On November 10th, NIO released its Q3 2021 financial report.

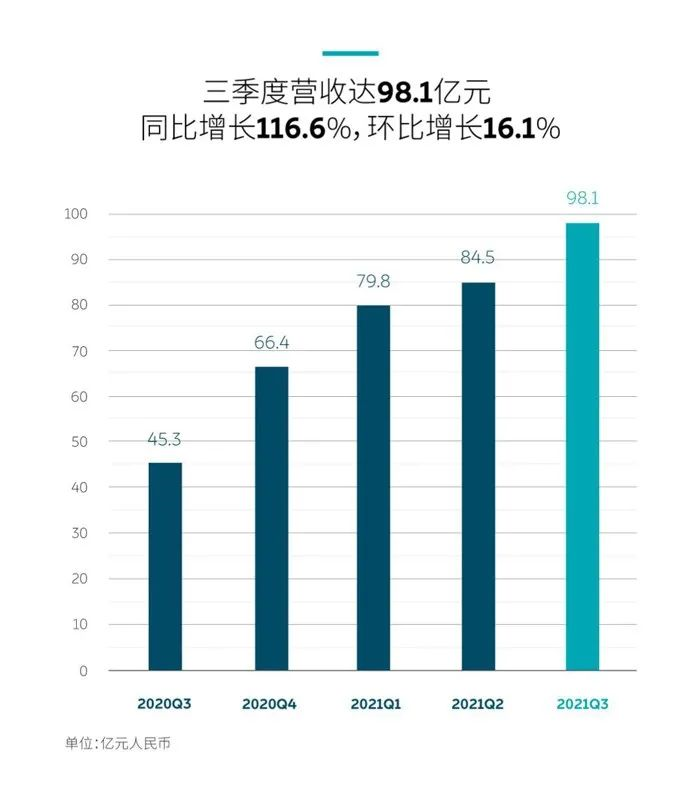

According to the report, NIO achieved a total revenue of RMB 9.81 billion in Q3, an increase of 116.6% YoY. The revenue from vehicle sales was RMB 8.64 billion, an increase of 102.4% YoY.

In terms of gross profit margin, the comprehensive gross profit margin in Q3 was 20.3%, an increase from 18.6% in Q2 2021 and 12.9% in Q3 2020. However, the gross profit margin for vehicles was 18.0%, lower than 21.2% in Q1 and 20.3% in Q2.

NIO’s net loss in Q3 was RMB 835.3 million ($129.6 million), a 20.2% decrease from last year, but a 42.3% increase from the previous quarter. The sales cost was RMB 7.812 billion, a YoY increase of 98.3% and a 13.6% increase from the previous quarter.

This indicates that although NIO’s sales volume continues to grow, its losses and sales costs have also increased as delivery volume increases.

NIO stated that the decrease in vehicle gross profit margin was due to two reasons: increased financial subsidies for vehicle purchases, which resulted in a reduction of vehicle sales revenue, and shorter depreciation cycles for existing products due to faster product upgrades, resulting in an increase in the amortization and depreciation cost per vehicle.

The increase in sales costs was mainly due to the increase in sales staff and the expansion of the sales and service network.

However, NIO expects an increase in gross profit margin for the 75kWh ternary lithium battery model and the 70kWh ternary lithium battery model that were delivered in November. NIO is confident that by working on product design and supply chain adjustments, it can improve overall gross profit margin. NIO expects to maintain a stable profit margin in Q4.

NIO’s CFO, Qiu Yu, stated that NIO’s vehicle gross profit margin target for next year is 20%, and after the launch of NT2.0, the gross profit margin target for NT2.0 products will be further increased to 25%. To achieve this, it is estimated that the annual production capacity needs to reach around 300,000 units, which is still a challenging target considering that most of China’s new car makers are still struggling to deliver 100,000 vehicles annually.

Record Delivery Volume in Q3NIO delivered 24,439 vehicles in Q3, a YoY increase of 100.2% and a QoQ increase of 11.6%, setting a new quarterly delivery record. Among them, the delivery volume in September exceeded ten thousand for the first time, reaching 10,628 units, a YoY increase of 125.7%. In terms of specific models, NIO sold a total of 5,418 ES8, 11,271 ES6, and 7,750 EC6 in Q3. The ES6, a relatively traditional model with a relatively affordable price, remains the main sales force.

However, in October, NIO’s delivery volume decreased significantly, with only 3,667 units, a QoQ decrease of 65.5%. Regarding this, NIO CEO William Li stated that this was due to the company’s preparation for the introduction of new products, as well as the reorganization and upgrading of existing production lines, while also being partly affected by supply chain fluctuations.

For order delivery delays caused by the impact of production line reform, NIO will issue 1,000 delay delivery points per day to each user from the order lock-in date until the vehicle is delivered. Users who were originally planned to receive delivery in September and October 2021, but did not receive delivery as scheduled, will also receive an additional 2,888 points after taking delivery, in addition to the delay delivery points mentioned above.

NIO expects to deliver 23,500-25,500 new vehicles in Q4, a YoY increase of about 35.4% to 46.9%, and a QoQ decrease of about 3.8% to about 4.3%. To meet this target, NIO must achieve monthly delivery volumes exceeding ten thousand in the remaining months of November and December.

Increased Investment in R&D will Continue

2021 is a critical year for NIO to lay a solid foundation for future development. Therefore, in the third quarter, NIO’s R&D expenses increased by 101.9% YoY and 35% QoQ, reaching CNY 1.19 billion, accounting for 12.17% of total Q3 revenue.

William Li stated that the number of R&D personnel in the company has doubled this year, so the efficiency of NIO’s R&D and landing of new products and technologies has improved rapidly. Some R&D results have been realized.

The aerodynamic design of ET7 has been re-optimized, reducing the drag coefficient from the original 0.23 to 0.208. The company has also released the innovative 75 kWh ternary lithium iron battery pack, which combines the advantages of ternary lithium batteries and lithium iron phosphate batteries. The NIO OS 3.0 vehicle system and the 8155 cockpit hardware upgrade plan for older models, as well as the new generation of NAD driving assistance system, have been comprehensively optimized.

In the fourth quarter, we will see a rapid increase in NIO’s R&D investment, especially in new products and charging infrastructure.

Summary

From the third quarter financial report, the high operating costs that have been hampering NIO’s short-term revenue growth still exist. However, it cannot be denied that a high-quality infrastructure, service network, and charging network are all part of NIO’s competitiveness. Continued high investment in R&D is also one of NIO’s long-term competitive strategies.

As these sustained investments become more scaled, and truly play a role in reducing costs, NIO’s new car profit will usher in a new leap forward.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.