To evaluate the combat effectiveness of joint venture brands in the field of new energy vehicles, as well as how powerful domestic brands are, it is necessary to carefully analyze and think about this question. Blind optimism is not advisable. It is relatively difficult to make an objective assessment, so it is more valuable to do data analysis.

In September 2021, the number of domestic new energy vehicles insured for joint venture brands was 234,900, accounting for 72% of the total 326,400 insured vehicles, of which 193,400 were pure electric vehicles (out of a total of 270,000), accounting for 71.55% of the market share, and 41,500 were plug-in hybrid electric vehicles (out of a total of 56,000), accounting for 73.89% of the market share.

It is necessary to systematically sort out the situation of each brand in various price ranges and niche markets associated with domestic brands.

Overall situation

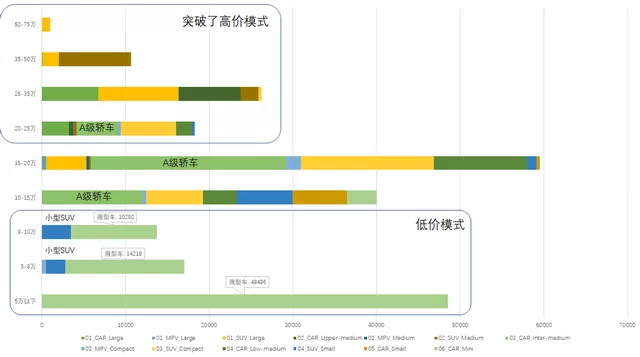

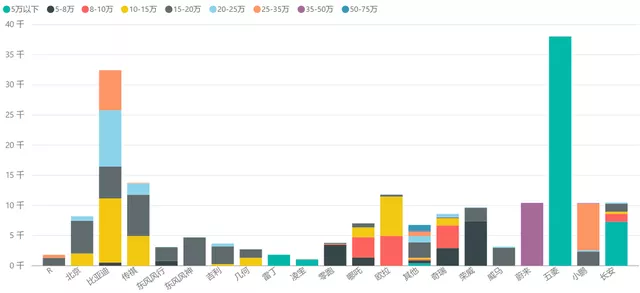

The following is the distribution of the 234,900 vehicles, which can be divided into three categories:

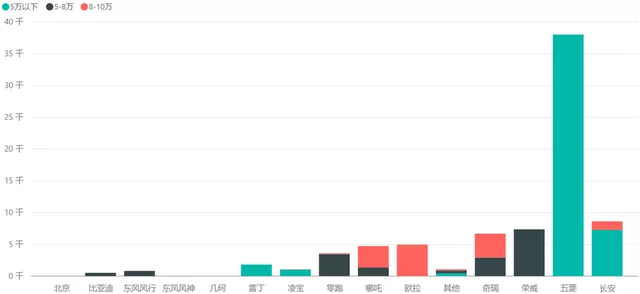

Low-priced vehicles: The number of vehicles priced below 100,000 is 79,200, accounting for 33.74% of all domestic new energy vehicles. Because there are no PHEVs in this price range, the actual proportion of pure electric vehicles is 41%. In other words, 41% of domestic brand vehicles are pure electric vehicles priced below 100,000, which adopt the sales model of around two vehicle types–micro A00 sedans and small SUVs. This strategy is actually influenced by subsidies and is a measure that car companies must take to comply. This mode has been unanimously recognized by Chinese car companies.

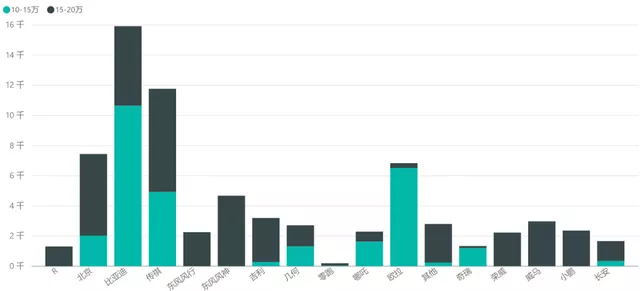

Family vehicles: Vehicles priced between 100,000 and 200,000, accounting for the largest share of new energy vehicles, with a total of 99,000 vehicles, accounting for 42.35% of the total. This is quite complicated and must be viewed from the two modes of PHEVs and BEVs: BEVs account for 72,000 vehicles, accounting for 37.22%. This is the key area we need to analyze the competition pattern, especially the impact of subsidies on this type of vehicle, making it the vehicle category most affected by battery prices in 2022.

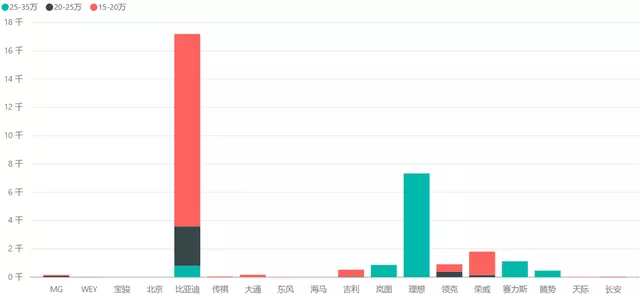

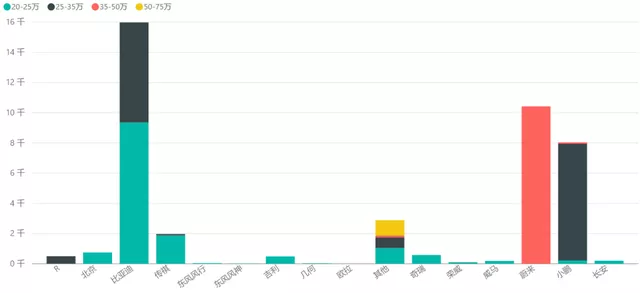

Vehicles priced over 200,000: A total of 56,100 vehicles, accounting for 23.91%, are priced such that car companies can still make money. Therefore, we will analyze which car companies can profit in this area. In this category, BEV vehicles account for 42,100 vehicles, accounting for 21.81%. This area is less influenced by subsidies, so the car companies that can stand firm in this area are actually very good.

PHEV

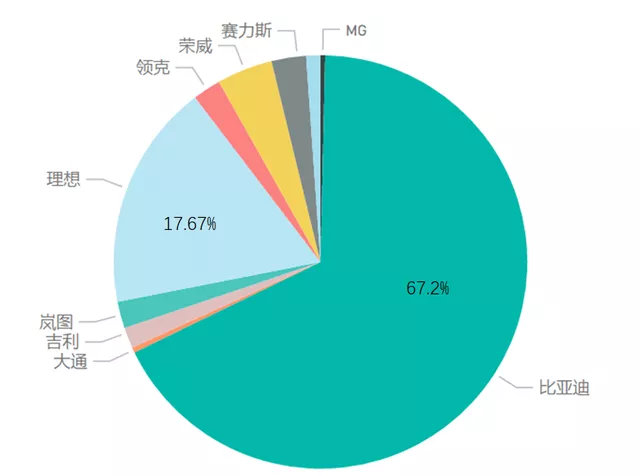

As for PHEV market, currently, BYD accounts for 67.2%, and Ideal for 17.67%. With Huawei’s impact in the field of cyber truck, these three companies’ position in the market may become more obvious in the future.Translated Markdown text with retained HTML tags:

In my understanding, BYD has set the price of PHEV in the range of 150,000 to 200,000 yuan based on very low gross profit per vehicle, which completely distinguishes it from ordinary PHEVs and widens the gap between them and the ideal 250,000 to 350,000 yuan range.

In the detailed subdivision of models and prices below, the main story is about BYD’s four cars and one of Ideal’s cars. From the perspective of data value, its influence is actually low due to the subsequent subsidies (PHEVs themselves have not received much subsidy).

BEV grading situation

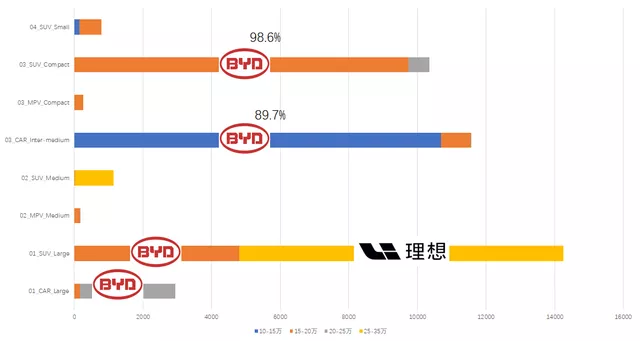

In the structural proportion charts of different brands, we can see their respective strategies:

(I) How do models below 100,000 yuan operate?

1) BEVs below 50,000 yuan and 100,000 yuan are mainly provided by Wuling, Changan, Rading, and Lingbao. There is nothing special to say about this. When it comes to amazing vehicles, everyone else follows along.

2) Cars priced between 50,000 and 80,000 yuan: The main suppliers here are Roewe, Chery, and Zerun. The strategy revolves around 300+ km high-end models. Of course, this is still suggested retail price. In fact, the price is higher than Wuling’s 28,800 yuan, but it may be pegged to the 50,000 yuan range.

3) Cars priced between 80,000 and 100,000 yuan: Mainly including Ora, Nio, and Chery, there are also some real price discounts here, but the configuration is relatively higher-end.

(II) Strategies for the 100,000-200,000 yuan range

The main players here are BYD, Aiways, Ora, BAIC, Dongfeng, and Geely.

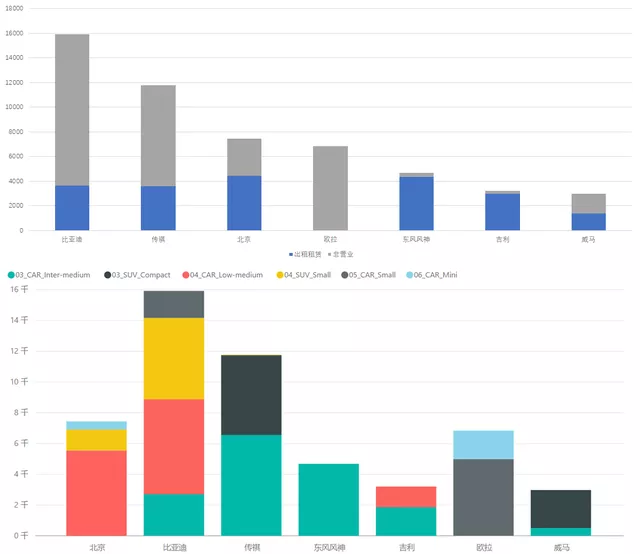

Geely, BAIC, and Dongfeng all aim to target the B2B ride-hail market with sedans, with most models priced similarly for the ride-hail market. EuLv’s EC5, however, has been significantly successful in creating its own market. BYD has focused on intermediate sedans, small and compact SUVs in this segment, achieving some effect. A large proportion of Aion S is focused on ride-hailing, while another part of personal use, with Aion Y having relatively good success in the personal market this year.

I personally believe that the greatest potential for exploration in this field lies with domestic brands, and thinking outside of the box, to successfully incorporate battery electric vehicles (BEV) within the market.

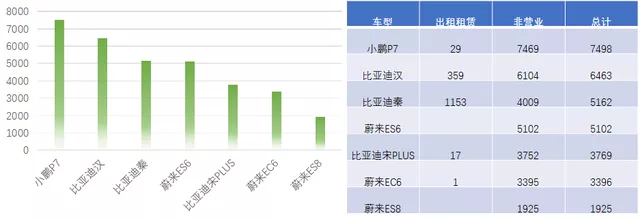

I believe that BYD has made a breakthrough in BEVs priced over 200,000 yuan this year, with the sales data of Han EV having surpassed XPeng. NIO has also demonstrated good performance. Note that the guide price of Qin and Song EV is above 200,000 yuan, but the actual transaction price may be lower. I estimate that this data may be intentional, and the actual transaction price is not that high.

Please note the price details of the following models, which may result in some adjustments to the previous figure.

In summary, in the BEV market priced above 200,000 yuan, the main breakthroughs among domestic automakers are NIO’s three models, XPeng P7, and BYD Han. In the 100,000 to 200,000 yuan market, various domestic brands have put in great effort, with EuLv having explored some new ground, but ultimately, A00s priced below 100,000 yuan remain the mainstay. (All prices listed are before government subsidies).

A realistic analysis of the overall market situation can bring us a clearer view.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.