Author: James Yang Jianwen

Following NIO and XPeng, the quarterly financial report of Li Auto is here.

Without further ado, let’s get into it.

Possibly the first profitable new automaker

After reading this financial report, I think many people will have the same feeling.

There are two key indicators in the financial report that are worth our attention: net loss and gross margin.

Net loss represents the operating situation of an automaker, while the gross margin reflects the ability of an automaker to generate profits.

In this quarter, Li Auto’s net loss was only RMB 21.5 million (USD 3.3 million), a decrease of 90.9% from the previous quarter (RMB 235.5 million) and a decrease of 79.9% from the same period last year (RMB 106.9 million).

In comparison, NIO’s net loss this quarter was RMB 8.353 billion (USD 1.296 billion) and XPeng’s was RMB 1.594 billion.

It has to be said that Li Auto’s cost control ability is really strong.

On the gross margin side, Li Auto performed exceptionally well compared to other new automakers in China. In this quarter, Li Auto’s gross margin was 23.3%, compared to 19.8% in the third quarter of 2020 and 18.9% in the second quarter of 2021, a significant improvement.

In comparison, NIO’s gross margin was 20.3% and XPeng’s was 14.4%.

Regarding the improvement in gross margin, Li Auto’s chairman Li Xiang said: “Mainly because the price of the 2021 Li ONE is higher, and despite the semiconductor shortage, our supply chain management team has made a lot of efforts in cost control.”

“We need to ensure a healthy gross margin (long-term target is 25%), in order to ensure long-term investment of more than 10 percentage points of R&D expenses for technological research and development beyond the product. This is a very important mission and responsibility for our hardware technology enterprise of this generation.”

Of course, another factor that makes people think that Li Auto will be the first to achieve profitability is its delivery guidance this time.

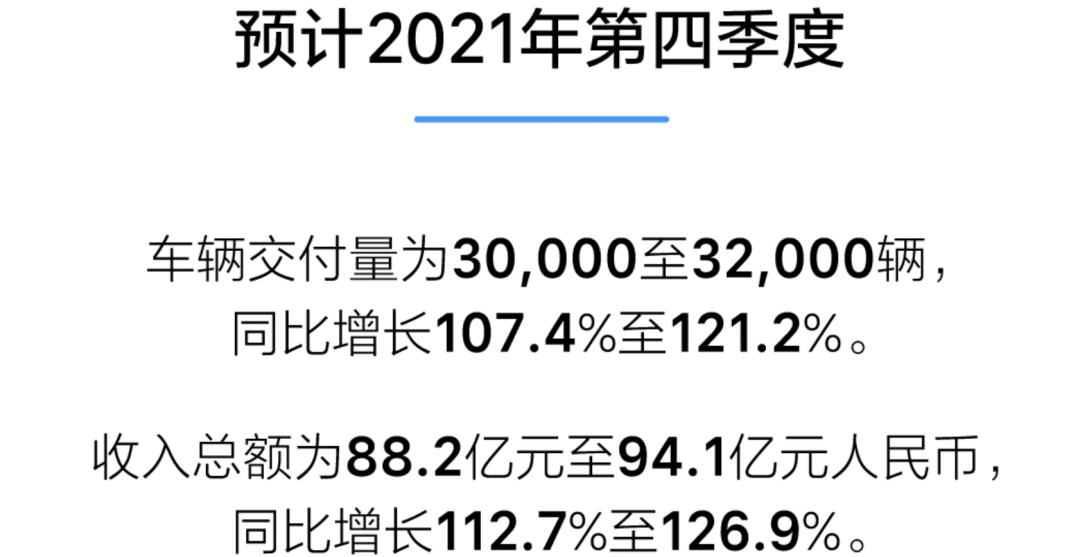

In the fourth quarter, Li Auto expects to deliver between 30,000 and 32,000 vehicles, with October’s delivery volume of 7,649 vehicles. This also means that Li Auto’s sales volume in the next two months will exceed ten thousand.

That is to say, Li Auto’s financial performance in the fourth quarter will be even better.## Increase R&D investment, NOA to be released in December

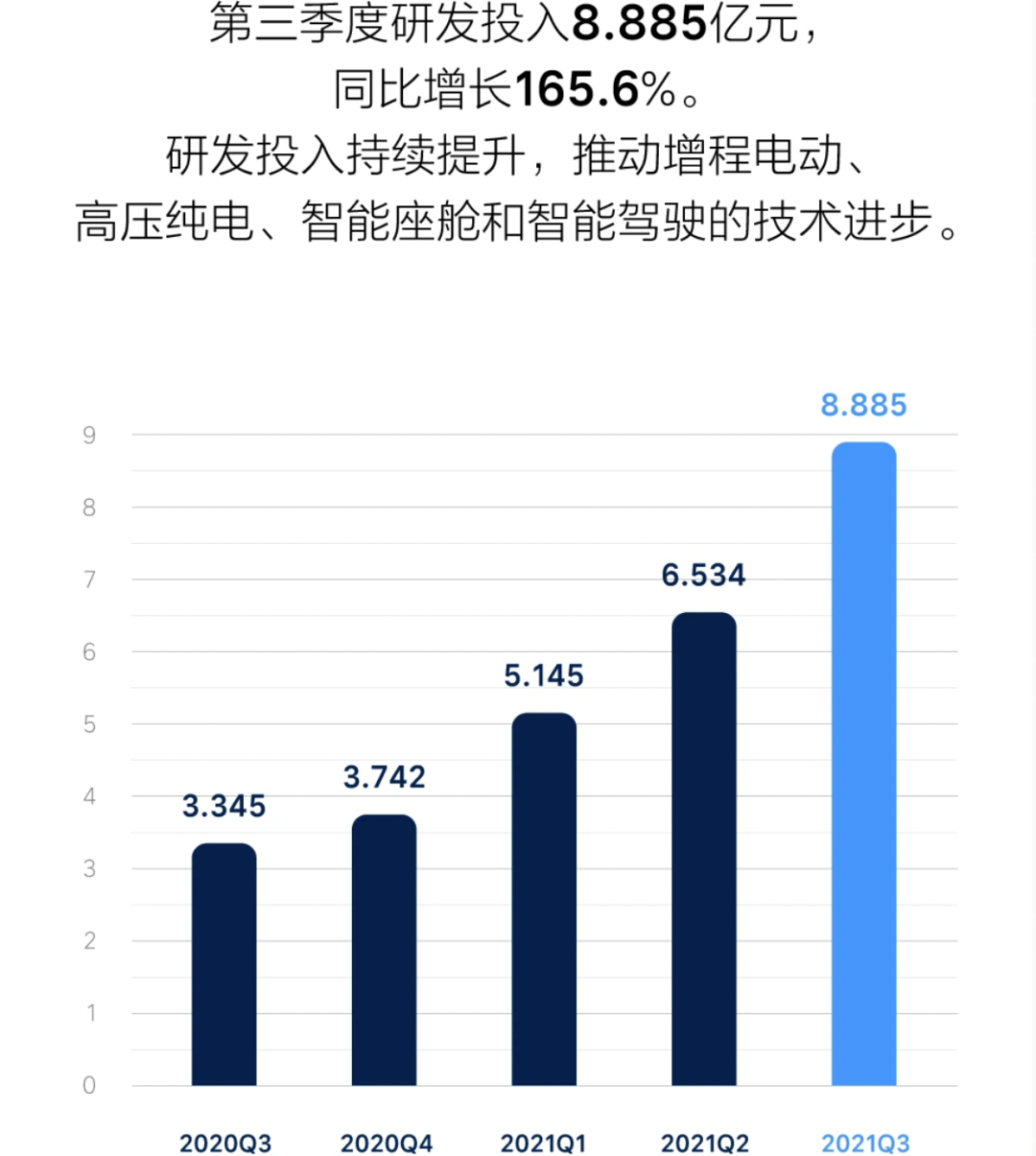

Furthermore, IDEAL continuously increases its investment in research and development.

In Q3 2021, IDEAL invested ¥888.5 million in research and development, a quarter-over-quarter growth of 36.0%. The total research and development expenditure in the first three quarters amounted to ¥20.564 billion.

Earlier, Li Xiang stated that “research and development investment for this year should be increased to ¥3 billion.” That is to say, investment in R&D for Q4 will be approximately ¥950 million.

In comparison, Xiao-Peng and Wei-Lai’s research and development expenses for the first three quarters came to ¥2.783 billion and ¥2.76 billion respectively, both are close to ¥3 billion.

However, IDEAL stated that it will continue to invest in high-voltage pure electric, intelligent cockpit, and intelligent driving technologies.

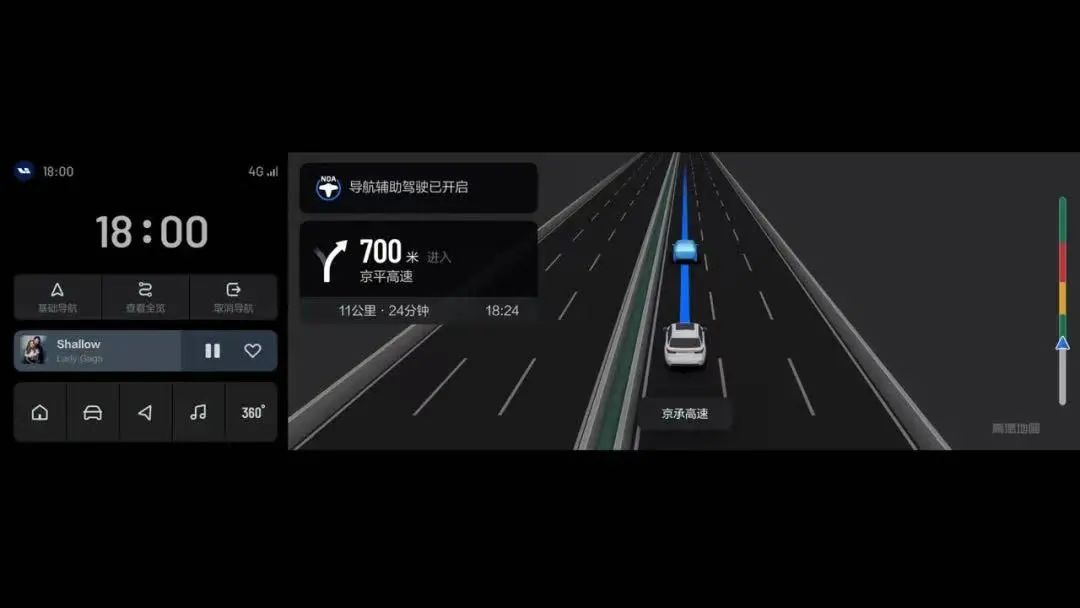

Since we mentioned intelligent driving, here is a small additional detail: IDEAL NOA will be officially released in December.

As the last among the top three new forces to deliver navigation assistance functionality, everyone is paying close attention to how IDEAL’s NOA will perform.

IDEAL Automotive CTO Wang Kai stated: “We have completed over one million kilometers of testing. Since the 2021 IDEAL ONE model, NOA functionality has been standard, making this month’s OTA push the largest NOA release activity in China, which I believe is the biggest difference compared to our peers.”

We can look forward to the upcoming performance of NOA.

Doubling of retail centers next year

In terms of sales and service networks, as of October 31, IDEAL has 162 retail centers nationwide, covering 86 cities, with 223 after-sales maintenance centers and authorized sheet metal spraying centers covering 165 cities.

Obviously, the continuous expansion of these sales and service networks has allowed IDEAL to reach a larger potential user base, thereby converting into IDEAL’s sales volume.

By the end of this year, IDEAL’s retail centers will open to 200, covering about 100 cities.

Moreover, IDEAL Automotive co-founder and president Shen Yanan announced another goal: “the plan for next year is to at least double the number of retail stores (to 400)“.

May 1st, 2019, the first 5 Ideal Retail Centers opened. The goal of 200 centers will be achieved by the end of this year.

Next, Ideal plans to double this number in a year, which is undoubtedly ambitious.

Behind this ambition are Ideal’s sales ambitions.

Although Ideal currently only has one product, Ideal ONE, it is really powerful. The sales of this model are almost catching up with the total sales of many new models from NIO or XPeng.

With the increase in the number of stores, Ideal’s sales are expected to further increase.

Moreover, don’t forget that there will be X01 next year. This new car will go on sale in the second quarter of 2022 and delivery will start in the third quarter.

The addition of this new car will bring new increases in performance.

The total production capacity will reach 700,000 by the end of 2023.

Correspondingly, there is the problem of production capacity.

Currently, Ideal has two factories: Changzhou factory and Beijing factory (under construction).

According to the previous plan, the Changzhou factory will add a new plant with an annual production capacity of 100,000 vehicles. The new workshop is expected to be completed in 2022. By then, the annual production capacity will increase to 200,000 vehicles.

In this financial report, Shen Yanan stated that currently the factory’s production capacity can basically meet the demand of 14,000 vehicles per month, and the main challenge is the shortage of chips. If the current chip shortage problem can be solved, the factory’s production capacity is expected to climb to 15,000 vehicles/month after the Spring Festival.

15,000 vehicles/month is equivalent to an annual production capacity of 180,000, which is close to the upper limit of 200,000. This expansion of production capacity is actually to prepare for the mass production of X01 in the future.

In addition to this Changzhou factory, Ideal also added a Beijing factory this year.

In October 2021, the Ideal Beijing Green Intelligent Factory officially started construction and is planned to be put into operation in 2023. After it is put into production, Phase I will achieve an annual production capacity of 100,000 pure electric vehicles, and it will become an important manufacturing base for Ideal’s high-end pure electric vehicles.

Ideal expects to reach an annual standard design production capacity of 500,000 by the end of 2023. With two shifts, the total production capacity will reach nearly 700,000 per year.

Behind the massive expansion of production capacity, is the intensive release of ideal products. According to the previous prospectus, in 2023, Ideal will launch two extended-range electric SUVs and two high-voltage pure electric cars.

It can be foreseen that 2023 will be a big year for ideal products.

Regarding the first pure electric new model in 2023, Ideal stated that in addition to the smooth progress in optimizing the 4C battery, the air conditioning system of the new product has also been improved. In addition, many progress has been made in high-power charging facilities.

“At present, we are still progressing according to the plan of launching the first high-voltage pure electric vehicle in the second half of 2023.”

Summary

Previously, when it was heard that Ideal was relying on a single product to survive in 2020, there were many doubts from the outside world.

However, in the past 10 months, Ideal has taken action to break this doubt – becoming the fastest company among new forces to break the record of 100,000 units with a single model.

At the same time, gross profit margin continues to increase, net loss continues to narrow, sales continue to rise, and Ideal has faintly reached the threshold of profitability.

In addition to these, Ideal has also clearly accelerated: doubling of retail centers, increasing research and development investment, capacity turning several times, and 5 new models…

The feeling I got is: Ideal is weaving a big net in an orderly manner, and this net will be fully deployed in 2023.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.