Recently, two pieces of information are worth paying attention to: one is that the energy density of lithium iron phosphate batteries can continuously exceed that of ternary batteries, and the other is that Tesla stated in its third-quarter report that for standard range Model 3 and Model Y, phosphate iron lithium batteries will be used globally. Ultimately, this is Tesla’s means of reducing costs and increasing gross profit margins.

It is interesting to consider how to view this phosphate iron lithium technology route.

Due to limited daily writing time, I will first copy the content and then check the situation of the patents. Tomorrow, we will make some comparisons of the performance of BYD blade cell and CATL lithium iron phosphate cell.

I think Tesla is amazing – first it competes with Panasonic using LG batteries, then it allows CATL to compete with LG and lower prices even further, and then it competes with BYD and other domestic iron lithium battery enterprises, continuously lowering costs.

We not only need to look at effective production capacity, but also effective orders, which are the most powerful in the market!

Market situation of lithium iron phosphate

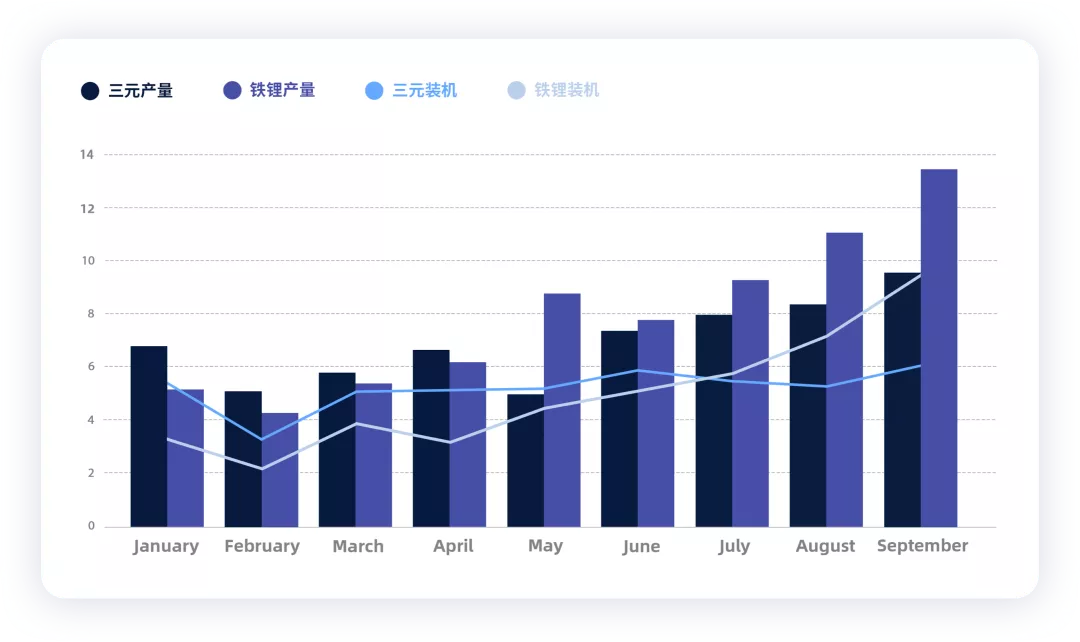

September’s domestic power battery installation data showed that in September, the installation of ternary batteries was 6.14GWh, while the installation of phosphate iron lithium batteries reached 9.54Wh. Phosphate iron lithium batteries have been leading ternary batteries in terms of installation volume for three consecutive months, and the growth rates are completely different.

In terms of production, the production of ternary batteries in September was 9.63GWh, accounting for 41.56% of the total production; the production of phosphate iron lithium batteries was 13.51GWh, accounting for 58.31% of the total production. This is the fifth consecutive month that the production of phosphate iron lithium batteries exceeds that of ternary batteries.

I have sorted the data, and the core change here is actually the use of phosphate iron lithium in passenger cars, from 3.4GWh in June to 7GWh in September, while ternary batteries are currently only concentrated in the passenger car sector. The main reason for the changes is that Tesla’s use of phosphate iron lithium has exceeded 2.5GWh, basically flying with iron lithium.

If we further break it down, it is evident that after BYD switched to blade batteries and promoted phosphate iron lithium in passenger cars, the follow-up speed of CATL is also considerable – relying on Tesla to drive a significant volume.At present, from January to September 2021, Ningde’s lithium iron phosphate is the most widely used, with a capacity of nearly 21GWh, of which the proportion supplied to Tesla in China is approximately 37% (this is the ratio after adding special vehicles and commercial vehicles, and it may exceed 60% if only passenger vehicles are calculated).

According to estimates, CATL will install approximately 7.8GWh for Tesla in China in 2021, while LG will install approximately 4.5GWh. If the export of 100,000 vehicles abroad is taken into account, it is estimated that CATL’s share is around 80%, which is approximately 4GWh.

The use of lithium iron phosphate is restricted by patents worldwide. The statutory protection period for invention patents is 20 years, and the patent term is calculated from the date of application and cannot be extended. When it expires, it will be made public and can be used free of charge.

From a global perspective, Europe entered the protection stage first in 2021, and the United States’ time node is in 2022.

John B. Goodenough, a professor at the University of Texas, is the inventor of lithium iron phosphate positive electrode material. Goodenough applied for a US patent (US5910382) in 1997, which was approved in 1999. He also obtained a US patent (US6514640) in 2003.

French lithium scientist Michel Armand proposed to use 1% carbon to encapsulate lithium iron phosphate, effectively solving the conductivity problem of lithium iron phosphate materials.

After carbon encapsulation, lithium iron phosphate has better conductivity, which allows lithium iron phosphate batteries to move from the laboratory to the market. The University of Texas then granted exclusive patent licensing for lithium iron phosphate to Hydro-Quebec, a Canadian public utility company, and H-Q granted exclusive commercial licensing for lithium iron phosphate to its investment subsidiary Phostech Lithium. H-Q mainly holds these two basic patents for lithium iron phosphate.The core patents of lithium iron phosphate are also owned by Valence Corporation based in the United States, who submitted patent applications related to Fe-doped or substituted lithium iron phosphate active materials in Europe, Japan, and the United States as early as 1997.

Valence’s research on the synthesis of lithium iron phosphate mainly focuses on the carbothermic reduction method, with a few involving precursor preparation and hydrothermal synthesis, mechanical solid-phase method, and high-temperature solid-phase method.

The development of domestic lithium iron phosphate in China is mainly attributed to China’s declaration of the invalidity of the core patent in 2011, which laid the foundation for the booming development of domestic lithium iron phosphate.

In 2003, the patent owners such as Quebec Hydro filed an invention patent application for “Synthesis Method of Redox Materials with Coated Carbon Controlling Its Size” based on international patents and obtained a patent authorization in 2008.

In August 2010, the China Battery Industry Association filed an invalidity request to the State Intellectual Property Office regarding the above patents.

At the end of May 2011, the State Intellectual Property Office made an invalid decision, which dispelled concerns about high patent fees and laid the foundation for the growth and development of the domestic lithium iron phosphate industry.

In conclusion, I think that patent protection is still one of the important factors for the technical route of lithium iron phosphate to succeed in China.

From a global perspective, such a large expansion scale is also based on future demand. Currently, the technological barriers are no longer the main problem. Indeed, “cost optimization” is a special ability of China’s industry. I have recently looked at many companies at the upper end of the industrial chain, and many things can only be achieved through hard work, which is something that Europe and the United States cannot do.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.