Author: Xiao K

On October 13, local time, French New Caledonian mining company Prony Resources announced a multi-year nickel supply agreement with Tesla, with Tesla purchasing over 42,000 tons of nickel.

One of the technical directions of Tesla’s power batteries is high nickel and low cobalt, and their “relationship” with nickel runs deep.

Let’s review the story of Tesla’s “relationship” with nickel:

On July 22 of this year, global mining giant BHP announced a nickel supply agreement with Tesla, with BHP’s Western Nickel subsidiary providing nickel for Tesla as a raw material for battery production.

On September 12, 2020, it was reported that Tesla was in talks with mineral developer Giga Metals to purchase low-carbon nickel metal developed by the latter.

During last year’s second-quarter earnings call, Tesla CEO Musk urged nickel miners to mine more nickel. However, Musk also made a requirement that the mining process should be efficient, large-scale, and environmentally friendly. For mining companies that meet these requirements, Tesla will give them a long-term and stable contract.

Why does Tesla love nickel so much? Will the global supply of nickel become a problem? Should other car companies follow suit?

Why is Tesla so anxious?

(1) Global perspective: there will be a hard shortage in the global nickel market

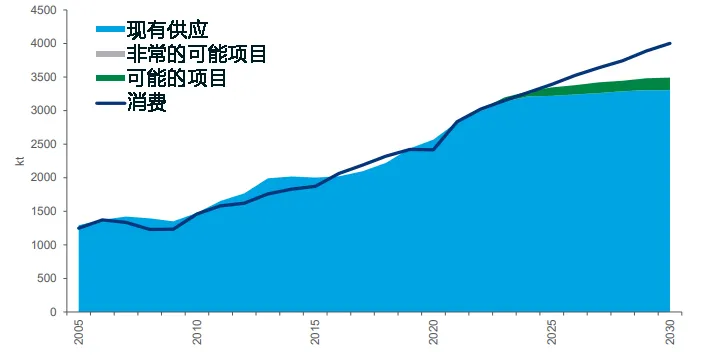

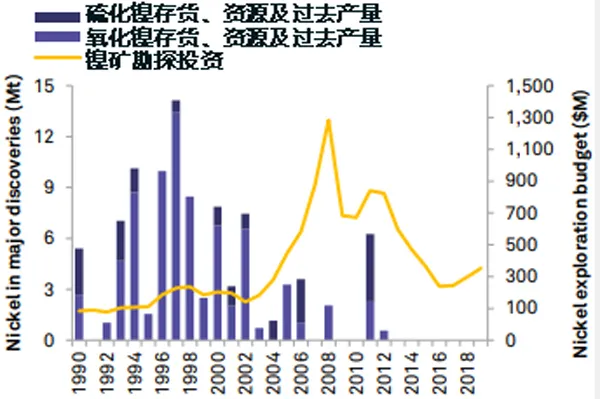

From a global perspective, the nickel metal market has been in a tight balance this year, and there will be a hard shortage after 2024, which will increase year by year. The main reason is that there has been little investment in mining exploration for the past ten years, and mining production lacks long-term investment. There are few new projects in the next five years. With regard to nickel mines, only the First Quantum Zambia project with a capacity of 34,000 tons (to be put into operation in 2022) and PT Vale/SMM’s Pomalaa (40,000 tons, to be put into operation in 2026) are available.

(2) Sino-US perspective: both countries are in shortage of nickel.According to the 2021 data from USGS and Wood Mackenzie, Philippines and Indonesia together account for 30% of the world’s nickel production, while their nickel reserves represent only 10% of the world’s total. This situation reflects the overexploitation of nickel mines in these two countries. Other countries with a high proportion of nickel reserves are Australia (nearly 25%), Brazil (13%), Russia (10%), and South Africa (5%). China only accounts for 3.0% of the world’s nickel reserves, but its consumption accounts for 60.3%; the United States only accounts for 0.1% of the world’s reserves, but its consumption accounts for 4.8%. Obviously, both China and the United States are highly dependent on foreign countries.

(3) Tesla’s perspective: high-nickel content for high-end models

Previously, Tesla primarily used high-nickel cylindrical batteries, which determined its high demand for nickel metal.

However, in its third-quarter investor conference, Tesla recently announced that it is changing the chemical composition of the batteries used in its standard range vehicles, preparing to use lithium iron phosphate batteries instead of the previous ternary lithium batteries, while the long-range models will continue to use ternary lithium batteries.

Combining Tesla’s 2021 shareholder meeting in October, where Musk reiterated a sales target of 20 million vehicles by 2030, we can estimate Tesla’s demand for nickel in the automotive sector.

First, let’s make a rough estimate. Assuming that one-third of Tesla’s future vehicle models use NCA cylindrical batteries or higher-nickel content batteries, and each electric vehicle has 80 kWh, with approximately 0.6 kg of nickel per kWh, each car will consume 48 kg of nickel, meaning that by 2030, Tesla’s automotive sector will consume 320,000 tons of nickel.

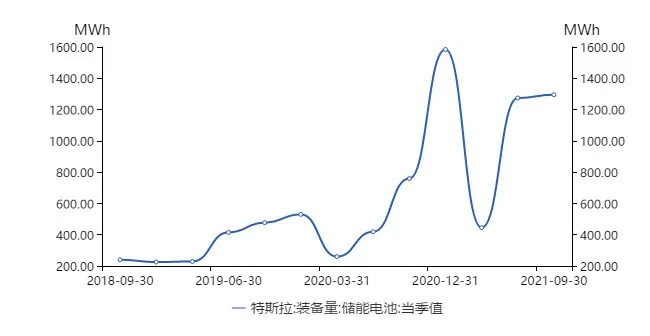

Second, let’s calculate Tesla’s demand for energy storage business, which could be a new frontier after new energy vehicles. Tesla’s energy storage battery equipment was 3 GW in the past 20 years, expected to increase to 6 GW in 2021. We predict that the average annual growth rate of Tesla’s energy storage business will be 50% in the future. Suppose that the proportion of ternary lithium in Tesla’s future energy storage batteries is 20%. In that case, it will consume approximately 280,000 tons of nickel by 2030.

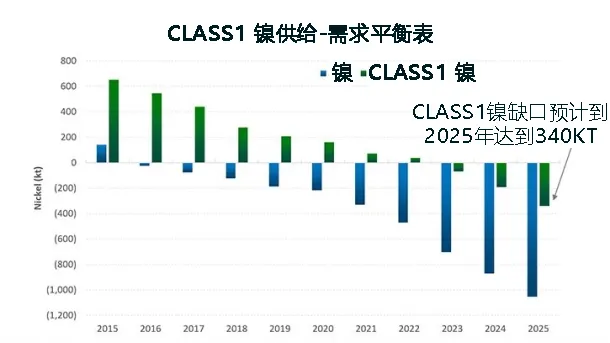

By 2030, Tesla alone is expected to consume 600,000 tonnes of nickel, while Wood Mackenzie predicts that the global available Class 1 nickel for batteries in 2030 will be approximately 900,000 tonnes, meaning Tesla alone will account for 67% of the world’s battery nickel consumption.

Finally, according to Wood Mackenzie’s forecast, there will be a shortage of Class 1 nickel after 2023. Obviously, with such a large appetite for nickel combined with a nickel shortage in the market, supply chain security or resource safeguarding is a problem that cannot be ignored.

How do car manufacturers choose?

Faced with the booming demand for new energy, how do many manufacturers choose?

BYD

As early as 2017, BYD invested in Chalco Ruimin New Energy Technology Co., Ltd., holding 10% of its shares and annually producing a total of 60,000 tonnes of high nickel ternary precursor (NCM811), with a by-product of 40 tonnes/year of high-purity scandium oxide.

Volkswagen

Volkswagen did not directly sign long-term contracts with material companies or mines, but indirectly locked in some nickel resources through Gotion High-Tech.

Mercedes-Benz and BMW

No relevant investments or long-term contracts have been heard of.

Although most automakers have not personally entered the nickel resource market, most battery manufacturers have to some extent secured their nickel resources to ensure supply chain security. For example, CATL, Gotion, and so on.

But we believe that with the situation of Tesla, more automakers will enter the nickel resource market, just like the current situation with lithium resources. With limited global nickel resources, resource scarcity is an inevitable problem faced by the high-speed development of the new energy industry.

Possible solutions for the industry

In the end, it all comes down to a shortage of nickel. The supply of the nickel industry cannot keep up with the fast-growing demand of the new energy industry. In theory, there are two solutions: reduce nickel consumption or increase nickel supply.

(1) Increase nickel supply.Currently, it seems unlikely that there will be a significant increase in nickel supply within the next 3-5 years, as capital expenditure in the industry has been accelerating downward since 2008. Even if investment were to be increased now, it would take at least 3-5 years to start production. Furthermore, the major companies have reported limited capital expenditure due to the disruption caused by the pandemic.

(2) Reduce demand for nickel. Or find a substitute for nickel.

In order to improve the energy density of lithium-ion batteries and increase the range of electric vehicles, high-nickel content in the batteries has become a trend. As nickel is a key material in the battery, it will occupy a higher proportion of the battery cell, thereby achieving a higher driving range for electric vehicles.

Therefore, the value of nickel is released in ternary (or quaternary) lithium-ion batteries. The fate of nickel is determined by the fate of ternary lithium-ion batteries. They are interdependent, and if one flourishes, so will the other; if one declines, so will the other. The emergence of nickel undoubtedly replaces the role of cobalt in some respects. Similarly, if new substances emerge in the future that have certain replaceability with nickel batteries in terms of comprehensive performance, such as energy density, safety, and cost, then the high growth rate of nickel consumption is likely to be eased, and the anxiety in the nickel supply chain will also be relieved.

Secondly, increasing the energy density of single cells, such as the upcoming solid-state batteries, can reduce the usage density of nickel to a certain extent. The most representative example is Volkswagen’s investment in QS and BMW’s investment in SolidPower, but these are still in the laboratory stage. It is expected that it will take until 2025 or even 2030 to put them into mass production and use for industry. In the short term, this will not help much in alleviating the tight supply of nickel.

Finally, as a futures practitioner, I believe that hedging can also alleviate the anxiety in the supply chain to a certain extent.

In the final analysis, supply chain security means being able to buy the required quantity of goods at the appropriate price and at the appropriate time, which is simply the three-dimensional space of price, time, and quantity. Derivatives markets can solve this problem to some extent.

Mainstream international automotive companies have participated in hedging to a certain extent, and have achieved remarkable results.

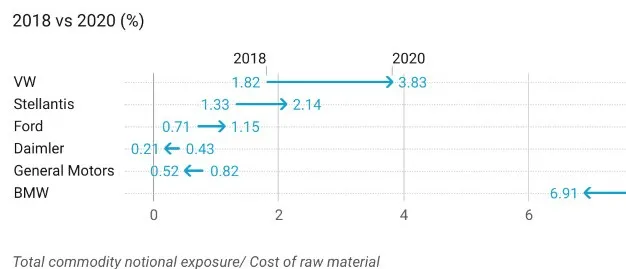

For example, in 2019, Volkswagen’s accumulated commodity derivative earnings reached 1.4 billion euros, making it a clear winner. By the end of 2020, Volkswagen’s commodity derivative investment portfolio had doubled in two years, with one-third of the hedging funds invested in nickel. The nominal amount of nickel held by the company increased nearly 10 times to 2.3 billion euros. In February 2021, the price of nickel reached $19,800 per MT, the last time this occurred was in April 2014, proving the good timing of Volkswagen’s actions.

Other companies such as BMW, General Motors, Ford, and Daimler also use futures markets for hedging to some extent, to ensure supply chain security.“`

To sum up, the automobile manufacturers do not always adopt a single strategy, but use various strategies to solve the problem of supply chain security in a comprehensive way. In this regard, it is hoped that domestic manufacturers can recognize the situation early, learn from the successful experience of overseas advanced manufacturers, and comprehensively utilize various supply chain protection strategies to achieve healthy and rapid development of the new energy vehicle industry.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.