Author: Wang Yunpeng

Haima Automobile, which was “removed from the watchlist” in the first half of the year, is still facing a crisis.

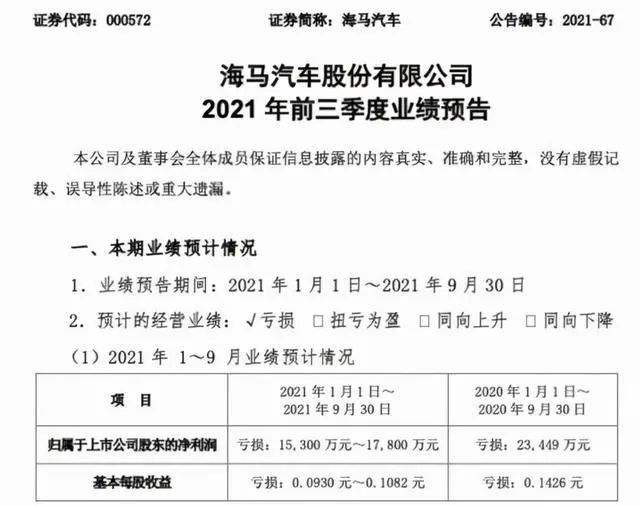

Recently, Haima Automobile released its performance forecast for the first three quarters of 2021. According to the financial report, Haima Automobile’s losses for the third quarter of this year were between RMB 70 million to RMB 95 million, and the net loss attributable to shareholders of the listed company for the first three quarters is expected to be between RMB 153 million to RMB 178 million, compared with a loss of approximately RMB 234 million in the same period last year, a year-on-year change of 24.09%-34.75%.

Haima Automobile explained its losses in the announcement, stating that the epidemic and extreme rain and flood disasters in the Zhengzhou base since the third quarter have had a certain impact on normal production and business operations. However, it is not difficult to find that the market performance of its vehicle models falling short of expectations is the main reason for the continued loss of its business performance.

It is worth mentioning that this is not the first time that Haima Automobile has recorded a loss. Prior to this, due to negative net profits audited over two consecutive accounting years in 2017 and 2018, Haima Automobile’s stock trading was subject to delisting risk warning by the Shenzhen Stock Exchange (hereinafter referred to as “SZSE”) on April 24, 2019, and the stock name was changed from “Haima Automobile” to “* ST Haima”.

Subsequently, thanks to “non-recurring gains and losses” from property sales in 2019 and 2020, Haima Automobile was able to reverse the loss and maintain its listing. By the end of May this year, Haima Automobile was “removed from the watchlist”.

Based on the trend of “removing from the watchlist” in May and the year-on-year reduction in losses in the first three quarters of this year, the overall development trend of Haima Automobile is showing signs of turning around. However, it cannot be ignored that Haima’s core business and profitability are still worrying, and whether it can truly get out of the predicament is still unknown.

“Recovering” through property and equity sales

Looking back at the past few years of Haima Automobile’s development, the road has been quite tortuous.

Let’s go back five years. In 2016, Haima Automobile sold nearly 220,000 vehicles. This achievement was not outstanding in the Chinese auto market at that time, but it was not bad for Haima Automobile.

In 2017, the situation began to change. Data showed that Haima Automobile sold only 140,000 vehicles that year, a year-on-year decrease of 35%. The sales volume of Haima Automobile then continued to decline dramatically in 2018, 2019, and 2020, and by 2020, it had dropped to only 17,800 vehicles.As the product sales plummeted sharply, losses were inevitable. In 2017, the total annual revenue of Haima Automobile was about RMB 9.683 billion, a year-on-year decrease of 30.29%, and the net loss attributable to shareholders of the listed company was RMB 994 million, a drop of more than RMB 1.2 billion from the net profit of RMB 230 million in 2016, a year-on-year decrease of 531.9%. In 2018, Haima Automobile’s full-year revenue fell again to RMB 5.047 billion, a year-on-year decrease of 47.88%, and the net loss attributable to shareholders of the listed company was RMB 1.637 billion, a dramatic drop of 64.5%.

Due to the consecutive audit of negative net profits for two accounting years, on April 24, 2019, the Shenzhen Stock Exchange implemented a delisting risk warning on Haima Automobile’s stock trading, and the stock abbreviation was changed from “Haima Automobile” to “* ST Haima”. The daily limit of price fluctuation is limited to 5%.

For a listed company, the biggest risk is delisting. Therefore, in order to remove the “hat” on its head, Haima Automobile also began to save itself.

On May 15, 2019, at the ninth meeting of the tenth board of directors of Haima Automobile, the founder of Haima Automobile, Jing Zhu, 53 years old at that time, was recalled to serve as the chairman again.

Although Jing Zhu’s return conveyed a signal to the outside world that Haima Automobile will enter the “startup” state again, considering the bleak prospects of relying on its main business to turn things around in a short period of time, Haima Automobile, which needs to maintain its operations, can only choose to “sell its houses to stay alive”.

In 2019, Haima Automobile sold 401 sets of houses, while also disposing of some real estate properties and divesting its automobile research and development business. Thanks to this, Haima Automobile successfully “preserved its shell” with a net profit of RMB 85 million that year and smoothly “removed its hat” in June 2020, changing from “* ST Haima” to “ST Haima”.

After experiencing a slight profit in 2019, Haima Automobile’s operating income fell again in 2020 to RMB 1.375 billion, and the net loss attributable to the owner of the parent company was RMB -1.335 billion, a year-on-year decrease of 1667.09%. However, thanks to the return to profitability in 2019, Haima Automobile avoided the situation of consecutive negative net profits for two years and met the conditions for “removing the hat”.

It is worth mentioning that Haima Automobile’s successful “self-saving” is not only about selling assets. In 2018, XPeng Motors, which did not yet have production qualifications, chose to cooperate with Haima Automobile, and the latter served as its contract manufacturer for its first car model, the G3. It is understood that the contract manufacturing vehicle is accounted for by the net amount method, which also has a positive impact on Haima Automobile’s operating income.## Betting on Hydrogen Energy to Achieve Transformation

As an automaker, what is the best solution for Haima Automobile to break free from its predicament? The answer is obvious, that is, to get its core business back on track.

Facing the “New Four Modernizations” trend in the automotive industry, the transformation of most car brands to new energy, and the bias of relevant policies, Haima Automobile, which is eager to return to the right track, has also formulated its own transformation plan. However, compared with other automakers, Haima Automobile’s strategy of “prioritizing intelligent cars, cooperating with electric cars, persevering in plug-in hybrid cars, and deeply cultivating hydrogen energy cars” seems to be quite radical, given its serious illness.

In the field of hydrogen energy, in April of this year, Haima Automobile signed a strategic cooperation agreement with the 101st Research Institute of China Aerospace Science and Technology Group in Haikou, to jointly build Hainan’s first integrated water-hydrogen and high-pressure hydrogen refueling station, which is expected to be completed and put into operation before October.

Thereafter, on August 16th, Haima Automobile announced that it has completed the development of its first hydrogen fuel cell prototype and is currently developing a third-generation hydrogen fuel cell vehicle. It aims to put about 2,000 hydrogen energy cars into demonstration operation before 2025. In addition, it plans to build a large-scale hydrogen refueling station in the east (Qionghai), west (Danzhou), south (Sanya), north (Haikou), and central (Qiongzhong) areas of Hainan Island.

It is worth mentioning that Haima Automobile’s plan is in line with the “Hainan Province Clean Energy Vehicle Development Plan” released in March 2019, which aims to achieve the goal of “100% private sector new energy vehicle additions and replacements and the statewide ban on the sale of fuel vehicles” by 2030.

It is not difficult to see that Haima Automobile intends to make hydrogen energy its main business and its main driving force to get back on track.

Although the medium and long-term plans seem promising, in the industry’s view, this is only a gimmick in Haima Automobile’s business strategy and is difficult to turn into actual application. On the one hand, the use of hydrogen energy cars has a huge demand for the number of hydrogen refueling stations (similar to the relationship between electric cars and charging piles), and according to relevant research data, as of the end of December 2020, only 118 hydrogen refueling stations have been built in China.On the other hand, at the beginning of this year, the Haima 7X hydrogen fuel cell trial vehicle made its debut in Hainan, with a full hydrogen endurance range of 800 kilometers. Haima Auto stated that it plans to promote the Haima 7X hydrogen fuel cell vehicle in Hainan. However, in June, Haima Auto changed its tune on the investor platform, stating that “the company’s hydrogen fuel cell vehicles are under development.”

In other words, Haima Auto’s so-called hydrogen fuel cell vehicle is still far from mass production and landing.

When will Haima Auto recover?

Although Haima Auto succeeded in “removing the hat” in May and its losses in the first three quarters of this year have decreased compared to the same period last year, when Haima Auto will recover is still unknown.

The reason is simple: after selling real estate and shares, Haima Auto’s core business has not become a new means of “earning money back.”

According to the production and sales data announced by Haima Auto on October 11, the cumulative production of Haima Auto from January to September this year was 22,200 vehicles, a year-on-year increase of 171.76%; the cumulative sales volume was 22,300 vehicles, a year-on-year increase of 136.30%. Among them, SUV sales were 17,500 units, accounting for 78.5% of Haima Auto’s total sales volume.

Although the increase in production and sales volume seems pleasing, the sales performance of less than 25,000 units in the first nine months, compared with other car companies, can be said to be insignificant.

In addition, Haima Auto’s “plug-in hybrid vehicles,” which they stubbornly promote, also have not performed as expected in the market. In March of this year, Haima Auto’s plug-in hybrid SUV, the Haima 6P, was listed, and the sales volume of this vehicle was only 27 units in the month it was released. As for their “hydrogen energy vehicles,” mass production and landing are still nowhere in sight.

In addition to the weak performance of their core business and difficulties in product transformation, Haima Auto will also lose the manufacturing business of XPeng Motors. At the beginning of this year, there were rumors that after acquiring the production qualification of Guangdong Foday Automobile Co., Ltd., XPeng Motors’ models would no longer rely on Haima Auto for manufacturing.

In July, the emblem of the new model of XPeng G3, the G3i, changed from “Haima” to “XPeng,” and the new car was produced in Zhaoqing instead of Zhengzhou Haima factory, basically confirming the previous speculation. Meanwhile, Haima Auto announced that its production cooperation with XPeng Motors is effective until the end of this year, and the two sides are currently negotiating related work.

If the joint venture with XPeng Motors terminates, after losing the manufacturing business, Haima Auto’s sales data on paper will not only be more bleak, but the loss of manufacturing fees will also make the financial situation of Haima Auto, which already lacks profitability, even worse.

It is worth mentioning that despite facing numerous challenges, Haima Automobile has not given up. On August 11, Haima Automobile established a travel company, which operates in the field of network reservation taxi operations and road passenger transportation. “For automobile manufacturers, the field of Internet reservation taxis can open up new avenues for vehicle sales, especially in the field of new energy vehicles,” said analyst Lu Bu.

However, looking at the operating conditions of Haima Automobile in recent years, its various transformation efforts have had little effect. In the future, if Haima Automobile wants to truly turn things around, it may need to focus on more practical product layouts instead of making flashy transformations or blindly expanding its reach.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.