Due to the delay of new energy vehicle data in Europe, this weekend we first made a review of the situation in France, Norway, Sweden, Spain, and Italy, and made some summaries of the performance of Chinese electric vehicles in Europe. After Germany and the UK are released, we will have a complete review.

Currently, combining with the declaration of Stellantis CEO that the cost burden of electric vehicles “exceeds the limit of car manufacturers”, it can be seen that in the short term, Stellantis and Renault are struggling to perform in the French and Southern European markets.

Overview and the Situation in France

Although the proportion of new energy vehicle sales is at a high level, this high penetration rate is accompanied by a decline in the overall automobile market, which has a great impact on the entire vehicle and parts enterprises.

So now the boss of Stellantis has to come out and say that this burden is too great, which means that it has caused a very large impact on the operation of existing enterprises and may face the problem of unemployment later.

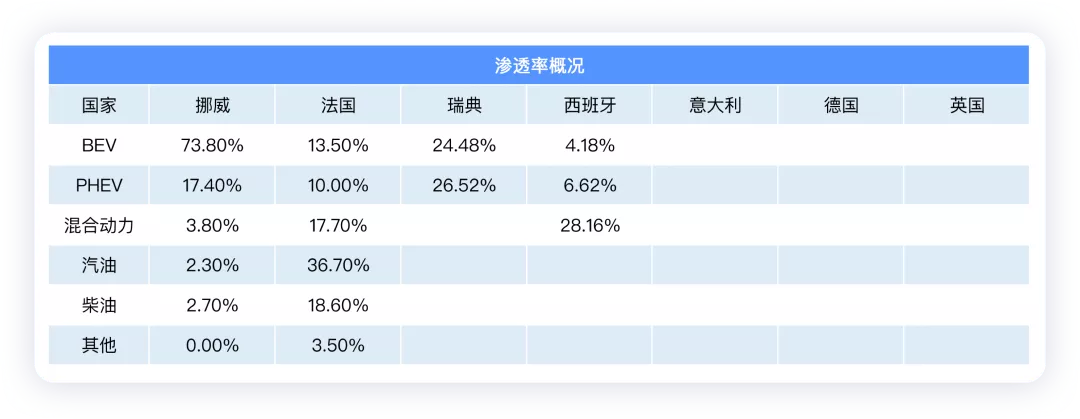

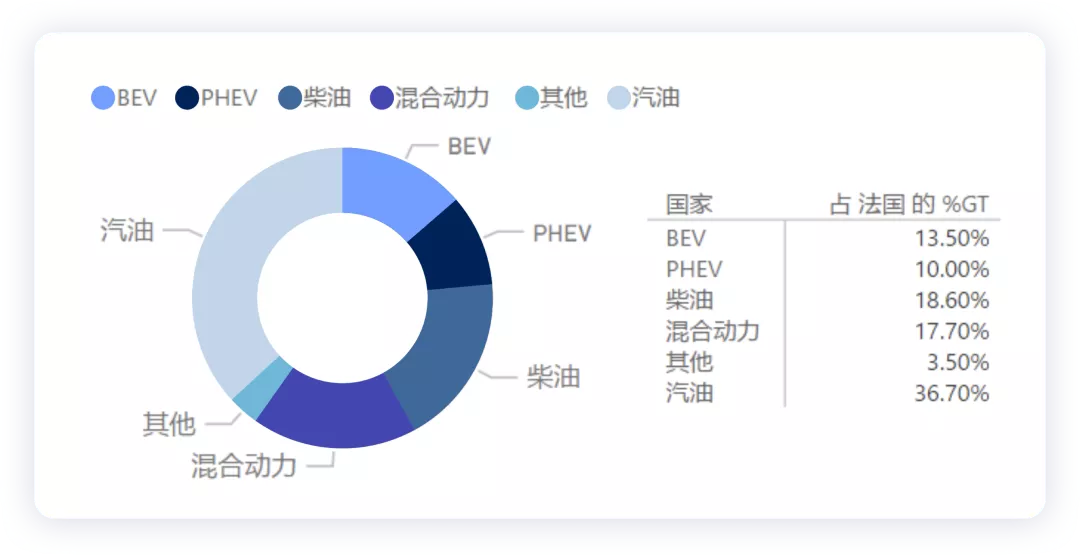

We can take the situation of the second-largest automobile market in Europe, France, and take a look: from the overall perspective, the automotive market is not performing well, less than 122,000 units year-on-year, a decrease of 3% (if less by 30% according to seasonal standards); and the corresponding market share of new energy vehicles reached a record high of 23.5%, an increase of nearly 10% compared with November 2020’s 14.8%.

The market share of diesel and hybrid vehicles in France is around 20%, and gasoline market share is slightly lower than 37%. The entire auto market has dropped by nearly 30% compared to seasonal standards. In November, Battery Electric Vehicles (BEV) accounted for 13.5% and Plug-in Hybrid Electric Vehicles (PHEV) accounted for 10.0%. From an accumulative point of view, the market share of new energy vehicles in France in 2021 is currently at 17.6%.

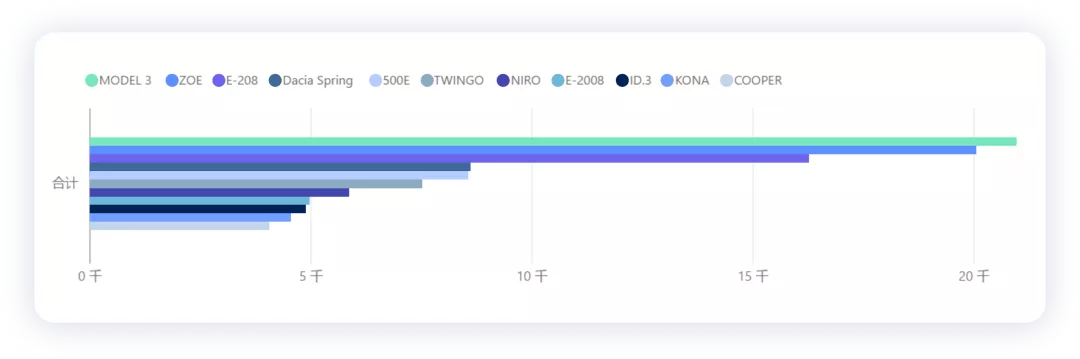

If we pull out the cumulative sales of new energy vehicles in 2021 according to the main models and brands, as shown in the following figure, Renault is ranked first, followed closely by Tesla and Peugeot.

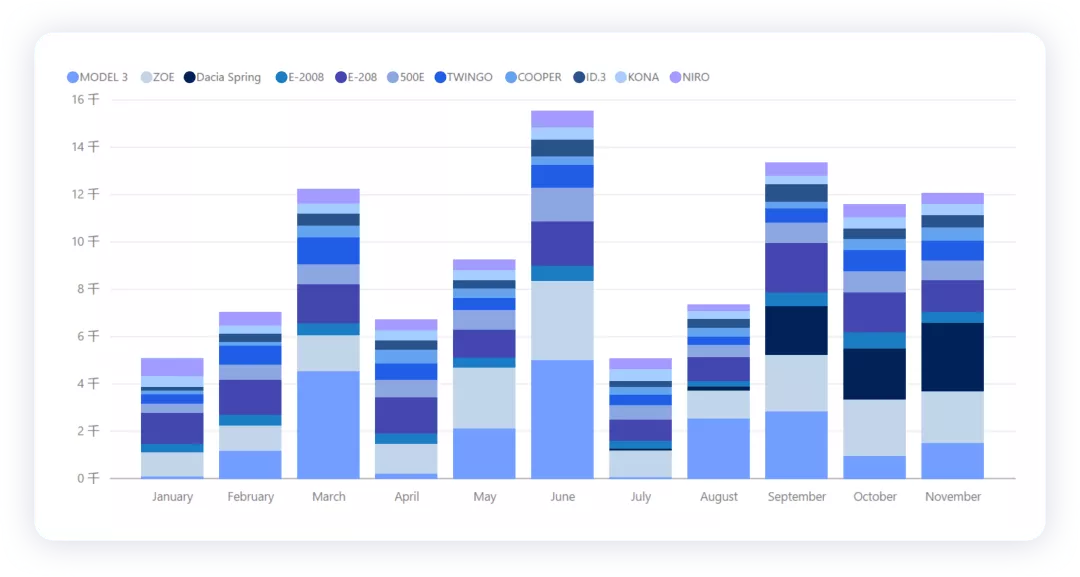

Looking at specific car models, the competition mainly lies between Model 3 and ZOE. Currently, with the popularity of Dacia Spring, ZOE’s sales volume is not increasing, and it also needs to be replaced by Renault’s own car models.

From monthly data, it is indeed the case that many companies’ willingness to promote the sales of electric vehicles is no longer strong due to the increase in market penetration rate. Therefore, except for Model 3 and Dacia Spring, the overall situation is not particularly good.

Performance of Norway and Overseas Troops

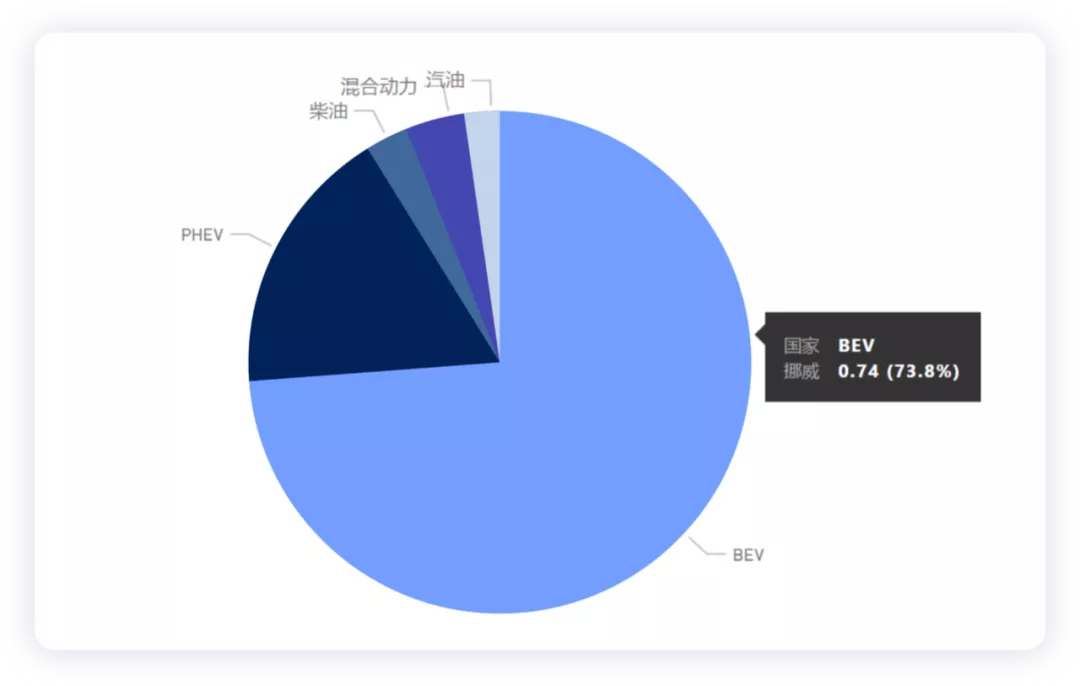

I think Norway in Europe is an exception. Due to the relatively small base, the November passenger car sales increased by 21.9% year-on-year to 15,274 vehicles, and the sales of new energy vehicles reached 13,927 vehicles (a year-on-year increase of 39%), with a historical high penetration rate of 91.2%! Less than 10% consists of hybrid vehicles (3.8%), diesel vehicles (2.7%), and gasoline vehicles (2.3%). The basic situation statistics for Norway this month are as follows:

- BEV: 11,274 vehicles (a year-on-year increase of 60.3%, with a market share of 73.8%)

- PHEV: 2,653 vehicles (a year-on-year decrease of 11.1%, with a market share of 17.4%)

- Total sales of new energy vehicles: 13,927 (a year-on-year increase of 39%, with a market share of 91.2%), which is basically a perfect score.

If divided by brand, I made a table as shown below:

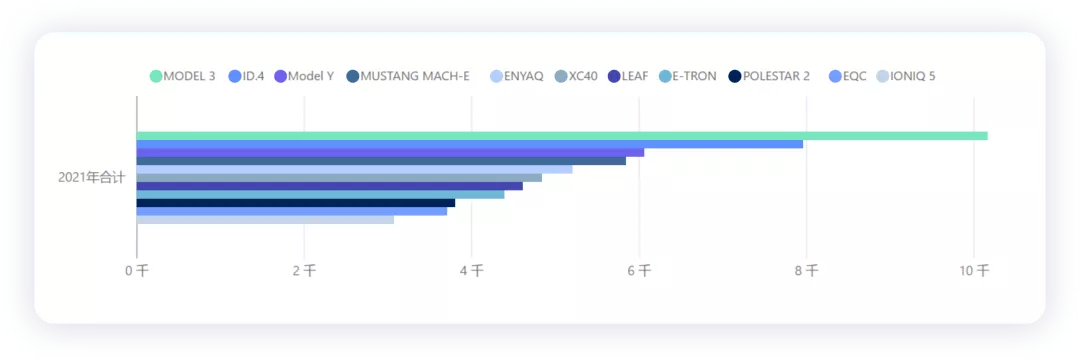

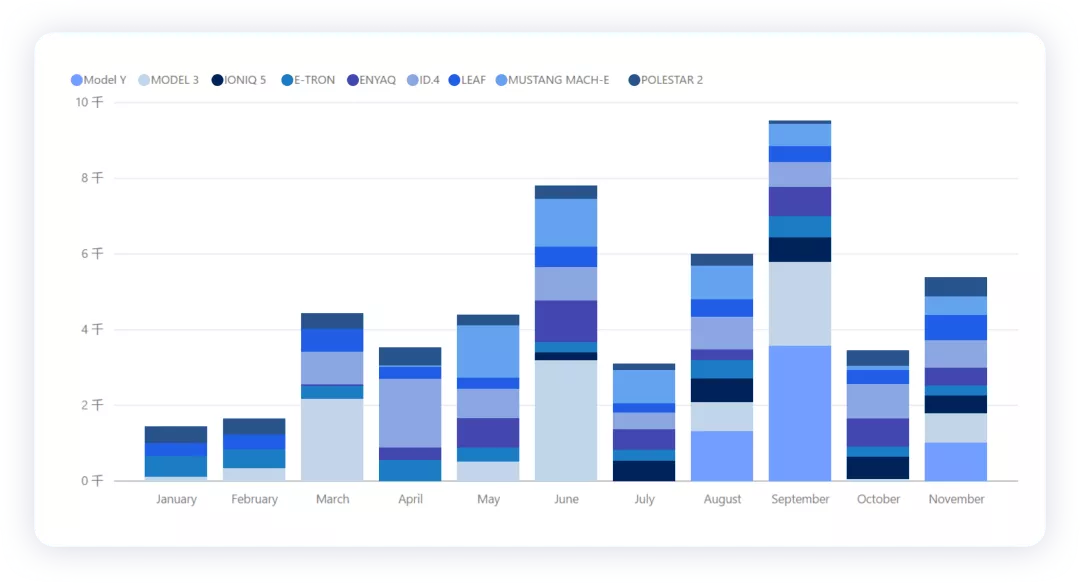

The main pure electric vehicle models in Norway had the following cumulative sales in 2021:

The main pure electric vehicle models in Norway had the following cumulative sales in 2021:

The main pure electric vehicle models in the Norwegian market include Tesla Model 3 – 771 (cumulative sales of 10,090 in 2021), Volkswagen ID.4 – 725 (cumulative sales of 8,230 in 2021), Tesla Model Y – 1,013 (cumulative sales of 5,888 in 2021) and Ford Mustang Mach-E – 491 (5,841YTD).

Tesla still has a very good market share in Norway.

Let’s take a look at the achievements of domestic automakers in Norway. With the easing of the chip supply shortage, it is believed that more automakers will be able to sell cars in Norway. For now, the ZS from MG is a little bit ahead, and the Tang EV from BYD is selling quite well in Norway, but we don’t know how they will perform in winter.

Conclusion: I believe that 2022 could be a year of differentiation for new energy vehicles in Europe. The policies of France and Germany are not in sync, and as Germany’s ruling party continues to ramp up efforts, other countries’ automakers simply cannot keep up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.