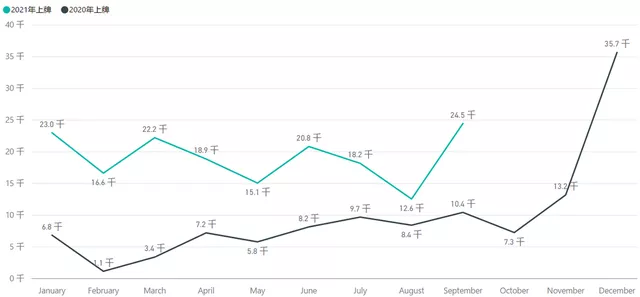

Tesla’s hot sales are always somehow related to Shanghai. In September, the number of new energy vehicles registered in Shanghai was 24,462, while the total number of registered vehicles in Shanghai was 52,796, resulting in a penetration rate of 46.33% for new energy vehicles, which is a very high number.

From January to September, the total number of new energy vehicles registered in Shanghai was 171,800, and the cumulative number of registered vehicles during the same period was 476,930, resulting in a sales penetration rate of 36% this year. Looking only at Shanghai plates, new energy vehicles continue to hold a high penetration rate this year.

Note: After the last insurance data error, the data from the Shanghai Economic and Information Center is assumed to be error-free.

Overview of September Registration Data

Since the implementation of the policy to allow non-Shanghai registered cars to pass through the inner ring in May, the overall registration volume in Shanghai has been very stable in 2021. In September, the registration volume once again surpassed the 20,000-vehicle average and reached 24,500 vehicles.

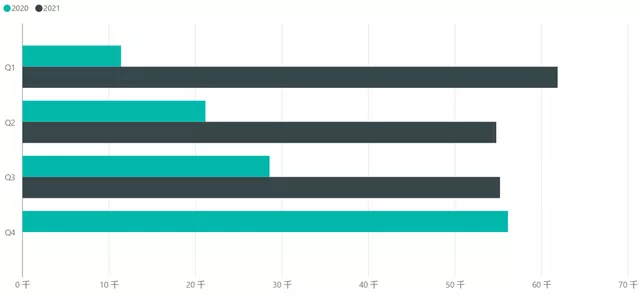

Looking at the quarterly data, Shanghai’s new energy license plate registration rate is on track to reach 60,000 per month. Previously, it was estimated that the data for September would decline, but with the price reduction of the Tesla Model Y, it suddenly rose.

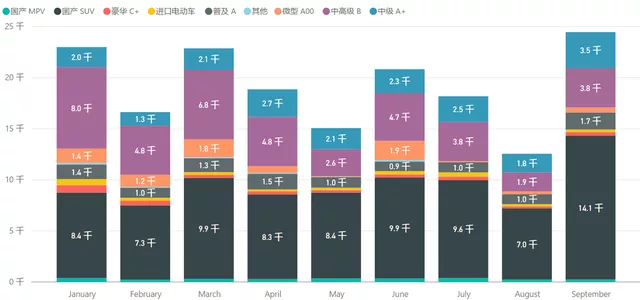

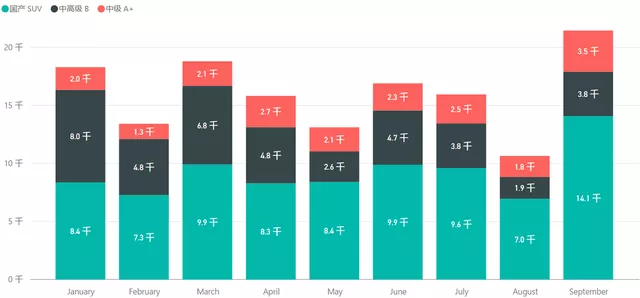

Breaking down the data by car model, SUVs were the most popular in September, with a total of 14,100 vehicles registered. Mid-size A-level and mid-to-high-end B-level vehicles both saw an increase in registration numbers, with 3,500 and 3,800 respectively. Currently, the A00 level has been eliminated after the restriction on license plate registration.

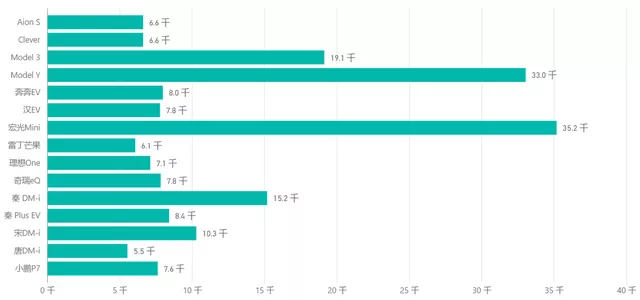

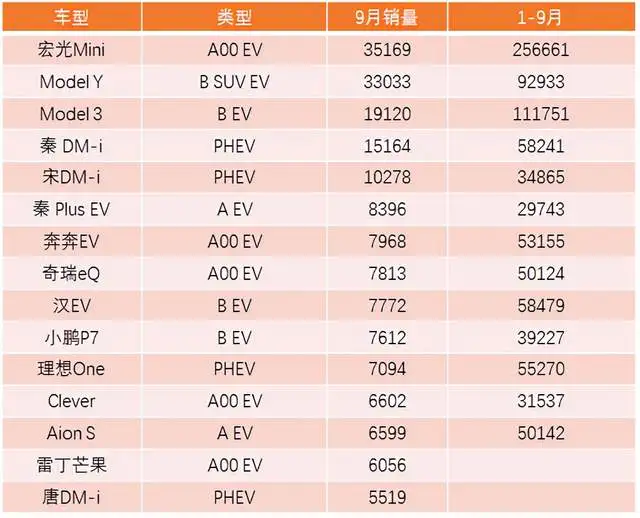

According to data from the China Passenger Car Association, 19,120 units of the Tesla Model 3 and 33,033 units of the Model Y were sold in September. Looking closer, the breakdown is as follows:

In the mid-to-high-end sedan market where the Model 3 is sold, there was a net increase of 1,961 vehicles in Shanghai, meaning the Model 3 sold at most around 2,500 vehicles.

In the SUV market where the Model Y is sold, there was a net increase of 7,116 vehicles, which means the Model Y sales might have exceeded 8,000 vehicles in Shanghai this month.

Structure of the new energy vehicle market this year

This year’s domestic new energy vehicle market is very interesting. In addition to last year’s A00 and Tesla leading the high-end models, the DM-i series and the Ideal One have also pulled up the plug-in market, forming a situation of “three-legged stand”.

At present, the Model Y, which tops the list, may become the only ruler among pure electric SUVs, with sales surpassing Model 3 this year. In September, the wholesale sales of A00-level reached 90,000 (30% market share in pure electric vehicles), among which the Hongguang Mini EV, Benben EV, Chery eQ, Clever, and Redding Mango are all outstanding. A-level electric vehicles, which mostly occupy the 2B market, only account for 24% of the pure electric market share, and it is uncertain whether they will breakthrough in the future. With Tesla’s growth, B-level electric vehicles suddenly soared to 86,000, accounting for 29% of the pure electric market share.

In terms of total data, the wholesale sales of new energy passenger vehicles in September reached 355,000 (298,000 pure electric and 57,000 plug-in hybrid), and 2.023 million units from January to September. The main manufacturers in these data include: BYD with 70,432 units (half EV and half PHEV), Tesla China with 56,006 (3+Y), SAIC-GM-Wuling with 38,850 units (mainly mini EV), SAIC Motor with 21,552 units (?), GAC Aion with 13,572 units (Aion family), Great Wall Motors with 12,770 units (Black Cat was the only one before, but now it has split), NIO with 10,628 units, and XPeng Motors with 10,412 units.

The retail sales of new energy passenger vehicles in September reached 334,000, and 1.818 million vehicles from January to September.With the chip shortage, domestic brands have allocated their resources to new energy vehicles. As a result, the penetration rate has increased to 36.1%. The top three performers are BYD, with a domestic retail of 69,818 units, Tesla with a domestic retail of 52,153 units for its locally produced vehicles, and SAIC-GM-Wuling with a domestic retail of 37,151 units.

In September, there were 14,800 exports of new energy vehicles, with 5,164 units from Dongfeng Yueda Kia, 4,560 units from SAIC Motor, and 3,853 units from Tesla China. New energy vehicle exports from other car companies have also continued to strengthen.

Conclusion: The insurance data is expected to be released tomorrow, and we’ll perform cross-validation of the data at that time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.