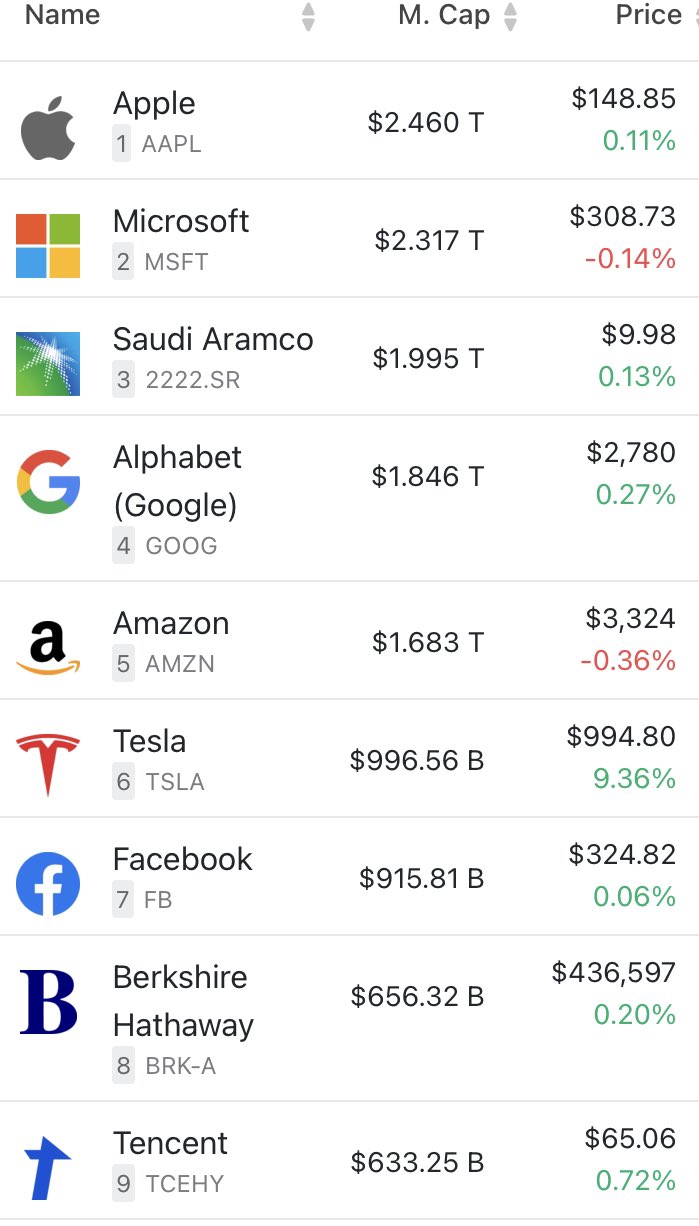

Tesla (NASDAQ stock symbol: TSLA) has officially reached a valuation of $1 trillion today after its stock price exceeded $1,000 per share. It may become the sixth company with a market cap over $1 trillion after Apple, Microsoft, Saudi Aramco, Google parent company Alphabet, and Amazon.

Tesla is currently the first car company to surpass $1 trillion in market value.

According to CNBC, Tesla has made a huge deal with car rental company Hertz to purchase 100,000 Model 3 cars for rental at a cost of $4.3 billion. After the official announcement, Tesla’s stock price rose more than 12% on Monday morning in the US, reaching a high of $1,020.

“Electric vehicles are the way of the future, and the demand for EVs around the world is just beginning,” said Hertz’s interim CEO Mark Fields. US stock analyst Dan Ives also believes that “this deal with Hertz creates a massive revenue opportunity for Tesla”.

Compared to traditional fuel car rental models, the maintenance and upkeep costs of electric cars are relatively lower in the long run. This means rental companies have significant profit potential.

For Tesla, being the first car company to enter the $1 trillion valuation club while being a new energy car manufacturer also proves that new energy vehicles may create market breadth globally that traditional fuel cars could not achieve.

🔗Source: TESLARATI

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.