China’s New Energy Vehicle Industry in 2021

Entering into 2021, China’s new energy vehicle production and sales growth has continuously broken historical records, with a growth rate far exceeding expectations.

The “Energy Conservation and New Energy Vehicle Technology Roadmap 2.0” and the “Development Plan for the New Energy Vehicle Industry” released in 2020 both set the target for new energy vehicle sales to reach 20% of the total sales by 2025, which was considered an ambitious goal at that time but now seems to be conservative.

The next question we are concerned with is whether China’s industry chain can securely and stably support this demand. Can China’s industry chain meet the market demand in terms of quality and quantity?

The three core components of new energy vehicles are the battery system, motor, and electronic control system. Among these, the battery system is the most important because its cost proportion is the highest and both the quality and quantity are related to the healthy development of the new energy vehicle industry. Motors and electronic controls receive less attention but cannot be ignored as products continue to move towards the mid-to-high-end market and bottlenecks in motors and electronic controls may arise.

The shortage of chips, core technology, and production capacity of chips have also brought hidden dangers to the supply security of motor controllers.

Battery: Technology is not a problem, but there is a shortage of cobalt and nickel resources and lithium resources are slightly inferior

Is our industry chain ready?

From the perspectives of safety, performance, and cost, the power battery still does not fully meet the needs of electric vehicles, which means that there is still a lot of room for development in power battery technology. Therefore, technology and cost have become the biggest competitive barriers in the battery field.

China’s early-mover advantage in new energy vehicles has won precious time for Chinese battery companies to develop.

In terms of scale, China’s power battery production capacity layout is globally leading, far exceeding that of Japan, South Korea, Europe, and the United States. Chinese production capacity accounts for more than half of the world’s total, showing significant scale advantages.

In terms of technology reserves, CATL (Contemporary Amperex Technology Co., Ltd.) has a leading global competitive advantage with its technology layout of structural innovation and material system perfection. CATL possesses strong diversified development capabilities in material systems, battery cell processes, pack design and covers mainstream domestic brands, new forces, and foreign-funded automakers.

In terms of technological innovation, BYD launched blade batteries, Guoxuan High-tech introduced JTM, and Honeycomb Energy introduced cobalt-free batteries and other leading technologies. These companies have also gained recognition from international major automakers and provide support for mainstream vehicle models.

In addition, under China’s leadership, lithium iron phosphate batteries have seen a revival worldwide. Tesla has started to use lithium iron phosphate batteries in large-scale production, and companies such as Volkswagen, Renault, Hyundai, and Ford are also considering adopting this technology.

Therefore, it can be said that China has a leading advantage to a certain extent in terms of scale and technology. However, China is still a country with relatively scarce resources of battery raw materials. The quality of lithium carbonate is relatively poor, and Cobalt and Nickel resources are relatively scarce, heavily relying on imports.The COVID-19 pandemic is like a stress test. Under the impact of the pandemic, abnormal fluctuations have appeared in the production and demand of the market, and the current shortage of supply in the industry chain is affecting the entire automotive industry.

(1) Rising raw material prices and driving technological and material innovation

Since the second half of last year, influenced by factors such as the improvement of downstream prosperity in China and an increase in U.S. inflation expectations, the prices of battery raw materials have skyrocketed.

In addition to main materials such as lithium iron phosphate, ternary, and electrolyte, auxiliary materials such as PVDF (polyvinylidene fluoride) have also risen by more than double their prices at the beginning of the year. According to GGII, a lithium battery research institute, the theoretical cost of battery cells and battery systems has risen by more than 30%.

The price of lithium carbonate, which is indispensable to the positive electrode materials and electrolytes of lithium batteries, is especially concerning. Due to the relatively poor overall endowment of lithium resources and the immature mining technology, China has a high degree of dependence on imports, with a self-supply rate of only 32% in 2020, while the world’s major lithium resources are mainly concentrated in South America and Australia.

Chinese companies are participating in the development of overseas mines through joint ventures, off-take agreements, and their own mining activities. Ganfeng Lithium and Tianqi Lithium are companies that have participated in the development of overseas lithium mines.

According to Antaike statistics, in 2019, seven lithium mines in Australia accounted for 85% of the global supply of lithium ore and 51% of the total global supply of lithium resources. Therefore, pricing power for spodumene has always been controlled by Australian mining enterprises.

It is worth noting that due to the fact that lithium mines currently in production are mainly supplied through long-term contracts, only Galaxy Resources and Pilbara have a small amount of spot sales. Moreover, nearly all of Galaxy Resources’ sales have been covered by YAHUA and Shengxin, and currently most of the market circulation of lithium ore comes from Pilbara. Therefore, this auction of Pilbara lithium concentrate has caused widespread attention among global peers in the industry.

In July of this year, Pilbara held its first auction of lithium concentrate, with the bidding price rising from $700/tonne to a final price of $1250/tonne, setting a historic high for the price of spodumene concentrate. Under the continuous intensification of supply and demand contradictions, the second auction of Pilbara lithium concentrate in September soared to a sky-high price of USD 2,240/tonne, far exceeding market expectations.

This price may not have a significant impact on China’s large lithium battery factories in the short term, but it reflects the sharp contradiction between supply and demand in the market, providing impetus for pushing up long-term contract prices.

Long-term contract prices may likely rise further, further increasing battery costs, squeezing battery company profits, and ultimately partially reflecting in the end market, affecting market demand.

Of course, Chinese battery companies will not sit idly by. Companies such as CATL and Guoxuan High-Tech, have launched close cooperation with Yichun.

The battery industry, led by CATL, has begun exploring the application of sodium-ion batteries in cars. It is foreseeable that the continuous rise in raw materials will force companies to reduce costs through technological and process innovations, as well as developing new materials.

(2) China’s relative shortage of lithium carbonate, cobalt, and nickel.

The rising price of imported lithium ore has forced battery companies to explore the potential of Chinese lithium mines. In terms of quantity, China’s lithium resources are relatively abundant. According to data released by the US Geological Survey in 2015, the world’s proven lithium reserves were approximately 39.78 million tons, with Bolivia having the most lithium resources at 9 million tons, followed by Chile (>7.5 million tons), Argentina (6.5 million tons), the United States (5.5 million tons), and China (5.4 million tons).

SMM data shows that China’s output of lithium carbonate in 2020 was 166,000 tons, a year-on-year increase of 4.4%, with battery-grade lithium carbonate accounting for 106,000 tons and industrial-grade lithium carbonate accounting for 60,000 tons. SMM predicts that in 2021, lithium carbonate production will reach 196,000 tons, a year-on-year increase of 18%. If two-thirds of this is battery-grade lithium carbonate, the production will be 130,700 tons.

Theoretically, for every 1KWh of battery capacity, 0.45-0.68kg of lithium carbonate is required, and the molecular weight of lithium cobalt oxide (LCO), nickel cobalt manganese oxide (NCM), and nickel cobalt aluminum oxide (NCA) is similar, requiring approximately 0.65kg of lithium carbonate. If we use an average value for estimation, approximately 0.565kg of lithium carbonate is required for every 1KWh of battery capacity. With 130,700 tons of lithium carbonate, we can produce approximately 230GWh of batteries.

It is predicted that by 2025, China’s demand for power batteries will reach 450GWh. In 2025, China will need to increase its battery-grade lithium carbonate production to 250,000-260,000 tons. Of course, China has the potential to do this with its lithium resource reserves, but the quality is slightly worse. This requires further improvement in lithium extraction technology, which can drive down costs.

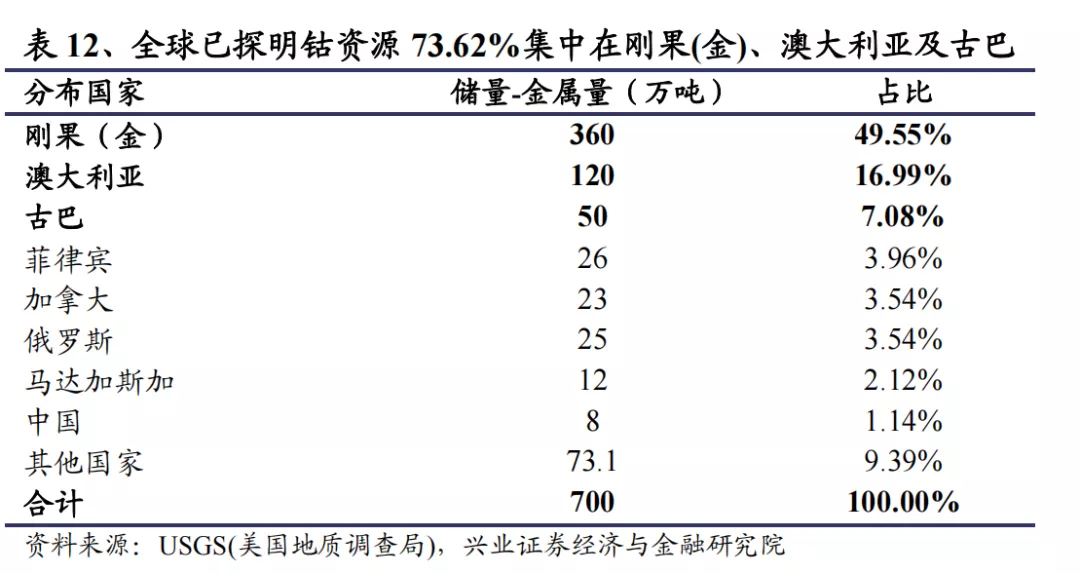

In addition to high external dependence on lithium carbonate, China also has a high external dependence on cobalt resources. 73.62% of cobalt resources are distributed in Congo (Kinshasa), Australia, and Cuba, and China’s cobalt resources are very scarce, with an import dependence rate of more than 90%.

Although its reserves are low, China is a major cobalt processing country, accounting for 67% of the world’s refined cobalt production, of which 94% of the cobalt raw materials are imported from Congo (Kinshasa). This means that if the supply of Congo’s cobalt is disrupted, the supply of cobalt raw materials will face a risk of interruption.

Industrial Securities predicts that by 2025, the amount of cobalt used in power batteries will reach 62,000 tons, with an average annual compound growth rate of 24.3%.

# Cobalt – A bottleneck resource in the development of batteries

# Cobalt – A bottleneck resource in the development of batteries

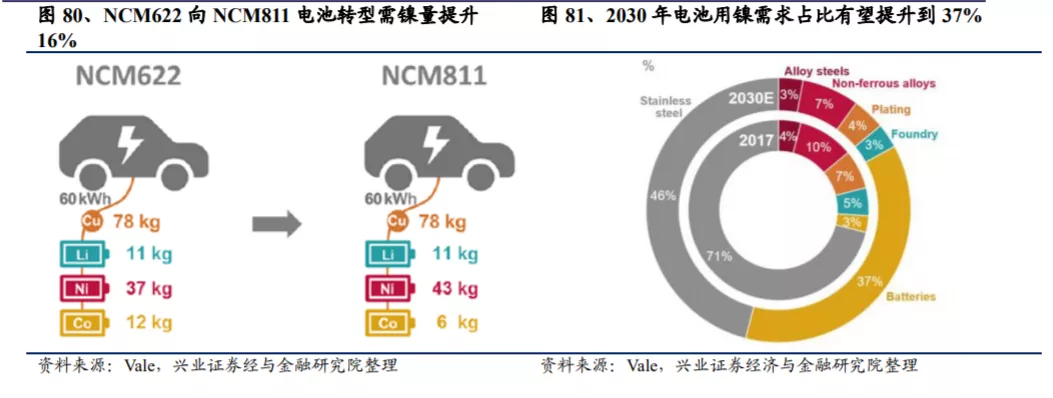

The resource of cobalt is the true bottleneck in the development of batteries, which can only be solved by reducing its usage. Currently, enterprises represented by Hive Energy have explored cobalt-free batteries. Companies such as Ningde Times are also developing cobalt-free batteries, and even rare metal-free batteries, to reduce the cost of batteries. Of course, the development of high-nickel batteries can also effectively reduce the usage of cobalt, but the usage of nickel will greatly increase at the same time.

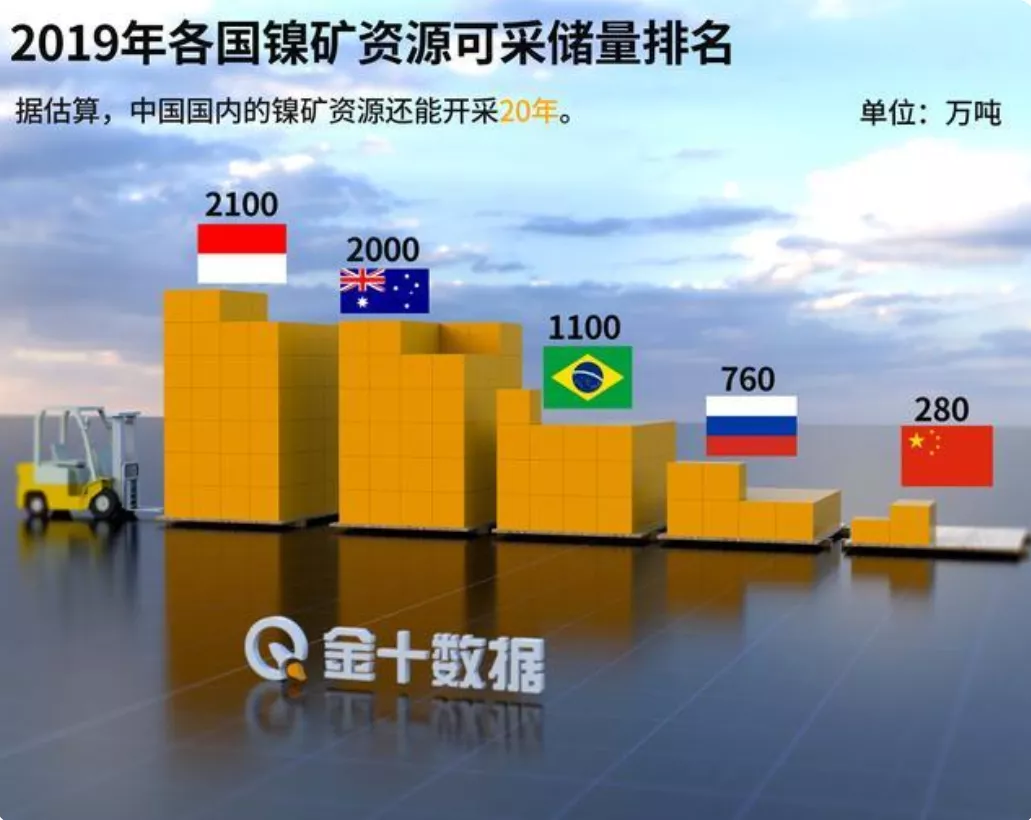

Nickel mineral reserves severely insufficient in China

In terms of nickel mines, China’s proved reserve of nickel mineral resources only accounts for 3.7% of the world’s total, and it can be said that the reserve of nickel mineral resources is severely insufficient. According to incomplete statistics, China’s nickel ore imports rely on imports more than 80%, mainly from Indonesia and the Philippines.

With the increase of China’s import volume, the Indonesian government realized the importance of nickel mines and issued a ban policy in 2019, completely prohibiting nickel ore export in 2020. Fortunately, before the ban policy was issued, Chinese enterprises had already started to layout nickel mineral resources in Indonesia. For example, Qing Shan Holdings bought 47,000 hectares of nickel mines in Indonesia in 2009, and Ningde Times directly built factories to smelt nickel mines in Indonesia. In addition, Chinese enterprises such as Vale, Hunan Shangcheng, and Qingdao Zhongcheng have also made investments in nickel resources. Moreover, since the Indonesian ban only restricts the minerals with nickel content higher than 1.7%, China has only imported minerals with nickel content below 1.7%, which are only classified as iron ore.

Through the above methods, China temporarily resolved the crisis of nickel resources. Reducing the usage of nickel and opening up more import channels will be the key work in the future of the industry.

Motor and Motor Control: Scattered and Disorganized, Low- and Medium-end products are Basically Sufficient

The attention paid to motor and motor control in the industry is relatively low.

In the view of Cai Wei, Professor of Harbin Institute of Technology and member of the China Electric Vehicle Hundred People Association, the low attention is because batteries are still the most easily broken parts in electric vehicles, while motor and motor control are relatively better. Since the “13th Five-Year Plan”, especially the research and drafting of the “Energy-saving and New Energy Vehicle Technology Roadmap 2.0” electric drive technology roadmap, Cai Wei and some industry experts have done basic material, basic electronic components/parts, and technology-based research, so he has a better understanding of the basic situation of China’s drive motors and power electronics industry chain.

Cai Wei believes that, for the industry as a whole, China’s motor and motor control are still at the level of meeting basic requirements, and cannot be called excellent.From the perspective of the industry, Cai Wei believes that there are characteristics of being small, scattered, and disorderly. “In 2020, there were more than 200 electric motor system companies listed on the MIIT directory (announcement).”

Cai Wei believes that many companies are optimistic about the development prospects of the new energy vehicle industry, and they are doing motor and electronic control to occupy their position, without thinking deeply about how to make good products. This has led to a competition among companies that is not based on technology and quality, but mainly on price wars. This makes it difficult for companies in the industry to grow bigger and stronger. Currently, many motor and power electronics companies are losing money.

(1) Lack of excellent high-speed bearings, and lagging behind in the development of high-strength and high-performance silicon steel sheets.

Cai Wei pointed out that China’s high-speed bearings do not yet meet the requirements of the industry’s development. “So far, domestic brand bearings are almost invisible for motor bearings above 12,000 rpm.”

Cai Wei said that large car companies and motor suppliers basically use imported bearings, mainly purchasing from the three major bearing companies SKF, Schaeffler, and NSK.

Some Chinese companies are also working towards this direction, but there is still a gap with foreign levels.

The upstream bearing steel and bearing grease, especially wide-temperature resistant grease, are not yet made well in China and still need to be imported from Japan and Europe. Currently, no domestic enterprise is capable of producing wide-temperature resistant grease that can work at a temperature range of -40°C to 150°C.

In addition, although China can be self-sufficient in silicon steel sheets, high-strength and high-performance silicon steel sheets are still relatively backward, with a certain gap from Japan and France.

In Cai Wei’s opinion, this is the negative impact brought by the price war and vicious competition.

(2) Lack of raw materials for insulation materials for electrically resistant enamel wires

Cai Wei told “Electric Vehicle Observer”, “The main reason why motors often fail, apart from bearings, is the insulation system, but raw materials for electrically resistant insulation materials need to be imported. For example, the raw materials of the electrically resistant insulation paint film coating the surface of the enameled wire mainly come from abroad, especially from DuPont in the United States.”

Cai Wei said that during the “Thirteenth Five-Year Plan” period, he led his suppliers to do some work on tackling materials in the national key research and development program for new energy vehicle motors, and overall progress has been made. However, the entire series of insulation materials still lags behind foreign levels.

(3) Severe dependence on imports of testing and manufacturing equipment

In terms of testing equipment and dynamometers, China still does not have strong products. “Even the dynamic test bench within 10,000 rpm is not good enough, especially for testing equipment above 20,000 rpm, which can only rely entirely on imports.”

In terms of manufacturing equipment, the well-made flat and round wire equipment is mainly concentrated in enterprises from Japan, the United States, Germany, Italy, and other countries.

In addition, precision equipment such as torque measuring instruments, vibration and noise testers, high-end power analyzers, and even constant temperature boxes are still in need of improvement in domestic capabilities.”We car manufacturers all need to spend huge amounts of money purchasing foreign equipment.

(4) The power chips in the controller also mainly rely on imports, and the control chip is basically blank. In terms of motor controllers, Cai Wei pointed out that the biggest problem is the lack of chips. “In recent years, some progress has been made in domestically produced power chips such as IGBT, but high-end products cannot currently use them; moreover, control chips, especially car-level main control chips (MCUs), are basically zero.”

China urgently needs outstanding domestic chip manufacturing companies.

In Cai Wei’s view, this is a very serious problem, especially in the field of main control chips. However, he believes that the production of independent chips for cars is still worthwhile to anticipate within the next 5 years.

In addition, the third-generation wide-bandgap power semiconductors, such as silicon carbide and gallium nitride, are a mainstream direction for future development, but so far, China has no independent chip production for cars.

Cai Wei believes that China is about a generation behind the international leading level in high-temperature resistant capacitors. The gap in power electronics is even greater, and the gap in chips is even larger.

(5) There are no independent products for software platforms.

Cai Wei stated that software platforms, including motor design and controller simulation software, as well as chip operating system software, all require foreign dependence from China.

When it comes to chips and software platforms, Cai Wei reminds us to be cautious, as chips and software have been hot topics recently, and to avoid the reoccurrence of the “Hanxin” fraud incident, which may cause losses to the industry’s development.

(6) Rich reserves of rare earths, high market share of permanent magnet materials

Of course, in terms of the rare earth permanent magnet market share, China still has a significant advantage. However, in Cai Wei’s view, this advantage comes from geographical convenience-China’s rare earth mineral resources are abundant-and the market-China’s permanent magnets occupy about 85% of the global market share.

In terms of technology, China is not very far behind international advanced levels. However, in some new technology areas, such as the development and application of less dysprosium rare-earth permanent magnets, there are still some gaps compared to magnet companies in Japan and other countries.

China is a major rare earth country, especially with abundant light rare earth resources.

Cai Wei told the “Electric Car Observer” that rare earths account for about 15-25% of the cost in motors. Recently, the price of raw materials has continued to rise, and the proportion of rare earth costs has increased, approaching 30%, which has become a major concern in the motor field.

Cai Wei believes that there is a gap in the utilization rate of rare earth raw materials between Chinese companies and foreign ones, which is 5-8 percentage points lower than the advanced foreign level. The product qualification rate is also insufficient, resulting in waste of rare earth resources, something that needs to be focused on and improved. “Generally speaking, the new energy vehicle industry chain in China has achieved some degree of self-supply, but there is still a strong dependence on internationally advanced products and technology in many upstream fields. These fields are usually based on basic science and academic accumulation, and it is difficult to break through comprehensively in a short period of time. Therefore, intensifying research on basic science and engineering applications is the ultimate solution.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.