Author: Guo Hehe

If you’ve heard of the story of Tesla, you may or may not have heard of their CEO Musk.

Many people describe him as crazy, but there is no doubt that he is a genius in some ways. Everyone knows that Tesla is the best-selling electric car in the world. Everyone knows that Tesla’s cars don’t stop shaking when they brake. But what many people don’t know is that Tesla actually sells car insurance.

At the 2021 shareholder meeting held at the Texas Super Factory on the other side of the ocean, Tesla CEO Musk criticized that “insurance regulations are a maze and crazy, as if designed to be difficult,” and even announced that “the company will launch a new insurance product in Texas next week”.

Musk is undoubtedly the king of hype, and last time he hyped up the virtual currency “dog coin” for a long time, which raised the price and ultimately let a bunch of investors lose their money. After announcing the entry into the insurance industry this time, Tesla’s stock price broke through the $800 mark, hitting a new record high.

The amazing thing about Musk is that while he talks a lot, he doesn’t just talk. Tesla selling car insurance is not something that only happened this year. We found on enterprise investigation that as early as 2020, Tesla had established Tesla Insurance Brokerage (Shanghai) Co., Ltd. with a registered capital of RMB 50 million, 100% controlled by Tesla Hong Kong Company. This layout did not just start with the shareholders’ meeting.

Many people may not understand why a car manufacturer can sell car insurance. Wouldn’t they lose money? Other car companies may not be able to do it, but Tesla really has the potential to succeed.

Tesla’s insurance billing method is different from the formula calculated by actuaries in traditional insurance. Its premiums are based on each person’s driving habits. By collecting big data and tailoring insurance coverage and prices to different users based on their driving styles, the insurance coverage and prices are all different. According to other media calculations, although car owners have the same car, using the new calculation method, Tesla’s car insurance pricing can be 30% to 40% lower than current car insurance, and the car insurance business will also bring Tesla 30% to 40% of revenue.

This billing method is not actually the first proposed by Tesla, and it is called Usage-Based Insurance (UBI) car insurance.

UBI insurance is not a new concept. In simple terms, it provides differential premiums based on the actual driving behavior of car owners for the same policy. For example, compared to conventional insurance billing, UBI insurance offers a parking reward program where consumers receive daily deduction and refund when the car is not in use.

What are the advantages of this billing method? If this concept can really be implemented, it will be revolutionary for the car insurance industry!

For car owners, UBI can reasonably reflect the insurance and risk costs of drivers, and reflect the fairness of premiums. In other words, the better the driver, the lower the premium. And with the decrease in premiums, it can also encourage drivers to develop better driving habits and improve safe driving behavior.

Imagine that if your car insurance is no longer an annual package, but can be customized monthly, with appropriate refunds for good driving behavior and low mileage, and lower premiums than traditional fuel vehicles, would you want to buy such car insurance? If such insurance is only available for new energy vehicles, would Tesla become more attractive?

For insurance companies, this billing method has several advantages.

-

The driving risk of drivers can be identified through feedback data of higher quality and faster response time, such as monitoring excessive acceleration, braking, and turning, speeding, and dangerous driving areas and road conditions.

-

When an accident occurs, the entire system has a stronger ability to determine liability. By combining videos, vehicle operating records, and other data, the responsibility can be divided and claims can be paid more efficiently.

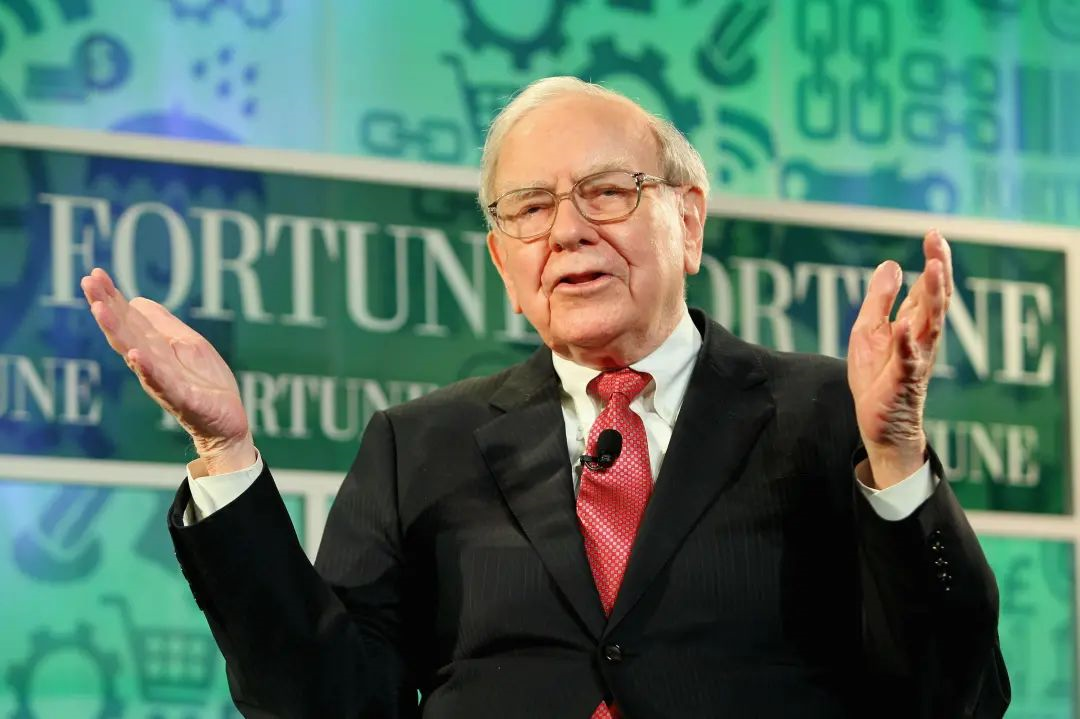

With the huge sales volume of Tesla, the data collected on the road will be astonishing. However, is it really that simple to do insurance? Maybe not, as early as 2019, there were rumors that Tesla wanted to enter the insurance industry. Even the optimistic media asked Warren Buffett’s opinion on this matter. At that time, Buffett summarized his opinion on this matter with a simple sentence — “I believe that the probability of a car company doing insurance well and an insurance company doing cars well is about the same.”

Buffett believes that many companies have tried to enter the car insurance industry in the past, but the chances of a car company succeeding in the insurance business are like those of an insurance company entering the car industry.

Buffett believes that many companies have tried to enter the car insurance industry in the past, but the chances of a car company succeeding in the insurance business are like those of an insurance company entering the car industry.

The car insurance industry is not easy to operate. For insurance business, US insurance giant, Progressive, has launched UBI car insurance products. They provide an OBD box for each purchased user to plug into the car to record data in real-time. After a 30-day observation period and six months of use, the insurance company will recover the hardware and then formulate an updated insurance preferential policy, with the highest discount of up to 30%.

Tesla lacks sufficient scale relying on its single brand, and also lacks traditional accumulated abilities in the insurance industry. After all, having vehicle data and being able to train truly valuable models to accurately assess risks are two different things.

At the time, Buffett felt that new car insurance gross margin was only 6% and that there was not much profit space left. The entry of companies such as Tesla into the industry would make them competitors of traditional insurance companies, but would not destroy the entire car insurance industry, and he did not expect that it would have a disruptive impact. Furthermore, insurance regulations change very slowly, and they are more inclined to support the stability of established benefit organizations. As an automotive company that does not seem to have a stable economic source, it is difficult to obtain insurance licenses for selling insurance.

From the announcement in 2019 to the actual proposal to enter the car insurance industry in 2021, Musk’s insane move can at least prove something. First of all, there is still profit margins in the insurance industry that can be squeezed. Even as a latecomer, Tesla can still take a share of the pie. After all, building rockets can really burn money.

Second, Tesla’s move is more of an Internet economic thinking than an attempt to seize the car insurance market. Just like the early investment of Didi, even if it does not make money or even loses money, it first attracts more people into Tesla’s ecosystem with huge discounts, and then gradually pulls you into the “abyss.” This successful model is not unfamiliar to us, just take a look at Apple.

The entry of Tesla into car insurance is still an unknown factor, but regardless of the outcome, if this matter really takes off, it will be revolutionary for the car insurance industry.

Previously, car insurance was like “common prosperity,” and the difference in premiums between good and bad drivers was not significant, sharing the big pot of insurance. A very small proportion—probably less than 5%—of bad drivers greatly inflated the insurance premium for everyone.If data could help us better judge risks, it would be a material incentive for the 95% of good drivers. As a result of this incentive, the behavior of good drivers would be further optimized, which could indirectly reduce road safety risks. After all, being familiar with traffic regulations doesn’t necessarily mean you are a good driver, but money probably does.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.