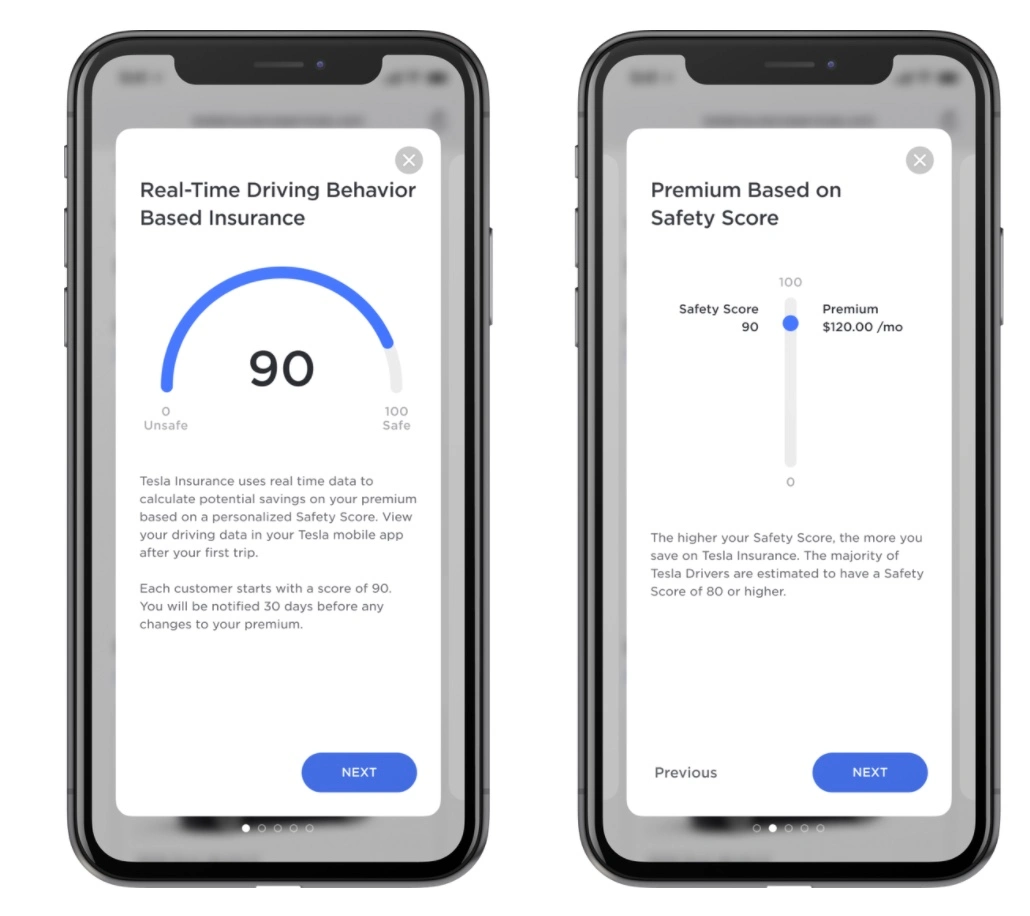

Tesla has officially launched its insurance service in Texas based on real-time driving behavior monitoring. Although Tesla had already launched insurance services in California before, it will now monitor driver behavior every 30 days and notify users of any changes in rates at least 30 days in advance based on their dynamic score.

The default score is 90 points, and Tesla’s rating mechanism is based on the following five points:

- Number of forward collision warnings triggered every 1,000 miles

- Emergency braking

- Sharp turns

- Unsafe following distance

- Passive exits from Autopilot

Tesla claims that regular drivers who use Tesla’s insurance plan will be 20%-40% cheaper than using a competitor’s product. For car owners who drive particularly carefully, insurance costs can be reduced by up to 30%-60%.

Do you think this type of insurance model could become popular in China? Would you welcome this model?

If borrowing a car to a friend lowers driving score, can the friend make up the difference in insurance costs?

🔗Source: Tesla Insurance

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.