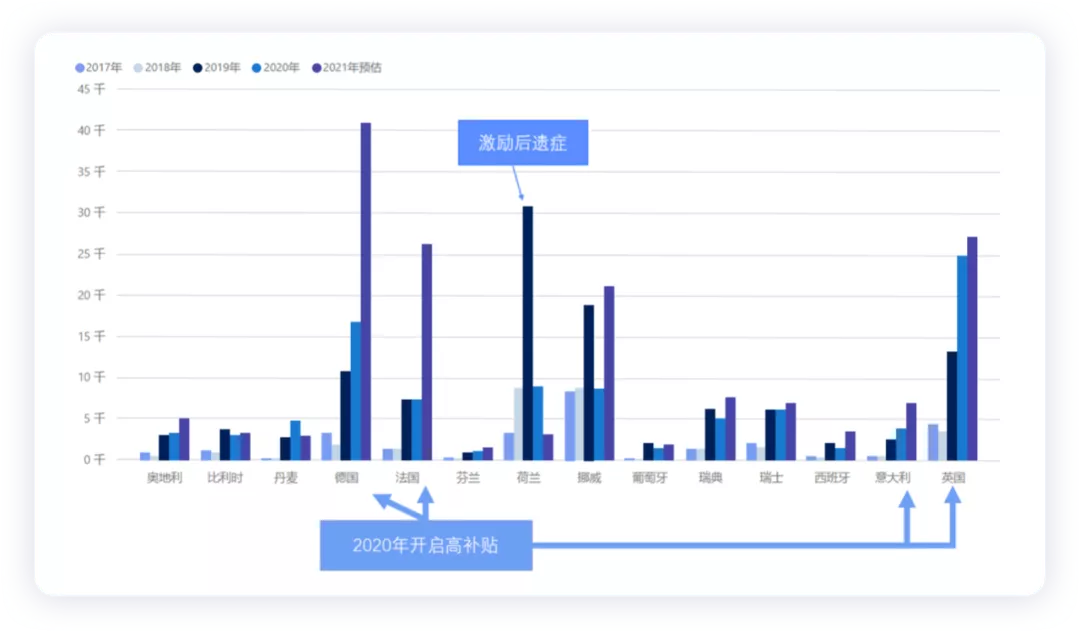

If we observe from a higher scale, Tesla’s market in Europe can indeed be decomposed into:

● High growth, large market: Germany, France, and the UK. The characteristics of these three markets are that the overall market capacity is relatively large, and with these countries increasing subsidies to promote the increase of the penetration rate of electric vehicles, Tesla’s product volume is growing very fast. The market, such as Italy, may be the next one to explode.- High penetration, small-scale markets: This mainly includes Norway, Switzerland, Austria, Belgium, and Sweden. Overall, these markets are relatively small, and with the push in recent years, Tesla’s overall growth is not significant. However, the penetration rate is relatively high.

- Continuously stimulated and falling markets: Mainly in the Netherlands, this was previously a speculative market born under the stimulus policy for electric vehicles. With changes in tax policies, it has compensated for the previously overdrawn demand.

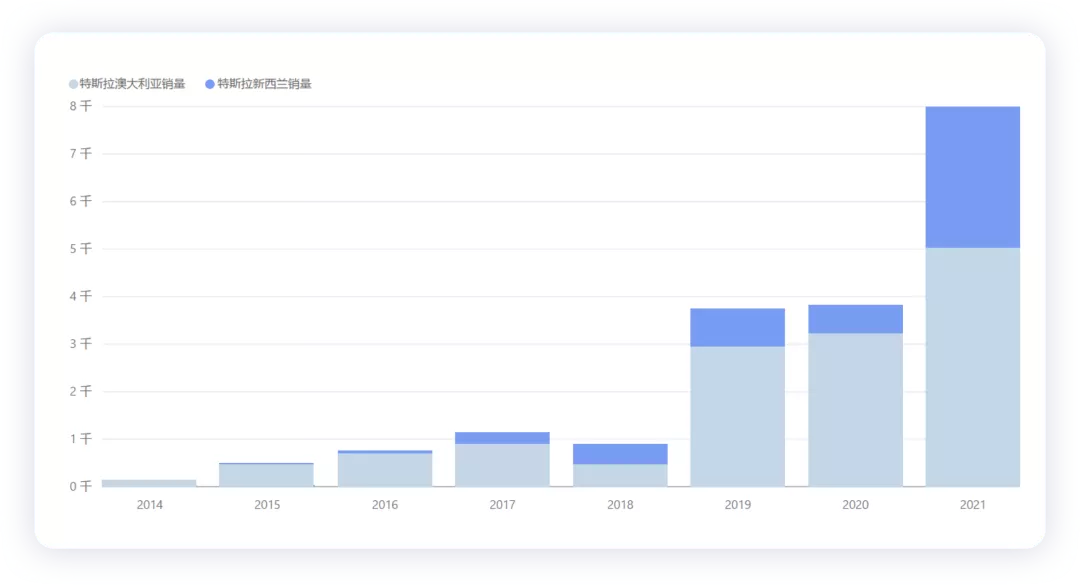

- In comparison, I looked at the situation in Australia and New Zealand with a low base number. Tesla’s penetration rate in Oceania is not particularly ideal, and electric cars still require certain policies and subsidies to slowly promote.

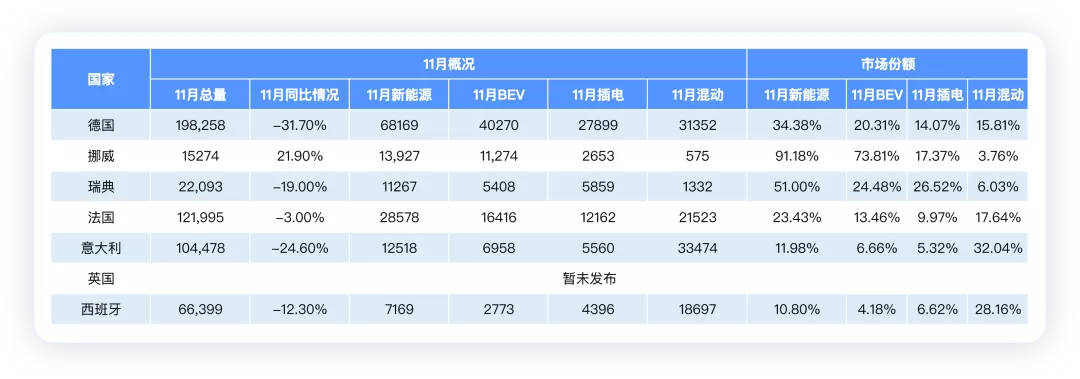

- Here, I also completed the overall data for November in Europe, as shown below. Overall, the European automotive industry is still suffering from a shortage of chips, and internal conflicts in automotive companies have reached a critical point, with differences from current demand still existing. Europe still needs large investments and subsidies conditions to hope for a natural and smooth transition for automotive companies, but I think this is relatively difficult.

- Summary: For Europe’s monthly summary, I still want to write something interesting with more depth and ideas rather than following a routine.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.