CXB100 News – Focusing on the Evolution of the Automotive Travel Industry

Author: Zheng Wen

The Malaysian epidemic, which began in mid-July, has lasted for more than two months. The confirmed cases have dropped significantly from the peak, providing some relief to the chip supply pressure.

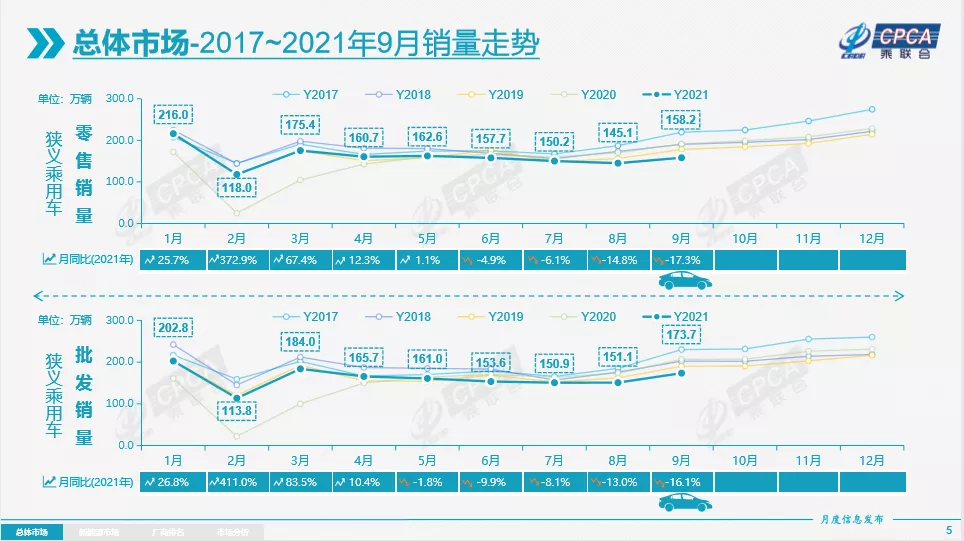

This good news belongs to the October market, as the traditional “Golden September” has not been able to prosper due to chip supply issues. Sales trends in September still remained relatively weak. From June to September, sales have been hovering around 1.58 million units.

Fortunately, there are signs of improvement that can be seen.

According to the production and sales data released by the China Association of Automobile Manufacturers in September, production and sales have gradually improved, but the retail side has not yet seen effective improvement.

The production in September reached 1.72 million units, a month-on-month increase of 16%, but still a year-on-year decline of 15%. Although it is still at a relatively low level, there has been some improvement on the production side.

With 1.72 million units, this data is only second to the 1.84 million units in March this year, and compared with the scale of 1.5-1.6 million units from April to August, it has improved, indicating that the chip problem caused by the Malaysian epidemic in July and August has been somewhat relieved in September.

The performance on the wholesale side is similar to that on the production side. The wholesale volume reached 1.73 million units, a 16% year-on-year decline but a 15% month-on-month increase, which has improved significantly.

The performance on the retail side is relatively poor, with only a level of 1.58 million units, a 17% year-on-year decline but a 9% month-on-month increase. This month-on-month increase does not necessarily indicate an increase in market vitality on the retail side. This is because the low point that should have appeared in July was delayed until August, and the 9% month-on-month increase is not enough to explain anything in the context of a low base.

According to the weekly data monitoring of the China Association of Automobile Manufacturers, the improvement on the production side began in late September, and the improvement in wholesale data followed suit. As for the improvement on the retail side, it is hoped that it will be reflected in October.

“Golden September” is not prosperous, and manufacturers suffer from a “chip shortage”

As mentioned earlier, although there has been some improvement in the data from the three dimensions, the percentage decline on a year-on-year basis is still staggering and remains at a low market level.

With an overview of the overall picture, we will now conduct a more detailed analysis of the September market.

(CXB100 News logo)

Note: The English translation of the media name “出行百人会” is CXB100.We choose retail data that better reflect the terminal for analysis.

In September 2021, the retail sales of passenger cars in the market reached 1.582 million units, a year-on-year decrease of 17.3%, and the sales volume fell to the level of September 2014. Compared with the peak in September 2017, it has decreased by 27.9%. The retail sales in September were significantly weak.

Based on the characteristic base of the downturn in August retail sales compared to July, September retail sales only increased by 9.1% compared to the lowest value in the third quarter in August, which is relatively low compared to the normal trend of at least 20% growth from September of previous years.

That is to say, both the month-on-month and year-on-year results are poor.

The cumulative retail sales from January to September this year were 14.486 million units, a year-on-year increase of 12%, which is 5 percentage points lower than the growth rate from January to August. The main reason for the slowdown is the impact of the high base of retail sales in July-September 2020. Among the year-on-year increase of 1.55 million units from January to September this year, the new energy vehicle increase of 1.39 million units accounted for 94% of the total increase and contributed 11 percentage points to the year-on-year growth rate from January to September.

Looking at the subdivided market, the year-on-year decrease in retail sales of SUVs and cars was 16.5% and 17.7%, respectively, and the decline in sales of MPVs reached 20.7%. It is slightly comforting that SUVs have achieved a certain recovery growth, with a month-on-month increase of 14.5%, which is one step ahead of the recovery of the car market.

By changing the dimension of division, luxury car retail sales were 200,000 units, a year-on-year decrease of 23%, and a month-on-month increase of 0.1% in August. An important reason here is that European companies have been severely affected by the chip shortage. BBA production has been hit, and some brands even showed a sharp drop in sales figures.

The retail sales of domestic brands were 690,000 units, a year-on-year increase of 5%, and a month-on-month increase of 16% in August. The shortage of chips caused by the overseas epidemic affected the production pace. Domestic brand traditional car companies and new energy vehicle companies strengthened their supply chain advantages, effectively resolved the pressure of chip shortage, and achieved good market results.

The retail market share of domestic brands reached 44.3%, an increase of 9.4 percentage points from the same period last year. The wholesale market share is 47.7%, which is 11 percentage points higher than the same period. The head enterprises of domestic brands have strong industry chain resilience and effectively resolved the pressure of chip shortage, turning unfavorable factors into favorable ones and obtaining significant increases in the new energy vehicle market. The traditional car enterprise brands of BYD and SAIC Motor both showed a high increase year-on-year.Compared to that, the overall situation of joint venture is relatively bleak.

In September, the sales of joint venture brands reached 690,000 vehicles, a decrease of 31% year-on-year, an increase of 6% month-on-month, and a relative decrease of 26% compared to September 2019. Specifically, Japanese brands account for 20.8% of retail sales, a decrease of 3.8 percentage points year-on-year; American brands achieved a retail market share of 11.3%, an increase of 1.3 percentage points year-on-year, with a good performance; German brands are still in the stage of adjusting and accumulating momentum due to the huge supply gap.

New energy vehicles stand out, and there is an evident differentiation between the penetration rate of independent brands and that of joint venture brands.

Different from the overall market, in September, the production and sales of new energy vehicles presented a super-hot situation.

The production in September reached 347,000 vehicles, with wholesale of 355,000 vehicles and retail of 334,000 vehicles. A good overall situation of production, sales and retail was formed, with a same trend for retail and wholesale if the export volume is added. The year-on-year growth rate was also good, with retail, wholesale and production reaching growth rates of 202.1%, 184.4%, and 184%, respectively.

In the first nine months, the wholesale of new energy passenger cars reached 2.023 million units, a year-on-year increase of 218.9%. Moreover, the cumulative retail sales reached 1.818 million units, a year-on-year increase of 203.1%. In addition to the wholesale volume, the production volume of new energy vehicles has also surpassed the scale of 2 million units, maintaining a good level, and showing a growth trend of around 220% year-on-year.

It has formed a strong differentiation from the trend of traditional fuel vehicles, achieved partial substitution effect of the fuel vehicle market and brought huge impetus to the auto market.

Looking at the five-year longitudinal dimension, from 2017 to 2019, it showed a stable trend, gradually rising in 2020, and developing independently from the overall market in 2021. Both wholesale and retail sales showed a strong rise in the third quarter.

From the perspective of market penetration rate, the substitution effect of the new energy market will be more deeply reflected. Similarly, there are wholesale penetration rate and retail penetration rate of the penetration rate. Here we will cite the more precise retail penetration rate data that are closer to the market end. In September, the retail penetration rate of domestic new energy vehicles was 21.1%. The penetration rate from January to September was 12.6%, a significant increase from 5.8% in 2020.## From Chinese Markdown Text to English Markdown Text

Among self-owned brands, the penetration rate of new energy vehicles is 36.1%; the penetration rate of luxury vehicles is 29.2%; and the penetration rate of mainstream joint venture brands is only 3.5%, showing significant differentiation. It’s worth noting that in September, the new energy retail sales of mainstream joint venture brands, including FAW-Volkswagen and SAIC Volkswagen, were only 14,000, which already accounted for 72% of mainstream joint venture sales.

As can be seen from the many manufacturers in the market, 14,000 vehicles is clearly not an impressive achievement. The eight companies that exceeded 10,000 in sales in September were BYD, Tesla, SAIC-GM-Wuling, SAIC Motor Passenger Vehicle, GAC Aion, Great Wall Motors, NIO, and XPeng. Not a single joint venture manufacturer is on the list. Their sales numbers were 70,432, 56,006, 38,850, 21,552, 13,572, 12,770, 10,628, and 10,412 respectively. The top three manufacturers in terms of retail sales in September accounted for 49% of the total, with a significant lead.

From the perspective of different driving modes, pure electric vehicle wholesale sales in September were 298,000, a year-on-year increase of 192.4%; plug-in hybrid sales were 57,000, up 149% year-on-year, accounting for 16% of total sales, and it’s worth mentioning that BYD contributed significantly to plug-in hybrid sales.

Specifically, high-end car sales showed strong growth, while mid-to-low-end cars improved. Wholesale sales of A00-level cars reached 90,000, with a 30% share of pure electric vehicles; A-level electric vehicles had a 24% market share, maintaining a relatively stable position; and B-level electric vehicles reached 86,000, an increase of 29% month-on-month, and accounting for 29% of pure electric vehicle sales.

It’s worth noting that although Japanese brands seem to have a weak presence, they are in fact quietly making money in the conventional hybrid field (the data is not included in the new energy sector). In September, the wholesale volume of conventional hybrid passenger cars in the Japanese brand’s main battlefield was 56,750, a year-on-year increase of 70%, and a month-on-month increase of 48%. This is a very strong growth rate, especially considering that Toyota is prioritizing the production and sales quota of hybrids despite being significantly affected by the semiconductor shortage.

Outlook for October

October has 17 working days, which is 4 fewer days than September. The performance of “Golden September and Silver October” last year was due to a combination of policy promotion and resumption of work and production after the epidemic. This year’s high base pressure and supply shortage make it difficult for “Golden September and Silver October” to become a highlight, but the sales volume in October, which is better than September, is something to look forward to.With the anti-monopoly investigation launched by the State Administration for Market Regulation and the channel hoarding issue addressed by chip manufacturers with targeted measures, which reflects the fact that wafer supply exceeds the amount of shipped cars, it is believed that the chip supply will improve with better expectations. However, it is still too optimistic as the current production and sales are at a low level. If the production and sales base increases significantly, there is still a significant problem with whether the chip supply can keep up with the growth of car market. According to the assessment of China Association of Automobile Manufacturers, the negative growth rate is still significant in year-on-year comparison at the end of September.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.