Storytelling is fundamental

Humans enjoy listening to stories, as well as telling them. It is the ability to tell stories that has allowed our civilization to exist, and it is this superpower that enables us to harness the power of cooperation and productivity on a scale that surpasses that of other animals (with the exception of ants). Most of us have probably read the beginning of “Sapiens”, which tells this story. In ancient times, monarchs, generals, and prophets all told stories, not unlike “The Little Prince”.

My favorite type of story has always been the ones about power struggles. When I finished watching “Game of Thrones”, I was actually not feeling well because I was entering an entertainment drought. But thanks to the era of Artificial Intelligence and Big Data Recommendation Algorithms, the internet had discovered my obsession and led me to discover a new show–“Vikings”–which is essentially a Nordic pirate version of “Game of Thrones”. And watching it on Douyin has a significant advantage in terms of efficiency–after all, a story that’s too wordy is no longer sexy.

To be honest, my love for this show is not inferior to my love for “Game of Thrones”. Because in this show, there’s something that was rarely portrayed in “Game of Thrones” and most other shows about power struggles:

That is, sustainable development!

Sima Guang once said in “Zizhi Tongjian”:

Conquering a territory is easy, but holding onto it is difficult;

Why is there a semicolon? Because there’s a second half to this line!

Holding onto a territory is easy, but giving it up is difficult.

While watching this drama, I repeatedly thought of the brand Polestar. Like the mighty and practical Viking axe, Polestar’s product philosophy incorporates sustainable and environmental concepts.

The ultimate simplicity lies in the understanding of principles. The difficulty lies in chaining the principles logically and making the story valuable. The core of the value is consensus.

Today, let’s take a look at how Polestar tells its capital story and see if we can reach a consensus.

SPAC listing? It’s quick money!

On September 27th, a document appeared in the “Investor Contact” section of Polestar’s official website, opening a new chapter in the Polestar story. This story is the Polestar listing roadshow PPT.

Different from the traditional IPO method of Volvo, which has equity relations with the hometown brand, Polestar will adopt a more rapid SPAC listing method. SPAC stands for Special Purpose Acquisition Company.Translation:

The only purpose of SPAC is to merge with a private company through stock issuance after the IPO, that is, De-SPAC Transactions, allowing the private company to quickly go public, while the SPAC’s sponsor and investors achieve investment returns. Prior to completing the SPAC merger transaction, SPAC is an empty shell company in the stock market with no other business purpose except to find appropriate targets for merger and “reverse” going public.

Isn’t it just shell listing?

Wrong. SPAC itself is an empty shell company without actual business, and it is a tool for constructing shells and fundraising. Afterwards, SPAC merges with a private company and eventually makes the merged company a listed company.

In contrast, the shell company in “shell listing” is usually a listed company with actual business, but due to poor operations, it has aspirations for delisting. The private company will then acquire the listed shell company to achieve a listing.

Fast and affordable

It only costs $25,000 to set up an empty shell SPAC. Moreover, within 3-4 weeks, it can submit an IPO application to the SEC (U.S. Securities and Exchange Commission) and complete the listing within 15 days after the SEC approval.

The speed is fast because SPAC is a newly established shell company with no financial statements or assets to disclose, and there are few potential risk items to disclose, so the SPAC’s application for listing registration form is usually highly formatted.

For a private company seeking a fast listing and hoping to minimize the uncertainty of the listing process, SPAC provides speed and certainty.

This is obviously a great compensation for Geely, which failed to be listed on the Science and Technology Innovation Board.

Whose shell to use?

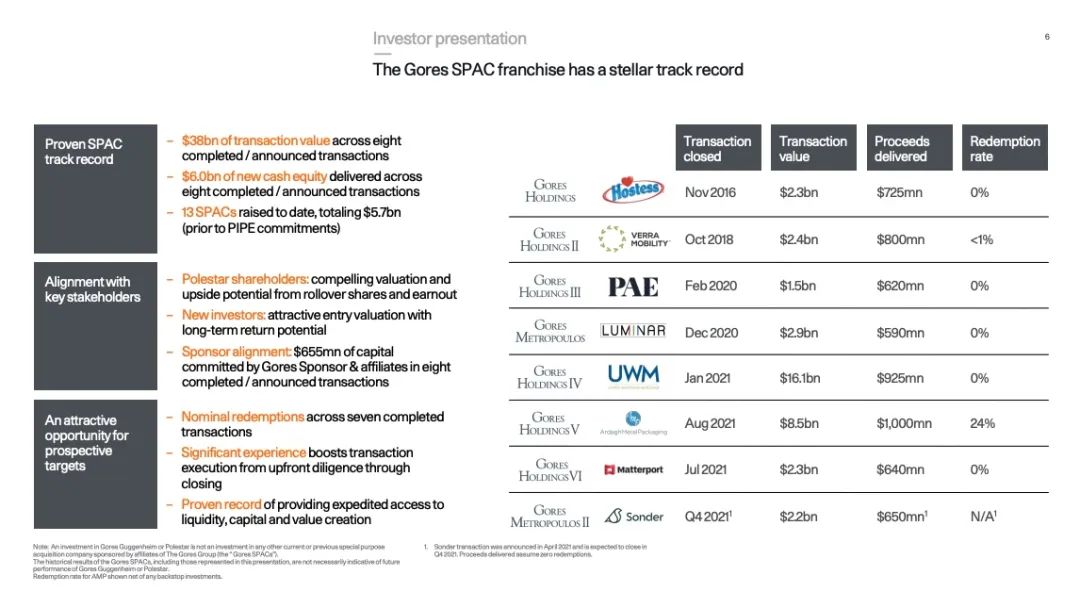

In fact, this practice has been popular since last year. Faraday Future, known as the “Tesla Killer,” Lucid, and Luminar, the first listed company of laser radar, all went public through SPAC. And the SPAC listing of Luminar was orchestrated by the Gores Group.

The Gores Group is still in charge of the Polestar SPAC listing. Friends who are optimistic about this deal can pay attention to the SPAC shell stocks this time, with the ticker symbols GGPIW/GGPIU on the US stock market.

A Valuation of $20 Billion

At this point, the two parties have signed the final merger agreement. After the proposed business combination is completed through SPAC merger, the merged company will be incorporated into a new company named Polestar Automotive Holding UK Limited, and the stock code after listing on NASDAQ will be “PSNY”.

According to the SPAC listing timeline, this process should be completed within 6 months. According to the official announcement, the valuation of the Polestar brand is $20 billion. In comparison with family members, Volvo, which is preparing to go public through a conventional IPO, is currently rumored to have a valuation of $25 billion, while the newly launched brand Geely has an estimated value of about $9 billion. This is really high for Polestar, a brand that sold only 10,000 cars in 2020.

Hollywood actor Leonardo DiCaprio, also mentioned as a celebrity investor in the official announcement, but the specific amount is unknown. Although he is getting fatter, this Oscar-winning best actor is very loyal to his partner and loves to date supermodels.

His requirements for choosing a car are also very loyal, and he has always been a supporter of new energy. Starting early with the Prius, he also invests heavily in environmental protection. In addition to investing in two artificial meat companies recently, he has also invested and supported Fisker, but this investment may not have been successful, as Fisker went bankrupt shortly thereafter.

But it can be certain that there will be many opportunities in the future to see him in scenes with his new baby, Polestar, in order to raise its valuation and promote its products. As for what insider information Little Li received and what kind of preferential policies he received to invest in Polestar, we do not know.

Polestar Story

Through this SPAC listing, the Polestar brand can obtain more than 1 billion US dollars in new funding, mainly used for future vehicle development.

Confronting Porsche

From the positioning of the brands under Geely Group, which aim to go public, there are older Volvo, younger Lynk & Co, and more sporty and luxurious Lotus. Polestar is taking a more avant-garde and personalized route.

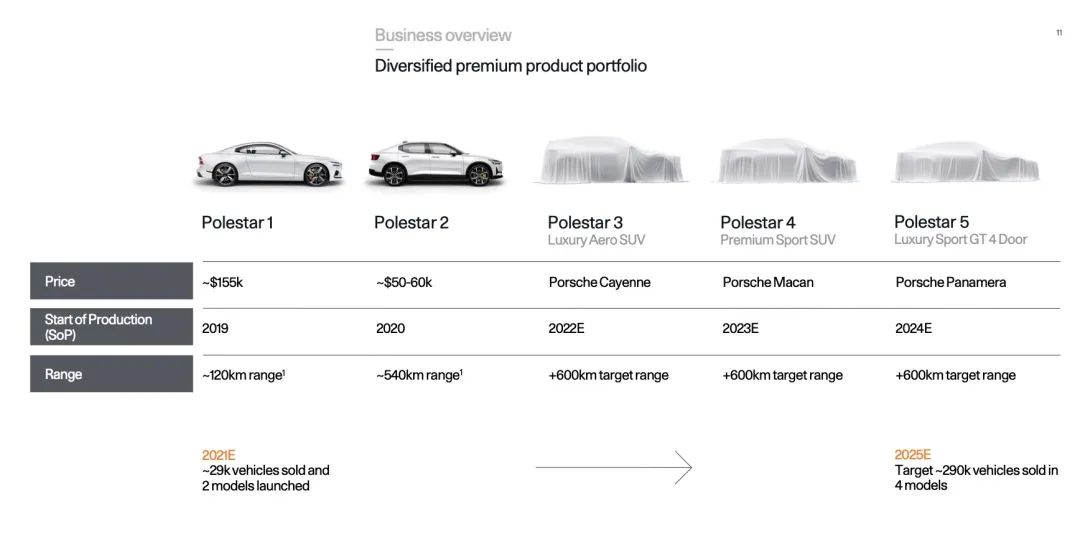

The former costs 1.45 million, while the latter costs 250,000 to 400,000 yuan. Such product structure and pricing obviously cause some disjointed brand positioning, to a certain extent resulting in Polestar’s sales of only 10,000 vehicles in 2020. And the expectation for 2021 is to remain at 29,000 units.

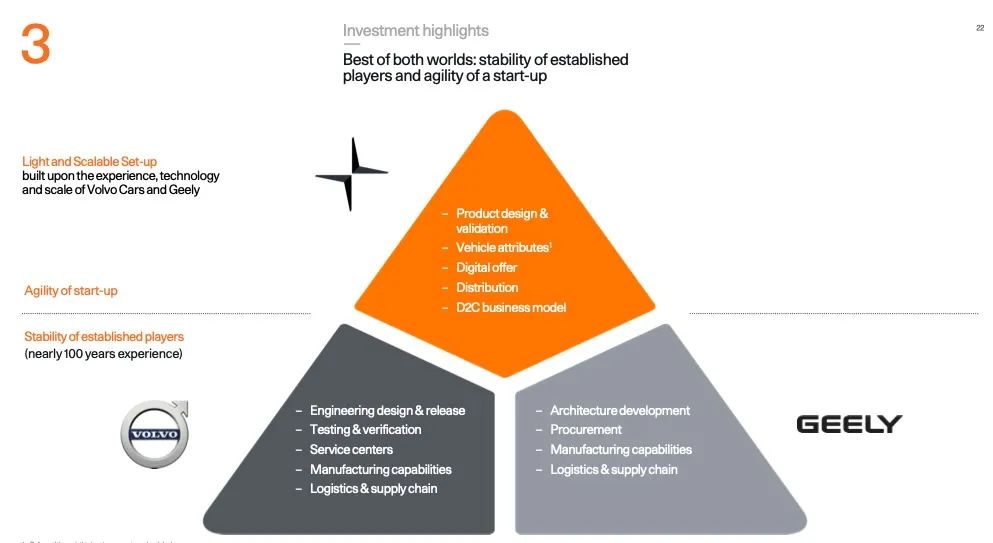

However, in the next three years starting from next year, Polestar will also adopt the one car per year strategy, which many new brands also promote, to quickly expand its product line.

- The Polestar 3, benchmarked against the Cayenne, will be a luxurious SUV with aerodynamic styling and is expected to be mass-produced in 2022;

- The Polestar 4, benchmarked against the Macan, will be a premium sports SUV and is expected to be mass-produced in 2023;

- The Polestar 5, benchmarked against the Panamera, will be a four-door GT and is expected to be mass-produced in 2024.### The Origin of Polestar Brand

However, Porsche’s success is not easy to replicate. Its brand value is already a consensus, and its development history is already a legend. Porsche can sell a 911 at 2 million but is still equipped with the McPherson suspension system. Porsche can also complete the downgrade attack as a luxury sports car brand, and successfully open up the high-end mid-size SUV market by launching products on the same platform as Audi Q5, such as Macan.

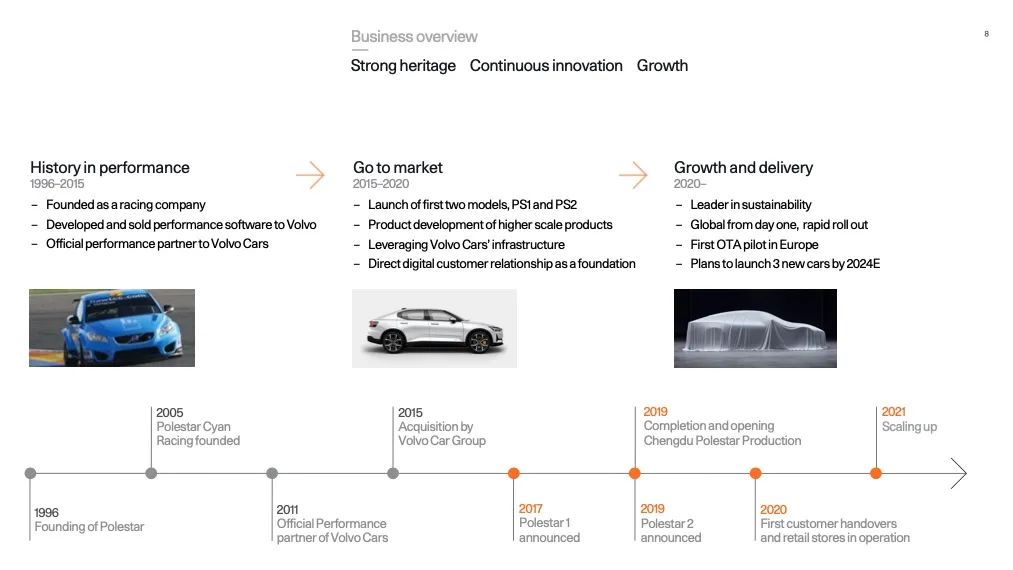

So, what is the story of Polestar? It starts with a racing team.

Polestar, established in 1996, was initially a racing company positioned in the Volvo factory team. Due to its stable performance and technical strength, it began to authorize the official after-sales engine program modification for Volvo and became Volvo’s performance partner, similar to Mercedes-Benz’s AMG product line.

In 2012, the straight-six turbocharged S60 Polestar concept car with 508 horsepower was also introduced.

With Geely’s $1.8 billion acquisition of Volvo from Ford in 2010, Polestar’s fate also changed.

Despite its racing origins, the Polestar brand seemed more like a ball being kicked around during every marriage until it met Geely…The highly dramatic story brought a much-needed boost to the brand, compared to the time when it produced classic Porsches to make ends meet by outsourcing to Mercedes-Benz and Audi.

Performance

Apart from having brand value support, even if Porsche’s configuration is poor and the optional costs are absurd, the performance is always on top. Concerning this comparison, Polestar has actually provided a better outlook. Based on the SPA platform, the Polestar 1 is actually a carbon-fiber, two-door modified S90 T8. The non-sexy powertrain and poor weight distribution let this Nordic brand fully display its tuning skills. The dynamic experience of the Polestar 2 also makes it hard to believe that it’s basically the same as the Lynk & Co CMA platform.

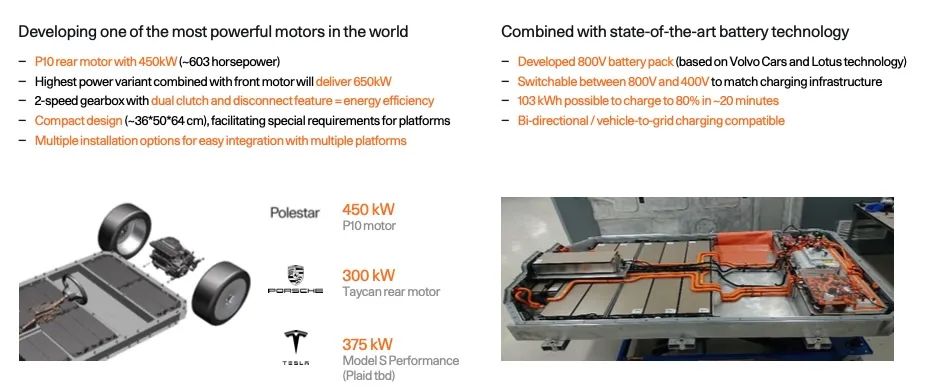

A rear electric motor with a power output of 450 kW is enough to make the Porsche Taycan sweat, as neither the current Tesla Model Plaid S nor anyone else has an electric motor that big. Combined with the front electric motor, the Polestar’s future models will be able to output 650 kW, which means 883 horsepower of dynamic performance.

However, in my opinion, at this time point, equipping with a two-speed gearbox seems to have added a selling point in mechanical quality, but actually, just like the Porsche Taycan, it may be because the range of the motor’s efficiency is too narrow, and the maximum speed is too low. In contrast, Tesla’s Plaid version relies on a carbon fiber wrapped rotor motor with an ultra-high speed, without a multi-gear gearbox, it still provides acceleration and top speed at the same level, or even higher.

Moreover, the subsequent models produced in factories under the jurisdiction of Geely Group in China and the United States will also adopt higher-level suspension structure and more reasonable layout of parts on the SPA2 platform and PMA platform (in fact, the product under the SEA architecture, which can be understood as the same series of extremely cool products), breaking the current unsatisfactory situation of the platform.

Is there anything that makes investors willing to pay for it?

Many adjectives

Polestar is the First OTA pilot in Europe and also has the Best-in-class sustainability ambition. It has an interesting interpretation of its own brand positioning.

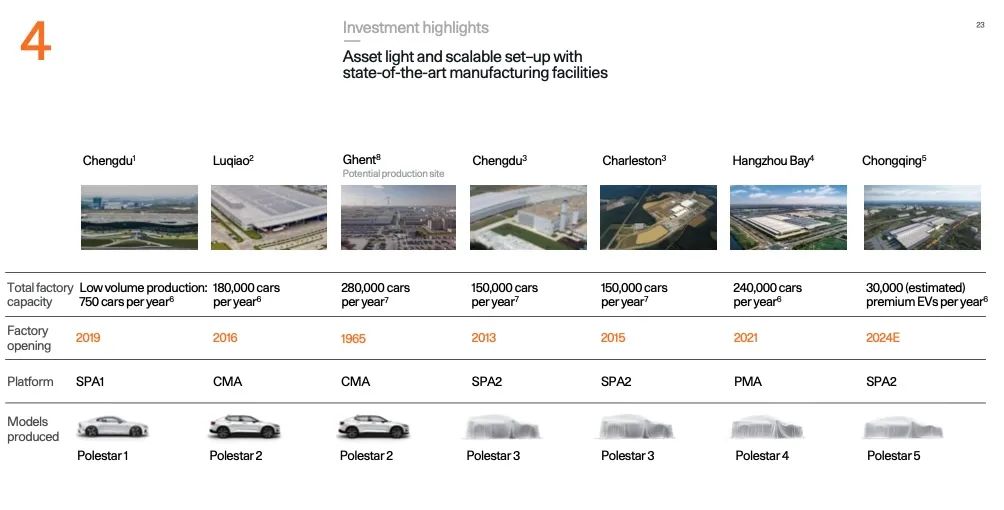

According to Polestar’s own understanding, on this EV brand ladder that has not been capped, only Tesla can be compared with it in terms of globalization. However, from the current situation, this is also a fact.

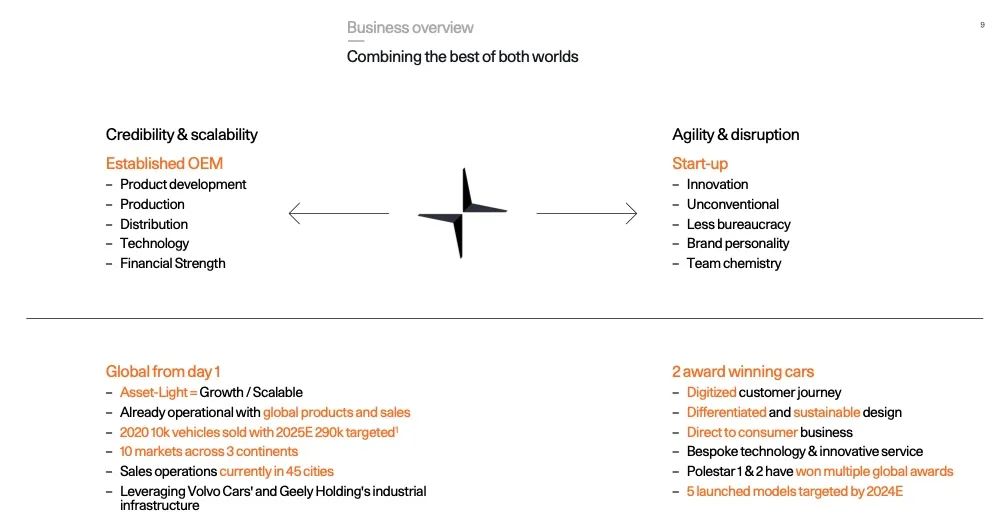

Trinity

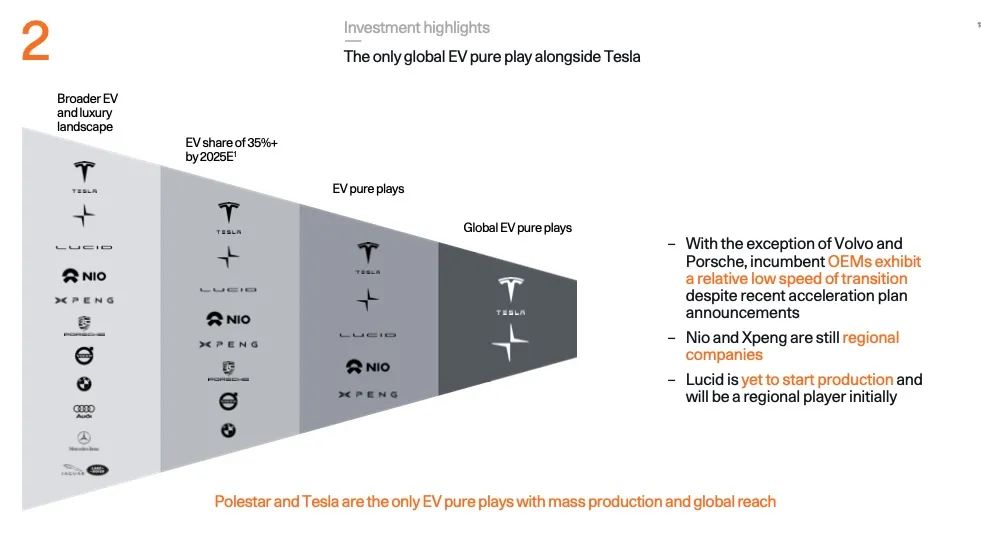

The Father, the Son, and the Holy Spirit are the Trinity. Geely, the “father,” is the richest and has the most overall planning ability. Volvo, the “son,” provides technology and research and development. And Polestar, supported by the light asset model, is the “soul” in this combination. The combination of Polestar under this mode of operation makes me smell a little bit of Apple flavor.“`markdown

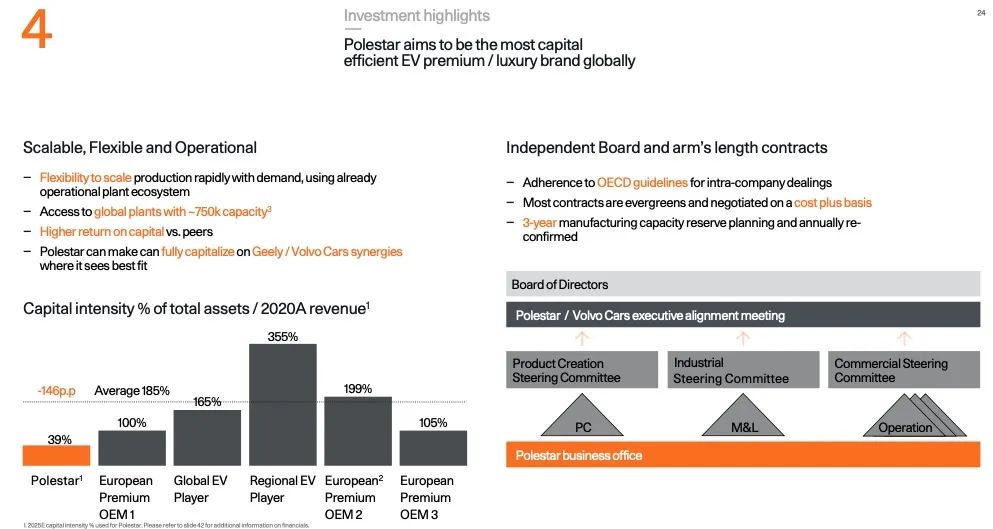

If Apple’s strength lies in design and interaction, then industrial design and dynamic experience are currently the strengths of Polestar. The resources of its elder brother Volvo and its father Geely can be compared to Foxconn, helping Polestar achieve the process from paper to storefront.

The maximum global annual production capacity of 750,000 units and advanced booking production three years in advance is equivalent to Polestar having exclusive suppliers, and they are insiders who are easier to talk to. However, core R&D capabilities also depend on group resources, which means that the light assets of Polestar do not have the ability to develop entire vehicles.

Intelligentization

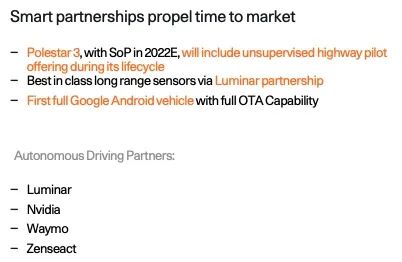

By the way, Apple’s super barrier is its ecosystem. For the intelligent ecosystem of automobiles, intelligent driving is the most important infrastructure.

“`# Polestar’s Laser Radar: Ordering Priority for Chips in the Chip-Shortage Age

Polestar’s endorsement in autonomous driving is also notable. Luminar’s lidar and Nvidia’s Orin chip hardly require further introduction. Don’t forget that Gores, which operates Luminar, also operates Polestar’s SPAC, and Volvo is also one of Luminar’s institutional investors. These two relationships are enough to give Polestar and even Geely Group a place in the queue for laser radar procurement in this chip-shortage age.

The fact that Waymo will become a partner of Volvo, Polestar, and Lynk & Co in L4 is just icing on the cake for Polestar’s financing point in this era when Robotaxi’s valuation fever is gradually cooling down.

However, the autonomous driving company Zenseact, which is jointly owned by Volvo and Veoneer, is remarkable. This company allows Volvo and Polestar to have “full-stack autonomous driving software” and will also build a data factory with a throughput of 200 PB next year to accelerate the iteration of intelligent driving performance.

Please note that with the development of the self-driving industry and the flow of talents, the barrier of basic algorithm itself is getting lower and lower. The most important thing is to obtain massive user data and have the ability to process it, so as to eliminate corner cases more efficiently and accelerate the progress towards higher level autonomous driving.

The prospect of intelligence is good. The collaboration valuation of Waymo and Zenseact, I don’t know if it will be diluted because of Volvo, which has also decided to go public.

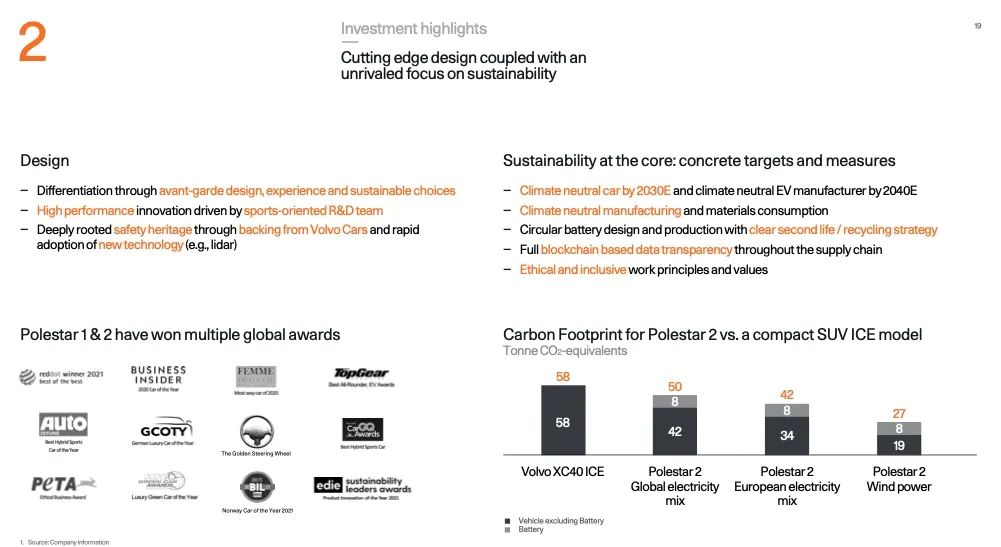

Carbon neutrality + Going for simplicity

10 years ago, everyone had no reaction to electric cars, some missed the opportunity to make money, and some faced career decline.

Using blockchain technology to trace the source of raw materials to ensure adherence to humanitarianism, and recording the entire process of carbon emissions for carbon-neutral vehicles and factories and making corresponding demands on suppliers. Now, indifference to the values of carbon neutrality may indeed miss new opportunities.

It is obvious that everyone’s switch to pure electric is also due to increasingly stringent environmental regulations. Nowadays, carbon emissions can be traded, and Tesla made $1.6 billion through this business in 2020. Whoever can achieve carbon neutrality throughout the product lifecycle will face fewer sanctions and even gain additional benefits by selling carbon emissions quotas. This is also a new competitive dimension that electric vehicle manufacturers need to consider in the future. With an expected annual output of 290,000 in 25 years, Polestar, as long as the carbon credit of a single bike is high enough, can also do this business.

Is the pre-IPO financing story of Polestar sexy enough? Investors among the readers, share your thoughts in the comments section.

Finally, from the perspective of an automotive media and a consumer with a preference for niche car models, I hope that this candid and less bureaucratic Nordic electric brand, instead of a no-bureaucracy one, can provide more unique and appealing products for more consumers in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.