New Energy Vehicle Investment Fund for Charging Stations Established by Prudential and Cloud Energy Charge

On October 11th, the Nanjing Yintan Energy Cloud New Energy Industry Development Fund (referred to as the Yintan Fund), with a total scale of 1 billion RMB, was launched. The first phase of the fund is 200 million RMB, co-sponsored by Prudential Yintan Capital and Cloud Energy Charge.

Prudential Yintan Capital is a private equity investment organization initiated by the logistics asset operation giant Prudential, focusing on equity investment in the large logistics ecology circle. Cloud Energy Charge is a leading independent third-party charging platform company in the field of electric vehicle charging.

With Prudential and Cloud Energy Charge, the investment direction of the Yintan Fund is first of all the vertical scenario charging stations for logistics operation, which is focusing on new energy; secondly, it also emphasizes the scaled public charging stations in quality public areas. At the same time, based on Cloud Energy Charge’s big data technology and the assistance of its industrial investors such as Contemporary Amperex Technology Co., Ltd., the fund will actively invest in the construction of “integrated light storage and charging” charging stations.

Following the trend of new energy vehicles, the charging industry is thriving, but charging operators and platform businesses have not found a sustainable, universally feasible profit model. As a third-party operating platform company, Cloud Energy Charge jointly launched the first charging infrastructure fund in the Yintan Fund with Yintan Capital, and responsible for the charging asset management. It is a great opportunity for it to realize its data-driven operation capabilities.

In addition, although charging infrastructure is the content of “new infrastructure”, local governments and non-industry enterprises have been unable to start it. The Yintan Fund, jointly established by Cloud Energy Charge, local governments and upstream and downstream of the industrial chain, integrates scenarios, industries and capital, creating a new model for the landing of charging new infrastructure. With the first signing completed, several local governments are currently negotiating cooperation intention for the second phase.

The initiators of the Yintan Fund are Prudential Yintan Capital and Cloud Energy Charge, and the first-phase investors include two state-owned high-tech investment platforms in Nanjing, charging equipment manufacturer Changyuan Shenrui, etc.

With many parties united, the main participants in the charging ecology are basically covered: Prudential has the scenario and the demand; Cloud Energy Charge and Changyuan Shenrui can provide charging equipment, platform services, and operation; local state-owned platforms are the driving force for promoting charging infrastructure construction.

All of them have a strong strength. Prudential manages 120 billion US dollars of global logistics assets, and has more than 400 logistics assets in China. Yintan Capital has invested more than 8 billion RMB and invested in more than 50 enterprises.# Cloud Quick Charge, the largest third-party charging IoT SaaS platform in China

As of September 2021, Cloud Quick Charge had provided services to over 2,700 station operators, with an overwhelming number of over 130,000 directly connected charging piles.

Changyuan Shenrui

Changyuan Shenrui, also known as Changyuan Shenrui Protection Automation Co., Ltd., is a long-standing power system automation and intelligence enterprise with a leading market share in the high-end charging equipment market. It often wins major equipment orders from China Southern Power Grid and State Grid.

Nanjing

Nanjing is one of the representative cities in China that actively invest in intelligent and new energy vehicles. The two state-owned investment platforms, which invested in many emerging technology and startup companies, also invested in this project.

Why not build and operate the charging stations themselves?

“The role of Prosperus Hidden Hill Capital as a fund manager is to match the appropriate capital with appropriate assets,” said Dongfang Hao, Chief Strategy Officer of Prosperus China and Chairman of Hidden Hill Capital to Electric Vehicle Observer. Charging stations are network assets that are very scattered and not limited to logistics parks. From the perspective of asset operation and management, it is necessary to maximize the network effect and thus requires joint management by various parties.

“This has a lot to do with the positioning of the two companies,” said Tian Bo, founder and CEO of Cloud Quick Charge. Prosperus relies on logistics infrastructure and through Hidden Hill Capital investment platform, seizes the big trends of digitization, intelligence, and new energy, forming an open ecosystem. “Cloud Quick Charge has always been a third-party IoT SaaS platform since its establishment, providing comprehensive solutions to everyone through technology and data.”

Charging infrastructure is included in “New Infrastructure.” Governments across the country, represented by Nanjing, have a strong desire to promote its construction.

Tian Bo believes that local governments have resources and funds, but lack technology and operation capabilities, making it difficult for them to operate the charging stations they invest in.

For equipment manufacturer Changyuan Shenrui, direct entry into the construction and operation of charging stations is not their forte. According to the announcement made by Changyuan Group, the parent company of Changyuan Shenrui, participating in Hidden Carbon Fund can drive the sales and layout of Changyuan Shenrui’s charging equipment, and promote the development of the company’s charging business by leveraging its own equipment and engineering advantages.

“This market cannot be realized by any single entity alone, we need to be more open and work together upstream and downstream of the industry chain to accelerate the construction of the charging pile network in the new infrastructure,” said Tian Bo.

Logistics vehicle electrification will accelerate

Based on the background of the sponsor, it is logical for Hidden Carbon Fund to start building charging stations in logistics parks first. So, are logistics vehicles starting to electrify? With the construction of charging stations, is there anyone coming to charge their vehicles?# Review of China’s Development of New Energy Vehicles

The development of new energy logistics vehicles in China has experienced rapid growth in the past, but has also been a heavily impacted area of fraudulent subsidies and excessive claims. Heavy reliance on subsidies has led to poor operational efficiency, and growth has not been sustained.

However, subsidies have been withdrawn earlier in the specialized category of logistics vehicles, and new energy logistics vehicles have been adjusted for several years and are showing signs of a comeback.

The Hidden Carbon Foundation first started by focusing on the charging needs of new energy city distribution vehicles.

“There are more than 15 million city distribution vehicles throughout the country, but I estimate that only 1% to 2% are electrified, leaving huge room for improvement,” said Tian Bo.

Tian Bo explained that the previous generation of new energy logistics vehicles just replaced the fuel tank with a battery, and many characteristics did not match, so the benefits were completely not realized. However, many manufacturers have now started redesigning vehicles for different logistics scenarios to make them more suitable for operational needs. In addition, energy consumption per 100 km for new energy vehicles has become increasingly low in recent years, and technology is constantly improving.

“The logistics vehicle is a long-term operating asset, and saving one penny per kilometer is a great achievement,” he said. Advances in electric vehicle technology, battery cost declines, and the economic benefits of new energy logistics vehicles are gradually becoming evident.

In addition, Tian Bo also believes that more cities have opened up road access to new energy logistics vehicles. “Under policy guidance, the market will increasingly choose new energy logistics vehicles.”

Dong Fanghao also stated that they have already seen strong demand for new energy logistics vehicle charging. “In addition to the Pro-Luce industrial park, many of the enterprises we have invested in have an increasing demand for charging piles.” He explained that Pro-Luce has invested in more than 50 logistics-related companies, forming an ecological system, including vehicle operating platforms, autonomous driving development, and vehicle manufacturing. These companies will also support Hidden Carbon Fund’s investment in charging stations.

Yunkuaichong is not unfamiliar with the charging market for new energy logistics vehicles. Pro-Luce’s charging stations throughout the country serve electric logistics vehicles, and most of these stations are connected to the Yunkuaichong platform.

How to Plan and Operate?

As Tian Bo said, new energy logistics vehicles are production assets, so there is special emphasis on operating time and sensitivity to charging times. So, will the stations built by Hidden Carbon Fund focus on high-power charging, allowing new energy logistics vehicles to charge as quickly as possible to ensure operating time?Translate the following Markdown Chinese text into English Markdown text, in a professional way, preserving the HTML tags inside Markdown and only outputting the result:

田波否认了这一看法。他认为,从充电场景来看,应该快慢结合,有一些场景需要快,有些场景慢充也可以。「我们的数据中心会起到很重要的作用。比如有些客户白天要快充,晚上需要慢充,哪些场地需要满足哪样的需求?充电网络和它的运力图是不是能够匹配?能回答这些问题,就能提升充电场站的效率。」

云快充为什么能掌握这些问题的答案?

云快充团队成立之初,起步是自建电桩做充电服务。2016 年底开始,云快充搭建了专业化的充电物联网 SaaS 平台,并且向行业开放,自此剥离自建桩业务,转而专心服务全国的区域电桩运营商。因为区域电桩运营商都有运营平台的需求,但自己开发成本高昂,效果也不好。

云快充花费很大精力开发的充电物联网 SaaS 平台,打通了市面上 90% 的充电设备,可以帮助运营商建立充电桩管理平台,实现订单查询、运营统计、安全监测、财务管理和用户管理等基础功能,同时获得全渠道引流、精细化运营、政府监管平台对接乃至代运营等特色服务。运营商无需自己开发平台,只要将自己的场站接入平台,就能开业运营。

此前平台服务以免费服务为主,云快充似乎没有获得什么。但是田波认为,「云快充在过去几年中,沉淀了非常强的技术能力、服务能力和运营能力。」

这些能力如果用一个成果物来呈现,那就是大数据应用。

「我们记录了平台所有的充电交易行为数据,基于大数据分析,我们对充电桩的建设选址、运营维护,完全以用户为导向,比以前更加精准,更加高效」,田波说,「依托平台数据分析建的桩,肯定不会闲置。」

田波表示,云快充基于数据构筑的运营能力,已经在过去得到了实战检验。「第一,云快充早期投资的充电桩资产,早就已经收回成本了;第二,我们提供了代运营服务的其他运营商,其运营效益得到明显提升。」

云快充预计,在隐碳基金整个周期内,投运充电桩总充电量将达 100 亿度,车辆行驶总里程达 350 亿公里,可减少 42 亿升汽油燃烧,减少 966 万吨二氧化碳排放。

「我们始终遵循的一个原则就是,在创造社会价值的过程中获取一定的企业收益。」 田波说。

## 云快充的未来

云快充 2016 年成立,以第三方充电物联网 SaaS 平台公司的独特定位在充电行业开疆拓土。随着平台接入的充电场站越来越多,引起业界关注。

Tian Bo denied this view. He believed that, based on the charging scenario, both fast and slow charging should be used. Certain scenarios require fast charging, while others can make do with slow charging. "Our data center will play a very important role. For example, some customers need quick charging during the day and slow charging at night. Which locations need to meet what kind of requirements? Can the charging network and its capacity match? Answering these questions can improve the efficiency of charging stations," he said.

Why can Yun Kuai Chong master the answers to these questions?

At the beginning of the founding of Yun Kuai Chong team, it started by building its own electric poles to provide charging services. Beginning in late 2016, Yun Kuai Chong established a specialized charging IoT SaaS platform and opened it to the industry, thus separating from its own pole business and focusing on serving regional electric pole operators across the country. Because regional electric pole operators have platform needs, but developing their own platforms is costly and ineffective.

The charging IoT SaaS platform that Yun Kuai Chong has spent a lot of energy developing has connected to 90% of the charging equipment on the market. It can help operators establish a charging pole management platform, achieve basic functions such as order inquiries, operational statistics, safety monitoring, financial management, and user management, and also provide characteristic services such as full-channel drainage, meticulous operation, government regulatory platform docking, and even proxy operation. Operators do not need to develop their own platforms; they just need to connect their own stations to the platform to start operating.

Previously, the platform services were mainly free services, and Yun Kuai Chong seemed to have gained nothing. However, Tian Bo believes that "Yun Kuai Chong has accumulated very strong technical ability, service ability, and operational ability over the past few years."

If these abilities are presented as a product, it would be big data application.

"We recorded all charging transaction behavior data on the platform. Based on big data analysis, we locate the construction and operation and maintenance of charging poles entirely based on users, which is more accurate and efficient than before," Tian Bo said. "Poles established based on platform data analysis will certainly not be idle."

Tian Bo stated that the operational capabilities built upon data by Yun Kuai Chong have already been verified in practical combat. "Firstly, the charging pole assets invested by Yun Kuai Chong in the early days have already recovered their costs. Secondly, we have provided other operators who offer agent operation services with a noticeable improvement in operational efficiency."

Yun Kuai Chong expects that total charging volume of the charging poles that were put into operation will reach 10 billion kWh and the total mileage of the vehicles driven will reach 35 billion kilometers throughout the entire cycle of the Carbon-Neutral Fund, which would help reduce 4.2 billion liters of gasoline combustion and 9.66 million tons of carbon dioxide emissions.

"Our guiding principle has always been to obtain some corporate earnings during the process of creating social value," Tian Bo said.

## The Future of Yun Kuai Chong

Yun Kuai Chong was established in 2016 as a third-party charging IoT SaaS platform company, with a unique position to expand the territory of the charging industry. As more and more charging stations are connected to the platform, the industry is paying increasing attention to it.

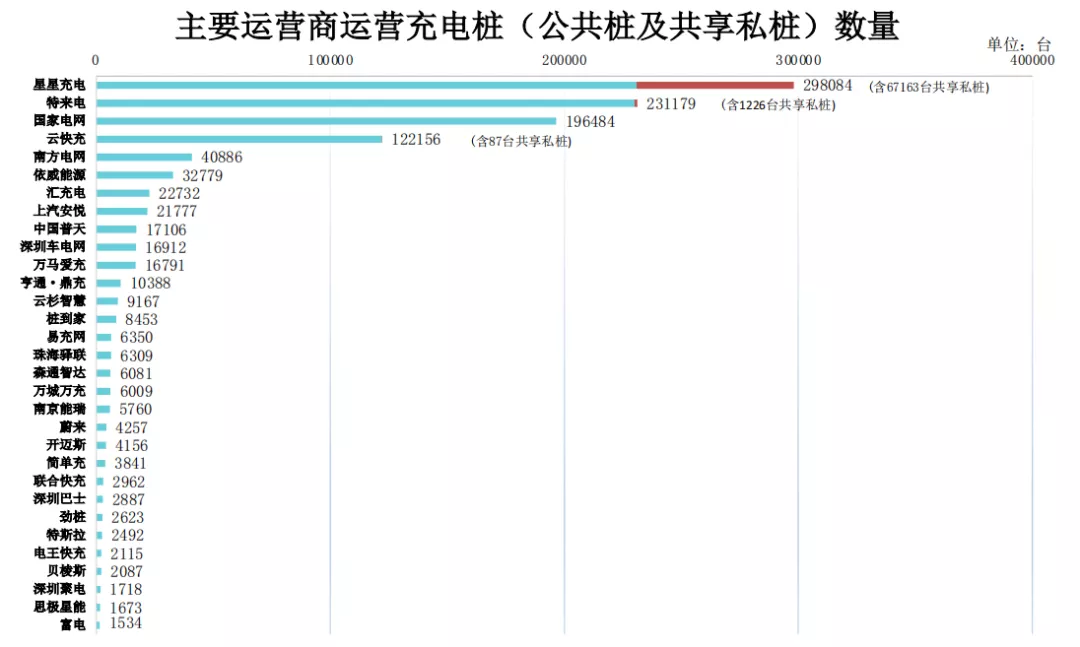

As of September 2021, according to statistics from the China Electric Vehicle Charging Infrastructure Promotion Alliance, Yunfast Charging ranked fourth in the industry in terms of access to 122,200 charging piles.

Yunfast Charging has always insisted on providing SaaS platform services, including charging station operation and derivative service exploration.

This time, Yunfast Charging launched the Hidden Carbon Fund, which will delve deeper into the operation and management of charging stations.

“You can think of this fund as my client, and I provide it with operation and management services,” said Tian Bo. Yunfast Charging is still a comprehensive solution provider based on the charging IoT SaaS. “What have we always been paying attention to? How to help customers reduce costs, increase efficiency, better match supply and demand, and save costs? That’s essentially what we’ve been doing.”

From the trend of new energy vehicle development, it is increasingly integrated with new energy power under the national strategy of carbon neutrality and carbon peak. The cost reduction and efficiency enhancement of charging stations must consider energy conservation and emission reduction in power generation and distribution.

Dong Fanghao introduced that the Hidden Carbon Fund and the goal of Prolose’s new energy transformation have high synergy. Prolose’s subsidiary, Pufeng New Energy, focuses on distributed rooftop photovoltaic power generation, which can easily be combined with charging station electricity consumption.

“In the next step, there may also be battery swapping, energy storage, hydrogen energy, etc. It’s just that we will add our services based on market development,” said Dong Fanghao. In the process of Prolose’s new energy transformation, Yunfast Charging will explore various possible derivative services.

He also mentioned in particular that CATL has also invested in Yunfast Charging, and their battery technology, combined with Yunfast Charging’s platform technology and Prolose’s scene integration, has great imagination space.

Interestingly, Prolose Yingshan is an early investor in Yunfast Charging, and CATL is the B1 round investor in Yunfast Charging. Like the Hidden Carbon Fund, the integration of capital, industry, and scene, along with the technical and operational capabilities accumulated by Yunfast Charging, has a landing foundation.

“As far as the overall strategic positioning is concerned, Yunfast Charging’s positioning has always remained unchanged,” said Tian Bo. “In the future, charging stations will definitely become more and more decentralized. Demand will be diversified, and scenes will be diversified as well.” He believes that, just like the logistics infrastructure industry where Prolose is located, it is difficult for the charging industry to have an operator who can cover the whole country, and the proportion of the top 10 is not expected to be large.

“Against this background, there is still a great opportunity for Yunfast Charging as a third-party charging IoT SaaS platform,” said Tian Bo.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.