Author: Kenvin

Introduction: The Polar Star brand is so prestigious, how could it be crushed by Tesla/XPeng? Strange? Not really.

Recently, there’s been a screenshot circulating online regarding the Polar Star 2, a vehicle under the Polar Star brand, being sold at a heavily discounted price of 61% off, becoming the talk of the new energy vehicle industry.

The Polar Star 2 currently has three models on sale for the 2021 version, which are the single-motor standard range, single-motor long-range, and dual-motor long-range models. The current recommended price range is between 252,800-338,000 yuan (subsidized price), with a range of between 485-565 kilometers under NEDC conditions. Its competitors are Tesla Model 3, XPeng P7, and other models.

The discounted model mentioned in the online screenshot is the 2020 old model, and from the above information, it is revealed that the production date is between June-October 2020, which is obviously a stock car that has been overstocked, rather than a car that needs to be sold at a discount due to transport integration. So why did the Polar Star brand, with Volvo blood, fall to the point of needing to clear inventory with a heavy discount, spitting blood to sell them?

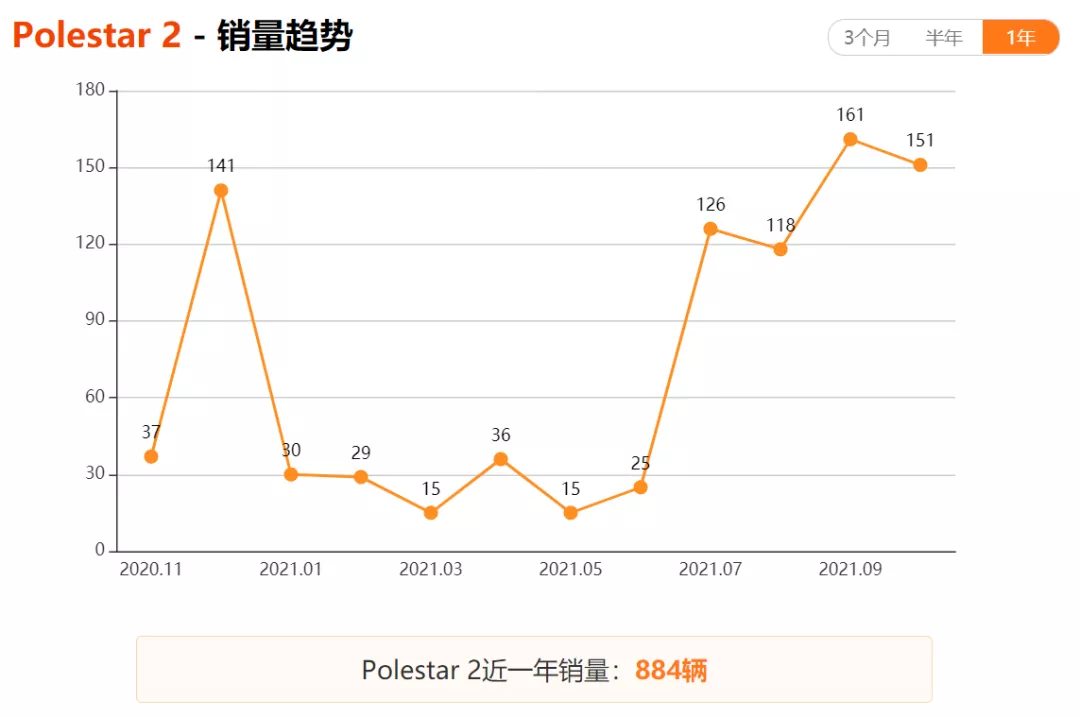

After checking the sales of the Polar Star 2 over the past year, it can be learned that the total sales of the Polar Star 2 in the past year do not even exceed four digits, with only 884 vehicles sold, and the lowest monthly sales being only 15 vehicles. Another car that is currently on sale is the Polar Star 1, which is limited to 500 vehicles and has a price of as high as 1.45 million yuan. In the past year, it recorded a miserable 19 vehicles sold, which is pitiful to behold.

From the information revealed in the screenshot, it can be learned that the discounted inventory car is the 2020 Polar Star 2 (Polestar 2) First Edition, with a recommended price of 418,000 yuan, and after a discount, it sells for only about 250,000 yuan, with optional high-performance packages costing only 260,000 yuan. From the perspective of the price drop, the price is quite tempting, and some “car reviewers” believe that the discounted price is worth considering, stating that after test driving the vehicle, they feel that the car has the essence and shadow of Volvo with a solid chassis and top-notch handling.

Relying on Volvo, Poor Brand Promotion

Currently, Polar Star’s domestic sales channels are divided into direct stores + agents, with only Beijing and Shanghai having Polar Star direct stores, while other cities are all franchise agents. The screenshot of the Polar Star 2 selling at a discount online is also likely a means for the franchise agents below to clear their stock and make a profit.# Polestar: The High-End Global Electric Vehicle Brand Co-created by Volvo and Geely

Polestar, a high-end global electric vehicle brand co-created by Volvo and Geely, was established in 2017. Sharing the same headquarters location in Sweden with Volvo, Polestar’s marketing strategy, design, and interior style also bear the resemblance of the renowned carmaker.

For instance, the classic Volvo Thor’s Hammer headlights have been fully transplanted onto the Polestar 2. As for the Polestar 1, it looks more like the coupe version of the Volvo S90, which only has a starting price of 330,000 RMB (about $51,000) compared to the Polestar 1’s limited release of 500 units selling for 1.45 million RMB (about $225,000). Such a sales tactic is hard to comprehend.

The promotion of Polestar is mainly led by Volvo rather than Geely, who plays the role of an OEM. However, this overreliance on Volvo has resulted in low design recognition for Polestar vehicles and a logo that looks similar to other brands. This has made it challenging for the new brand to attract more consumers in China. Consumers tend to have the thinking that if they can buy a Volvo, why would they purchase a relatively unknown sub-brand? This lack of attention and sales naturally dampens the brand’s growth.

Geely sees Polestar as a strategic brand that competes with Tesla. In September 2020, Polestar CEO Thomas Ingenlath stated that Polestar’s vision is not only to become a strong challenger against Tesla in China, but also to compete with traditional luxury car giants such as BMW, Benz, and Audi (BBA).

Polestar’s designs are created by its Swedish headquarters while its factory in Chengdu, China handles production before exporting to other markets. Although Polestar 2’s sales in China have not met expectations, it has become a hot seller in the European market. In fact, last year, Polestar 2 even outsold Tesla Model 3 in some European markets (M3 sales can be quite erratic).

Although Polestar 2’s global sales figures are not available online, the number of recalls worldwide shows its sales performance in Europe was decent. In 2020, Polestar officially announced a worldwide recall of Polestar 2 sedans due to faults in the inverter and coolant heater, affecting 7,736 units. This reflects the brand’s sales performance in the European market.

Media outlets have reported on the closures of Polestar stores in China. Within a year, three Polestar stores have closed as of July 2021. A sales representative from a Polestar store in Xi’an explained that the store closed in mid-July, and the test drive cars have been recalled by the manufacturer. As such, selling off existing stock at a discount after closing down is not surprising.

Despite this, Geely is not giving up on Polestar and intends to achieve multi-brand development.As the major shareholder of Volvo Car, Geely Group had hoped to leverage Volvo’s foundation to create a high-performance global electric car brand that could compete with Tesla, designed and promoted by Volvo, which would have enabled faster and more convenient entry into the European market than domestic brands’ international sales channels.

However, from the current sales situation, Li Shufu’s vision is lofty, but the reality is tough. In light of this, Li has adopted a “multi-legged” approach, not only joining forces with Baidu to establish Jidu Auto, but also spinning off a pure electric car brand from the former Lynk & Co brand – ZEEKR, which has officially entered the increasingly fierce competition in China’s new energy vehicle market.

On October 23, ZEEKR 001 officially started delivery of its first batch. From the brand’s founding to the production and delivery of its first model, ZEEKR only took 192 days. This demonstrates Geely’s efforts and urgent desire to catch up in the field of new energy vehicles, and also highlights Geely Group’s ample reserves in vehicle manufacturing technology and supply chain management.

Due to the strategic planning and product positioning of the Geometry brand, which primarily focuses on ride-hailing and supply for Caocao Zhuanche, a ride-hailing service owned by Geely, this market share of ride-hailing falls far behind the “giants” such as BYD and Guangzhou Automobile Group because of the lack of products and outdated designs.

On the other hand, the Polestar brand is primarily focused on high-end electric vehicles, but its weak product performance and lagging brand promotion and channel marketing have fallen behind even competitors such as Tesla’s Model 3 and new challengers such as Xpeng P7 and BYD Han EV. In simple terms, Polestar can’t even keep up with its competitors, let alone lead the way.

Geely Group has not yet given up on the Polestar brand, and is working hard to push for Polestar’s IPO fundraising. According to foreign media reports, Geely is trying to seek a listing in the United States for its luxury electric vehicle subsidiary Polestar through a special purpose acquisition company (SPAC) transaction. This capital operation of shell listing has been tried by Jia Yueting’s FF and LUCID, Tesla’s main competitor, which has recently begun deliveries.

According to a report by The Wall Street Journal citing unnamed sources, Geely had planned to raise the valuation of Polestar from $7 billion to $40 billion.

At present, it is inevitable for Polestar to seek IPO financing, but with the current products and poor sales, investors in the market cannot see the development prospects of Polestar. Polestar needs to leverage Volvo’s technology and Geely Group’s strong supply chain and production capacity to create impressive products, rather than just relabeling and rebranding existing Volvo models for launch, while also deepening its user operations to find breakthroughs.# Polestar Precept Concept Car Unveiled at the 2020 Beijing Auto Show

Polestar unveiled its new concept car, the Precept, at the 2020 Beijing Auto Show, which immediately captured the attention of the public. Although still a concept car, with Geely’s strong car-making ability, it is not impossible for Precept to be mass-produced, and its entry will further enhance the market awareness of the Polestar brand. With the increasing competition in the new energy vehicle market, Polestar has yet to announce the timetable from Precept’s concept car to mass production.

With Volvo’s deep technological heritage, and Geely’s strong manufacturing capability and sales channels, whether the Polestar brand can rise remains to be seen. The answer can only be answered by Geely and Volvo’s management through product and market measures. However, how much time is left for them?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.