Author: Dan Huang

Only one month left in 2021, and it’s time for the year-end performance sprint for all industries, including the automobile industry. On December 1st, new energy vehicle companies announced their vehicle delivery results for November. Four companies delivered more than 10,000 vehicles, namely XPeng, Li Auto, NIO, and Neta, which is a great breakthrough compared to previous years.

The performance of the new energy market in 2021 is of extraordinary significance. In addition to the rapid development of leading new energy vehicle companies, there are also new entrants with greater potential. This time, we have collected delivery data from 9 new energy vehicle companies. Let’s take a look at how they performed!

First Place: XPeng Motors

- Breaking the 15,000 mark

Among the 9 companies surveyed, XPeng Motors was the last to announce its delivery results, but it played a trump card with the November delivery volume of 15,613 vehicles, a month-on-month increase of 54% and a year-on-year increase of 270%.

For the first time, more than 15,000 vehicles were delivered, setting a new record for XPeng and new energy vehicle companies. Its three models, P7, G3i, and P5, all hit new highs. In total, XPeng has delivered more than 10,000 vehicles for three consecutive months, not only taking the lead but also going the farthest.

Looking at the cumulative delivery volume for 2021, XPeng Motors delivered a total of 82,155 vehicles throughout the year, surpassing NIO, which ranked first, and becoming the automaker with the highest total delivery volume this year. The advantage of a rich product line has become increasingly prominent.

Not long ago, at the 2021 Guangzhou Auto Show, XPeng Motors officially unveiled its new mid-to-large-size SUV, the XPeng G9, and also released a refreshed brand logo. Further improving its product matrix will greatly contribute to the delivery performance of XPeng Motors next year.

Second Place: Li Auto

- Breaking the 10,000 mark for the first time

After a decrease in delivery volume in the first two months, Li Auto made a one-time effort in November, delivering 13,485 Li ONEs, an increase of 190.2% year on year, creating a new record for monthly deliveries once again. For the first time, it achieved a good result by breaking the 10,000-unit threshold, which can be considered as completing the plan of breaking 10,000 units that was not accomplished in September.

After a decrease in delivery volume in the first two months, Li Auto made a one-time effort in November, delivering 13,485 Li ONEs, an increase of 190.2% year on year, creating a new record for monthly deliveries once again. For the first time, it achieved a good result by breaking the 10,000-unit threshold, which can be considered as completing the plan of breaking 10,000 units that was not accomplished in September.

From January to November, Li Auto delivered a total of 76,404 cars, which may only rank third in the list, but don’t forget that among many car models that are “fighting” with each other, Li ONE is the only one from Li Auto. For a single car model, its combat effectiveness is extremely powerful.

Third Place: NIO

- Back to Normal Level

In November, NIO delivered 10,878 new cars, an increase of 105.6% year on year. The chip issue has always been a headache, and different automakers have been affected to different extents. It can be seen that NIO was seriously affected by it last month, but it has returned to normal level this month.

From January to November this year, NIO delivered 80,940 cars. This month, it was surpassed by XPeng in the overall delivery volume ranking, slipping to second place. This also shows that the competition among the three giants of new energy vehicles is becoming increasingly fierce. From the perspective of market advantages, NIO’s product positioning and product matrix have some shortcomings, such as its high-end positioning and only selling SUVs. These may also be the reasons for NIO’s lower market share.

However, according to the known information, NIO’s ET7 model, which is positioned as a mid-to-large-sized sedan, will be launched in January 2022 and will begin delivery in the first quarter. The arrival of this new car may bring better sales results for NIO.

Fourth Place: NIO

- Breaking the 10,000-Unit Threshold for the First Time

NIO keeps breaking delivery records this year. It is not only stable, but also has a very strong momentum of growth. In November, its delivery volume was 10,013, an increase of 372% year on year, breaking the important threshold of 10,000 units for the first time. This is an important milestone for NIO.# The Comparison of Chinese New Energy Vehicle Startups in 2021

This year, NETA Motors came close behind the Big Three in the Chinese new energy vehicle market. From the growth trend, it performed very well in terms of both the increase and the quantity of sales. It’s worth mentioning that even though NETA Motors focuses on affordable and practical cars, 91% of their customers are individuals, which proves the recognition of the brand by users.

By the end of 2021, NETA Motors’ cumulative delivery reached 59,547 vehicles, ranking fourth on the list of new energy vehicle startups and pulling far ahead of its competitors. With this kind of growth momentum, NETA Motors may soon be on a level playing field with the Big Three.

Moreover, at the Guangzhou Auto Show in 2021, NETA Motors unveiled a brand-new platform “Shanhai” and a NETA S model that is closer to mass production. With the help of NETA S, the company, which lacks cars in its lineup, may achieve better sales performance in the future.

In fifth place is LI Auto.

- Record Orders and Deliveries

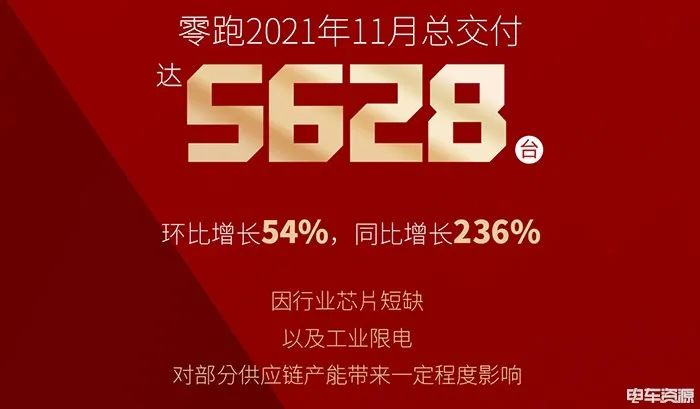

In November, LI Auto delivered 5,628 vehicles, an increase of 54% compared to the previous month and 236% compared to the same period last year. The addition of the C11 model has contributed to this outcome.

As a new energy vehicle company with promising prospects, LI Auto may not grow as fast as the top players, but it is still able to maintain a growth trend in the difficult environment of chip shortages and industrial power restrictions.

It’s worth noting that LI Auto’s total orders in November reached 16,310 vehicles, of which the C11 model accounted for 7,005 vehicles, and the T03 model accounted for 9,297 vehicles. The addition of SUV models is important to LI Auto in terms of consolidating its position in the new energy vehicle market.

And in sixth place is WM Motor.

- Steady Development

# Weima Automobile Delivers 5027 New Cars in November with a YoY Growth of 66.6%

# Weima Automobile Delivers 5027 New Cars in November with a YoY Growth of 66.6%

The cumulative delivery volume from January to November has reached 39095, and based on the current stable monthly sales of over 5000, Weima is expected to exceed 40,000 vehicles this year.

Like NIO and Xpeng, there are no sedans among the currently available models. However, Weima’s first all-scenario intelligent pure electric sedan, the M7, will be launched in 2022. In the same category of intelligent pure electric sedans, the M7 may have strong competitiveness, which is worth looking forward to.

7th Place: Polestar

- Promising Potential

Polestar delivered 2012 new cars in November. As a “new” new energy company, Polestar currently only has one model, the Polestar 001, and officially started delivery at the end of October this year. However, in the first week of delivery, Polestar delivered 199 vehicles.

However, the Polestar 001 has already had high popularity before delivery, attracting many viewers’ attention with its unique appearance and decent configuration. It is also a promising model. As it has just started delivery and is still in the early stage, it is likely to become a black horse in the new energy vehicle market in the future, and we look forward to it.

8th Place: Skyworth Auto

- Sales Break 1,000

Skyworth Auto delivered 1,220 new cars in November, with a MoM growth of 22.7%, and has achieved a significant MoM growth for seven consecutive months. The number of domestic experience centers has reached 138. Skyworth Auto currently has only one model, the EV6, renamed from Tianmei Auto’s ET5.

Skyworth Auto’s domestic sales have broken 1,000, and international sales continue to break through. It has obtained the EU whole vehicle certification and exports to 42 countries and regions. It is expected that by 2030, Skyworth Auto will achieve an annual global sales volume of one million, including 500,000 in China and 500,000 overseas.### 9th place: Voyah Automobile

- Promising future

In November, Voyah delivered 1139 cars, a MoM growth of 13.2%. As a new car that only began delivery in August this year, this is a pretty good result. The delivery volume has continued to climb for four consecutive months, and the cumulative delivery this year has reached 3461 cars. Currently, the only model for sale is the Voyah FREE, which comes in two versions: extended range and pure electric.

At the recent 2021 Guangzhou Auto Show, Voyah Automobile officially unveiled its second product, the MENGXIANGJIA, which is built on the ESSA native intelligent electric architecture and positioned as a mid-to-large-sized MPV. It is expected to be released in mid-2022.

In addition, Voyah Automobile also said that it will form a matrix of three major categories: SUVs, MPVs, and sedans over the next three years, and will release at least one new car to the market each year. This indicates that Voyah’s first sedan is expected to be released in 2023.

Final thoughts

Overall, these new forces in the automotive industry are a powerful and radical force in the entire new energy market and even the automotive market as a whole. For traditional new energy vehicle brands, they can be considered as both teachers and friends.

Looking at the delivery performance of new energy vehicles in November, it is clear that the new car makers have taken a significant slice of the market, with four new companies demonstrating a monthly delivery volume exceeding 10,000. Other new car companies have also shown a strong “attack” capability. While the market leader is constantly changing, the new power can be seen as the future “leader” and their day of dominating the automotive market is not far off.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.