XPeng Motors Releases Q3 2021 Financial Report

Delivery Data

-

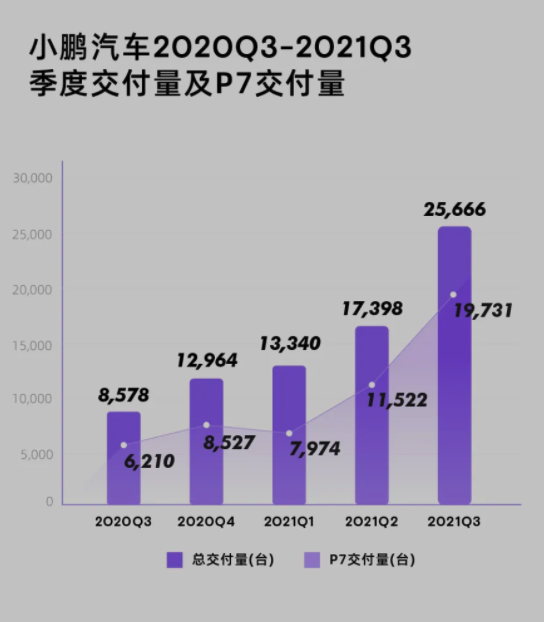

XPeng delivered 25,666 vehicles in Q3 of 2021, among which 19,731 were P7s. The number exceeded XPeng’s prediction for Q3 delivery, which ranged between 21,500 and 22,500 cars.

-

The overall delivery volume increased by 199.2% YoY and 47.5% QoQ.

-

99% of the P7 delivered in Q3 2021 supported XPILOT 2.5 or XPILOT 3.0.

Financial Data

-

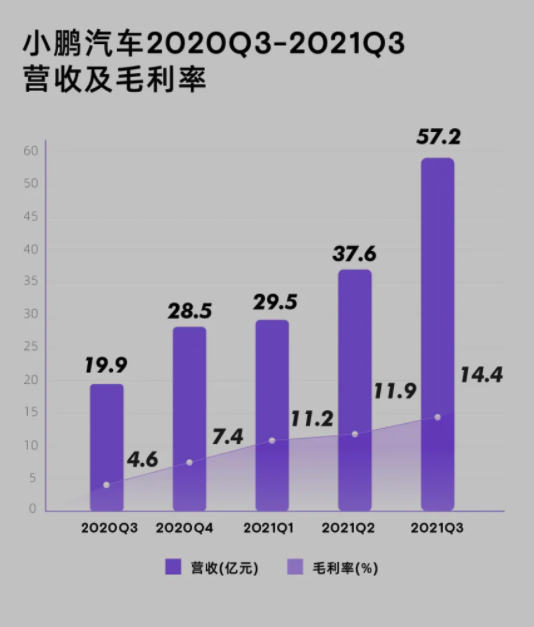

Total revenue was CNY 5.7199 billion, up 187.4% YoY and 52.1% QoQ.

-

Revenue from car sales was CNY 5.4601 billion, up 187.7% YoY and 52.3% QoQ.

-

The total gross margin for Q2 was 14.4%, up from 4.6% YoY and down from 11.9% in Q2 2021.

-

The gross margin per car was 13.6%, up from 3.2% YoY and down from 11.0% in Q2 2021.

-

The net loss was CNY 1.5948 billion, up from CNY 1.1488 billion YoY and down from CNY 1.1946 billion in Q2 2021.

-

Cash and cash equivalents, restricted cash, and short-term investments totaled CNY 45.3579 billion, up from CNY 32.8712 billion in Q2 2021.

-

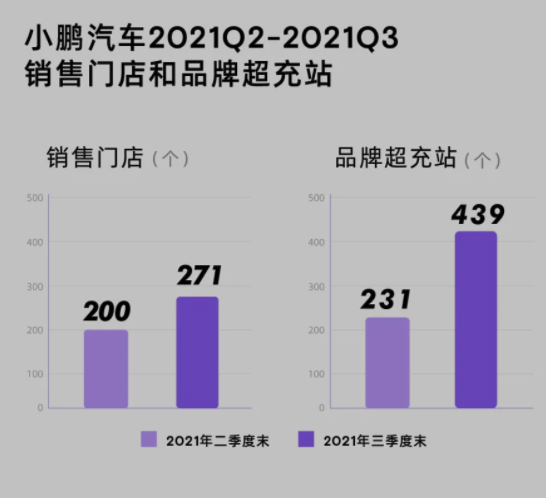

As of September 30, XPeng’s entity sales network had 271 stores covering 95 cities. XPeng’s brand supercharging stations expanded to 439, covering 121 cities.

Sales Cost# Sales Cost

The sales cost of Q3 2021 was RMB 48.991 billion, an increase of 158.0% compared to RMB 18.986 billion in the same period in 2020, and an increase of 47.9% compared to RMB 33.127 billion in Q2 this year. The growth was mainly due to an increase in delivery volume.

R&D Investment

The R&D expense of Q3 2021 was RMB 12.642 billion, an increase of 99.0% compared to RMB 6.354 billion in the same period in 2020, and an increase of 46.4% compared to RMB 8.635 billion in Q2 this year. The increase was due to:

- An increase in personnel costs

- An increase in R&D costs for vehicle and software technology

- R&D costs for P5 and G9.

Sales and General Administrative Expenses

The sales and general administrative expenses of Q3 2021 was RMB 15.384 billion, an increase of 27.8% compared to RMB 12.038 billion in the same period in 2020, and an increase of 49.3% compared to RMB 10.308 billion in Q2 this year.

The increase was mainly due to:

- Higher marketing and advertising expenses to support vehicle sales

- An increase in manpower costs and site costs, as the sales network expands.

XPeng’s Q4 2021 Expectations

XPeng expects to deliver between 34,500 and 36,500 vehicles, a year-on-year increase of approximately 166.1% to 181.5%.

Total revenue is expected to be between RMB 7.1 billion and RMB 7.5 billion, a year-on-year increase of approximately 149.0% to 163.0%.

Source: XPeng Official Website

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.