Translation:

Article: 1,597 words

Estimated reading time: 6 minutes

The future of Tesla is: a vertically integrated car company with software and hardware integration, an energy production and charging network company, and a company in travel technology.

Next, let’s talk about why Tesla is a travel technology company.

Tesla has a set of automated driving assistance software (Autopilot, AP) and a set of fully automated driving software (Full Self-Driving, FSD). Currently, Autopilot has been widely used commercially, while FSD is still in the testing process.

In my opinion, the commercial maturity of AP and FSD software corresponds to completely different future developments for Tesla.

Firstly, let’s analyze AP. Currently, Tesla divides AP into: Basic AP (BAP) and Enhanced AP (EAP). BAP has become a standard configuration for all Tesla models, which means it can be used for free after purchasing the car. EAP can be purchased once ($5,000) or subscribed monthly ($99/month).

The standard BAP has adaptive cruise control, automatic lane keeping, and vehicle emergency response functions. EAP has four additional functions compared to BAP: automatic lane change with indicator, high-speed automatic navigation driving, automatic parking, and vehicle summoning.

From the perspective of car owners’ usage scenarios, the standard BAP of Tesla is basically sufficient for urban use, which can reduce daily driving fatigue and increase vehicle safety. If daily travel distance is relatively long and there is a strong demand for automatic parking or vehicle summoning, EAP can be purchased as an option.

Based on the current fleet size, as of the end of 2021, there are approximately 2.5 million Teslas on the road globally, assuming that 5% of them use EAP by subscribing monthly. At the same time, Tesla delivered 950,000 new cars in 2021, assuming that 5% of them were purchased once to use EAP.

Therefore, it can be calculated that Tesla’s EAP revenue in 2021 is $240 million (one-time payment) + $150 million (subscription payment) = $390 million.

By 2031, if Tesla sells 18 million cars per year as mentioned in the previous article, and the vehicle is calculated based on an average of 7 years of elimination period, based on modeling, there will be approximately 640 million Teslas in circulation. At the same time, assuming that the market gradually accepts EAP and the subscription rate reaches 45%, and the one-time purchase rate reaches 10% at that time.

Then, it can be calculated that Tesla’s EAP revenue in 2031 is approximately $9.6 billion (one-time payment) + $25.5 billion (subscription payment) = $35.1 billion.BAP and EAP are both software, and the characteristics of software revenue are that marginal costs are almost zero. Since the expenses of software R&D teams have been taken into account in the net profit of vehicle manufacture (operational costs per vehicle are subtracted) at the time, the EAP revenue calculated here can basically be considered as net profit.

At the beginning, I mentioned that the corresponding commercial maturity of AP and FSD, two sets of software, will lead to completely different futures for Tesla. The calculation of AP revenue is actually based on the assumption that FSD cannot achieve wide commercial use until 2031.

If FSD can be widely used in the future, Tesla can truly become a travel technology company.

The biggest difference between AP and FSD is that the former is “human-machine cooperation”, while the latter is “full automation”. The cost of any work involving “people” in the world will be high, so full automation is actually reducing “labor costs”.

There are many ways to measure the impact of FSD on Tesla’s revenue and net profit after widespread commercial use. Here, we will temporarily analyze it from a closer-to-common-sense perspective–factor substitution method.

Since the car is a means of transportation, the ultimate goal to be achieved is actually to move from point A to point B. It is not necessarily to own a car to achieve this goal, that is, “shared travel (rental car / Didi)” or “owning a car (private car)” is also possible. Of course, when considering these two options, it is not always just about moving from point A to point B. Often, personal needs such as cleanliness, comfort, and peace and quiet are also taken into account.

Assuming that 30% of Tesla’s fleet in 2031 is a shared travel fleet, and the remaining 70% are still privately owned private cars (the revenue and net profit logic of this part is the same as AP).

So, how will the 30% shared travel fleet affect Tesla’s revenue?

In China’s shared travel market, drivers can earn about 15,000 yuan/month (2400 US dollars/month) after deducting all necessary expenses (fuel, meals, maintenance costs, etc.) when working for about 12 hours a day. When FSD can replace the driver’s work, that is, the driver’s income becomes FSD’s income.

64 million vehicles x 30% = 19.2 million vehicles, FSD’s annual income is $28,800, and the calculated revenue is $552.9 billion.

The net profit of $552.9 billion is likely more than three times the sum of the profits from AP, energy, and manufacturing discussed in previous articles.The translation of the Chinese text in Markdown into English Markdown text is as follows, with HTML tags preserved:

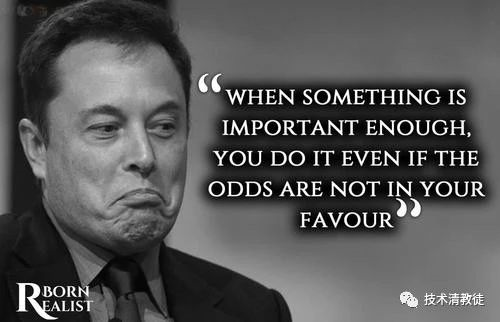

Of course, this requires Elon Musk and Tesla’s team to work hard and achieve FSD. However, I am reminded of a sentence, “when something is important enough, you do it even if the odds are not in your favour.”

(to be continued)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.