Regarding the new energy insurance data for October, I want to analyze it from a geographical dimension by selecting some distinctive regions for analysis. From a macro perspective, analyzing enterprises and models from multiple angles will yield better results.

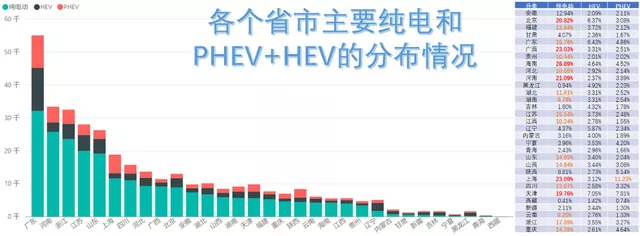

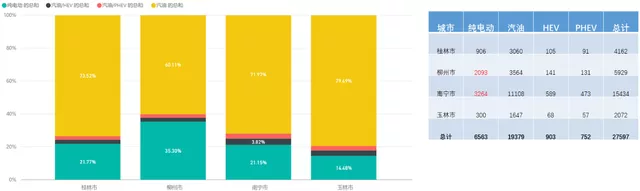

Traditionally, we mainly focus on regions with the highest penetration rate of pure electric vehicles, such as Hainan, Beijing with a penetration rate exceeding 20%, Guangxi, Henan, Shanghai, and Tianjin with a penetration rate close to 20%.

In terms of absolute numbers by province, it is not particularly meaningful because the automobile consumption base in different regions is not the same. The significance is greater when exploring the provinces and cities from the perspective of penetration rate.

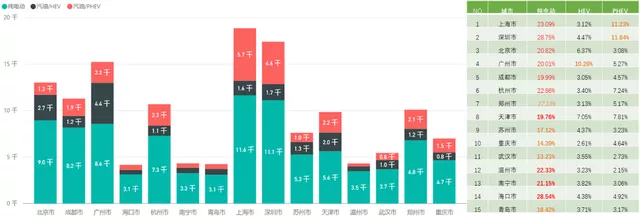

Looking at it from the city dimension, the top 15 cities have a pure electric penetration rate of over 10%. They are divided into three levels: 10%, 20%, and the one that strives for over 30%. As for the penetration rate of PHEVs, it is generally below 10%, with only Shanghai and Shenzhen exceeding 10%. From the geographic perspective of PHEV development, it is more like a differentiated strategy for HEVs, vying for the market of fuel vehicles on a broader geographic scale.

Secrets of High Penetration Rate in New Energy Provinces

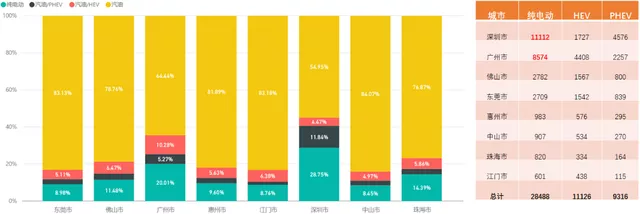

(1) Guangdong Province

Guangdong Province has experienced the fastest growth in new energy vehicles, with two cities having an extremely high penetration rate, and the penetration rate of several surrounding cities is gradually increasing. Overall, Guangdong’s total sales volume is achieved around Shenzhen and Guangzhou. The policies of the two cities have been sustainable, making Guangdong the leader of China’s new energy vehicles for a considerable period of time in the future.

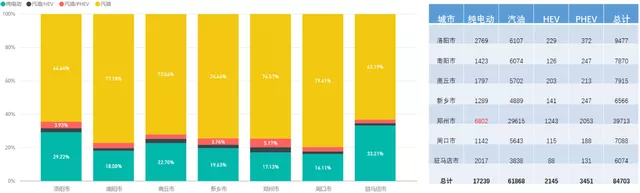

(2) Henan Province

The high penetration rate in Henan is mainly due to the limited overall sales volume, making it a typical A00-level high penetration province. The A00-level penetration has achieved popularization of cars in a certain way, resulting in a high penetration rate of 30% in cities such as Luoyang and Zhumadian.

(3) Guangxi ProvinceThe high penetration rate of electric vehicles in Guangxi is mainly based on the promotion of pure electric A00 models in major cities such as Liuzhou. In essence, it is somewhat similar to the strategy in Henan, where HEV and PHEV models are not selling well, and only popular models are being promoted.

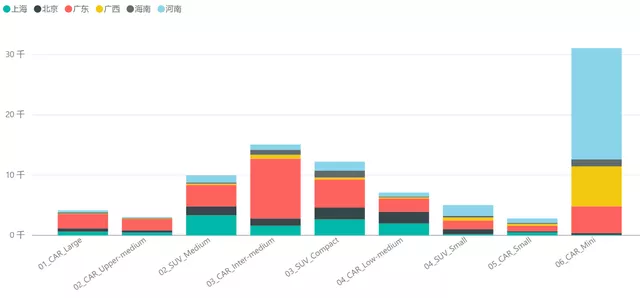

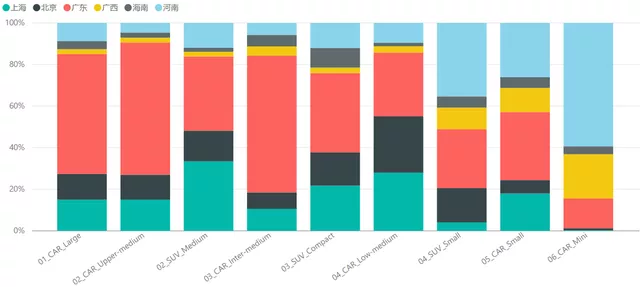

Therefore, if we compare the ratio and absolute quantity of different types of vehicles among these provinces with Beijing and Shanghai, we can see the strategic weapons relied on by well-promoted regions as shown below.

If we further break down the vehicle types, this is quite obvious.

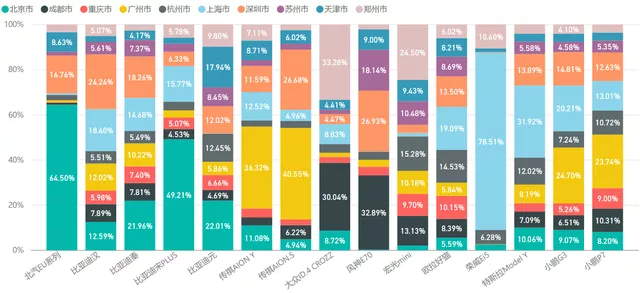

The Secret of Cities

From the current vehicle models, the following table is quite clear. BYD has better overall promotion effect in Beijing, but there are concerns about the actual situation after winter. And several models of GAC, Aion S depends on Guangzhou and Shenzhen, while Aion Y still depends on Guangzhou and Shenzhen.

From the following perspective, there are still quite a few 2G models in recent times, and we need to carefully match the data.

## Summary:

## Summary:

I’ve always believed that China has made a breakthrough in new energy vehicles this year. From the perspective of the total amount, it’s been a very good year. However, there are problems with the structure and promotion model, and this poses a certain potential risk for 2022. We can’t just focus on the penetration rate.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.