Author: Leng Zelin

This year has been a tough year for the global automobile industry, and major car companies have been hit hard by chip shortages. Fires at Renesas and TSMC and COVID-19 outbreaks in places like Malaysia have disrupted the supply chain.

The high level of electrification in new energy vehicles has further exacerbated the problem of chips demand, which can easily reach thousands of pieces.

The NIO factory has stopped production twice, and at the end of the year, it has lowered its delivery expectations, while XPeng and Li Auto have come up with a “deliver first and issue the invoice later” delivery plan despite complaints from customers.

However, the chip shortage has not stopped the progress of new energy vehicles. The national penetration rate of new energy vehicles has risen against the market trend, surpassing 20%.

It has been such a strange and tortuous year; how have NIO, XPeng, and Li Auto fared? Recently, the three companies have released their third-quarter financial reports, allowing us to see the current situation of the top three new carmaking forces.

Delivery rankings reveal new leader

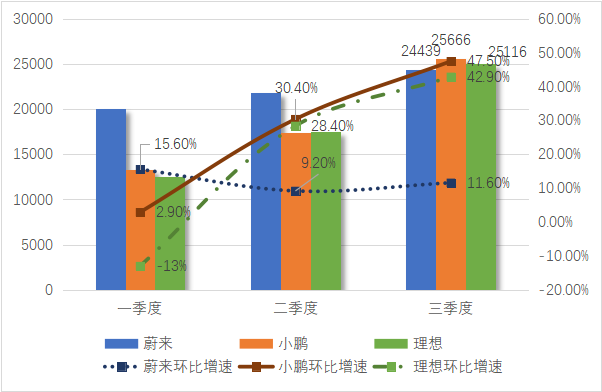

Delivery volumes for the third quarter had long been disclosed. All three companies had normal growth, with the only difference being how much. However, the biggest development was that the delivery ranking began to change significantly.

Looking at the delivery volumes for the third quarter, XPeng and Li Auto ranked first and second with 25,666 and 25,116 deliveries, respectively, followed by NIO, which dropped to third place. This marks the first significant change in delivery rankings.

NIO’s month-on-month increase in delivery speed was somewhat unexpected. Apart from its good performance in the slow season in the first quarter, it has been hovering around 10% since then, while XPeng and Li Auto have seen significant growth this year, surpassing NIO one after another.

At the beginning of this year, we pointed out that NIO has a relatively high unit price, and as the penetration rate increases, a wave of mid-to-low-price new energy vehicles would emerge. Therefore, it is normal for NIO’s delivery volume to not be able to maintain its dominance in the long term.

In the third quarter, the total sales revenue of the three car makers was RMB 8.34 billion, RMB 5.46 billion, and RMB 7.39 billion, respectively. Combined with delivery volume data, the average unit prices of each car can be roughly calculated to be about RMB 341,000, RMB 213,000, and RMB 294,000, respectively, with NIO’s unit price still the highest.

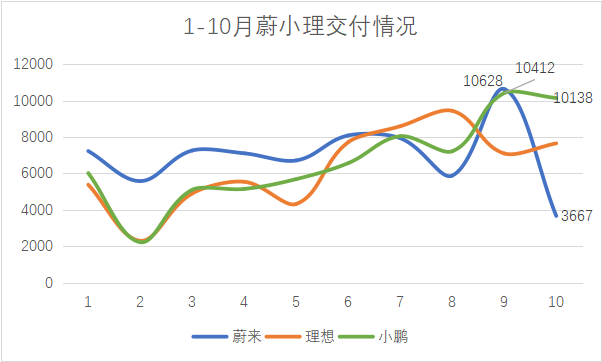

Due to the chip shortage, all deliveries by these carmakers have been significantly impacted, with NIO being the most affected.

From July to October, NIO’s delivery volumes were 7,931, 5,880, 10,628, and 3,667, respectively, with significant fluctuations. Although the delivery volume exceeded 10,000 in September, close observation indicates that it was most likely a short-term surge caused by an accumulation of orders in the previous month.

# XPeng Motors Continued to Lead the New EV Makers with High Delivery Volume

# XPeng Motors Continued to Lead the New EV Makers with High Delivery Volume

XPeng Motors recently achieved a breakthrough with its G3i and P5 models and high delivery volume for its P7 model, which exceeded 10,000 units in September and October. The P5 models had deliveries of 244 and 437 units respectively, and the G3 series had deliveries of 2,656 and 3,657 units respectively in these two months, achieving a new high for the model’s deliveries this year.

The ideal model has maintained a stable delivery volume of around 8,000 units since the facelift in May. In the short term, new models and facelifts are important factors for boosting delivery volume for new EV makers.

Despite the high unit price, chip shortage, and lack of new models or facelifts, NIO appears to have had a quiet year. In the short term, Ideal continues to follow the explosive sales strategy, relying on a single model for sales, while NIO maintains its mid-to-high end positioning and XPeng’s new model has continued to increase production capacity.

With the old leader stepping down, XPeng may continue to lead the new EV makers.

In the delivery guidance for the new quarter, XPeng remains optimistic, with expected deliveries of 34,500-36,500 and 30,000-32,000 units respectively. NIO maintains a steady attitude, only raising the goal by 500 units compared to the previous quarter.

In fact, NIO was quite lively earlier this year when the ET7 was unveiled, which impressed many users with its LiDAR, solid-state battery, and rare sedan model in the market. However, looking at the end of the year, these advantages seem to be gradually shrinking.

For example, with LiDAR, XPeng was the first to deliver the P5 with two LiDARs, followed closely by WM Motor’s M7 with three LiDARs, even with Saloon Car’s “less than four” tagline. At the just-concluded Guangzhou Auto Show, in addition to the ET7, the range of the IM L7 and AION LX Plus both exceeded 1000km.

At the same time, each brand is gradually moving towards the mid-to-high end market, with models such as the Mech-Dragon, Zeekr 001, and XPeng G9 continuously raising their prices, revealing a desire to build a mid-to-high end brand. Especially for traditional brands that have been making mid-to-low-end vehicles for more than ten years, the electric vehicle wave is definitely an opportunity that needs to be grasped.

This is also the current situation in the entire industry, where the low profit margins and fierce competition of mid-to-low-end cars are forcing brands to move up to the mid-to-high end market, ultimately leading to a fierce competition. Fortunately, NIO entered the market early and has a certain foundation in its brand. However, it remains to be seen how much advantage this brand strength can show in future competition.

At the same time, the industry is rapidly upgrading, and companies’ R&D investment and strategic layout for forward-looking technologies is becoming increasingly stringent.

Financial Review, Ideal Leads in Gross Profit Margin

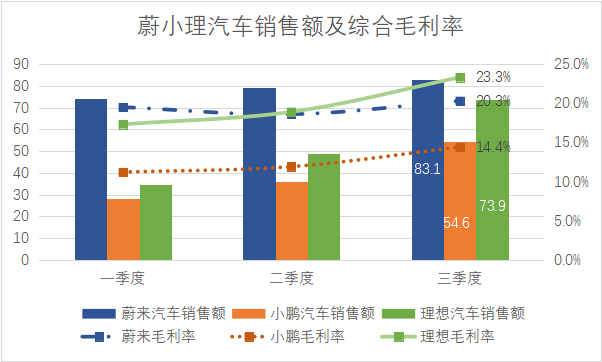

While XPeng has won the crown for delivery volume, due to its low unit price, its gross profit margin and total sales are still the lowest among the top three new EV makers.

The sales revenue of NIO, XPeng, and Li Auto in the third quarter were 8.31 billion, 5.46 billion, and 7.39 billion yuan respectively. NIO continues to rank first while Li Auto and XPeng rank second and third respectively.

The sales revenue of NIO, XPeng, and Li Auto in the third quarter were 8.31 billion, 5.46 billion, and 7.39 billion yuan respectively. NIO continues to rank first while Li Auto and XPeng rank second and third respectively.

It is worth noting that Li Auto’s comprehensive gross margin reached 23.3% in the quarter. This was mainly driven by the growth of vehicle gross margin. The vehicle gross margin for Li Auto was 21.1% in the quarter, compared to 18.7% in the previous quarter. The main reason for the increase was that the delivery volume of the Li ONE increased, leading to a rise in the average selling price.

According to the financial report conference call of Li Auto, the delivery cycle of Li Auto is currently between six to eight weeks. Therefore, Li Auto will not take promotion or other activities to boost sales growth this year.

In contrast, the vehicle gross margin of NIO in the third quarter was 18%, a slight decrease compared to 20.3% in the previous quarter. This was mainly because the accounting treatment of accelerated depreciation will be adopted for the NT1.0 platform due to the launch of NT2.0 platform. However, according to the financial report conference call of NIO, the gross margin of NT2.0 platform will reach 25%, which is also NIO’s long-term goal.

XPeng’s vehicle gross margin in the third quarter was 13.6%, compared to 11% in the previous quarter, showing an overall upward trend, although still significantly lower than that of the other two companies.

However, low revenue and gross margin did not affect R&D investment. As mentioned earlier, ensuring the frequency of technological upgrades and model updates is an important factor for maintaining competitiveness.

XPeng ranked first in R&D investment with 1.26 billion yuan in the third quarter, and has been continuously increasing R&D investment since the fourth quarter of last year, mainly due to the R&D of software and new models such as P5 and G9. On the other hand, XPeng’s R&D team is also expanding, with the number of employees exceeding 4,000 by the end of the third quarter of 2021, twice the number at the end of last year.

XPeng’s investment has also yielded results. At the 1024 Technology Day this year, XPeng launched the 800V high-voltage SiC platform, 480kW high-voltage supercharging pile, energy storage and charging technology, as well as XPILOT3.5 and 4.0.

According to the financial report conference call of XPeng, the attachment rate of XPILOT3.0 in P7 was close to 20% in the third quarter, and more than 11,000 P7s delivered by September 30 were equipped with XPILOT3.0.

While NIO and Li Auto have low exposure this year, XPeng is the most dynamic among the three automakers. Not only did it enter the field of “mech horse” and “flying car”, but with the launch of XPILOT3.5, it will also explore the robotaxi business in the second half of next year.

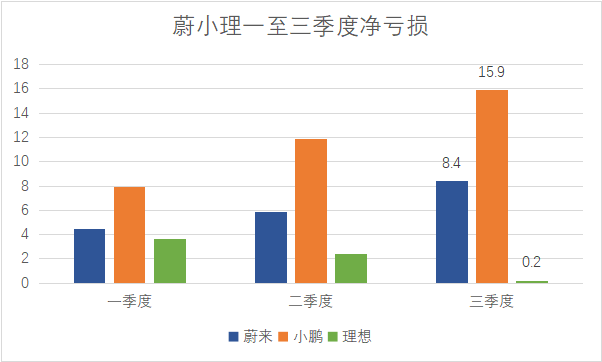

Although capital does not care whether the new forces in the automotive industry can make money at present, the continuously opened new business will put significant pressure on the company’s short-term profit.

In the third quarter, XPeng recorded a net loss of 1.59 billion yuan, far exceeding the sum of the other two companies. However, the outstanding performance of Li Auto benefited from high gross profit and good cost control, resulting in a net loss of only 0.2 billion yuan that quarter.

However, some investors expressed that they do not want to see Li Auto profitable at this stage, but rather want it to spend money to occupy the market.

Currently, Li Auto’s next model, the X01, is still an extended range electric vehicle, and is scheduled to be released in the second quarter of next year and delivered in the third quarter. The pure electric model is still expected to wait until the second half of 2023.

The good news is that Li Auto’s assisted driving system is gradually catching up with NIO and XPeng. According to its financial report conference call, in December, Li Auto’s NOA will usher in the largest OTA in China. As the standard configuration for the 2021 Li ONE, Li Auto may have some advantages in data acquisition and testing.

Evaluation of Sales Network: NIO strives to be a pioneer in going global

As of the end of the third quarter, Li Auto had a total of 153 offline retail centers, XPeng had 271 offline sales stores, and NIO had 32 NIO Houses and 285 NIO Spaces.

In the first quarter, Li Auto had only 65 offline retail centers, XPeng had 178, and NIO had about 260. It seems that each company is expanding their marketing network. This has led to rapid growth in marketing expenses.

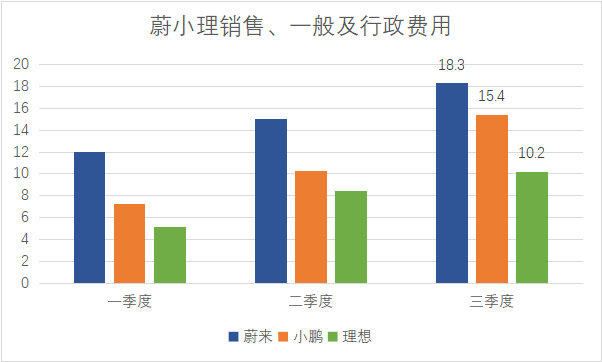

In the third quarter, the sales, general and administrative expenses of NIO, XPeng, and Li Auto were 1.83 billion yuan, 1.54 billion yuan, and 1.02 billion yuan respectively. Due to NIO’s long-standing high-end service image, its high rental and personnel expenses put it in first place in spending.

Although XPeng has a similar number of offline sales stores as NIO, its self-operated plus franchise model results in slightly lower expenses. Li Auto currently has the smallest sales network, but since it only sells a single model, having too many offline stores would actually result in lower efficiency. As it adds more models, expanding the sales network will become more reasonable.

In overseas markets, NIO and XPeng are currently expanding rapidly, but Li Auto is still in the process of building a team and studying market channels. The reason may be that Li Auto’s extended range electric vehicles and positioning are strictly tailored to meet the needs of Chinese consumers, and whether they can be favored by overseas consumers is a major issue.

So, how are NIO and XPeng doing in overseas markets?

At the beginning of October, NIO House located in the Norwegian capital Oslo officially opened for business, and the first batch of ES8s began to be delivered.After the success of G3, XPeng has also successfully expanded to overseas markets with P7 in the third quarter. However, XPeng’s overseas marketing network differs from NIO’s self-operated model. XPeng has established a sales network in Norway through cooperation with local dealer groups, which is advantageous in terms of cost savings and faster localization.

However, if NIO’s self-operated system can take root and thrive in Europe by exploring an operating model, it may also gain a foothold in the European market. Li Bin also revealed that NIO will enter 5 European countries, including Norway, and directly provide the NT2.0 platform products next year.

This means that the European market will no longer have a significant time lag in updating products compared to the domestic market.

In addition, Li Bin revealed an interesting fact that more than a quarter of users who test-drive NIO cars go on to place an order, far exceeding the domestic market. The BaaS service provided by NIO also presents different situations. In Norway, over 94% of people have chosen to install the service, far exceeding the domestic installation rate of 55%.

These data constantly reveal differences between overseas and domestic markets.

Let’s compare the sales volume of the Volkswagen ID series in the domestic and European markets. The sales volume of the Volkswagen ID series in the Chinese market from January to September this year is about 47,000 units, while the European sales volume during the same period has exceeded 220,000 units. This may indirectly lead to the resignation of the CEO of Volkswagen Group (China), Feng Sihan.

Interestingly, just a year ago, Feng Sihan publicly criticized extended-range electric vehicles, saying, “From the perspective of a single bicycle, extended-range EVs have some value, but from the perspective of the whole country and the planet, it is simply nonsense and the worst solution!”

In this era, where almost anything can be made into a car, the divide between the East and the West seems unlikely to last even thirty years. Even if the top three emerging automakers with increasing delivery volumes cannot afford to take it lightly.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.