OutingOne Media under the Outing100, focusing on the evolution of the automotive industry

Author: Zheng Wen

Joy and sorrow are not interconnected in the world.

After the release of the third-quarter financial report, each company had its own situation. Tesla showed a sign of going far ahead in the midst of doubts and controversies, while CATL was walking on thin ice and moving forward in anxiety.

If CATL is expanding while striving to maintain balance, then BYD’s troubles may be more profound, as it is helpless in the face of rising raw material costs. Doing nothing means doing nothing, and being a downstream worker is a great burden that is hard to express.

But fortunately, their troubles are all sweet troubles, with the recovery of economic production and the new energy trend.

Tesla Conquers in Controversy

Tesla’s third-quarter financial report showed quarterly revenue reaching USD 13.757 billion, a YoY increase of 58%, and net profit reaching USD 1.618 billion, a YoY increase of 389%.

In Q3, Tesla delivered 241,000 new cars worldwide, setting a new record. In the Chinese market, Tesla sold a total of 73,000 cars in Q3. While achieving record sales and revenue, Tesla’s net profit exceeded USD 1 billion for the second consecutive quarter and has been profitable for nine consecutive quarters.

Of course, the Chinese market has played a significant role in this performance. Tesla stated that “China has been our main export center throughout the third quarter, and our production capacity in China has been significantly increased.”

According to documents filed by Tesla to the SEC, Tesla’s revenue in the Chinese market reached USD 3.113 billion in Q3, a YoY increase of 78.5%, and revenue from the first three quarters in China was USD 9.015 billion, accounting for 25% of global revenue and becoming Tesla’s second-largest market after the United States.

The enthusiastic capital market responded with the warmest applause. On the day Tesla released its Q3 financial report, the stock market saw a surge, and this butterfly flapping its wings ushered in countless resonances.

Yes, Tesla’s stunning market value continues to rise.

In the previous trading day, Tesla hit a new high again, closing at a stock price of USD 1,114 and becoming the global leader with a market value of USD 1.12 trillion in the automotive industry.

In the financial report, Tesla predicted that future operating profit margins would continue to grow and the average annual growth rate of new car deliveries is expected to reach 50%. “Demand for electric vehicles is still undergoing structural changes.”## Hidden Concerns under NINGDE Era’s Prosperity

Recently, a sales report from the market has created a connection between Tesla and NINGDE Era, both beloved by the capital markets.

According to the news, Tesla has reserved 45 GWh of lithium iron phosphate batteries from NINGDE Era. Calculated based on the configuration of Model 3, this is an equipment capacity for 800,000 new cars.

Of course, this also means that if Tesla’s high growth rate begins to materialize, NINGDE Era’s performance growth is inevitable.

In the third quarter report, NINGDE Era’s revenue increased by 130.73% to CNY 29.287 billion; net profit was CNY 3.267 billion, a year-on-year increase of 130.16%. In the first three quarters of this year, NINGDE Era achieved a total revenue of CNY 73.36 billion, a year-on-year increase of 132.7%, and a net profit of CNY 7.75 billion, a year-on-year increase of 130.9%.

In fact, NINGDE Era, like Tesla, has also reached the peak of market value. In the last trading, NINGDE Era’s stock price hit a new historical high recorded at CNY 639.22, with a market value of CNY 1.49 trillion, second only to A-share’s Maotai and ICBC.

As the first company on the ChiNext to break through CNY 1 trillion in market value, NINGDE Era is a unique existence in the automotive industry. It went public on the ChiNext of Shenzhen Stock Exchange in June 2018 with an issue price of CNY 25.14. It took more than three years for NINGDE Era to climb from a market value of less than CNY 50 billion at that time to becoming the first stock in the automotive circle today.

However, some market analysts believe that, compared with its market value, its performance can only be said to be within a reasonable range and has not exceeded the market’s expectations.

In the third-quarter data, NINGDE Era’s operating costs still achieved a MoM decrease under the reality of upstream raw material price hikes, from 29.35% in the second quarter to 16.48%. The gross profit margin for the first three quarters was basically the same year-on-year. Nevertheless, it still faces downside risks.

For NINGDE Era, the instability of the upstream raw material supply has always been a sword of Damocles hanging over its head. Last month, a company in which NINGDE Era had a stake invested USD 240 million in a lithium mining project located in Manono, the Democratic Republic of Congo.

However, this is far from enough.## BYD’s Increasing Revenue But Not Increasing Profit

If there are hidden concerns for CATL’s “increasing revenue but not increasing profit” situation, then BYD is already facing such a predicament.

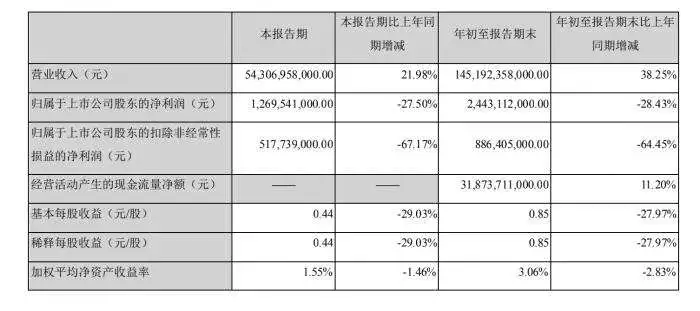

On October 28th, BYD released its latest financial report. According to the report, BYD achieved operating revenue of 54.306 billion yuan in the third quarter, a year-on-year increase of 21.98%; the net profit attributable to shareholders of the parent company was 1.27 billion yuan, a year-on-year decrease of 27.5%. In the first three quarters, the company’s operating revenue was 145.192 billion yuan, a year-on-year increase of 38.25%; the net profit attributable to shareholders of the parent company was 2.443 billion yuan, a year-on-year decrease of 28.43%.

Looking at the data on automobile sales and production, BYD’s sales for all models in the first three quarters reached 452,000 units, a year-on-year increase of 68.32%, and the sales volume of new energy vehicles was 337,000 units, a year-on-year increase of 204.29%. This growth rate is significantly higher than the overall sales level announced by the China Association of Automobile Manufacturers (CAAM).

It’s worth noting that the proportion of BYD’s sales of gasoline vehicles continues to shrink, with gasoline vehicles accounting for less than 20% since June, and the proportion of plug-in hybrids continuing to increase. Based on DM-i and the popularity of various models, the sales of BYD’s plug-in hybrid products in the third quarter reached 88,000 units, a quarter-over-quarter increase of 111.72%.

Nevertheless, while revenue is growing, BYD’s operating costs are increasing even more rapidly.

In the first three quarters, BYD’s operating costs were 126.353 billion yuan, a year-on-year increase of 51.81%. Judging from this, the gross profit margin has decreased significantly. Compared with the same period last year, the gross profit margin has dropped by more than 7 percentage points from 20.75%.

Clearly, the pressure on BYD’s net profit attributable to shareholders of the parent company’s is largely due to rising costs. Although this pressure is not reflected much in the financial report data, it can still be felt. Just recently, there was news of a letter from BYD announcing a 20% increase in battery prices.

In fact, the general increase in raw material prices is no longer unusual.According to incomplete statistics, since the beginning of this year, the prices of four major materials of lithium batteries have skyrocketed: the price of lithium iron phosphate positive electrode material has risen from 35,000 to 40,000 yuan/ton at the beginning of the year to 60,000 to 65,000 yuan/ton; the price of ternary 523 power single crystal material has risen from 110,000 to 130,000 yuan/ton to 180,000 to 200,000 yuan/ton; the price of artificial graphite negative electrode has risen from 32,000 to 45,000 yuan/ton to 40,000 to 60,000 yuan/ton; and the price of electrolyte has soared from 35,000 to 50,000 yuan/ton to 90,000 to 110,000 yuan/ton…

Apart from battery raw materials, the prices of series raw materials such as steel, aluminum, copper, and rubber have also surged. Against the backdrop of price increases in all raw materials to varying degrees, this is not a problem unique to any one company.

Great Wall Overseas Blossoms in Multiple Places

In the post-epidemic era, Great Wall has shown a trend of rising against the trend.

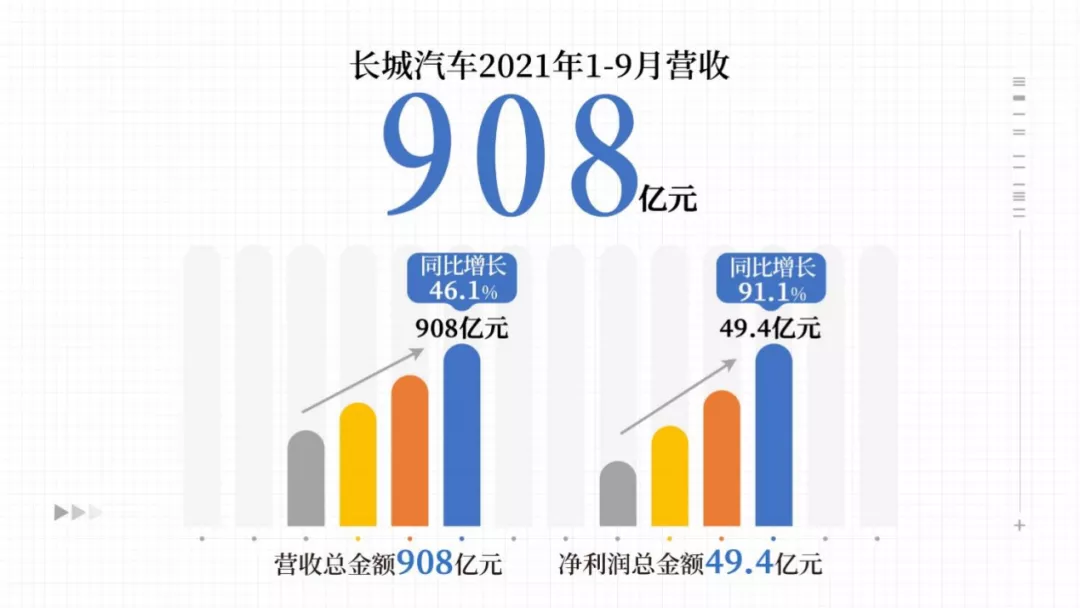

On October 29, Great Wall Motors released its Q3 2021 financial report. In the third quarter of this year, Great Wall Motors’ total operating revenue was 28.869 billion yuan, a year-on-year increase of 10.13%, and net profit was 1.416 billion yuan. From January to September, Great Wall Motors achieved a total operating revenue of 90.797 billion yuan, a year-on-year increase of 46.11%, and net profit of 4.945 billion yuan, a year-on-year increase of 91.13%.

What drives the growth of revenue and net profit is solid sales. Thanks to the accelerated renewal of product matrix, continuous breakthroughs in core technology strength, and deepening development of overseas markets, Great Wall Motors has achieved not only a new car sales volume of 884,000 units in the first nine months of this year, a year-on-year increase of 29.9%.

Two noteworthy points are the continuous increase in Great Wall’s single car sales price and the increasing overseas sales volume. In addition to the growth of sales volume, performance, and market value, Great Wall Motors’ brand premium ability is also continually improving. Nowadays, the average single car selling price of Great Wall has reached 102,700 yuan, a year-on-year increase of 12.50%.

With the assistance of four global car models including Haval H6, Haval Chulian, Haval Big Dog, and Great Wall Cannon, Great Wall Motors’ overseas journey has blossomed in multiple places. In the first three quarters, the accumulated overseas sales volume has reached 98,000 units, a year-on-year increase of 136.3%, and the overall sales volume ratio has reached 11.1%.

In the Thai market, Haval H6 HEV ranked the first in the local C-class SUV subdivision market with a monthly sales volume of 33.2% in September, and has maintained the C-class SUV market champion for two consecutive months; in the Russian market, Great Wall Motors sold 3,513 new cars in September, a year-on-year increase of 147%, breaking the historical sales record for a single month.

In the Thai market, Haval H6 HEV ranked the first in the local C-class SUV subdivision market with a monthly sales volume of 33.2% in September, and has maintained the C-class SUV market champion for two consecutive months; in the Russian market, Great Wall Motors sold 3,513 new cars in September, a year-on-year increase of 147%, breaking the historical sales record for a single month.

In the third quarter, Great Wall Motors continued to promote global development on a large scale, officially entering the Egyptian, Brunei, and European markets, and putting into operation the Jingmen Vehicle Production Base in Hubei and acquiring the Iracemapolis factory in Brazil, further expanding the global production layout of Great Wall Motors.

In addition, at the overseas dealer conference, Great Wall proposed a new strategic goal of selling 1 million vehicles overseas in 2025.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.