Baidu’s Apollo Lite – the Advantages and Challenges of a Pure Vision Automated Driving Technology

Baidu has been making headlines in the automotive industry this year, not only for its rapid progress with Jidu Auto, a joint venture with Geely established earlier this year, but also for its achievements with its Apollo project.

In June, Baidu officially launched its fifth-generation robotaxi, the Apollo Moon, which boasts a major highlight of cutting costs down to CNY 480,000. Lower costs imply easier commercialization. Last month, on the 26th, Baidu’s Apollo project announced an automatic driving travel service pilot license, signifying that Baidu Robotaxi has entered the commercial trial operation phase.

Baidu Apollo has an absolute advantage in the field of autonomous vehicles, whether it is test mileage, vehicles iteration, or industry-leading technology. However, Robotaxi focuses more on public autonomous travel, which begs the question: when will Baidu’s autonomous driving system be implemented in mass-produced vehicles? This leads us to Baidu’s pure vision automated driving technology – Apollo Lite.

In the current industry, there is a polarization in the direction of autonomous driving development. The vision-based camp, led by Tesla, firmly believes that vision is the best perception. Elon Musk even openly stated: “They’re all gonna dump Lidar, mark my words.”

On the other hand, a group of new car companies have chosen to embrace multiple sensor fusion technology, with some even mounting multiple LiDAR on their vehicles. In Baidu’s opinion, there is no right or wrong technology route. Vision-based solutions can mass-produce vehicles at a lower cost, while multi-sensor fusion solutions can provide more structured data. This is why Apollo Lite was born.

It is worth noting that Apollo Lite is currently the only domestic pure vision technology solution.When Apollo Lite was born in 2019, Baidu hoped to reduce its strong reliance on lidar and achieve L4 autonomous driving at a relatively low cost. According to reports, Apollo Lite can rely on 12 cameras to achieve 360-degree environmental perception and stable detection distance of up to 240 meters.

In the year it was released, Baidu conducted on-site autonomous driving verification tests at Daohu Lake in Beijing. Thus, Baidu Apollo became the second technology company in the world, after Mobileye, to conduct on-site autonomous driving tests relying solely on vision.

In addition, although pure vision is cheaper and easier to deploy, it also has significant limitations.

Firstly, although cameras can obtain image information, they cannot directly perceive distance information of objects (which can be achieved through special algorithms). Secondly, the detection coverage area of millimeter-wave radar is relatively limited, requiring algorithms to filter a large amount of irrelevant information. Thirdly, the data generated by Apollo Lite’s 10 cameras (excluding the two fisheye cameras added in 2019) exceeds 1G, and Baidu Apollo uses more than 30 deep learning models for computation. All of this data is compressed into a single GPU computing platform.

Even though numerous difficulties have been overcome, there are still four major challenges to be faced if it wants to become a product and be delivered to cars.

The first is the changes to the vehicle. During the development stage, Baidu Apollo Lite used Lincoln MK-Z, but it is obvious that this retrofitting method cannot be used for mass production. However, mass production with front-loading presents all new challenges for redundant design, line control tuning, cooling solutions, and sensor integration.

Front-loading also means that the reliability, consistency, and stability of the vehicle will be put to the test. The intelligent navigation-assisted driving product, ANP, which evolved from Apollo Lite, was first installed and tested for mass production on the WM W6. From this test vehicle, we can see that the intelligent driving hardware has been well integrated into the vehicle design.

The second point is the hardware computing problem. The computing platform needs to be adapted to vehicle-grade applications. During the early development stage, Baidu used hardware identical to that used in Robotaxi, although Baidu limited the computing power. Few production vehicles will use server-level GPUs. Therefore, Baidu turned to self-developed computing platforms with mass-producible, low-power computing units.

The third point is the transition from X86 to ARM architecture, which directly reduces computing power by half. The significant decrease in AI computing power means that Apollo Lite must improve the visual perception model while reducing computation and latency and ensuring model accuracy. In terms of planning and control, most programs are not yet AI-driven, so the team conducted a massive overhaul of the software system.Translate the following Markdown Chinese text into English Markdown text in a professional manner. Retain HTML tags inside Markdown and only output the result. Corrections and improvements are to be made and only responses to corrections and improvements are to be provided, without explanatory text.

The last point is about the application of high-precision maps. In the R&D stage, the system can fully rely on Robotaxi’s high-precision map because planning, control, and decision-making have not changed, and the map markings are very detailed.

However, it is not practical to continue using a “bulky” high-precision map on mass-produced cars. Since users may drive this car to any place, maps are needed wherever they go. In order to improve the coverage of high-precision maps and reduce production costs, ANP reduced the demand for high-precision map features and made them more lightweight while maintaining accuracy and freshness. Therefore, on the mass-produced version, Apollo Lite has moderately relaxed its requirements for high-precision maps.

Baidu has reduced the number of high-precision map elements to 50% of the original and the size of the map per unit distance is only 10% of the original. At the same time, Apollo Lite engineers have developed perception, positioning, and decision-making planning algorithms that are compatible with lightweight maps and have compensated for the lack of map information through algorithm upgrades in the vehicle.

Possibilities brought by ANP

The most important thing for autonomous driving is mass production and landing of products.

Thanks to three years of development and optimization of Apollo Lite, as well as Baidu’s profound accumulation and iteration in the Robotaxi industry, Baidu has finally submitted its answer this year, and the content of the answer is rich enough. From the AVP parking area to the ANP driving area, Baidu can cover the entire scene.

Currently, the AVP autonomous parking function has been installed in the WM W6, GAC Aion V Plus, and WEY Mocha, and pushed to users. The ANP urban navigation assisted driving system will also be mass-produced on Jidu’s new car.

One point worth noting is that although many car companies and technology companies are working hard to develop open road navigation assisted driving, there are only a few that really show the performance of their products to the outside world. In addition to the small but strong representative of new energy vehicle maker XPENG’s City NGP and the Huawei ADS system, Baidu’s ANP is the only solution, whereas the former two are equipped with two or more LiDAR. Compared with them, Baidu’s ANP is supported by Apollo Lite’s pure visual perception autonomous driving technology and does not rely on expensive LiDARs.

Therefore, among these three, Baidu’s solution has the lowest cost and the most scalability. To put it more bluntly, the penetration rate of XPENG’s City NGP, as a new energy vehicle maker, is currently dependent on the sales of P5 models.Huawei, like Baidu, acts as a supplier, but the cost of the Huawei ADS solution is too high. Not only does it require pre-installed lidar for car models, but the MDC computing platform, which costs hundreds of TOPS, also adds a hefty price to it.

On the other hand, ANP can function like a set of templates and customize according to different car models without any limitations. Moreover, this system is not exclusive to lidar, and car companies can add lidar based on ANP’s pure visual system.

In addition, features such as city navigation and assisted driving require a lot of real road testing experience as a foundation, and this is where Baidu’s advantage lies. ANP and Robotaxi are originally from the same source, and the former was derived from the latter by reducing configurations. Baidu’s Robotaxi has tested over 18 million kilometers, guaranteeing ANP’s leadership with real-world road testing experience data.

However, ANP is not perfect. Although the Apollo Lite’s technical plan brings us unlimited imagination, ANP software has not been pushed yet, even for WM W6 deliveries. The upcoming Jidu Auto, a Baidu product, is still on the road, and the experience in real scenarios is something we are looking forward to.

Baidu’s pure visual solution, Apollo Lite, after three years of development and iterations with Robotaxi, finally delivered a Level 4 automatic driving mass production solution this year. Its significance cannot be simply defined by being “unique in China and second globally”.

In conclusion, Baidu is not alone in exploring the potential of vision. When it comes to autonomous driving, we cannot ignore Tesla and Mobileye. Software ability is a key factor for competition, especially for automakers like Tesla. Although Tesla’s FSD has made breakthrough progress in North America, it has not brought significant value to us at this stage.

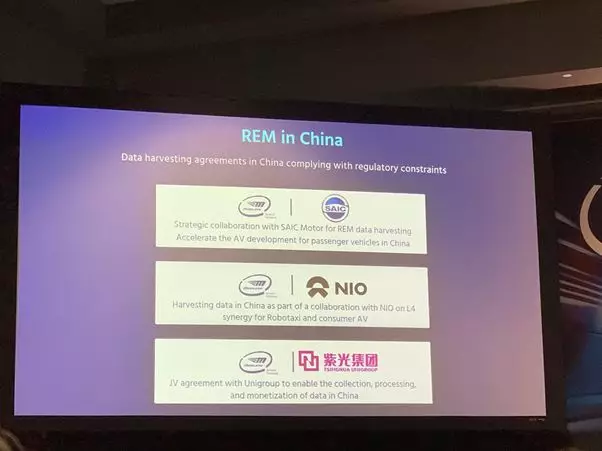

Tesla also faces restrictions in China, which limits its capacity in navigation-assisted driving. Mobileye and Baidu Apollo are more similar, even though they have laid out multi-sensor fusion solutions and pure visual solutions. However, as with Tesla, Mobileye must follow the game rules.As a supplier, it can only provide basic perception capabilities for L2 level assisted driving for car companies. In its pure visual solution Supervision, REM (Road Experience Management) is crucial.

Although Mobileye chooses to partner with SAIC and Tsinghua Unigroup to obtain mapping qualifications, it is impossible to achieve this in the short term. Therefore, it is difficult for Mobileye to seek breakthroughs in its cooperation with domestic automakers.

In contrast, as the map maker with the highest market share in China, Baidu has accumulations such as its own qualifications, mature map production lines, and scaled map acquisition fleets. At the same time, Baidu has established cooperative relationships with most domestic automakers, providing them with mass-produced high-precision maps that have been verified.

At this time node, Baidu is the first to productize its technology, which definitely makes it a leader compared to other suppliers. However, quantitative changes can only cause qualitative changes. The burden is still on Baidu to allow more customers to carry advanced products and assistive driving at a lower cost, and to let more users use these high-level functions. Baidu’s job is to trigger this qualitative change.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.