Financial Data:

-

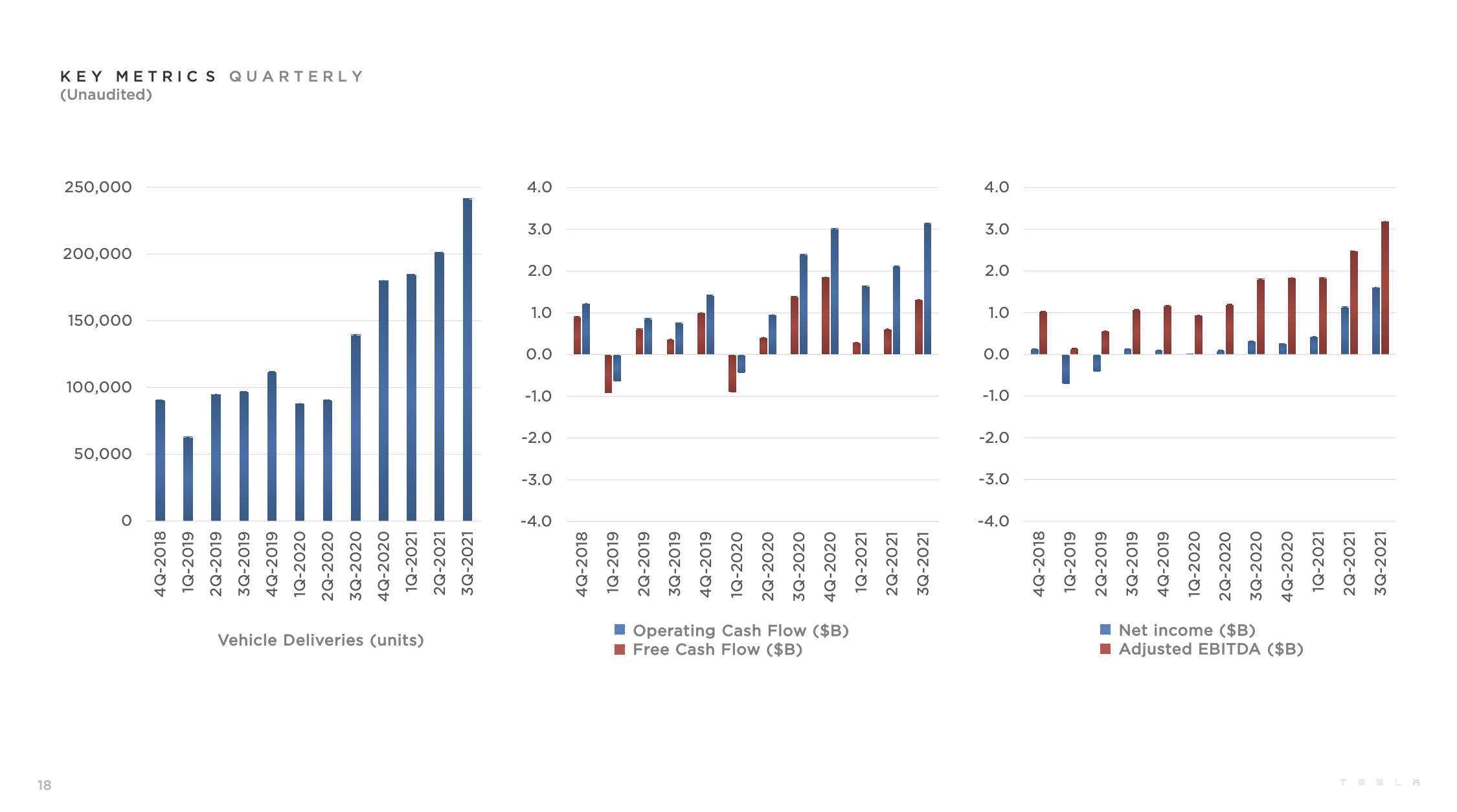

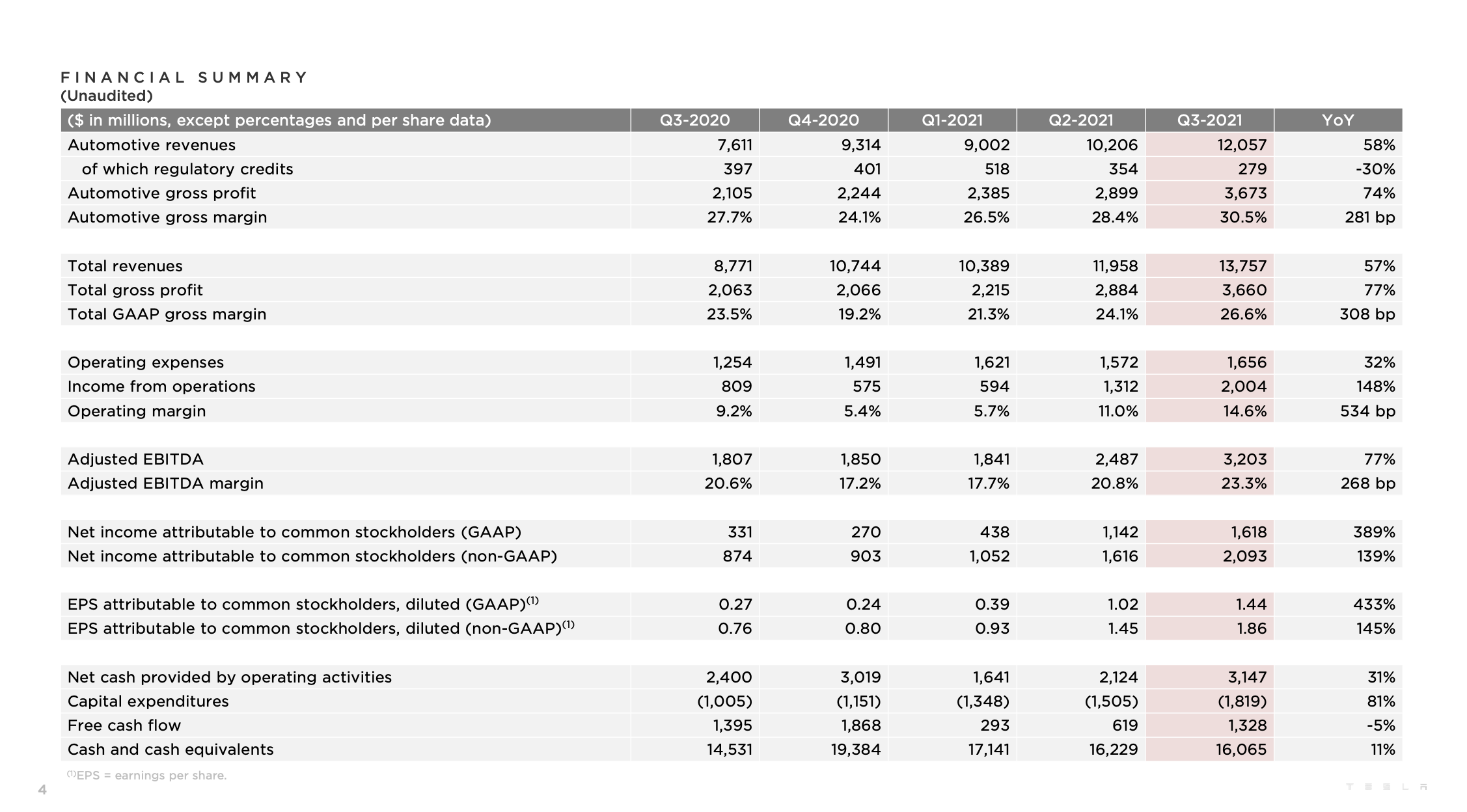

Total revenue of $13.757 billion, an increase of 15% QoQ and 58% YoY. Automotive revenue was $12.057 billion (of which $0.279 billion was revenue from the sale of carbon emission credits), an increase of 18.1% QoQ and 58% YoY.

-

Automotive gross profit of $3.673 billion, an increase of 26.7% QoQ and 74% YoY.

-

Total gross profit of $3.66 billion, with an overall gross margin of 26.6% and a vehicle gross margin of 30.5%.

-

Cash and cash equivalents reached $16.065 billion, and $1.5 billion in loans were repaid in Q3.

-

GAAP net income of $1.6 billion.

-

Operating cash flow minus capital expenditures (free cash flow) of $1.328 billion.

-

GAAP operating revenue of $2 billion, with an operating margin of 14.6%.

Financial Summary: Tesla again achieved historical highs in total revenue, automotive revenue, gross profit, gross margin, net income, and net profit margin in 2021Q3. The main reason for this was the increase in vehicle deliveries.

Delivery Data:

-

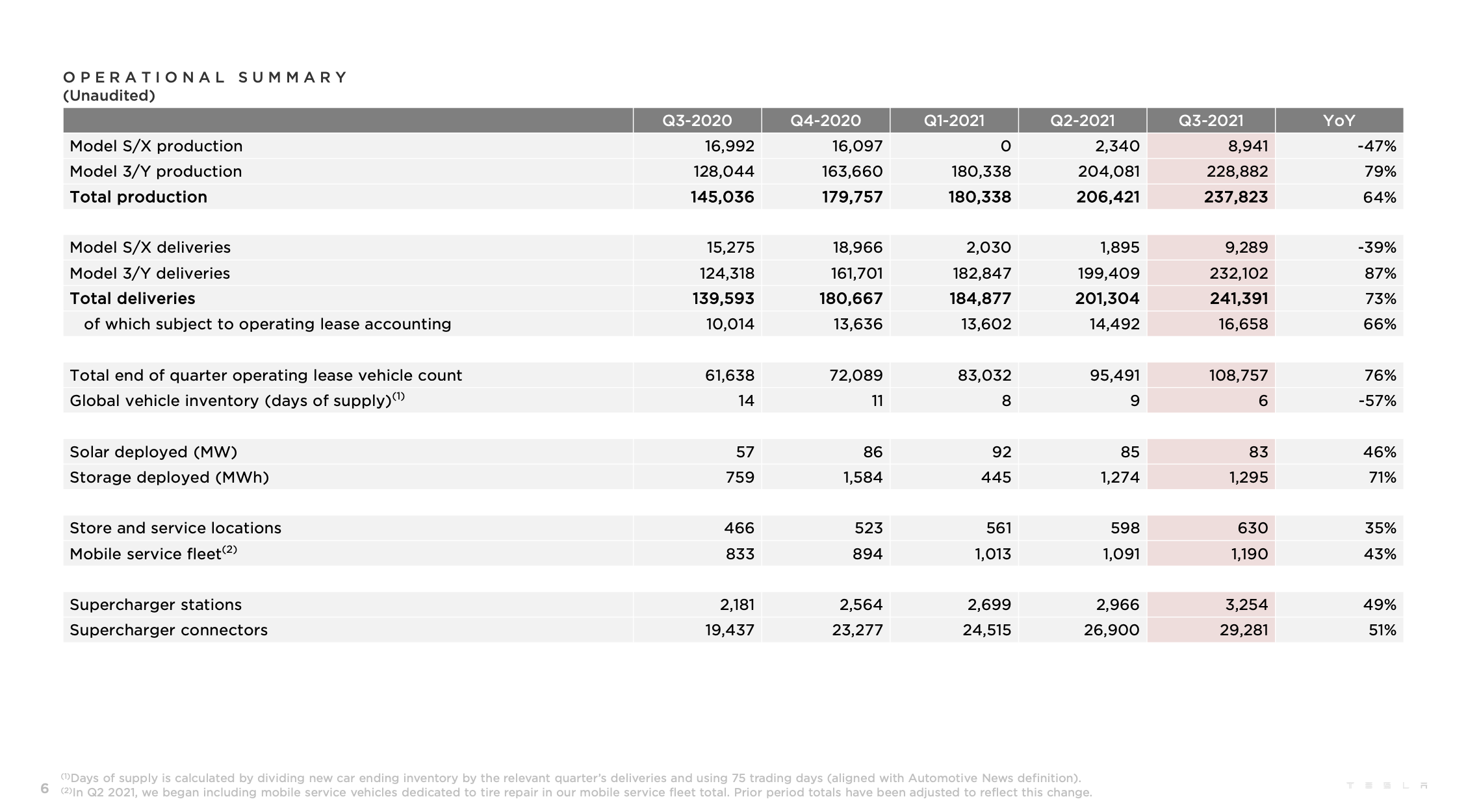

Total production of 237,823 vehicles in 2021Q3, including 8,941 Model S/X and 228,882 Model 3/Y.

-

Total deliveries of 241,391 vehicles in 2021Q3, including 9,289 Model S/X and 231,102 Model 3/Y.

-

The global average inventory turnover days were 6 days, a decrease of 30% QoQ and 57% YoY from 9 days and 14 days, respectively.

Factory and Capacity:

Tesla stated that Q3 was affected by continued global supply chain shortages, logistics challenges, and various other manufacturing challenges, but Tesla still did its best to ensure planned production capacity. Currently, Tesla’s strong demand is mainly dependent on these uncertain external constraints.

- California/Texas, United States:The Fremont factory has produced over 430,000 cars in the past four quarters, with room for further improvement in production capacity. The production of the updated Model S is ramping up and the updated Model X has started delivery. The construction of the Texas factory is currently proceeding according to plan, and the factory has entered the equipment debugging phase and begun production of the first trial assembly cars (Model Y).

- Shanghai, China:

The Shanghai Gigafactory is the main production capacity for exports in Q3, and the factory’s production efficiency is still improving. The domestically-made Model 3/Y equipped with lithium iron phosphate battery cells has begun to be exported globally.

- Berlin, Germany:

The construction of the factory is still ongoing and equipment testing has begun. The Berlin factory is expected to obtain final approval at the end of this year.

Superchargers and Energy Business:

The number of Supercharger stations has reached 3,254, with 288 new ones added, an increase of 9.7% compared to the previous period and 49% compared to the same period last year. The number of Supercharger piles has reached 29,281, with 2,381 new ones added, an increase of 8.9% compared to the previous period and 51% compared to the same period last year.

Solar deployment increased by 82 MW, a decrease of 2.4% compared to the previous period but an increase of 46% compared to the same period last year. Energy storage deployment increased by 1,295 MW, a decrease of 1.6% compared to the previous period but an increase of 71% compared to the same period last year.

Other:

The Tesla FSD Beta has started to implement more widespread push based on users’ “Safety Score”.

Tesla plans to begin production of Model Y in the Texas and Berlin Gigafactories this year as planned.

The 4680 battery cell project has made progress, and Tesla is testing more battery packs for testing.

In early October, Tesla launched a new type of insurance based on “Safety Score” in Texas, with premiums more accurately reflecting users’ accident rates.

🔗Open a US and Hong Kong Stock Account (Get 1 NIO share for free and enjoy 90 days of commission-free trading in US stocks)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.