In the afternoon of today, the China Association of Automobile Manufacturers released the national analysis report of passenger vehicle market in September. In this traditional peak season of China’s auto market – Golden September, the national retail sales of passenger cars totaled 1.606 million, up 8.9% month-on-month, but down 17.3% year-on-year.

From January to September this year, the cumulative retail sales of passenger cars reached 14.74 million, an increase of 12% compared to 2020 which was severely impacted by the pandemic.

Meanwhile, the wholesale sales of new energy passenger cars in September reached 334,000, marking the highest single month in history, and a year-on-year growth of 184%.

As a result of this balance, the wholesale penetration rate of new energy vehicles in China’s passenger car market has reached 20.4% in September, while the retail penetration rate has reached 21.1%.

In addition, from January to September, the cumulative retail sales of new energy passenger cars have surpassed 2 million, reaching 201,900 units, with a year-on-year growth of 228.4%. The cumulative retail penetration rate from January to September was 12.6%, while in the whole year of 2020, our retail penetration rate of new energy vehicles was only 5.8%.

This progress is faster than many people had expected, and the growth is also reflected in the sales of the top new energy vehicle enterprises.

The Leader of New Energy Vehicles

In September, the sales of new energy vehicles showed a significant head concentration effect. According to the data of the China Association of Automobile Manufacturers, the top three new energy vehicle companies accounted for 49% of the market share in this month. Now we will take a look at the achievements of these new energy vehicle pioneers.

BYD’s Fourth Consecutive Crown

According to the statistics of the China Association of Automobile Manufacturers, BYD’s wholesale sales in September were 70,432 vehicles, which marked its fourth consecutive month on top of the monthly wholesale sales list of new energy vehicles in China since June.

BYD’s official production and sales report showed that in September, the sales of new energy passenger cars reached 70,022 units, which is the new highest record of BYD’s monthly sales of new energy vehicles. Among them,

- The sales of pure electric vehicles were 36,306 units.

- The sales of plug-in hybrid vehicles were 33,716 units.

The sales data of specific models are as follows:

- The Han series sold 10,248 units.

- The Tang series sold 6,254 units.

- The Song series sold 21,414 units.

- The Qin series sold 24,988 units.

- The Yuan series sold 5,327 units.

- The e series sold 4,853 units.

- The Dolphin series sold 3,000 units.

Overall, BYD continued to achieve growth and break new records during these months especially with its DM-i models being the most popular.The DM-i models of both Qin and Song series have become popular models in the same level after their release. The new DM-i powertrain system has significantly improved fuel efficiency and smoothness compared to the previous DM hybrid system. In addition, the cost of the two DM-i models has been significantly reduced by adopting lithium iron phosphate batteries throughout the series, removing the gearbox, and cutting off the rear axle driving motor.

As a result, the DM-i models are more competitively priced than the same level of joint venture cars, with better power performance, better fuel economy, and are even eligible for green plate. It is no surprise that such a product has a good market performance.

In terms of pure electric products, BYD has replaced its entire line with “blade batteries” this year. Self-produced batteries have brought advantages in cost again due to the scalability effect. Now all product lines have been updated successively, and sales of the electric product lines such as Yuan, Qin, and Song have also risen significantly.

Tesla Shanghai breaks through production capacity limit

Tesla China’s sales are the most important data of CPCA each month. After surpassing 40,000 in August for the first time, Tesla’s Shanghai plant set a new historical record again in September with a wholesale sales volume of 56,006, including 3,853 exports and 52,153 domestic deliveries.

Before the CPCA data came out, various parties had already made predictions about Tesla China’s sales in September. Even whistleblowers had revealed that the September deliveries in China were 52,000 on September 29th, and this data precisely confirmed the prediction.

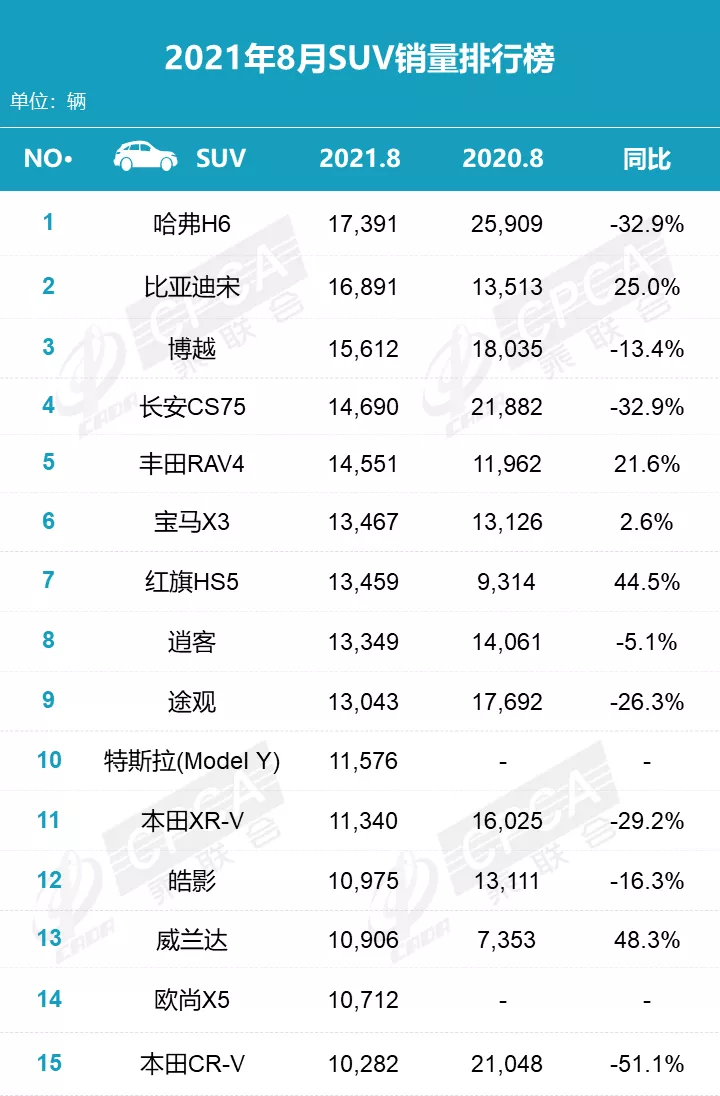

In terms of models, Tesla sold 33,033 Model Y units in September. This is not only the highest monthly delivery record achieved by the Model Y in China since it was delivered, but also the monthly sales record of pure electric SUV models in the domestic market.

For comparison, the sales champion Haval H6 sold 17,391 units in August this year in the full range of SUVs. The sales volume of H6 for the same period as the year before was 25,909 units. This means that Model Y is likely to overwhelmingly surpass Haval H6 in September and become the best-selling SUV model in the domestic market.

However, before achieving this record, let’s talk again about the capacity allocation of Tesla’s Shanghai factory.The vehicles produced by the Tesla Shanghai factory are not only supplied locally, but also help the Fremont factory supply other parts of the world such as Europe, the Middle East, and Asia-Pacific.

Most of the vehicles exported from the Shanghai factory to Europe take about a month for the logistics by sea. This creates a problem where it is difficult for the factory to achieve monthly deliveries in Europe for vehicles produced in the last month of the quarter. If the deliveries cannot be made in the last month of the quarter, the sales will not be counted in the quarterly report.

Therefore, in terms of delivery strategy, the Tesla Shanghai factory prioritizes producing exported vehicles in the first two months, ensuring early transportation and delivery within the quarter. Domestic orders, which have significantly shorter logistics times, are delivered in bulk in the last month of the quarter.

As a result, the 52,153 vehicles delivered by Tesla in China in September actually included the delivery of orders concentrated in July and August. This means that the sales figures for a single month are not representative.

Tesla’s delivery strategy creates a vacuum period and outbreak period at the beginning and end of each quarter, which makes it easy for Tesla to make a breakthrough in various sales rankings during the outbreak month.

Overall, Tesla delivered a total of 73,659 vehicles in China in the third quarter, with an average monthly delivery of 24,553 vehicles. The average monthly delivery of Model Y in the third quarter was 15,584 vehicles.

Considering the current shortage of automotive components in the industry and the need to ensure vehicle exports from the Shanghai factory, these figures are quite impressive. Based on the factory’s planned annual production capacity of 500,000 vehicles, the 56,006 vehicles delivered in September have even exceeded the production capacity limit.

In September, SAIC-GM-Wuling’s new energy vehicle sales remained steady at 38,850. The steady growth of the micro electric vehicle market brought about by the popularity of MINIEV is evident from the stable sales figures. SAIC Passenger Car, GAC Aion, and Great Wall were all among the top performers in the traditional independent brand industry.

In this golden September, the top three new forces in the industry achieved a milestone. Xpeng and NIO both achieved monthly sales exceeding 10,000, with 10,412 and 10,628 vehicles delivered respectively. However, IDEAL experienced a decline in sales because of the shortage of millimeter wave components, delivering only 7,094 vehicles in the month.

Looking at the overall trend, the delivery curve of the top 3 new energy vehicle companies still shows a month-on-month increase, with strong demand. Among them, Li Auto had over 10,000 new orders in June, NIO also had over 10,000 new orders in August, and XPeng Motors expects to achieve a monthly sales volume of 15,000 vehicles in Q4 according to its Q3 financial report.

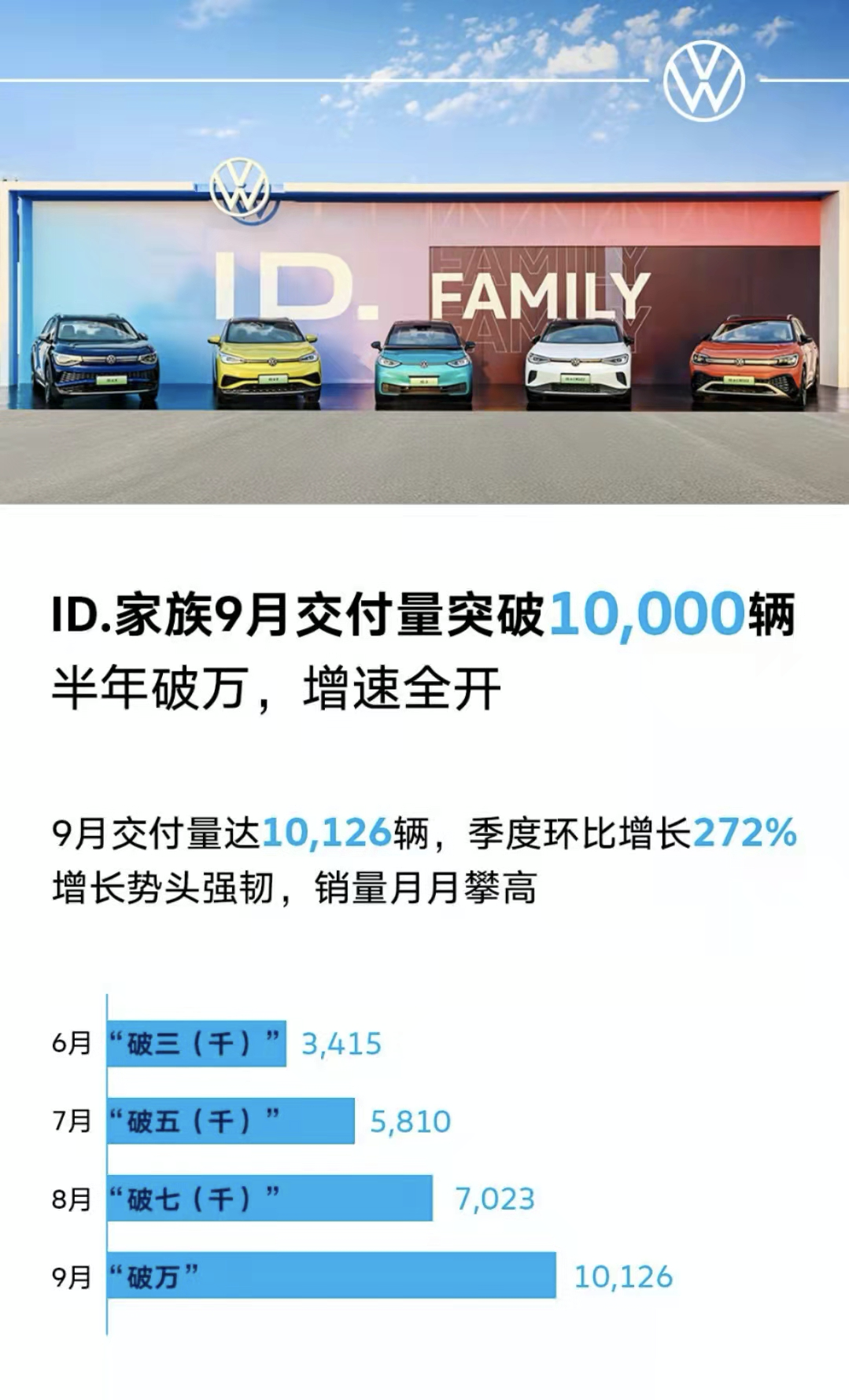

In addition to the various new energy vehicle companies, the Volkswagen ID series, a traditional automaker, quietly achieved over 10,000 deliveries. Two versions of the ID model were delivered by Volkswagen North and South, with a total of 10,126 units delivered in September. Including other new energy product lines, Volkswagen North and South sold 14,000 new energy vehicles in September.

When “big trend” becomes “big reshuffle”

The continuous breakthroughs by top new energy vehicle companies have helped the domestic new energy market achieve a milestone of 20% penetration rate in September. Companies that actively embrace electrification and layout early have gained significant returns in the market this year.

At this point, the pattern of the new energy market has become apparent, and in the next stage of market expansion, competition will become fiercer. Changes brought about by the continuous shift from oil to electricity in market share will put greater pressure on companies that still rely on traditional internal combustion engine vehicles, as this pressure is already reflected in the data.

The reason for the collective decline of industry giants

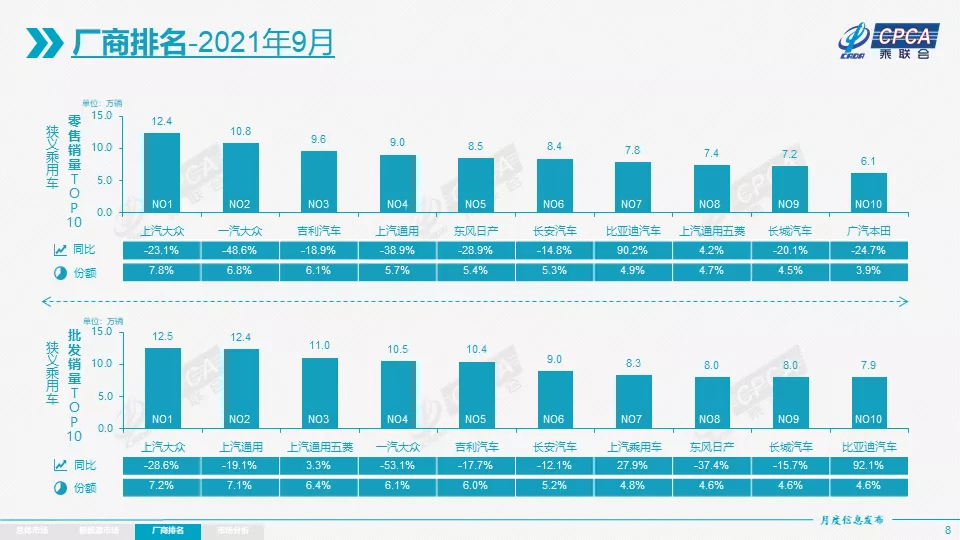

In the ranking of domestic manufacturer retail sales released by the China Passenger Car Association in September, eight out of the top ten automakers, with the exception of BYD and SAIC-GM-Wuling, saw a year-on-year decline.

In September, a month that was expected to see strong sales, sales volumes of Volkswagen-SAIC and FAW-Volkswagen fell by 23.1% and 48.6% year-on-year, respectively.

Other joint ventures between American and Japanese automakers were also not immune, with SAIC-GM experiencing a year-on-year decline of 38.9% and Dongfeng Nissan experiencing a year-on-year decline of 28.9%. GAC Toyota also saw sales fall by 24.7% year-on-year.

Even domestic brands were not spared, with Geely, Changan, and Great Wall experiencing year-on-year sales declines of 18.9%, 14.8%, and 20.1%, respectively, in September.

BYD and SAIC-GM-Wuling, the only two automakers with year-on-year growth in the top ten retail ranking, ranked first and third, respectively, on the new energy vehicle sales ranking in September.

While the continuing growth of the new energy market has contributed to the ongoing shift in market share, there is another story to be told when looking at the cumulative sales rankings of January-August this year.

Compared to the severely affected 2020 due to the pandemic, as of August this year, 14 out of the top 15 passenger car manufacturers in cumulative sales have achieved a year-on-year growth, with only SAIC Volkswagen experiencing a 1.1% decline.

Combined with the turmoil in the automotive industry this year, the reasons for it are not difficult to guess — chip shortage.

The suspension caused by the pandemic has had an impact on the entire automotive industry chain’s production capacity. For newly-created car companies that have relatively smaller scale, stockpiling and buying chips at high prices may be a feasible solution, but for companies with sales of hundreds of thousands of vehicles, this approach is not enough.

In fact, companies had already warned the public of the impact of chip shortages on sales much earlier, and the current sales decline is proof of this.

We can see that while sales are declining year-on-year, the delivery cycle of major brands is getting longer, discounts are becoming tighter, the prices of used cars are rising, and some manufacturers are even beginning to introduce “invoice repurchase” policies.

Therefore, the recent drop in passenger car market sales does not reflect changes in demand, as supply shortages are the core reason.

In addition, under the premise of a shortage of parts, most companies will choose to allocate resources to new energy product lines. After all, new energy vehicles have national subsidies, which will gradually decline year by year. It is better to sell them earlier and earn more. Selling new energy cars can also reduce the pressure of double integral points, so it is not difficult to make this decision.

After the industry collectively made this choice, it also indirectly accelerated the penetration rate of new energy.

Time is running out for XXX

In April of this year, the retail sales penetration rate of new energy passenger cars in China reached 10.1%, achieving the first double-digit breakthrough. This process may take as long as 10 years to calculate, but in just 5 months, this number has already reached 21.1%.

Although the shortage of parts mentioned earlier has affected this process, the fact that the new energy market is expanding rapidly is beyond doubt. When Tesla began to eliminate BAA competitors in various sub-markets around the world, when the Ideal ONE began to top the domestic medium and large SUV sales chart, when BYD’s electric vehicle market share surged, we saw excellent new energy products beginning to break through and shedding their new energy labels, competing equally with traditional fuel cars in the market, and even starting to stage scenes of new kings ascending in sub-markets.

However, please also note that adjective, “excellent new energy products”. The wholesale penetration rate of new energy of major joint venture brands in September was only 3.5%, while that of independent brands was 36.1%. The 3.5% of the major joint venture brands is basically supported by SAIC-GM Wuling and the ID. series of North and South Volkswagen.When the domestic electric vehicle market has already entered the era of strong connection with intelligence and automation 2.0, we can still see Mazda launching the CX-30 EV in September 2021 at a starting price of 159,800 yuan, with a CLTC range of 450 km, a “retro” electric vehicle.

While Ideal, Great Wall, BYD, and Voyah’s large-battery series hybrid products have gradually gained momentum in the market, Toyota is still releasing the PHEV version of the RAV4.

Nissan has just released a small-battery range-extension solution for the Xuan Yi e-Power, a non-pluggable pure oil-fired range-extension vehicle.

This is already a visible gap.

Some say, let the bullet fly for a while. Looking ahead, in the future, Volkswagen will have MEB, Hyundai-Kia will have E-GMP, and GM will have Ultium. These major players are coming or have already landed in the domestic market, leaving even fewer opportunities for the Japanese.

Conclusion

The analysis of the September sales in 2021 is more meaningful than in previous years. Shortages of chips, new energy, new forces, Tesla, and traditional brands play different roles in this report, making the numbers meaningful.

Our focus has unconsciously shifted from “which is the brand with the highest monthly sales” and “the ranking of popular gasoline cars” to keywords such as “new energy penetration exceeds 20%”, “new forces’ monthly sales exceeded 10,000.”

Not only because those things have made us feel numb, but also because we are experiencing a century of great change in the industry. In this process, our country and enterprises have hit the jackpot. The “overtaking in the bend” that has been mocked countless times is now coming true.

Behind the list is the continuous growth of our new energy industry, which is embodied by Tesla’s increasing domestication rate. It reflects our proud level of “self-sufficiency”, which has become a systematic advantage and strength.

20% has been achieved. With the expectation of new technologies and new models, will 50% still be far away?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.