Author: Michelin

Since Tesla announced its delivery data in September and forecasted a global single-quarter delivery volume of 241,300, there has been no doubt that the third quarter will be another “best in history” report.

Sure enough, Tesla held its Q3 earnings call early on the 21st Beijing time, and the company set a number of historical records in the third quarter, achieving profitability for the ninth consecutive quarter and recording a net profit of over $1 billion for the second time in company history.

However, following the impressive earnings announcement, Tesla’s stock price remained relatively flat, closing up only 0.18%. Is it because the previous sales have reduced expectations for the report, or is it because the absence of Musk made the earnings call “conservative”?

Sales Approaching Supply Chain Limits

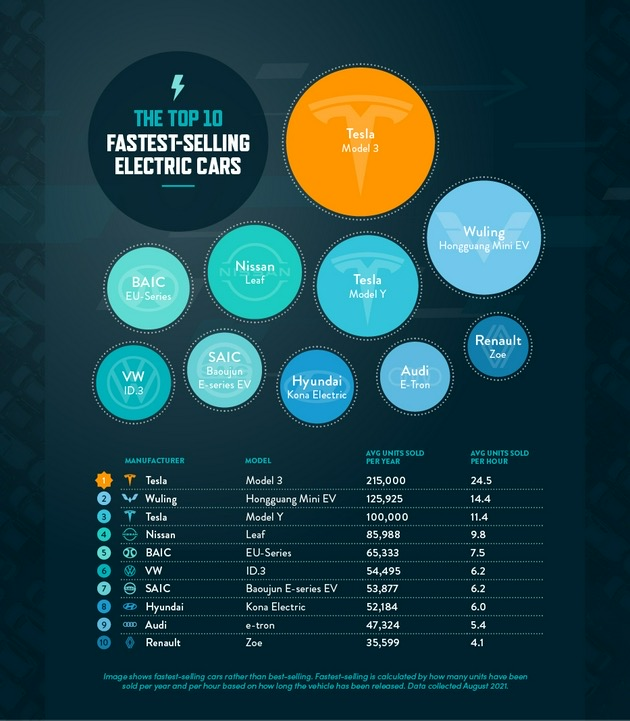

Recently, some institutions have reported that the Tesla Model 3 sells an average of 24.5 vehicles per hour worldwide, making it the fastest-selling electric car in history. Its younger sibling, the Model Y, sells an average of 11.4 vehicles per hour, ranking third. It is not an exaggeration to describe the performance of the Model 3 and Model Y as “supply cannot meet demand.”

Tesla’s earnings report confirms this data.

In terms of production, a total of 237,800 cars were produced and 241,300 cars were delivered in the third quarter, with Model Y and Model 3 deliveries exceeding 232,000, accounting for 96.15% of total deliveries.

Thanks to the growth in delivery volume:

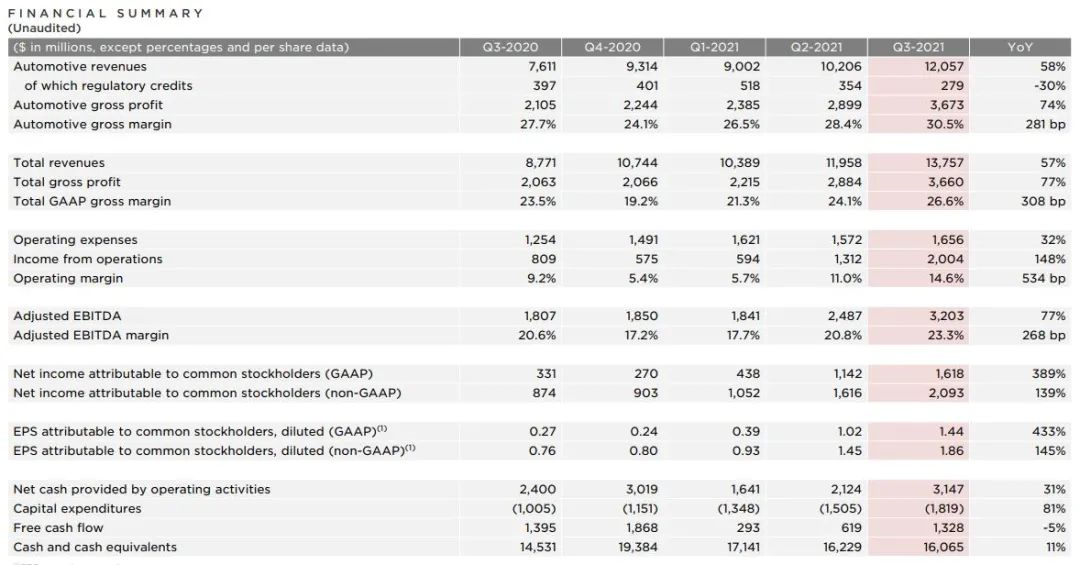

- Tesla’s revenue in the third quarter reached $13.757 billion, a year-on-year increase of 58%;

- Automotive revenue was $12.057 billion, a year-on-year increase of 58%;

- Operating profit was $2.004 billion, a year-on-year increase of 148%.

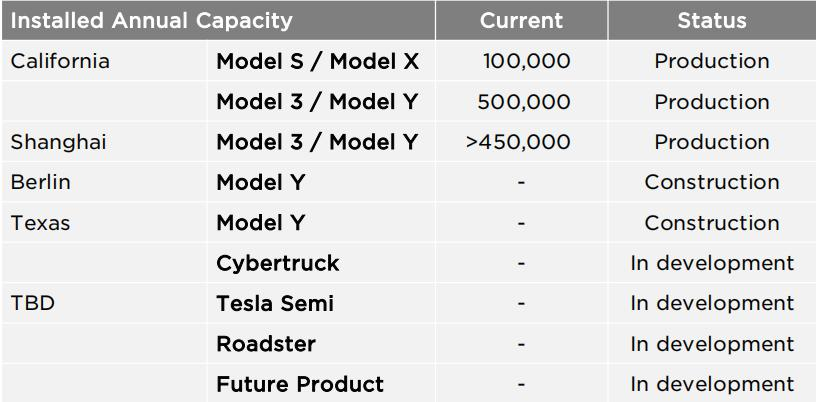

With data looking all good, Tesla’s supply chain is quietly showing warning signs. Affected by issues such as the semiconductor shortage, port congestion, and frequent blackouts in the automotive industry, Tesla’s global inventory turnover days in the third quarter were only six days, further shortening from nine days in the previous quarter and far lower than the industry average.It is no wonder that Tesla reiterated its goal for the next few years in a recent conference call – to rapidly increase production capacity and strive for an average annual delivery growth rate of 50%. The burden of a 50% increase in output next year falls not only on the newly-built Berlin Gigafactory, but also tests Tesla’s supply chain. Despite Tesla’s assertions that it has yet to achieve full production capacity at its factories, the Shanghai Gigafactory’s annual production capacity has reached 532,900 vehicles, surpassing the planned 450,000 vehicles/year and becoming the center for exporting to Europe; the production capacity of the California factory also needs to be further explored. Given the current quarterly production capacity of around 260,000 for the two factories, the room for growth compared to Q3’s sales volumes of 241,300 isn’t that large. This means that if faced with a larger order volume next quarter, Tesla may encounter “a sweet burden” due to supply chain and production capacity limitations.

In Q3’s earnings report, a highlight beyond sales volume was the gross profit margin reaching as high as 30.5%.

As new forces celebrate approaching their target of a 20% profit margin, Tesla’s Q3 gross profit margin exceeded 30%, with an overall operating profit of 14.6%, a level that even conventional gasoline vehicles cannot help but admire.

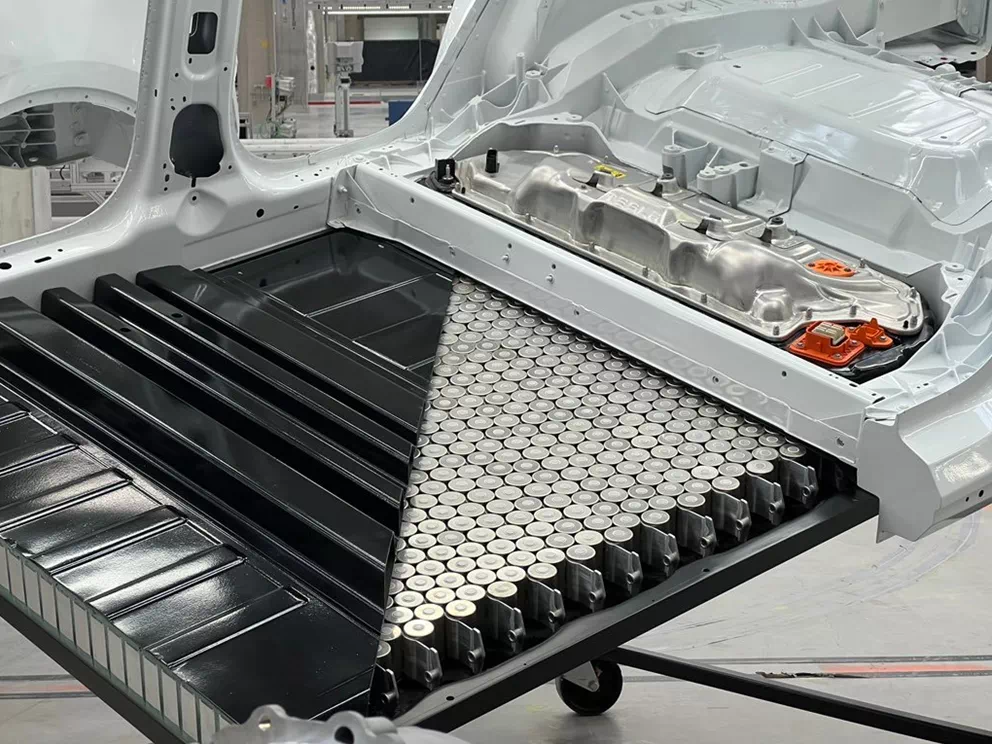

In Q3, the Model 3 and Model Y accounted for 96.15% of the total delivery volume, causing Tesla’s average selling price to continue to decline, down 6% year over year. However, as the structure continues to shift towards lower-priced models, the gross margin has not only not decreased, but has increased. This is because Tesla continues to reduce costs at a faster rate than the average selling price decline, such as through economies of scale brought by mass production and delivery, further localizing component procurement and reducing vehicle costs at the Shanghai Gigafactory, and using cheaper and safer lithium iron phosphate batteries.

During the quarterly earnings call, Tesla announced that it will be using lithium iron phosphate batteries worldwide for its Model 3 and Model Y standard range versions, regardless of whether they are produced in China, the US or Europe. This means that the standard range versions will switch from using ternary lithium batteries to lithium iron phosphate batteries. The long range versions will continue to use ternary lithium batteries. Earlier, Tesla announced that US customers could choose to use lithium iron phosphate batteries when purchasing the standard range version of the Model 3, enabling earlier delivery of the vehicle.

By switching to the lower-cost lithium iron batteries, Tesla may be able to stabilize its cost structure. Recent fluctuations in Model Y prices have made many Tesla customers nervous. Additionally, we are curious whether Tesla will lower prices again soon, as it benefits from economies of scale and increasing gross margins.

There are still a few unknowns regarding Tesla’s operations. For example, during its conferences, Tesla often discusses the 4680 battery, the Cybertruck, a small car costing less than $25,000, and new factories. During the earnings call, Tesla finally gave a more specific timeline for these topics.

With the successful completion of its Berlin factory during the Chinese National Day holiday, Tesla’s Berlin and Texas Austin factories will receive final permits by the end of the year and begin producing the first batch of Model Ys by the end of the year. The 4680 battery is also in the trial production stage and the first cars equipped with the 4680 battery will be delivered from the Berlin factory early next year. The Berlin Super Factory will gradually relieve the capacity pressure of the Shanghai Super Factory, which serves as the export center of Europe. Moreover, Cybertruck production is scheduled for the Texas factory, but based on the current construction progress, it is expected to be launched next year.Tesla said that its current production capacity is limited, mainly focused on Cybertruck and Model Y vehicles, so the $16,000 (USD 2.5K) car won’t be available until at least 2023. After all, Model 3 and Model Y are still in high demand, and Tesla’s demand for a lower-cost, lower-profit sinking market is not that urgent.

Oh, without Musk’s earnings report, I almost forgot about Bitcoin. In Q3, Tesla’s devaluation of Bitcoin was USD 51 million. It should be noted that, after the sharp drop in Q2, Bitcoin saw an increase in Q3. Thus, this part of Tesla’s devaluation should have been sold secretly.

Finally,

Three months ago, at the Tesla Q2 earnings conference attended by Musk, he said that the tipping point for electric cars has come. At that time, we didn’t feel it very strongly, but Q3’s performance really makes us feel the tipping point has arrived.

In the Q3 electric car market, we not only saw Tesla breaking historical sales and gross profit margins, but we also saw electric cars represented by Model Y racing ahead with labels such as “new energy” and “pure electric” in the sales charts, directly going against gasoline vehicles. We also saw forecasts from institutions that expect Tesla to exceed 1.6 million sales next year… Electric cars are slowly moving towards the same stage as gasoline vehicles.

On this road, Tesla is becoming more and more proficient at leading.

And what we care more about is whether Tesla’s next price cut is coming soon, as the economies of scale become apparent and gross profit margins grow against the grain.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.