The experience of NIO in the third quarter was like a trip that had been planned for a long time, with a series of exciting and beautiful moments at the beginning, but ended with someone suddenly leaving the group.

Despite the highs and lows, a series of technical and product releases marked the highlight of the time, which made the industry somewhat unpredictable when the delivery volume came out in October.

Fortunately, the release of the 2021 Q3 financial report soon followed, providing NIO with a good opportunity to validate itself.

From the content of the financial report to the conference call, a clear signal can be felt: to evaluate NIO, what is needed is to look forward.

Surpassed gross margin, advancing R&D expenditure

Strong growth remains the theme of this year’s financial reports for all new forces.

In terms of core indicators, NIO achieved another record high in Q3, including:

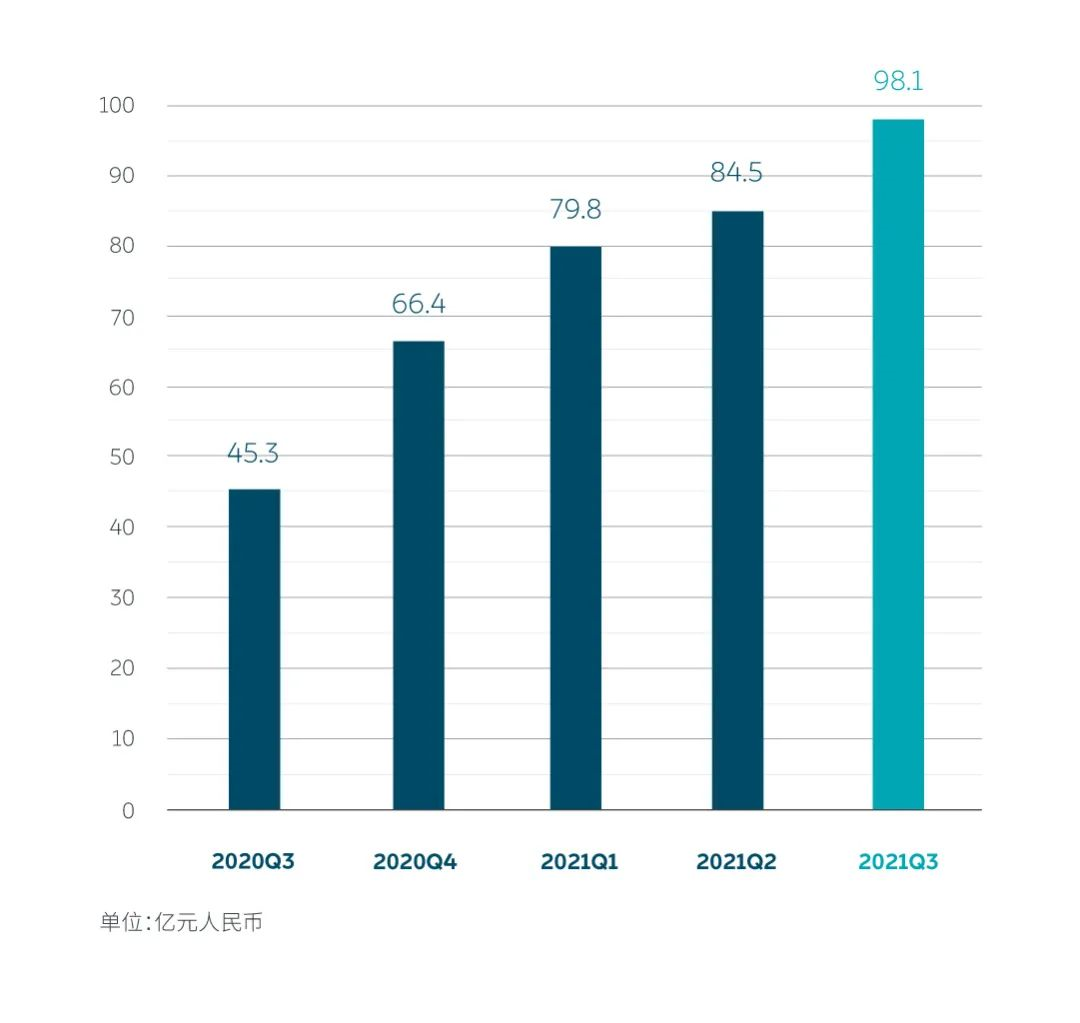

Total revenue in Q3 was RMB 9.8053 billion (USD 1.5218 billion), up 116.6% year on year and 16.1% quarter on quarter;

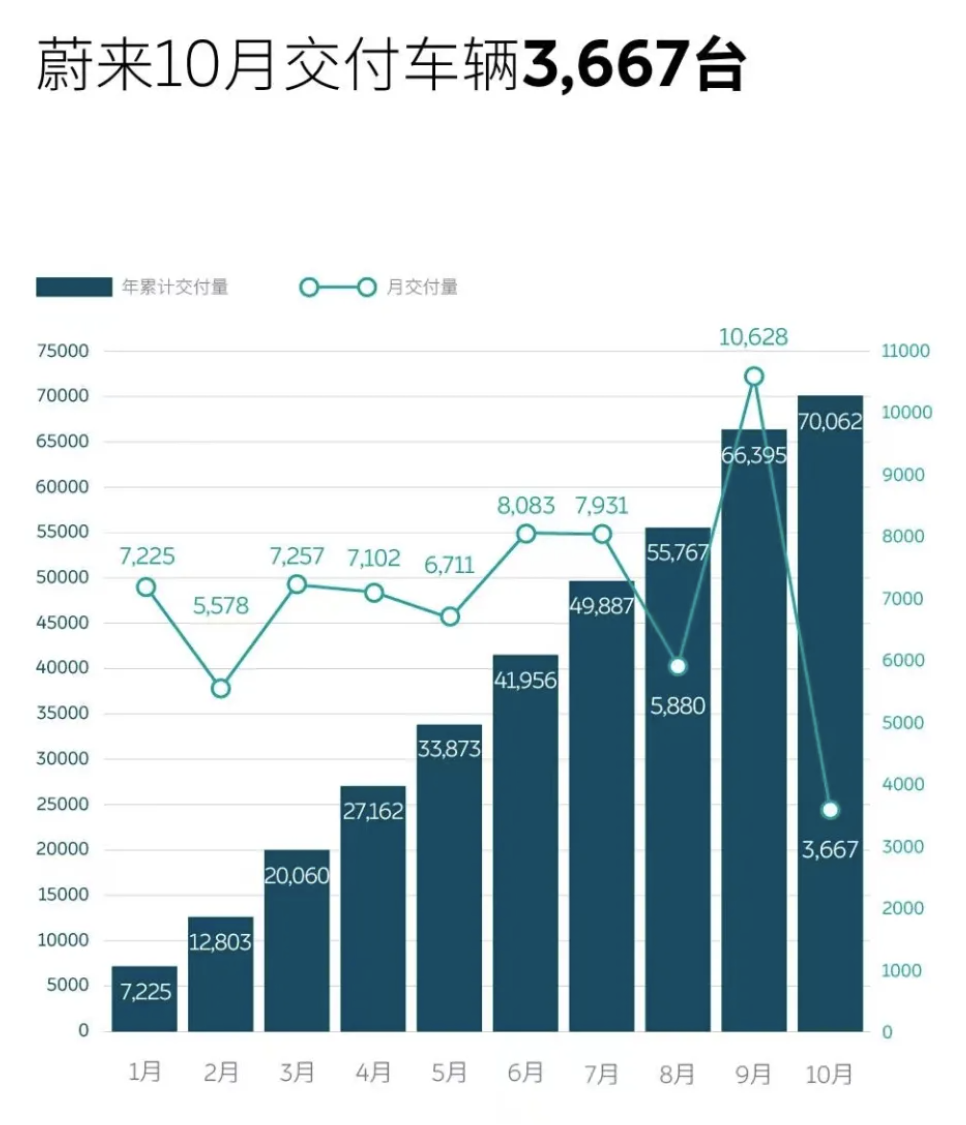

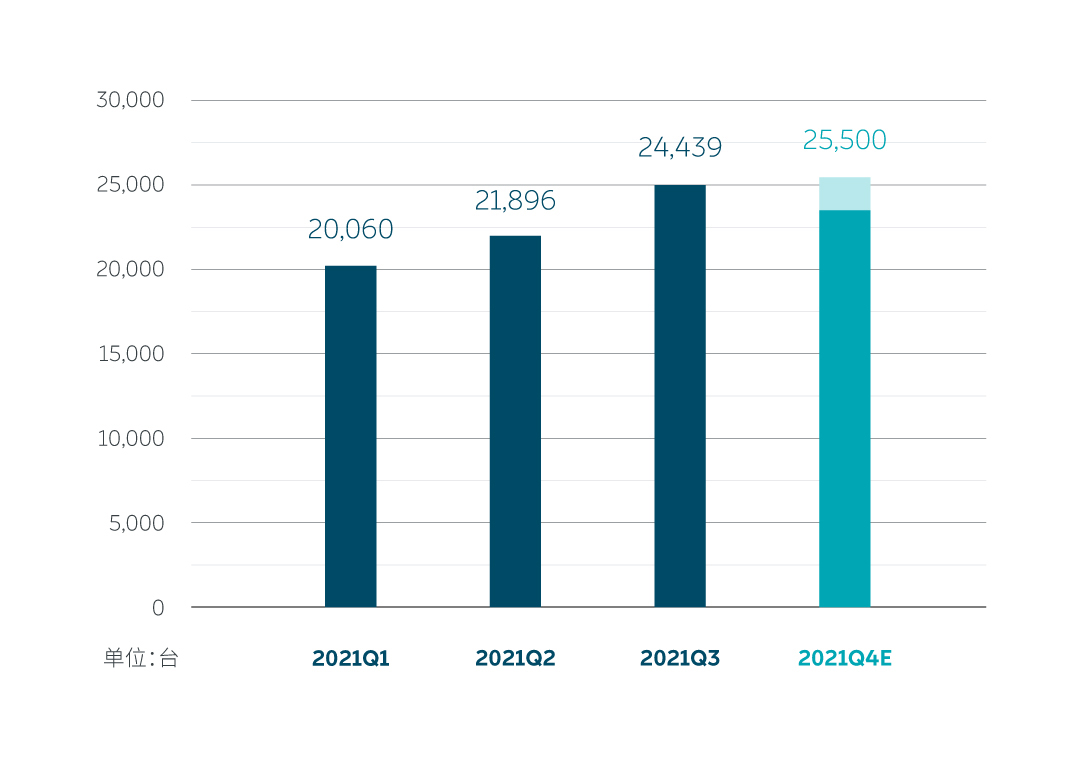

A total of 24,439 vehicles were delivered in the quarter, up 100.2% year on year and 11.6% quarter on quarter, setting a new quarterly delivery record, including 5,418 ES8s, 11,271 ES6s, and 7,750 EC6s;

Automobile sales in Q3 of 2021 were RMB 8.6368 billion (USD 1.3404 billion), up 102.4% year on year and 9.2% quarter on quarter;

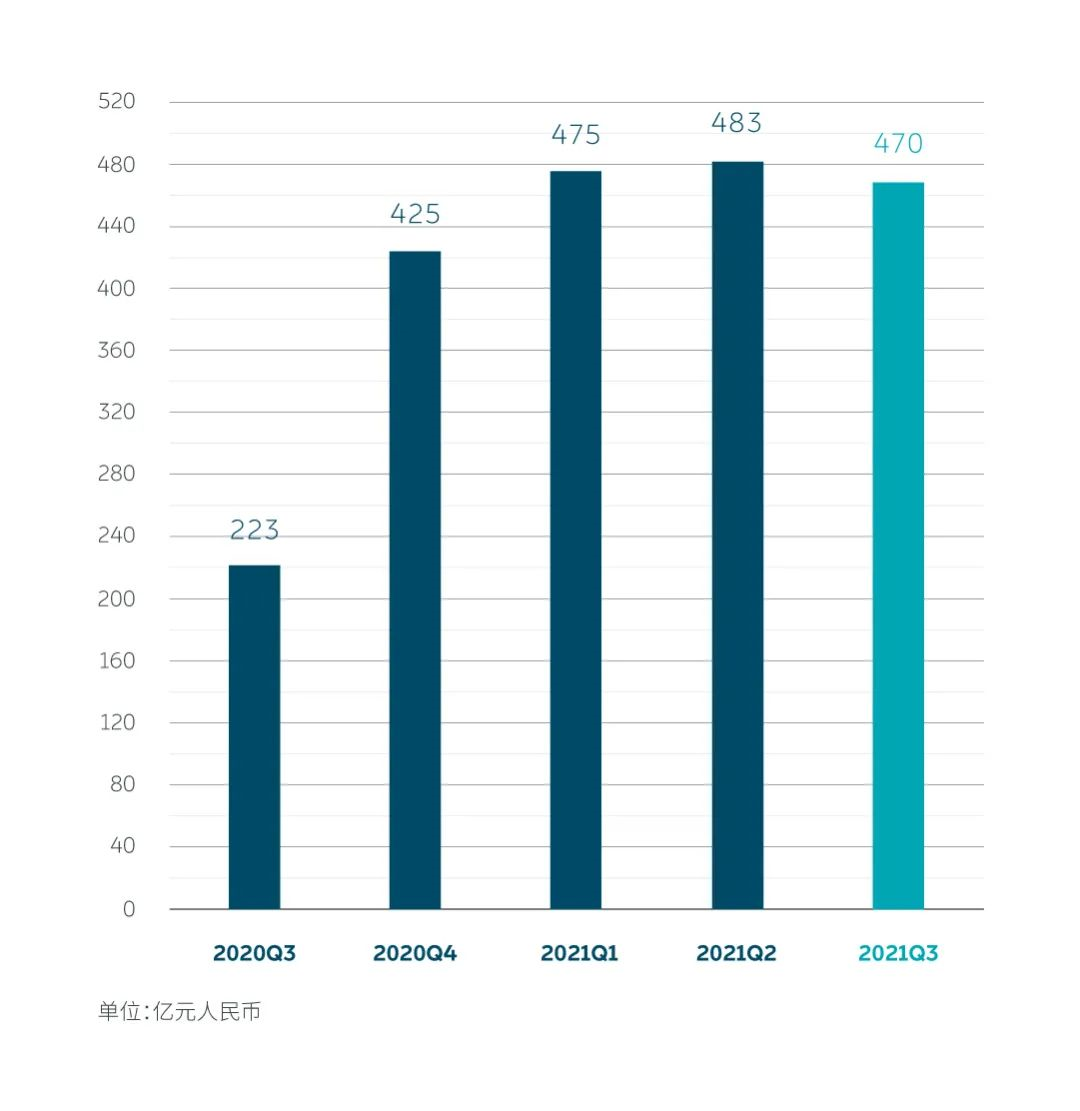

The total balance of cash, cash equivalents, restricted cash, and restricted investment as of September 30, 2021 was RMB 47.0 billion (USD 7.3 billion);

Among all the data, there are two key indicators worth noting.

Firstly, NIO’s gross margin reached a comprehensive gross margin of 20.3%. In comparison, NIO’s gross margin was 12.9% in the same period last year and 18.6% in the previous quarter.

This is still based on the fact that this quarter’s automobile sales gross margin was lower than that of the previous quarter—On the one hand, this indicates that NIO’s system capability is gradually demonstrating advantages, and on the other hand, this is also due to the increase in overall delivery volume, the average price of cars is rising, and material costs are also decreasing.

A comprehensive gross profit margin of over 20% has always been an important indicator for the industry to judge the health status of new forces. Reaching this standard generally means that the brand has good self-generation ability.

Secondly, there is a significant increase in research and development costs. Throughout the quarter, NIO’s research and development costs were RMB 1.1931 billion (USD 185.2 million), with a year-on-year increase of 101.9% and a quarter-on-quarter increase of 35%. The research and development costs excluding equity incentive expenses (non-US GAAP) were RMB 1.095 billion (USD 169.9 million), with a year-on-year increase of 89.5% and a quarter-on-quarter increase of 36.7%.

Apart from the salary increase caused by the continuous expansion of the team, the surge in research and development costs is directly related to the simultaneous increase in new technologies and new models being researched by NIO.

For NIO, in addition to having a large number of technology projects under research, the key is to accelerate the closed-loop cycle of “research and development-mass production-landing.”

With these two points, it makes sense to discuss the following topics.

Comprehensive 2.0

We used to say that intelligent electric vehicles should be viewed in two parts: intelligent and electric.

On these two dimensions, NIO is entering its 2.0 era.

The new models on the electric platform will be upgraded to the NT2.0 platform, and the first benchmark model is the ET7, which shone on NIO Day.

In September, the first batch of ET7 full-process production line trial vehicles had been officially produced, and it is particularly commendable that NIO has also improved the technical indicators of the ET7 in multiple dimensions during this process.

From the previously introduced drag coefficient to the 75 kWh ternary lithium battery pack, and the new electric drive system, they have all brought progress in the platform technologies of the whole vehicle.

ET7 will enter NIO’s city showrooms around the Chinese Spring Festival in 2022 and will then start delivery.

For the NT2.0 platform, this is just the beginning: there will be two new cars on the NT2.0 platform that will announce more product information on NIO Day this year and start delivery in the second half of next year.

The long-term concern for NIO users who have been paying attention to the market performance of NIO this year is that, according to the logic of traditional automakers, this year belongs to the upgrade year of NIO products. Coupled with NIO’s appraisal of product pricing, users may to some extent increase their wait-and-see attitude towards current products.

At this earnings conference, Li Bin also spoke for the first time about the upgrade plan for current models. He said that all current models will be gradually upgraded to the NT2.0 platform. However, specific plans and timing need to be determined based on progress, and NIO will announce related news at the appropriate time.

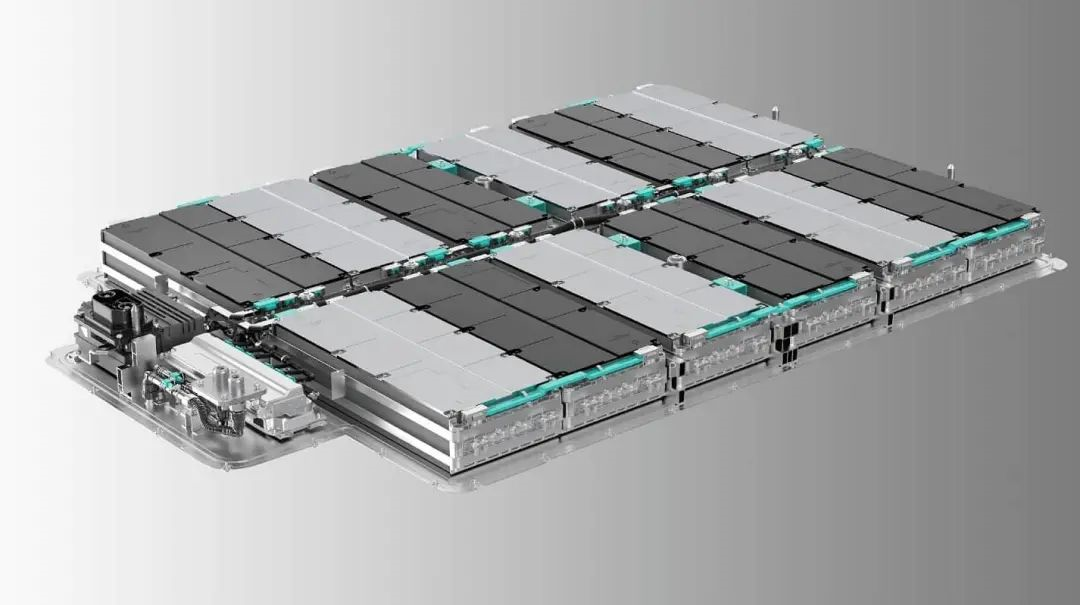

There has also been progress with the key hardware on the NT2.0 platform. The 150kWh battery pack, which was previously thought to support NIO in facing a new round of range competition, has a new time frame. The product is being jointly promoted by NIO and its partners according to plan, and is expected to enter the market in the fourth quarter of 2022.

In the long run, NT2.0 models will continue to boost NIO’s gross profit margin. Li Bin hopes that the gross profit margin of relevant models can reach 25%, and the corresponding target for NIO is to produce 300,000 vehicles per year.

In terms of intelligence, NAD is undoubtedly the most significant representative of the 2.0 upgrade.

From a technical perspective, this set of autonomous driving systems represents the most advanced computing and sensor routes at present.

From an engineering perspective, this is also NIO’s own challenge to its team’s and software team’s capabilities.

People are curious about the ultimate ability of this system and whether NIO can bring it to the market as scheduled.

Especially in the case of frequent demonstrations of various demos from competitors, NIO seems to have no real car scenes available yet.Li Bin’s answer is: Now there are too many people doing presentations, so we don’t need to do them again. We value mass production more.

When ET7 is first delivered, it will provide and assist driving-related functions, but it has switched to a brand-new full-stack technology, including perception and rule control. The advanced functions and subscriptions of NAD will all be opened after the future capabilities are reached.

What’s even more amazing is that besides cars, NIO’s industrial production capacity has also reached the stage of 2.0.

The construction work of the second production base located in the Hefei Xinqiao Intelligent Automobile Industry Park is also proceeding according to plan, starting from April 29, and the main structure will be capped on August 26. Equipment installation will begin at the end of November, and the official production will begin in the third quarter of next year.

By then, the two production bases will have a total capacity of 600,000. Some NT2.0 models will be put into mass production in the new production base.

Overcoming overseas markets

One thing that was underestimated in the Q3 financial report but is not overestimated in the long run is NIO’s overseas business.

On September 30, the NIO Center in Norway began operations and delivered the first batch of ES8 models on the same day. NIO’s entire ecosystem also means that it formally started to go international.

Both the NIO brand and services have been highly recognized by overseas users.

According to Li Bin, a quarter of the test driving users eventually made a purchase in Norway.

Among all the car buyers, 92% chose NIO’s BaaS service.

NIO’s entry into overseas markets may have two implications for other brands:

First, to make everyone pay more attention to bringing the entire product ecosystem and business system overseas, rather than just delivering products.

Second, it will make everyone more respectful of the market in terms of product technology and bring forth more competitive product lines.

Today, Li Bin also stated that only ES8 based on the NT1.0 platform will be delivered in the initial market of Norway, and all NIO products entering other countries will be based on the NT2.0 platform.

Therefore, in the long run, NIO’s performance overseas will become an important indicator for measuring brand value and sales expansion.

When asked about NIO’s long-term goals for going global, Li Bin replied: From a global perspective, we have always hoped to be the brand that satisfies users the most worldwide. This is our primary goal.

Regarding quantifiable metrics, Li Bin added: I think in the long term, it’s reasonable to expect that 50% of our sales will come from markets outside China.

Therefore, this earnings report is more like a forward-looking presentation, focused less on summarizing past accomplishments and more on painting a picture of the future.

Looking ahead.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.