Introduction

The perception module in autonomous driving is relatively independent compared to the overall vehicle and relies only on the sensor system. Therefore, it is easier for sensor manufacturers to bundle perception algorithms with sensor hardware and sell them to users. By providing a set of effective perception algorithms to users who purchase sensors, it will definitely increase sales. Moreover, continuous algorithm iteration will bring long-term profitability.

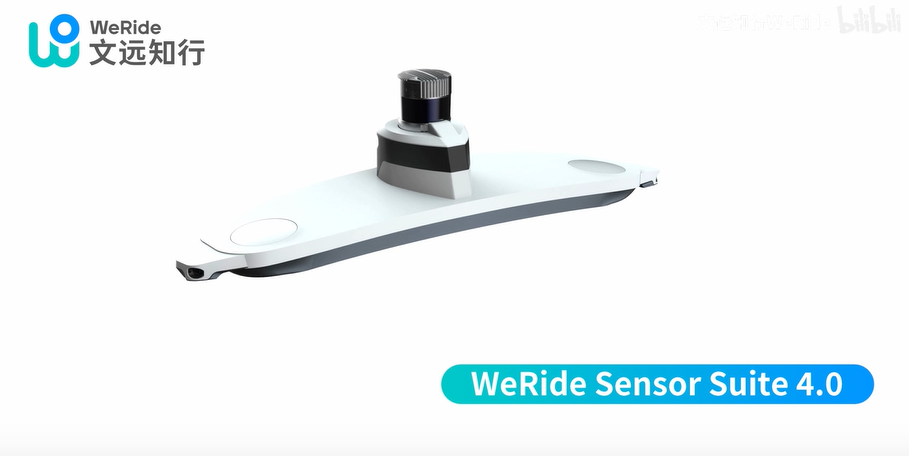

Recently, the industry’s first small-sized and lightweight sensor kit was released. It is WeRide Sensor Suite 4.0, the new generation of sensor suite provided by the autonomous driving company WeRide. It provides autonomous driving perception ability for various passenger car models. Today, we will briefly discuss the new market opportunity for start-ups competing in the sensor suite field.

Let’s start with WeRide Sensor Suite 4.0 provided by WeRide.

WeRide Sensor Suite 4.0

Smaller, Lighter, and More Powerful Functionalities

Due to the high integration of sensors, WeRide Sensor Suite 4.0 reduces length, width, and height compared to the previous version. Its volume is only 1/6 of the previous 3.0 suite, occupying less than 0.4 square meters of the roof area. Meanwhile, the weight has reduced by 20%, with a net weight of 13 kg.

Not only is the volume and weight more lightweight than the previous version, but the perception ability of the 4.0 version has also been greatly improved. WeRide Sensor Suite 4.0 includes LIDAR, 4D Millimeter Wave Radar, Solid-State LIDAR, Blind Spot LIDAR, and a new proprietary camera module developed by WeRide. It achieves 360-degree coverage of the field of view, detects objects and their movement states, special traffic scenes, and signs within the perception range, and precisely identifies them. The location of solid-state LIDAR follows the design reserved for the 3.0 sensor suite published by WeRide in December 2019.

At the same time, the lightweight and reliable kit design and smooth surface make the 4.0 kit more integrated with the vehicle’s appearance, making the product’s form of autonomous driving vehicles more natural, complete, and mature, leading the development trend of autonomous driving vehicles.

Modular Design, Suitable for Various ModelsTo sell well and be recognized by the market, the biggest challenge for perception suite is to support various car models in the market, making it easy and convenient for users to install it on their cars. WeRide Sensor Suite 4.0 continues to use “modular integrated design”. Based on customized basic modules, the suite can flexibly change the combination and structure to perfectly adapt to different car models and needs.

WeRide Sensor Suite 4.0 requires only 12 procedures to complete the assembly of the product module, and is currently the most standardized solution for L4 level autonomous driving. It can achieve rapid production of 20 minutes per set on the production line. Meanwhile, it also has the ability of sub-assembly, allowing the module integration to be completed in advance on the assembly line before being transported to the vehicle production line for final assembly. This not only ensures the consistency of product quality and the accuracy of sensor relative position but also greatly improves vehicle production efficiency.

The major problem with onboard sensors is that long-term use will greatly reduce perception accuracy due to dust and dirt. In this regard, perception kits like those developed by WeRide can automatically recognize dirt and trigger a cleaning function to provide stable guarantees for the perception system.

In the foreign market, Mobileye has almost a monopoly on the ADAS chip market for single-camera solutions. It is matched with its proprietary visual perception algorithm, which many vehicle manufacturers are willing to cooperate with. Bosch also provides a software and hardware integrated solution of sensors + chips + algorithms to vehicle manufacturers. However, Bosch’s influence is mainly in the L1 market, while Mobileye’s competitive advantage is more obvious in the L2 and L2+ markets. Due to Mobileye’s closed system, users can only wait for its algorithm updates and design their own R&D progress accordingly.

In China, Hesai Technology and Baidu Apollo jointly released the Pandora, an autopilot developer kit based on the Apollo platform. It is a set of autopilot developer kit that combines lidar, omni-directional camera modules, multi-sensor fusion, and perception recognition algorithms. The kit is designed to help developers complete sensor system selection and calibration, fusion of cameras and Lidar, and output of the most basic object tracking, which generally takes at least six to eight months for a small team to achieve a “not lagging behind” perception system.

Automated Driving Suite: Helping Auto Companies Build Better Cars

As a matter of fact, the advantage of these Automated Driving startups lies in their algorithms. However, it remains unknown if auto companies will recognize and accept the corresponding lightweight modular Automated Driving Suite provided by these startups, given the fact that the traditional automobile manufacturers have shown some reservations towards the Automated Driving solution proposed by startups, as exemplified by SAIC’s refusal to collaborate with Huawei on its Automated Driving solution, citing the latter’s failure to provide the “body” of the car. It seems that building the “soul” of Automated Driving remains a challenge for these startups.

That being said, it is certain that the final form of Automated Driving will not be dominated by one company. Rather, it will likely be characterized by a division of labor among different players in the industry, working together to expand the market. As a startup that focuses on Automated Driving software algorithms, Winye Intelligent Traveling Solutions Co., Ltd. offers firms an ideal modularization solution. However, due to the concerns surrounding cooperation with automobile manufacturers, these startups may inevitably end up walking towards the comprehensive self-development of their overall car-making process.

It can be said that these startups are willing to help auto companies build better cars, but whether this mutual collaboration can work out remains to be seen. However, with the expansion of the new energy vehicle market, traditional car manufacturers have been losing their competitive edge, while the cost of entering the market has been decreasing. Cars are increasingly becoming referred to as “mobile phones on four wheels”, and with the aggressive entrance of internet giants into the auto industry, it seems that the only way for these traditional automakers to stay competitive is by fully embracing collaboration with these internet enterprises, making use of the modular techniques they provide and pairing them with their mature and well-established supply chain for the ultimate breakthrough in auto manufacturing.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.