This article is reproduced from the Autocarweekly WeChat public account

Author: Financial Street Lao Li

There are no successful companies, only companies that adapt to the times and seize the opportunities. While not every company can seize the opportunity to thrive in the market, Wei Jianjun’s Great Wall Motors has done just that.

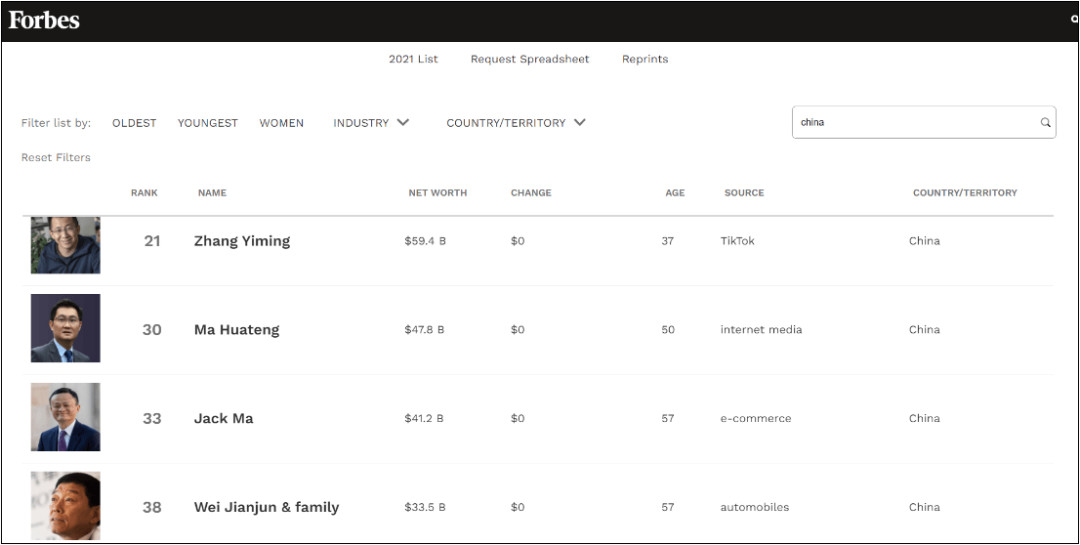

As of the end of October, Wei Jianjun, Chairman of Great Wall Motors, entered the top 5 of the Forbes Global Rich List in China, surpassing Wang Wenxue, Chairman of the real estate giant China Fortune Land Development, becoming the richest man in Hebei, and even challenging the richest man in the automotive industry.

Over the past two years, Wei Jianjun has become a celebrity in the industry, from “Can Great Wall Motors survive next year?” to “Sales of 4 million by 2025” and “neither making phones nor going to space”. With frequent quotes, the usually serious Wei Jianjun has become a popular figure in the industry.

Today, Lao Li will discuss with you from a capital and strategic perspective about how the capital market has been driving Great Wall Motors over the past two years. Why is Wei Jianjun’s ascent to the top spot inevitable? Will the capital market continue to be bullish on Great Wall in the long term?

Car analysts recommend Great Wall?

In 2020, Wei Jianjun ranked 96th on the Hurun China Rich List with a net worth of 45 billion yuan, third in Hebei Province, and ranking behind Li Shufu and William Li in the automotive industry. One year later, Wei Jianjun surpassed all his competitors and became the richest man in China. Lao Li will chat with everyone about what happened to Great Wall Motors in a year.

Friends who bought Great Wall Motors stock this year have mostly made a fortune. As of the close of October 29th, the total market value of Great Wall Motors A shares and H shares reached a historic high, with a total market value of over 900 billion yuan, just a step away from reaching one trillion yuan.

In the mainland market, Great Wall Motors hit a historic high last week, with a total market value of 628 billion yuan, second only to BYD in the automotive sector. In the past year, Great Wall Motors’ stock price has nearly tripled, and it is expected to break through the $100 billion mark this week without surprise. In the Hong Kong market, Great Wall Motors’ market value was HKD 324.2 billion (approximately RMB 266.5 billion) last week, with commendable performance.

The capital market is fair, from sell-side analysts to buy-side analysts, to fund managers, who have all spent a lot of time searching for targets. Over the past year and more, Great Wall Motors has consistently been in the sights of analysts. Lao Li is deeply impressed, so let’s take a look together at the capital market’s attitude towards Great Wall Motors, which is the driving force behind its market value growth.There are approximately 50 securities companies in China that have set up automobile industry analysts. In the past year or so, over half of the analysts have been recommending Great Wall Motors to the buyers. Among the top 100 wealthiest automotive companies last year, three of them conducted in-depth research on Great Wall Motors. When Great Wall Motors reached a market value of 300 billion yuan, one of the three believed that Great Wall Motors would definitely become a trillion-yuan-level company in the future.

Almost two-thirds of the general automotive fund managers among the buyers have purchased Great Wall Motors. It is noteworthy that there are many well-known mutual funds among the circulating shareholders of Great Wall Motors, and many of the mutual fund researchers and fund managers are loyal fans of Great Wall Motors. According to Li’s interview, these buyers are more familiar with Great Wall’s overall strategy and management situation than the middle-level employees of Great Wall. For example, an expert once proposed that Geely’s overall level surpassed that of Great Wall, but the fund manager of a well-known mutual fund logically refuted this during a conference call.

Li often tells his friends that the telephone conferences organized by the automotive industry to study Great Wall are the most frequent, surpassing those of CATL and BYD. When the automotive sector is hot, everyone yells “buy, buy, buy!” When the automotive sector is cold, everyone has teleconferences to find confidence.

Capital, industry, and media all have slightly different ways of analyzing a company. For example, in terms of market concepts, capital generally refers to “funds scale,” while industry and media generally refer to “sales scale.” When it comes to market size, capital will always “quantify” it with a specific number or number range, while industry and media generally “qualify” it. Regarding the development of the enterprise, capital likes to talk about “logic and the future,” while industry and media prefer to talk about “the present and feelings.” Market value should be judged more with a capital mindset.

Friends often ask, “What is different about Great Wall Motors compared to CATL and BYD?” In Li’s view, CATL and BYD are “gold mines” that have been dug out in the secondary market, and it seems that everyone has seen the finish line of the race; Great Wall Motors is a “gold mine” that analysts have not yet fully explored, and no one has seen the “finish line.”

In short, the future of CATL is distributed and mobile energy storage, and the future of BYD is the industrial chain and new energy vehicles. However, the future of Great Wall is more complicated. It is a technology company that nobody has fully understood, making it a scarce target.

The judgment of the capital market is somewhat more advanced than that of the industry. The capital market does not develop strategies; entrepreneurs do. For Great Wall Motors, the strategist is Wei Jianjun, and secondary market analysts are learning and judging his business strategy to make investment deductions.In the view of researchers, Wei Jianjun’s strategy is pragmatic. Last Friday, Great Wall Motors released its Q3 report, which is one of the best Q3 reports in the history of Great Wall Motors: In the first three quarters of this year, Great Wall Motors achieved new car sales of 884,000 units, an increase of 29.9% year-on-year; achieved total operating income of RMB 90.797 billion, an increase of 46.11% year-on-year; and achieved a net profit of RMB 4.945 billion, an increase of 91.13% year-on-year. Although the revenue and profit growth rate slowed down in Q3, Great Wall Motors created the best financial report in nearly five years. From 2017 to 2021, the revenue of Great Wall Motors was RMB 63.429 billion, RMB 66.645 billion, RMB 62.578 billion, RMB 62.143 billion, and RMB 90.797 billion, showing a step-like growth trend in 2021.

Currently, most complete vehicle enterprises lack a bit of pragmatism. It is easy to increase market capitalization, but difficult to maintain, where the former focuses on the future, and the latter focuses on the present. Many researchers believe that Wei Jianjun has implemented two major strategies in the past two years: focusing on the present, being the basic strategy, i.e. ensuring the quality and efficiency enhancement of Great Wall Motors in existing advantages areas, such as the seven brands and hybrid technology; focusing on the future, being the technology transformation strategy, i.e. Great Wall’s layout of new four modernizations and corporate digitization.

Most vehicle enterprises have developed technology transformation strategies, abandoning the basic strategies. Both are indispensable. Lao Li believes that currently, there are only three global vehicle enterprises that are capable of implementing basic strategies and technology transformation strategies at the same time. One is Great Wall Motors, and the other two are BYD and Tesla. Many friends may object, but it doesn’t matter. The capital market will prove it.

Lao Li will not elaborate on the implementation path of Great Wall Motors’ basic strategy and technology transformation strategy. He will take the opportunity to talk about enterprise culture and talent with everyone.

Referring to enterprise culture, the reputation of Great Wall Motors and another enterprise called Tesla is not good. The culture of these two enterprises can be bluntly described as “low cost, high efficiency decision making.”

The perspective of the capital market is that the more “low-cost, high-efficiency, and fast decision-making” the enterprise is, the better it is as a target for the capital market. “Low-cost” means that the enterprise controls costs well, and the three expenses are not too high. “High efficiency” means that the enterprise has good performance, and the revenue is considerable. “Fast decision-making” indicates that the enterprise has a clear strategy and strong execution at the top level.“`

Lao Li has several friends who are mid-level managers at Great Wall Motors and have talked about many internal reporting lines. Regardless of the basic strategy or the technological transformation strategy, they are directly reported to Wei Jianjun. Especially for new business sectors, the reporting line is generally “mid-level-manager → business sector leader → chairman of the board”, and Wei Jianjun’s projects of interest are usually approved despite objections.

In the past two years, many innovative projects have been personally supervised by Wei Jianjun. Lao Li used to think that “Wei Jianjun was very good at management, but a bit lacking in strategy; Musk was very good at strategy, but lacking in management.” However, this judgment has been proven wrong, as both individuals excel in both strategy and management.

The automotive industry competes for talent, and Great Wall Motors’ salary was once not high in the industry. After a salary increase three years ago, Great Wall attracted a large number of external talents, and the salaries of these “core personnel” were not low within the automotive industry, even in the entire north. At an internal meeting, Wei Jianjun once said that although Great Wall has lost many people, the core talents have remained.

Regarding talents, Lao Li very much supports Ren Zhengfei’s perspective. For an enterprise with tens of thousands of employees, the most important thing is to grasp the core personnel, i.e., the business sector general manager, the sector business director, and professional technical talents. Both Huawei and ByteDance follow this management approach, and from the internal reporting lines, Lao Li believes that Wei Jianjun also adheres to this talent management approach.

Looking toward 2025, one trillion is only halfway there.

As previously mentioned, Great Wall’s basic strategy supports its A-share market value of 628 billion yuan. In the eyes of many securities firms, as long as there are no major negative news about the automotive market in the next one or two years, Great Wall’s seven brands are fully capable of supporting its one trillion market value.

Three years ago, when CATL had just gone public, some securities firms stated that CATL was a one-trillion enterprise. Now, CATL’s market value is 1.5 trillion. Two years ago, when BYD’s market value was less than 200 billion, some securities firms said that BYD was a one-trillion enterprise. Now, BYD’s market value is about to break one trillion. Last year, when Great Wall Motors’ market value was 300 billion, a leading securities firm said that Great Wall Motors’ market value was one trillion. Now, Great Wall Motors’ market value has reached 628 billion, and time will show its strength.

Even if the market value reaches one trillion, in the face of the vast sea of technological transformation, it is only halfway there. At the 8th Great Wall Motors Technology Festival this year, Wei Jianjun announced Great Wall Motors’ 2025 strategy: “By 2025, we will strive to sell 4 million new cars globally, of which the sales of new energy vehicles will account for more than 80%, and the operating income will exceed 600 billion yuan.”

“`This is an ambitious goal. Great Wall Motors needs to increase its sales by more than three times and revenue by more than four times in the next four years, especially with the sales of new energy vehicles increasing by 55 times, achieving an annual compound growth rate of over 120%, which is a great challenge.

The capital market also knows the difficulty of the 2025 strategic goal. Even if it is not achieved, it will still promote the valuation of Great Wall Motors. The essence of the 2025 strategy is the transformation of Great Wall Motors into a “global technology travel company”. Technological transformation means high market value and high investment. Among them, high investment must be supported by basic revenue. Therefore, technological transformation cannot be separated from the basic revenue.

According to the plan, Great Wall Motors plans to invest RMB 100 billion in R&D in the next 5 years, focusing on new energy fields such as pure electric, hydrogen energy, hybrid, etc., while accelerating the development of forward-looking technologies such as efficient fuel power, intelligent driving, and intelligent cockpit.

Napoleon once said that “war is fought with money, money, and money”. In fact, the transformation of giant companies is also about “money” as the top priority. When observing the transformation of a company, it is not about what they say, but about what they do. It is necessary to read more financial reports and observe more actions. From what I know, Great Wall Motors has one of the most comprehensive layouts in the automobile industry, although not as good as Tesla, but better than Geely and BYD. I will discuss this in detail in the future.

Focusing on 2025, one trillion is only halfway up. This is not an empty talk.

First, among all domestic automobile companies, Great Wall Motors has the fastest improvement in its fundamentals, as already shown in the third quarterly report;

Second, the basic layout strategy of Great Wall Motors, with seven brand layouts providing protection in earning “big money” in “small markets”, makes it difficult for competitors to penetrate;

Third, in the technology transformation strategy, Great Wall Motors has laid out many companies with potential, such as the lithium battery field’s Honeycomb Energy, the hydrogen energy field’s Wu Shi Energy, and the automatic driving field of Moovex, which will all go public separately in the future and be beneficial for the growth of market value.

As the saying goes, “things are ever-changing”. In the past, it was the era of real estate, and a large number of real estate companies seized the golden track, taking turns becoming China’s richest people. Now in the era of the Internet, companies represented by Tencent and ByteDance are at the peak. Zhang Yiming and Ma Huateng are shining.

In the future, China’s industrial development direction will shift from real estate and the Internet to carbon neutrality and high technology. Emerging companies represented by CATL and technology transformation companies represented by Great Wall Motors are expected to jointly climb to the summit.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.