Analysis of the Sales of New Energy Vehicles in the US

I’ve just received the sales data for US new energy vehicles for October, and it’s quite interesting. Let me share it with you.

As a research investor, it’s essential to be driven by data, link various aspects of information, and use this data to conduct overall logic checks and loops. This is where the significance lies for me in monitoring the entire industry’s data in the future.

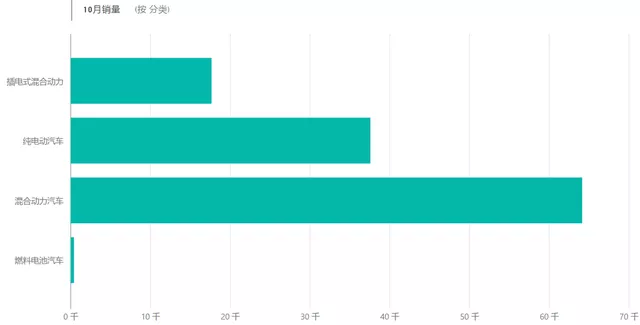

Looking ahead to 2022, the most significant increase and change will come from the US as new energy vehicle subsidies take effect. According to the data from M, sales for October are as follows:

- Battery Electric Vehicles (BEVs): 37,582

- Plug-in Hybrid Electric Vehicles (PHEVs): 17,658

- Hybrid Electric Vehicles (HEVs): 64,137

- Fuel Cell Electric Vehicles (FCEVs): 408

Analysis of New Energy Vehicle Sales

I want to first note that the accuracy of M’s market data for the US is not particularly precise. The data serves as an early estimate; by the end of the month, it’s compared to data from Argonne National Laboratory.

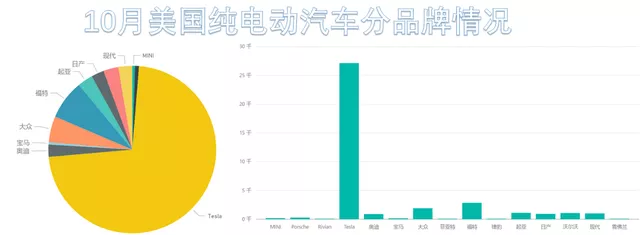

Tesla alone had a single-month sales volume of 27,137 vehicles, accounting for 72.21%, with early months of each quarter usually being their low point. Ford ranked second with 2,848 vehicles, accounting for 7.58% of sales, followed by Volkswagen with 1,900 vehicles, accounting for 5.06%. The performance of other car manufacturers was average.

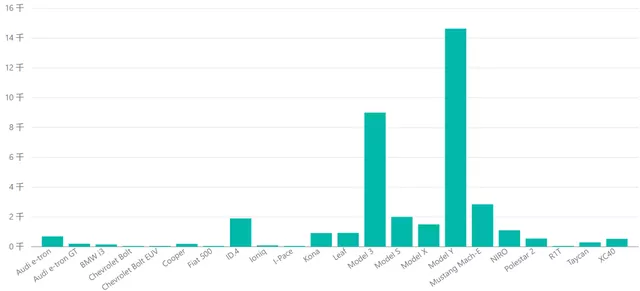

The specific breakdown of vehicle-type sales is as follows: the Model Y had the most sales, with 14,637 vehicles, followed by the Model 3 with 9,000, the Model S Plaid with 2,000, and the Mach E with 2,848.

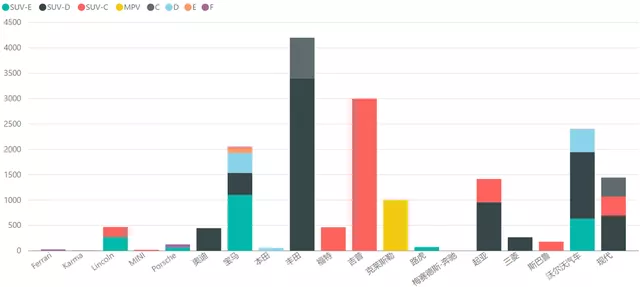

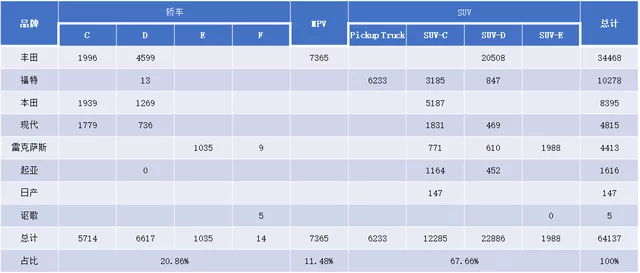

October 2021 saw the main demand for plug-in hybrid electric vehicles (PHEVs) in the US shifting to SUVs (accounting for 81%), with sedans accounting for only 13.07% and MPVs accounting for 5.66%.

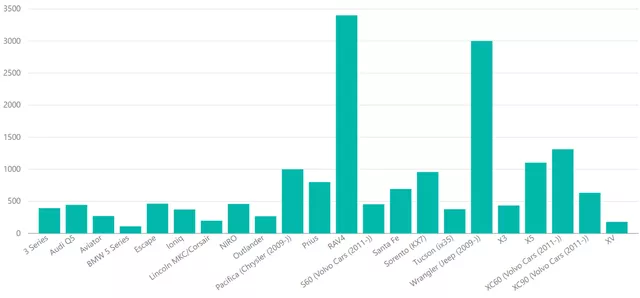

The outstanding plug-in hybrid SUVs in the US market are Toyota’s RAV4 PHEV and Jeep’s Wrangler PHEV, with a total quantity of just over 3,000. With the new energy subsidy (tax refund limit) about to be lifted, it is expected that the production capacity in this area will further climb.

The outstanding plug-in hybrid SUVs in the US market are Toyota’s RAV4 PHEV and Jeep’s Wrangler PHEV, with a total quantity of just over 3,000. With the new energy subsidy (tax refund limit) about to be lifted, it is expected that the production capacity in this area will further climb.

As the US’s new energy subsidy policy adjustment is imminent, the US market in 2022 is particularly noteworthy. With two super factories in the US, Tesla has the potential for a huge sales volume, which has been struggling in the past, but after the kernel is established, its advantages in the manufacturing sector compared to other automakers will gradually show.

Hybrid Cars

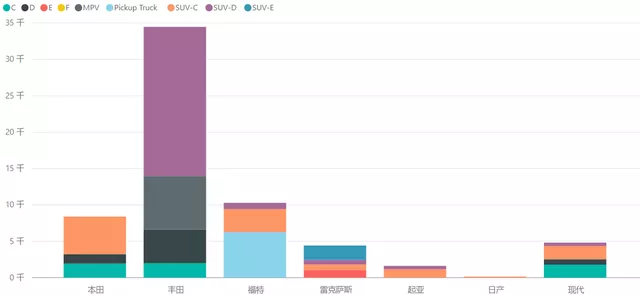

Looking at various submarkets, all of the hybrid cars in the US are also predominantly concentrated in the SUV sector. In terms of brands, the main players are Toyota, Ford, and Honda, and it is estimated that there will not be too many brands investing too heavily in this area in the future.

What I am not sure about is whether the low-cost lithium iron phosphate plug-in hybrid approach can replace hybrid vehicles globally. This possibility is worth exploring.

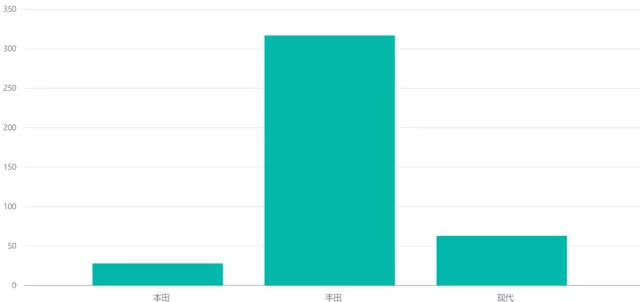

Finally, let’s take a look at the US fuel cell enterprise market, which has nothing much to see in the short term, with few quantities and players.

Conclusion: The most important US new energy vehicle market in 2022 is still in the preheating stage. Currently, it can be seen that various enterprises are crazy about reserving battery production capacity, and are rubbing their hands to enter the high-end pure electric vehicle market. However, the market differentiation will also be relatively severe next year, and I think it is basically possible to judge whether the traditional US companies can make breakthroughs in the field of pure electric vehicles in 2022. The company with the best relative position is General Motors, and we will see how the BEV3 platform performs in the future!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.