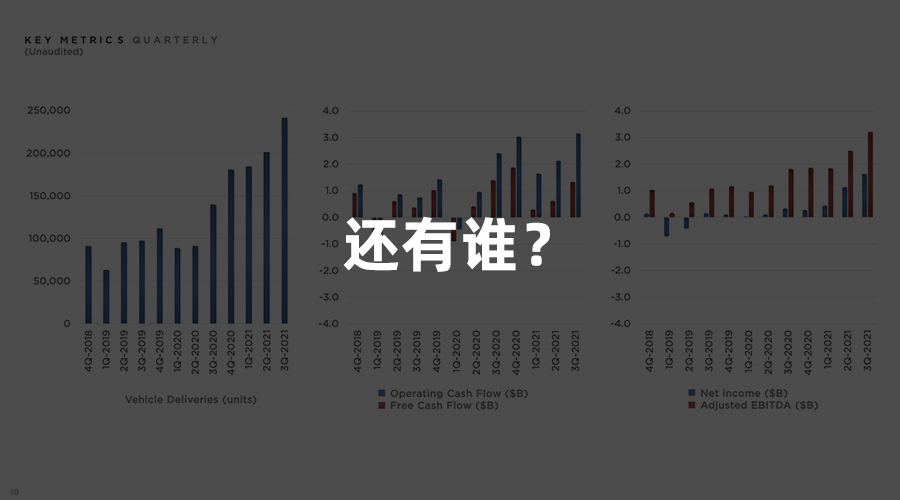

In the 2021Q2 financial report, Tesla set nine key financial records, including total revenue, gross profit, gross profit margin, per vehicle gross profit, net profit and profit margin. On October 2, Tesla announced its production and sales data for Q3, delivering a record 241,300 vehicles, a 20% increase from the previous quarter, despite the severe shortage of parts worldwide.

Before the official announcement of the 2021Q3 financial report, everyone was already expecting Tesla to “create new highs” again, and Tesla’s stock price has risen nearly $100 since the Q3 delivery data was released.

Yesterday morning, Tesla released its 2021Q3 financial report as scheduled, and its stock price once again responded positively, reaching an all-time high today. The reason is quite straightforward: Tesla’s Q3 financial report data once again shocked the industry.

The Data is Impressive

Making Money in the Auto Industry

First, let’s list the main financial contents of Tesla’s Q3 financial report:

-

Total revenue was $13.757 billion, up 15% QoQ and 58% YoY. Automotive revenue was $12.057 billion (including $279 million in revenue from the sale of carbon emission credits), up 18.1% QoQ and 58% YoY.

-

Automotive gross profit was $3.673 billion, up 26.7% QoQ and 74% YoY.

-

Gross profit was $3.66 billion, with an overall gross profit margin of 26.6% and a vehicle gross profit margin of 30.5%.

-

Cash and cash equivalents reached $16.065 billion, and $1.5 billion in loans were repaid in Q3.

-

GAAP net income was $1.6 billion.

-

Operating cash flow minus capital expenditures (free cash flow) was $1.328 billion.

-

GAAP operating revenue was $2.0 billion, and the operating profit margin was 14.6%.

Following Q2, Tesla set new historical records again in Q3, including total revenue, automotive revenue, gross profit, overall gross profit margin, per vehicle gross profit margin, net income, and net profit margin. Vehicle delivery volume was the main reason for the improvement.

The most stunning data are the 30.5% per vehicle gross profit margin and the 26.6% overall gross profit margin, which are both new highs for Tesla. By comparison, BMW Group’s gross profit from its automotive business in the second quarter was 15.8%.

Tesla’s Q3 operating profit margin was 14.6%, while Audi’s operating return rate for the first half of this year was 10.7%.In Q3, Daimler Group sold over 730,000 vehicles with a total revenue of 43.482 billion euros and a non-GAAP net profit attributable to shareholders of 3.598 billion euros. Tesla sold over 240,000 cars in Q3 with total revenue of 13.757 billion dollars, a ratio close to that of Daimler Group, but Tesla’s GAAP net profit reached 1.6 billion dollars. Given this level of profitability and an expansion of revenue to Daimler’s level, Tesla’s GAAP net profit would exceed $5 billion.

Therefore, in terms of profitability, Tesla in Q3 of 2021 has already surpassed mainstream luxury car brands, and the advantage is significant.

Full Production and Sales, Immediate Delivery upon Arrival

Here are Tesla’s delivery data for Q3:

-

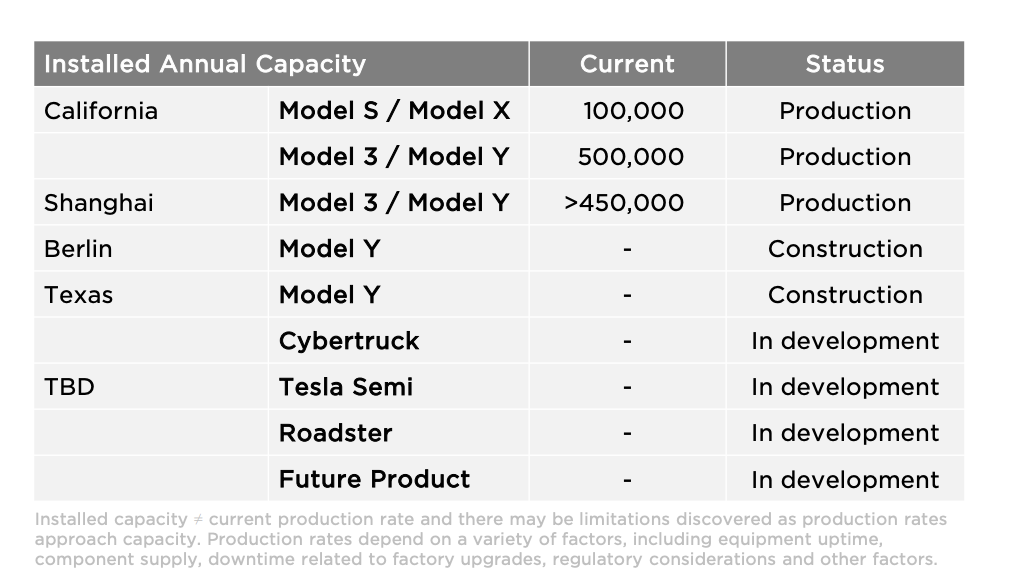

Total production of 237,823 vehicles in Q3 2021, including 8,941 Model S/X and 228,882 Model 3/Y.

-

Total deliveries of 241,391 vehicles in Q3 2021, including 9,289 Model S/X and 231,102 Model 3/Y.

-

The average global market inventory cycle is 6 days, down 30% from the previous quarter and 57% from the same period last year.

Tesla’s Shanghai factory contributed 133,238 vehicles, and in September, it even exceeded the planned production capacity, with wholesale sales reaching 52,006 vehicles.

Of the vehicles produced in Q3 at the Shanghai factory, 59,606 were sold for export, most of which were sold to the European market. These vehicles require shipping, which takes about a month.

Then there is another very exaggerated data point: with nearly 1/4 of the cars taking almost a month for shipping, Tesla’s average global market inventory cycle (the time from vehicle production to delivery) in Q3 was only 6 days.

What concept is this? The average sales cycle of many manufacturers’ vehicles in stores is more than 6 days. The efficiency highlighted by the word “6 days” is particularly evident. Considering that Model Y in Europe can achieve local delivery after the Berlin factory opens, there is still room to reduce the average inventory cycle of 6 days in the future.

However, the 6-day inventory cycle is directly related to Tesla’s current supply-demand imbalance in the global market.

In the European market, for example, the standard Model 3 will not be delivered until March next year, while the delivery time for the standard Model 3 and Model Y in China is 6 to 10 weeks.Compared with the Chinese market, the shortage in the U.S. market is much more severe. The standard range Model 3 without any optional equipment now has a delivery time scheduled for August next year. If you choose the 19-inch wheels, the delivery time can be advanced to May next year.

In the U.S. market, due to insufficient production capacity, the standard range Model Y has been suspended. Currently, the expected delivery time for the long-range all-wheel drive version ordered is July next year, but if you choose the 20-inch wheels, the delivery time can be advanced by 3 months. Yes, the current orders in the U.S. market are so numerous that the supply of wheels has become a bottleneck.

As for the two more expensive high-end models, the revamped long-range Model S has an order delivery scheduled for June next year, while the Model X Plaid is scheduled for July.

Referring to the situation of various factories in the Q3 financial report, it can be inferred that the Fremont factory is currently backlog with about three quarters’ worth of orders, with approximately 400,000 cars for Model S/X in a period of production capacity ramp-up. The Shanghai factory has backlog orders close to two months’ worth of production capacity, which translates into approximately 80,000 cars per year at a production capacity of 500,000.

This situation also reveals a very clear message: there is still significant room for growth in Tesla’s delivery volume if production capacity can be increased.

Other businesses are also actively expanding

While deliveries are increasing, Tesla’s charging facilities are also expanding. In the Q3 financial report, the number of Tesla Supercharger stations reached 3,254, with the addition of 288 new stations, an increase of 9.7% compared with the previous quarter, and a year-on-year increase of 49%, with a total of 29,281 Supercharger stalls, an increase of 2,381, an increase of 8.9% quarter-on-quarter, and a year-on-year increase of 51%.

With the rapid increase in the number of vehicles, the construction speed of charging stations also needs to be synchronously accelerated. This year, Tesla China’s construction of Superchargers has improved significantly compared to previous years. The Shanghai Supercharger factory, which started producing in February and plans to produce 10,000 Supercharger stalls per year, can now achieve local production of Supercharger stalls.

Today, Tesla China announced the launch of the 1,000th Supercharger station, with a total of 280 new charging stations and 1,700 Supercharger stalls added in China since February 7.From this data, we can see that the planned production capacity of the Shanghai charging pile factory has already considered the growth in the next few years. If calculated based on 8 piles per station, its production capacity can already meet the construction speed of 1,250 stations per year.

In Q3, Tesla’s solar deployment increased by 82 MW, a decrease of 2.4% compared to the previous quarter, and an increase of 46% compared to the same period last year. The energy storage deployment increased by 1,295 MW, a decrease of 1.6% compared to the previous quarter, and an increase of 71% compared to the same period last year.

Compared with the high growth of other businesses, photovoltaics and energy storage have slightly declined, but the reason is not that the demand has decreased. Many components of the energy storage products are shared with automobile products. In the case of an overall shortage of components, Tesla chose to give priority to providing materials to automobiles. Therefore, the orders for energy storage and photovoltaics have been backlogged. This part of the growth will only be reflected after the improvement of the industry’s component supply next year.

The Tesla Earnings Call Without Musk

During the 2021 Q2 earnings call, Musk stated that he will no longer attend earnings calls and will focus more on daily work. The Tesla attendees on this earnings call were:

- Martin Viecha, Senior Director of Investor Relations

- Zachary Kirkhorn, Chief Financial Officer

- Andrew Baglino, Senior Vice President

- Lars Moravy, Vice President of Vehicle Engineering

In the opening speech of the conference call, Tesla CFO Zachary Kirkhorn stated that Tesla’s Q3 production capacity increase mainly came from the Shanghai factory’s Model Y capacity ramp-up. Currently, the production capacity ramp-up of the redesigned Model S has achieved significant results, and the Model X has also begun delivery and entered the capacity ramp-up phase. With the production capacity increase of these two cars, Tesla will strive to achieve a delivery target of 250,000 cars in Q4. This goal depends mainly on the level of component supply.

It is worth noting that Tesla is facing the impact of the global automotive component shortage on the production side, and there are many challenges in logistics transportation. The factory capacity is still not at its limit due to the limitations of such reasons. Nevertheless, Tesla’s delivery volume this year has doubled compared to last year.

The adjustments and efforts made by Tesla’s production team in the upstream and downstream of the chip industry have played a key role in improving the supply problem. While continuously increasing orders and capacity, Tesla has also been synchronizing production expectations with suppliers to prepare for the next production increase.

The impact of a large number of backlogged orders and other positive factors will take some time to be reflected in the earnings report.

Tesla’s two new factories will begin production next year. Due to the application of many cutting-edge technologies in the new factories, the speed of capacity ramp-up is relatively difficult to predict, and the new factories will also lower Tesla’s overall gross margin in the initial stage of production. However, the growth of Tesla until the 2022 Q4 stage is still worth looking forward to.A: We are aware of the challenges caused by the shortage of charging resources in some areas and are actively developing solutions. We plan to expand our Supercharger stations globally in order to provide more charging options for our customers. In addition, we are also exploring alternative solutions such as battery swapping and charging at home, which may further alleviate the pressure on public charging infrastructure.Answer:

Our charging team is closely monitoring the growth trend of vehicles. Queueing may occur in some charging-stressed areas. However, in the past 18 months, our Supercharger network has doubled, and the overall waiting time in charging-stressed areas has decreased. We will continue to build our Supercharger network, and we expect it to triple in the next two years.

Recently, the prices of raw materials such as nickel, aluminum, and lithium have risen sharply. It’s reported that Tesla’s long-term orders can reduce such impact. When will the cost increase caused by the rise of raw materials be reflected significantly?

Tesla has been affected by the rise in raw material prices. The main raw materials are nickel for batteries and aluminum for production.

Tesla has signed a large number of mixed contracts with various suppliers, including some long-term contracts and commitment contracts. Still, some contracts are directly affected by price fluctuations, and part of the cost increase caused by the rise in raw materials has flowed to Tesla. Next year, the rise in raw materials may continue to bring cost increases. After some contracts expire, Tesla needs to renegotiate with suppliers.

Reducing costs has always been something Tesla pays close attention to. Tesla needs to overcome cost increases beyond its control, whether it’s from procurement or redesign, or improving manufacturing efficiency, Tesla will continue to work hard in this area.

Phone Conference Summary

Several main questions in the Q3 phone conference are focused on Tesla’s future developments, which can be briefly summarized as follows:

- Fremont will start Mass Production of 4680 next year.

- The $25,000 car may not be available until 2023.

- FSD update cycle depends on software training speed, and daily OTA updates are not practical.

- To achieve 20 million annual sales, Tesla will continue to launch more models to cover mainstream markets.

- Charging facilities will be built faster, with expansion tripled over the next two years.

- The rise in raw material prices will have an impact, and there will be a more significant impact next year if the market persists.

In short, everything is planned, but some plans depend on external factors. Above that, future growth is still promising.

Behind the skyrocketing share price

On June 10, 2020, Telsa’s share price broke through the $1,000 mark, and its market value surpassed Toyota for the first time, topping the global automaker market value.

After splitting 1:5, Tesla’s share price has already broken through $900, setting a new historical high in less than a year and a half. Tesla’s market value has risen 4.5 times.

What does Tesla’s valuation look at?

Then the question arises, is Tesla’s valuation reasonable?If we look at sales, Tesla still cannot reach 1 million units this year. There is a huge gap between them and small-scale car companies like Toyota and Volkswagen, which have sales levels of over 10 million. There is more than twice the gap compared to BBA’s annual sales of over 2 million units. Even after Tesla’s record-breaking Q3 2021 financial report, its P/E ratio remains over 260.

This is only Tesla’s ninth profitable quarter since its establishment, and even if we exclude the revenue from selling carbon credits, Q3 2021 is only the second quarter in which Tesla truly made a profit.

If we only look at the present, Tesla’s market value is certainly overvalued.

However, growth is the core of Tesla’s valuation. It is not difficult to see that when Tesla’s delivery volume increases, all its financial data is strongly correlated and improved.

Moreover, during this process, Tesla has done a lot of things that violate the rules of the automotive industry. For example, as the average transaction price of vehicles decreases, Tesla’s gross profit not only does not decrease but actually increases, far exceeding all its competitors.

Because this process is not based on quantity but on reducing the overall manufacturing cost of vehicles during traditional enterprise expansion.

Also, Tesla is always seeking innovation and change in its manufacturing processes, such as integrated die-cast car bodies and battery packs. These actions have repeatedly helped Tesla improve its product competitiveness while improving manufacturing efficiency and production costs.

Moreover, a very important point is that every Tesla model is a perennial product, with high comprehensive product competitiveness and forward-looking electronic and electrical architecture that can withstand years of competition. In this process, relying on cost reduction to generate price reductions and software iteration, Tesla can still maintain its position as the leader in the segment stably.

Based on the above points, the relationship between Tesla’s profit and vehicle delivery volume can maintain a stable proportional relationship during expansion, which enables Tesla to jump out of most enterprises’ difficult cycle of thin profits from large sales.

Therefore, we can see that although Tesla’s P/E ratio is still over 260, this number has been significantly decreasing after every financial report due to its continuous increase in net profit.

So the real question is, can Tesla’s high-speed growth be sustainable?

Supply is the Limit

In terms of product, Tesla still has significant advantages as an electric vehicle company, with its existing “SEXY” models against existing competitors. Tesla’s models have the fastest acceleration, lowest energy consumption, and longest range. These advantages are still inherited in the Cybertruck, Semi, and Roadster2 models, which are still in the pre-production phase.

Tesla has explained more than once why these models are not mass-produced: the current models are still in short supply, and there are shortages of parts and battery supply. Therefore, at this stage, Tesla is not in a hurry to mass-produce other models.

This reason has its own logic and objectivity, so let’s look further into the supply of parts and batteries.Tesla’s expected annual compound growth rate for its sales is 50%, and it will likely exceed its target this year. However, component shortages, led by a lack of chips, may prevent Tesla from achieving its goals again next year.

In fact, the chip shortage in the auto industry has been analyzed by the industry multiple times during this period. The main reason for this shortage is the anticipated insufficient production capacity due to the pandemic, and this shortage is recoverable.

However, in 2025 and 2030, Tesla will face a real supply problem with batteries.

According to SNE’s prediction, the global demand for power batteries will have an 18% shortfall in 2023, and this gap will increase to 40% after 2025.

The insufficient supply of batteries is due to the inadequate production capacity of battery suppliers. Tesla stated during Battery Day last year that its battery demand would reach 2 TWh by 2030. At that time, the combined production capacity of CATL, Panasonic, and LG Chem would not be enough to satisfy Tesla’s huge demand. On the other hand, the scarcity of battery raw materials, such as nickel and cobalt, may limit the supply of batteries. As the global production of electric cars increases, the price and production of raw materials such as nickel and cobalt will become increasingly scarce.

Tesla has already begun planning to address these issues by developing its own mines to extract raw materials and establishing its battery factories. However, raw materials often have regional attributes. For example, nickel producing countries, such as Indonesia, have already begun implementing a series of policies restricting the export of nickel ore raw materials. Similarly, this issue is like the vehicle import tax that Tesla now faces in India. It is beyond Tesla’s control as it is part of another country’s strategic development plan.

Therefore, in the long run, the most difficult factor to predict that may limit Tesla’s growth is the shortage of battery raw materials. Seizing more mineral resources early on is not just preparing for the future, but it is a necessary step.

Finally, I believe that every friend in the automotive industry who sees a company like Tesla delivering over 240,000 cars in a quarter, achieving a single car gross profit of 30.5%, and maintaining a six-day inventory cycle, will be extremely shocked, but similar things have happened before.

For example, the Model S Plaid became the world’s fastest delivery-ready production car, the Model Y features an integrated cast body, the Shanghai factory went from construction to producing its first car in only one year, and the Model 3, as an electric car, surpassed the BMW 3 Series to become the best-selling luxury car globally.

As subsequent milestones, such as Dojo’s launch, the global rollout of FSD Beta, and the opening of new factories, are achieved, such things will continue to happen in the future.

By the way, a 30.5% gross profit also means one other thing-Tesla may be lowering its prices again.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.