Author: Su Qin

Introduction: Euler’s “man” problem, also Wei Jianjun’s difficult problem.

In the booming domestic new energy market, the Euler is definitely a phenomenon.

Whether it is a subdivision market targeting young women or insisting on an individualized and fashionable design language, coupled with the disruptive marketing and channel setting of the automotive circle, under the support of the sales data that broke thousands in the same period with monthly sales exceeding 10,000, it runs out of a “beauty is justice, sales is truth” “favorite women” track in a subdivision market where most players are unwilling to bet.

Euler’s skyrocketing attention and sales may be accidental, but for Great Wall, which is manipulating behind the scenes, the familiar formula of taking a sharp turn may be inevitable.

From the despair of the pickup truck to the SUV that dominates sales by relying on a single category, whether it is a forced gamble or a voluntary concentration of efforts to heavily invest in subdivided markets, Wei Jianjun seems to have a good understanding of the issue of focusing on subdivided markets.

Of course, good tricks should be used to the full.

The banner of “love and cherish women” by Yu Fei is inserted into the forefront of the new energy list.

Hold high the banner of Women

At the beginning of its establishment, the Euler did not hold women in such high regard as it does today.

On August 20, 2018, Great Wall Motors officially released the independent new energy vehicle brand-Ora, and its mission was to brand-manage the new energy vehicle business. Its product category is “the new generation of electric vehicles for urban youth.” Wei Jianjun’s goal is clear- to penetrate the new energy market with electric vehicles. At the same time, the first model iQ is a crossover SUV. Whether it looks good or not is subjective, at least compared to the later Cat design, its beauty is not outstanding.

However, the black cat, which now supports half of Euler’s sales, actually debuted as R1 in December of the year the brand was released. It was not until a week after the White Cat was listed in July 2020 that R1 was officially renamed Black Cat. Since then, Euler has officially entered the fast lane of pleasing women with its beauty and fashion.

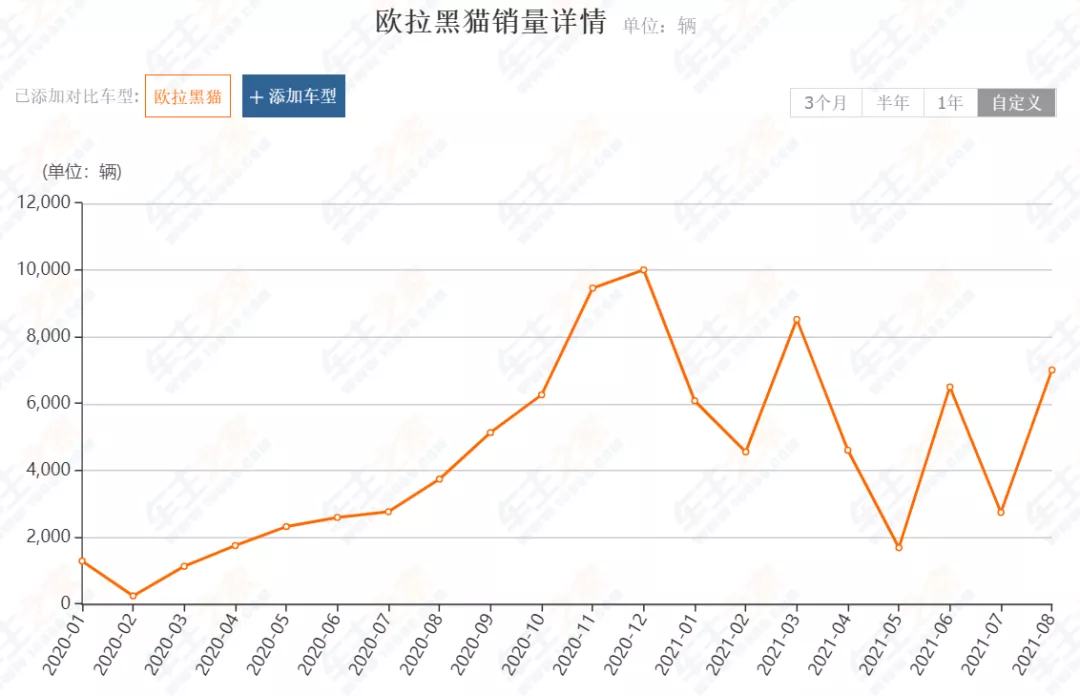

Sales data seems to confirm this. Euler’s Black Cat began to gain momentum in August 2020, rising from seventh place on the new energy sales list to third place, and breaking through 10,000 at the end of the year. The total sales for the year reached 46,774, also climbing to the top 3 of the cumulative new energy sales list, with 80% of the sales contribution in the second half of the year.

It is worth noting that at this time, it has been less than two and a half years since the Euler brand was released.

Euler has tasted the sweetness.

One new car model after another is shining in design language, new planned marketing activities are getting closer to the living radius of women, and new developed sales channels are going viral, making buying a car no longer just “buying a car”. The time has finally come to March 20, 2021. As the head of Euler, Yu Fei raised a flag – the world’s most beloved car brand for women.

One new car model after another is shining in design language, new planned marketing activities are getting closer to the living radius of women, and new developed sales channels are going viral, making buying a car no longer just “buying a car”. The time has finally come to March 20, 2021. As the head of Euler, Yu Fei raised a flag – the world’s most beloved car brand for women.

For female car owners, whether caring for women’s car brands and models is a must-have issue remains to be seen. But for Euler and Yu Fei, this flag is a must-have.

At the end of the track

According to the data of the China Passenger Car Association, from January to June 2021, the cumulative sales of narrow sense passenger car market in China reached 9.943 million units, among which the cumulative sales of new energy vehicles were 1.007 million units, a year-on-year increase of 220.9%, accounting for 10.1%. Under the big trend of the country’s control of carbon emissions and support for new energy, there is no doubt that the new energy track has huge room for growth.

However, does the overall upward space of the new energy track equal to that of Euler’s? Let’s explore this issue from the following perspectives.

Let’s first look at the car model level. According to the cumulative sales data from January to June 2021, the sales of micro cars and small cars accounted for less than 8%, which is just the main force of Euler’s sales – the black cat battlefield. With such a proportion of car model level, the sales limit of Euler’s black cat is obvious. Especially in the same level, Wuling is good at “one move is enough to eat all over the world”, swallowing the already struggling market share.

In the compact track with more than 30% of the proportion of car model level, Euler can only offer a good cat to compete with many new energy players who entered the market earlier. From the current highest monthly sales of 4,000, it is obvious that the good cat has not entered the “hot sales” track. Although the sales limit of the compact level is higher, it is still unclear whether Euler can achieve success with its current product quantity and product strength. More importantly, a group of traditional giants and new forces playing in a higher level are all gearing up to lay out or launch compact products.

The sales limit of the main track can be seen at a glance, and the potential track is still not fully recognized by the current products, while the competition is becoming more and more fierce. For Euler, such sales growth expectations are difficult to be optimistic.From the perspective of car models, the layout of Great Wall and Euler is quite confusing. As we all know, Great Wall’s product, brand and sales strategies in SUV have been widely recognized by the market, representing the company’s core competitiveness. And looking at the new energy list, SUV undoubtedly occupies the main force in the market above 200,000 yuan. One company excels in SUVs, while one brand is based on new energy. However, in the more profitable segment of new energy SUVs, this company and this brand’s products are not seen, which is quite puzzling. So, does Euler have the potential to rise in the new energy SUV segment?

Finally, and most worrisome, is the banner of “car brand that loves women more”, which brings attention and sales to Euler, but may also limit the brand’s upper limit?

As a car company, with the growth of female car owners, it has been consistent in the industry for many years to make product optimizations for female users, because meeting customer needs is the core of product strength. In terms of brand marketing and PR, designing targeted marketing activities for female users has also been common in the industry for a long time. But looking at the world, even for cars favored by women, no brand has ever expressed full “care” to a single gender user at the brand level. It is worth noting that this is a double-edged sword that caters to and rejects potential users. After all, car company management is not fan economy, and prominent fan groups cannot support car companies’ high costs. Car company management is also not a fast-moving consumer product with distinct genders. Even for fast-moving consumer products, smart companies will use different brands to manage customers of different genders to avoid customer loss caused by clear-cut brands.

However, in the current new energy brand of Great Wall, we only see Euler, we only see Euler holding the banner of “loving women”.

So for male users, how will you choose?

Wei’s Ambition

On June 28, 2021, at the 2025 strategic release conference and the 8th Technology Festival held by Great Wall, Wei Jianjun, the chairman of Great Wall Motors, released the main content and strategy of the 2025 strategic goal: by 2025, Great Wall Motors will achieve an annual global sales volume of 4 million units, of which 80% are new energy vehicles, and business revenue surpasses 600 billion yuan.

As of June 2021, Great Wall Motors had cumulative sales of 500,000 units from January to June, of which cumulative sales of new energy vehicles were 53,000 units, accounting for 10.6%, and all were from Euler brand.

The difference between 80% and 10.6%, 3.2 million versus 53,000, is evident, and the challenge can be imagined.More severe is that, while the new energy SUV racetrack is still in its infancy, Great Wall, which is best at SUVs, unexpectedly lost contact. At a time when traditional manufacturers and new forces that hold onto the high-end market are accelerating their layout of the traditional middle market, what kind of products and sales strategies will Great Wall come up with to turn the tide in the compact to midrange car market where it has made no progress? Regardless of the upper limit of Euler, can frequent establishment of sub-brands really help Great Wall in capturing the growth point of new energy? This is a problem for Euler’s “man” and also a challenge for Wei Jianjun.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.